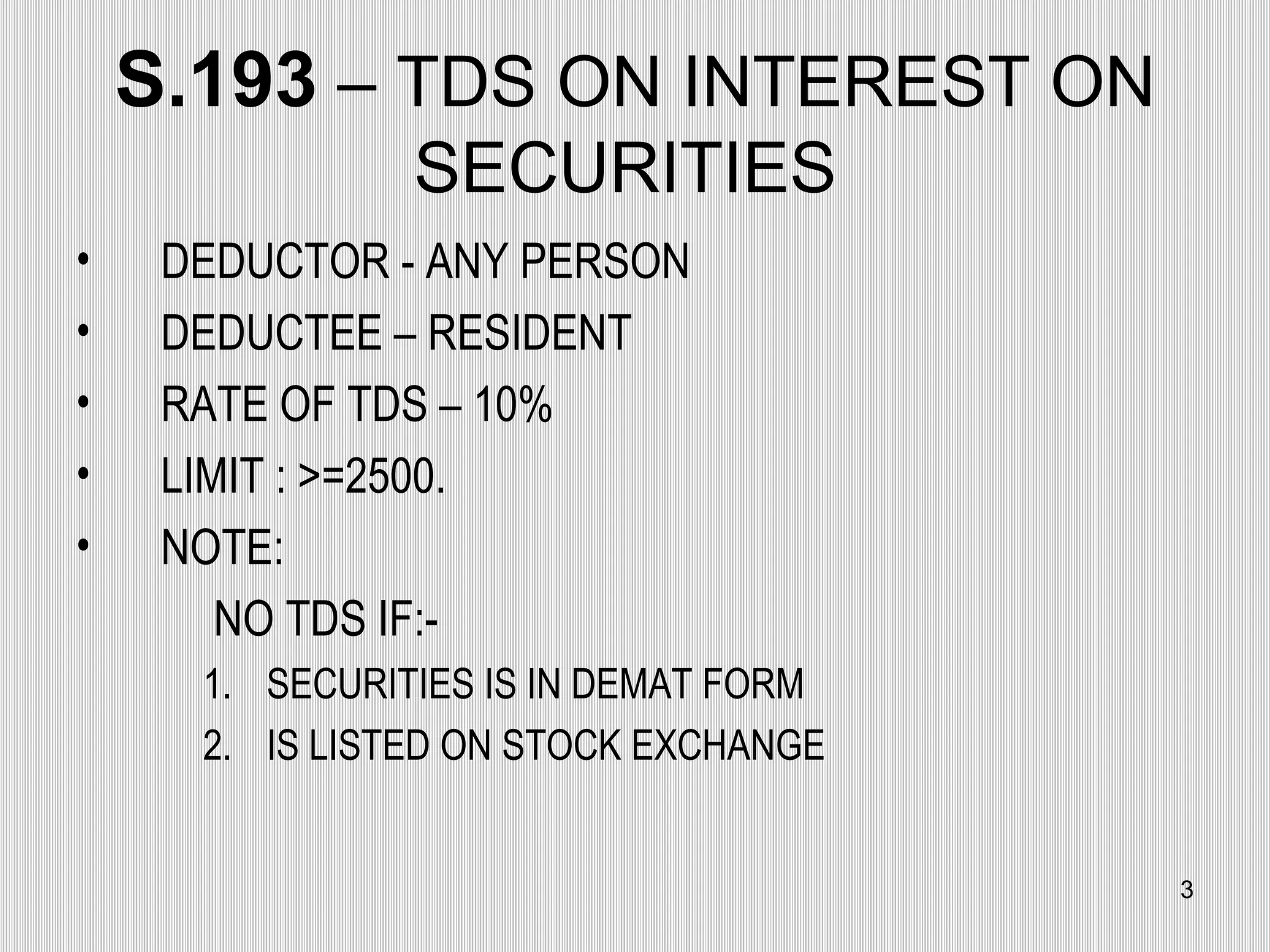

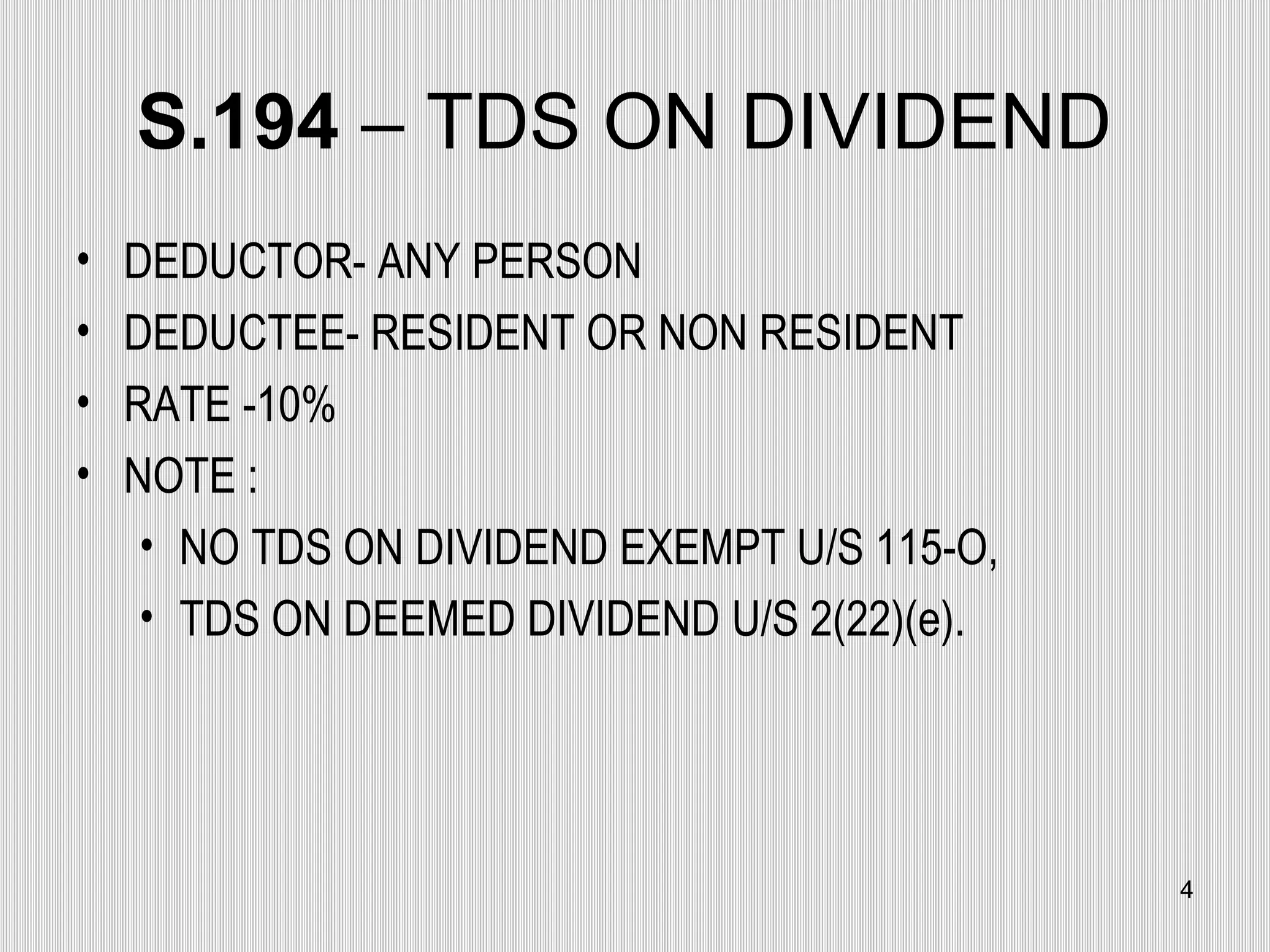

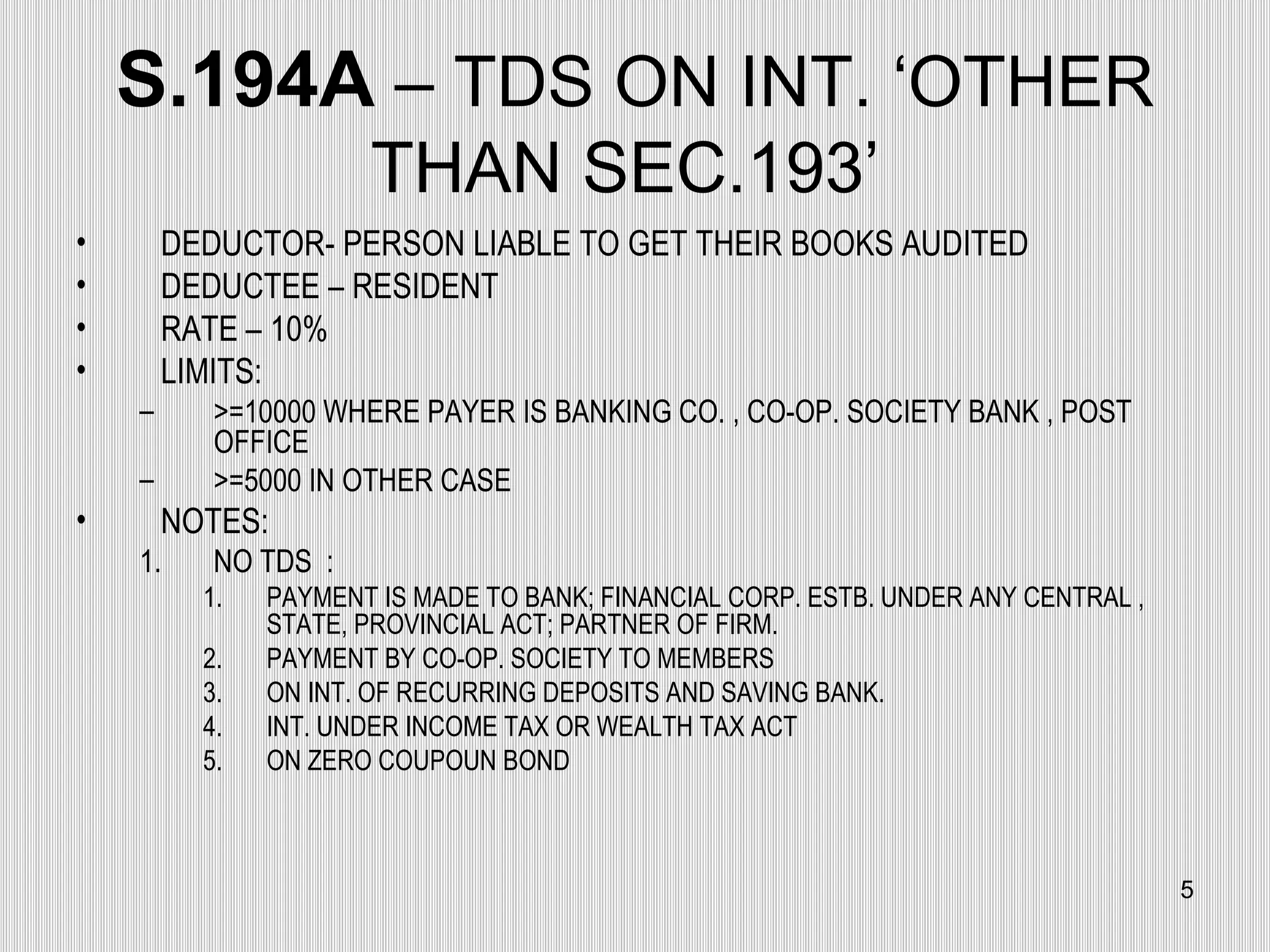

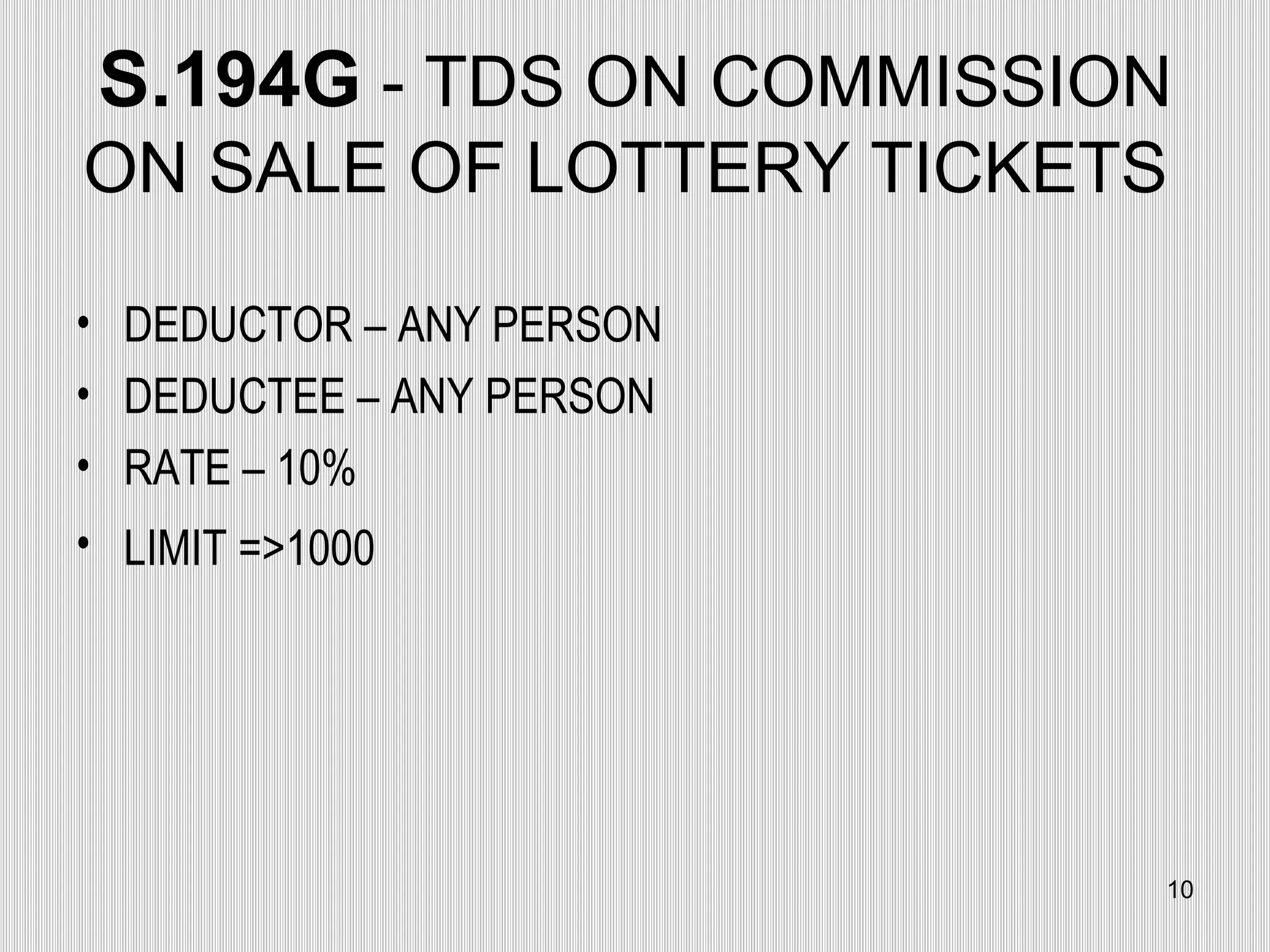

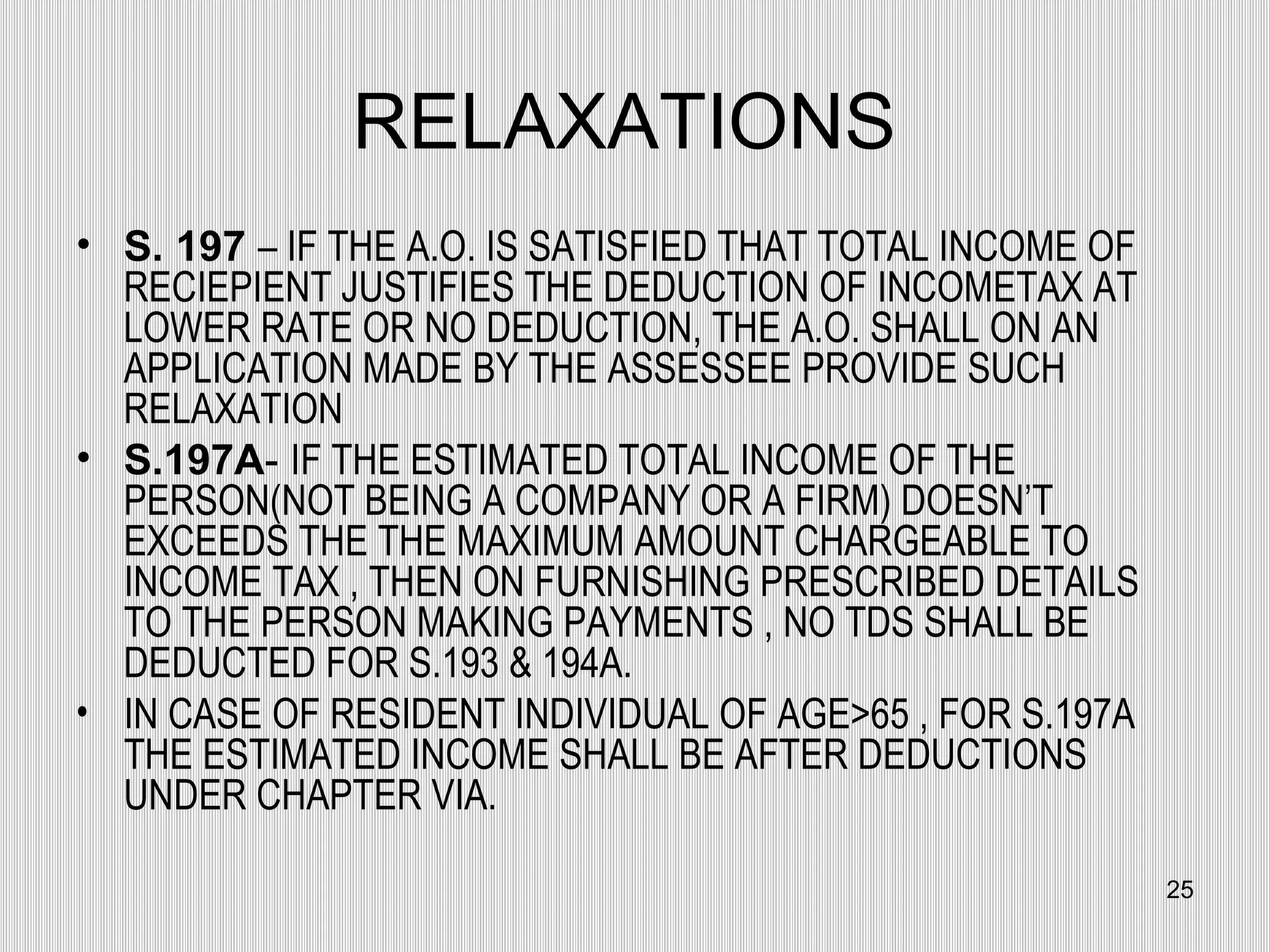

The document outlines various provisions of Tax Deducted at Source (TDS) under Indian tax law, detailing different sections and their applicability, rates, and conditions for deductions, such as salary, interest, dividends, and professional fees. It specifies the deductor and deductee classifications, limits for deductions, exemptions, and consequences of non-compliance, including penalties and relaxations. Additionally, it emphasizes the mandatory requirement of providing PAN and the reporting obligations for TDS compliance.

![REPORTING OF TDS UNDER 3CD :- UNDER CLAUSE 27: (a) WHETHER THE ASSESSEE HAS COMPLIED WITH THE PROVISIONS OF CHAPTER XVII-B REGARDING DEDUCTION OF TAX AT SOURCE AND REGARDING THE PAYMENT THEREOF TO THE CREDIT OF CENTRAL GOVERNMENT. [ YES/NO ] (b) IF THE PROVISIONS OF XVII-B HAVE NOT BEEN COMPLIED WITH PLEASE GIVE THE DETAILS, NAMELY : IN BALANCE SHEET:- FOR DEDUCTOR , THE UNDEPOSITED AMOUNT IS SHOWN AS CURRENT LIABLITIES FOR DEDUCTEE , THE TDS RECIEVABLE IS SHOWN UNDER LOAN AND ADVANCES …… . TAX DEDUCTED BUT NOT PAID TO THE CREDIT OF THE CENTRAL GOVERNMENT (4) …… . TAX DEDUCTED LATE (3) ……… SHORTFALL ON ACCOUNT OF LESSER DEDUCTION THAN REQUIRED TO BE DEDUCTED (2) …… . TAX DEDUCTIBLE ABD NOT DEDUCTED AT ALL (1) AMOUNT](https://image.slidesharecdn.com/tds-120203125920-phpapp01/75/Tds-27-2048.jpg)