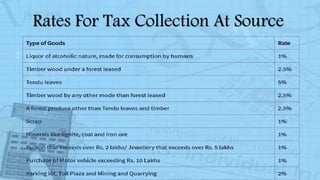

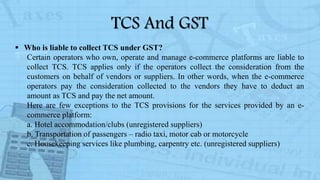

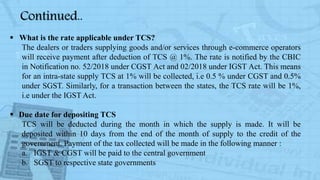

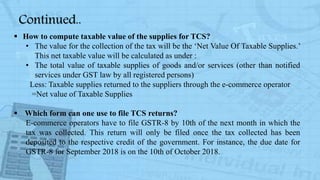

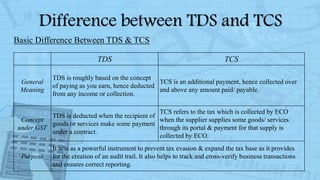

The document explains the concepts of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) under GST, detailing the roles of deductors and deductees in the tax collection process. It highlights the implications of TDS and TCS, including rates, responsibilities of entities required to deduct or collect tax, and procedural aspects including filing returns and refund claims. Additionally, it differentiates between TDS and TCS, emphasizing their functions in minimizing tax evasion and ensuring compliance.