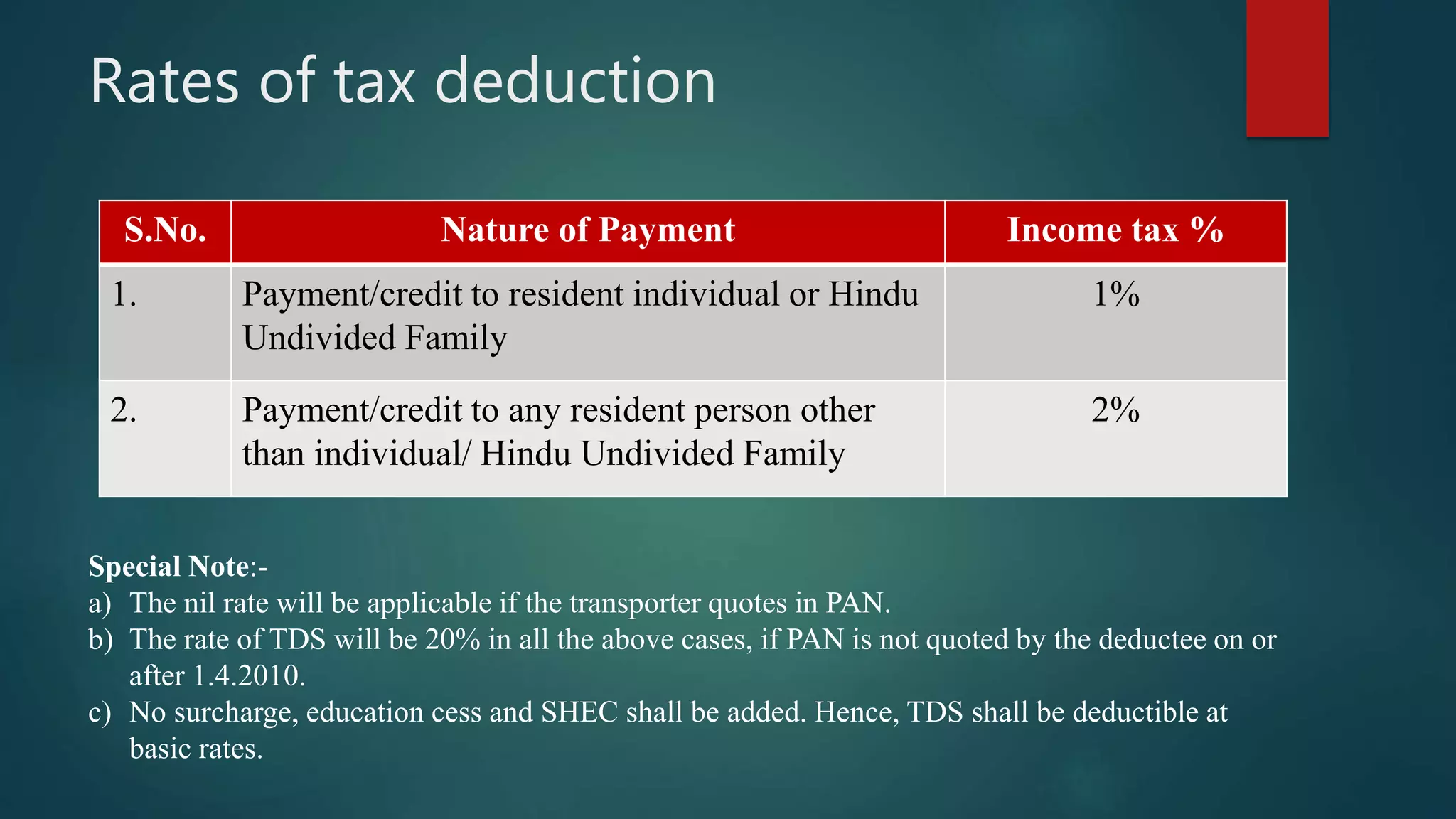

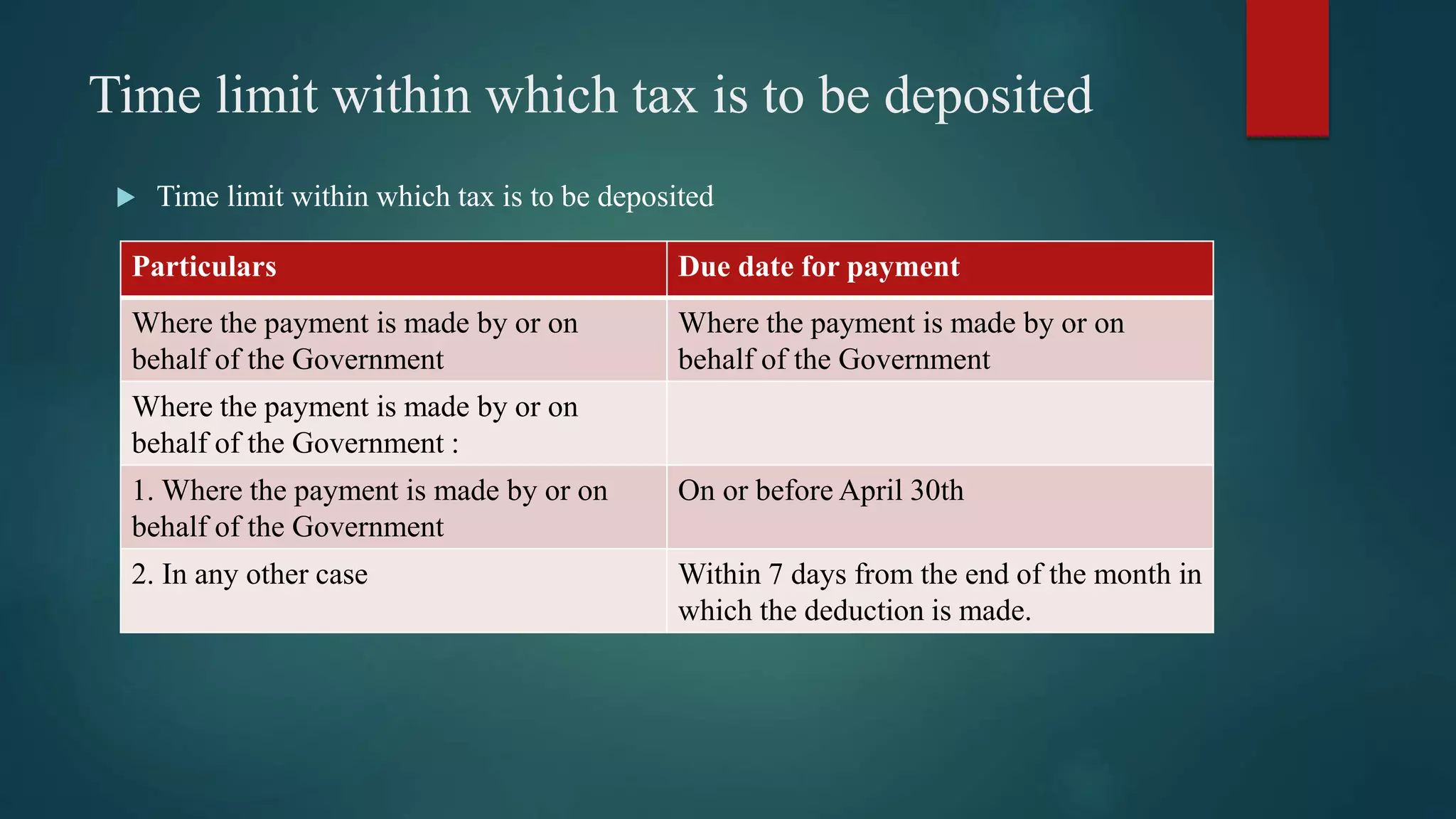

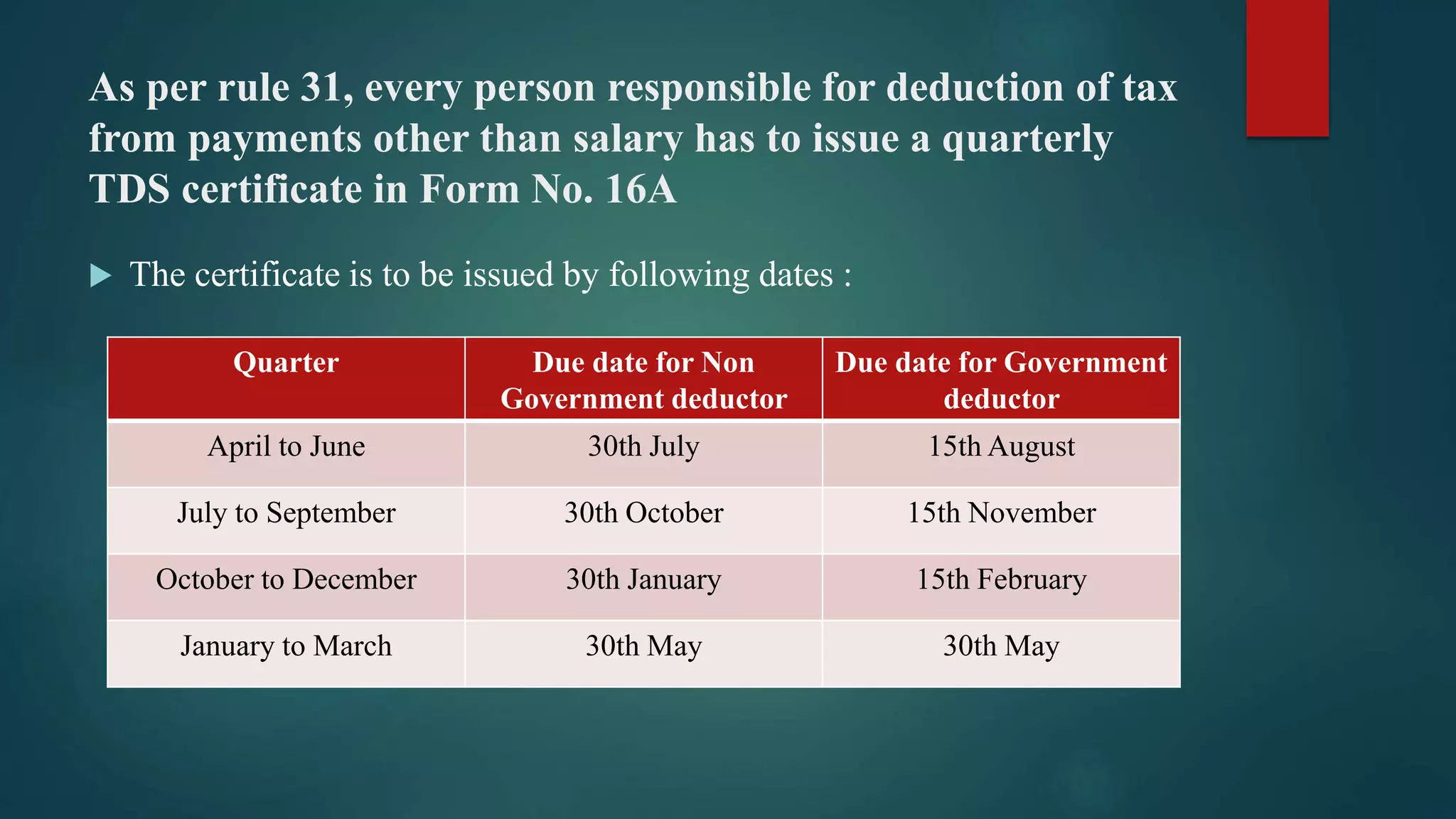

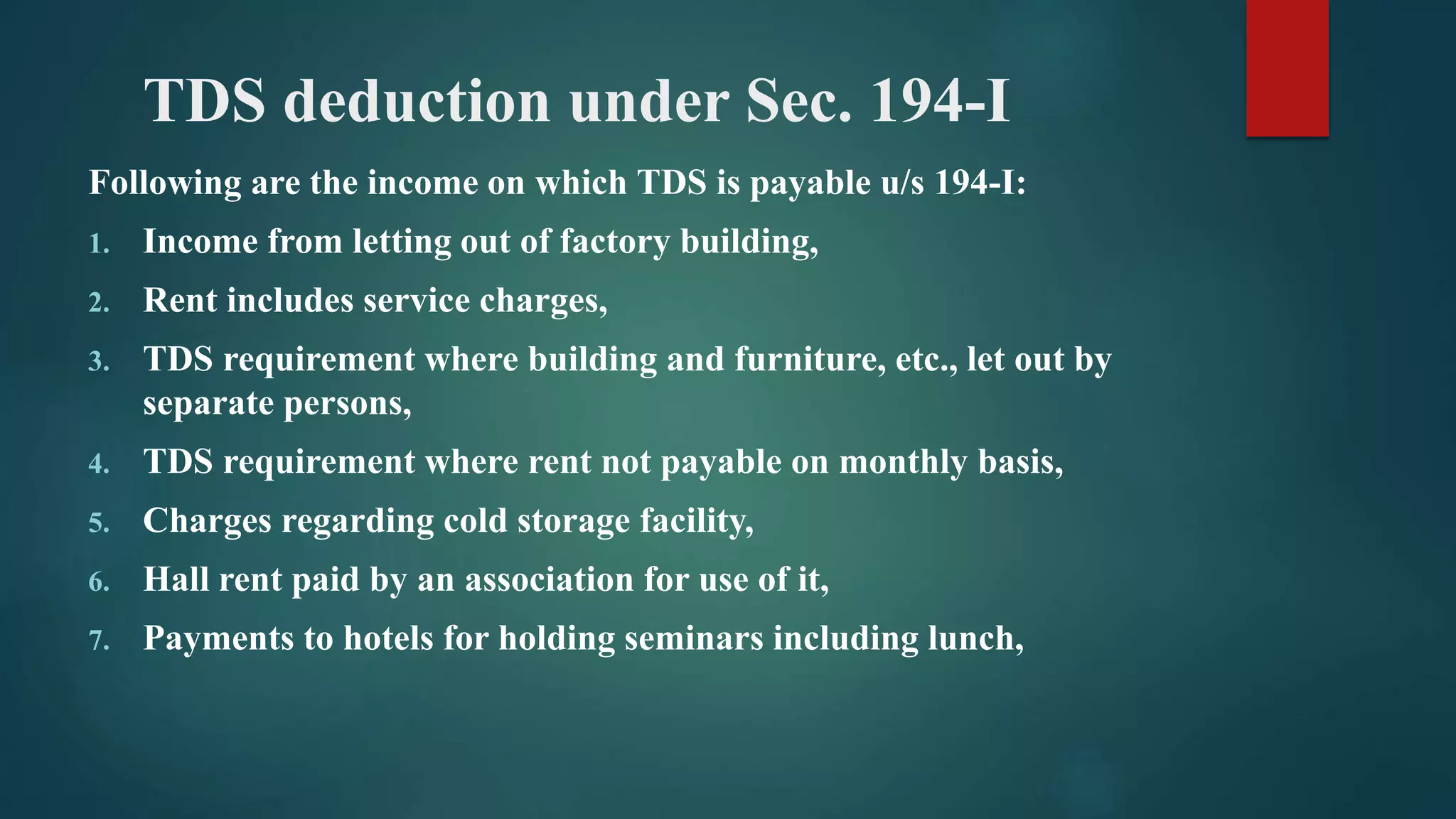

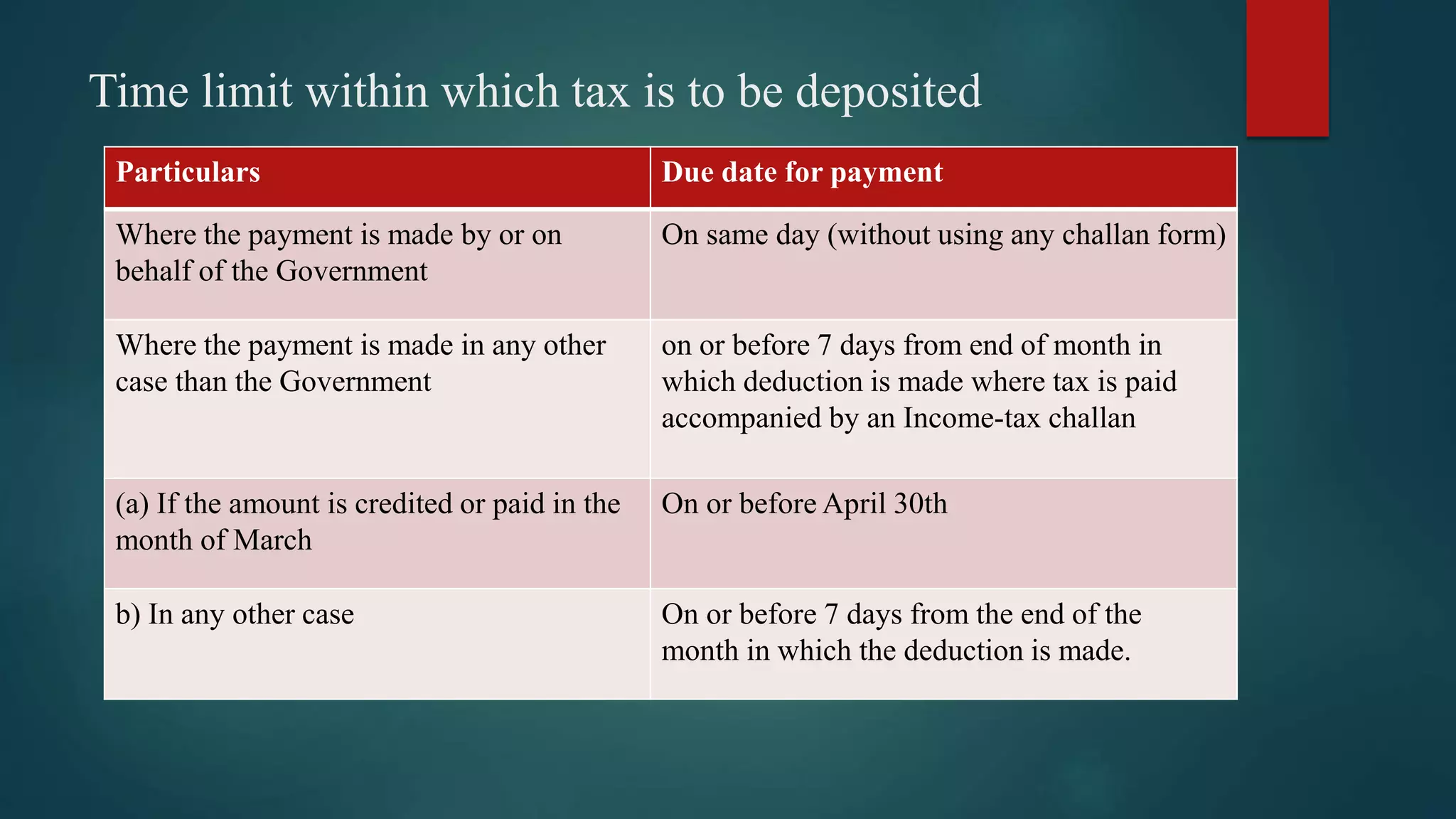

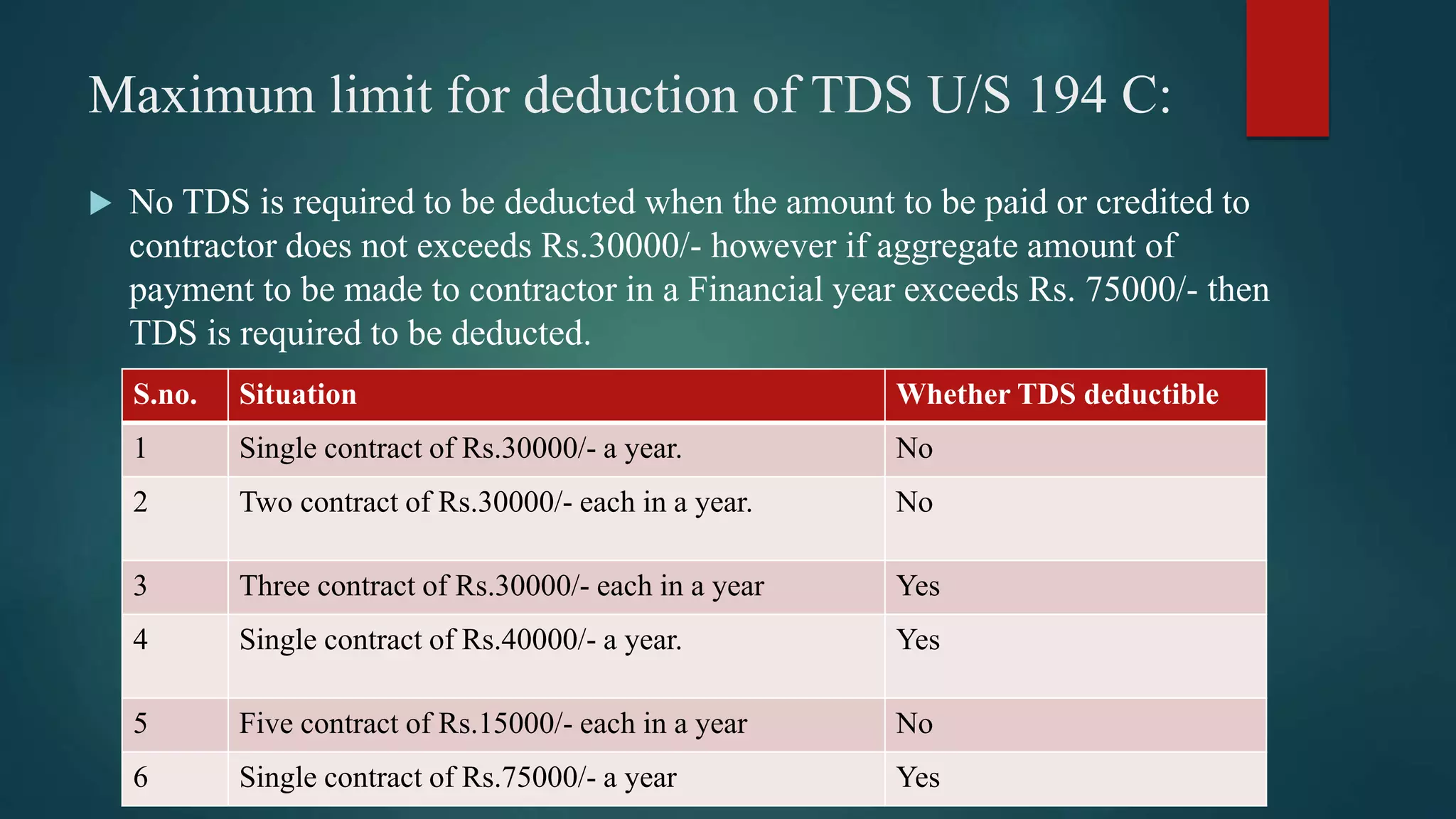

TDS is required to be deducted from payments made to resident contractors or sub-contractors under section 194C of the Income Tax Act if the aggregate amount exceeds Rs. 75,000 in a financial year. TDS of 1% or 2% depending on the recipient must be deducted unless the PAN is not quoted, in which case the rate is 20%. The deducted TDS must be deposited with the government within 7 days of the end of the month in which the deduction was made.

![Deduction of tax at source from payment to resident-

contractors [Sec. 194C(1)]

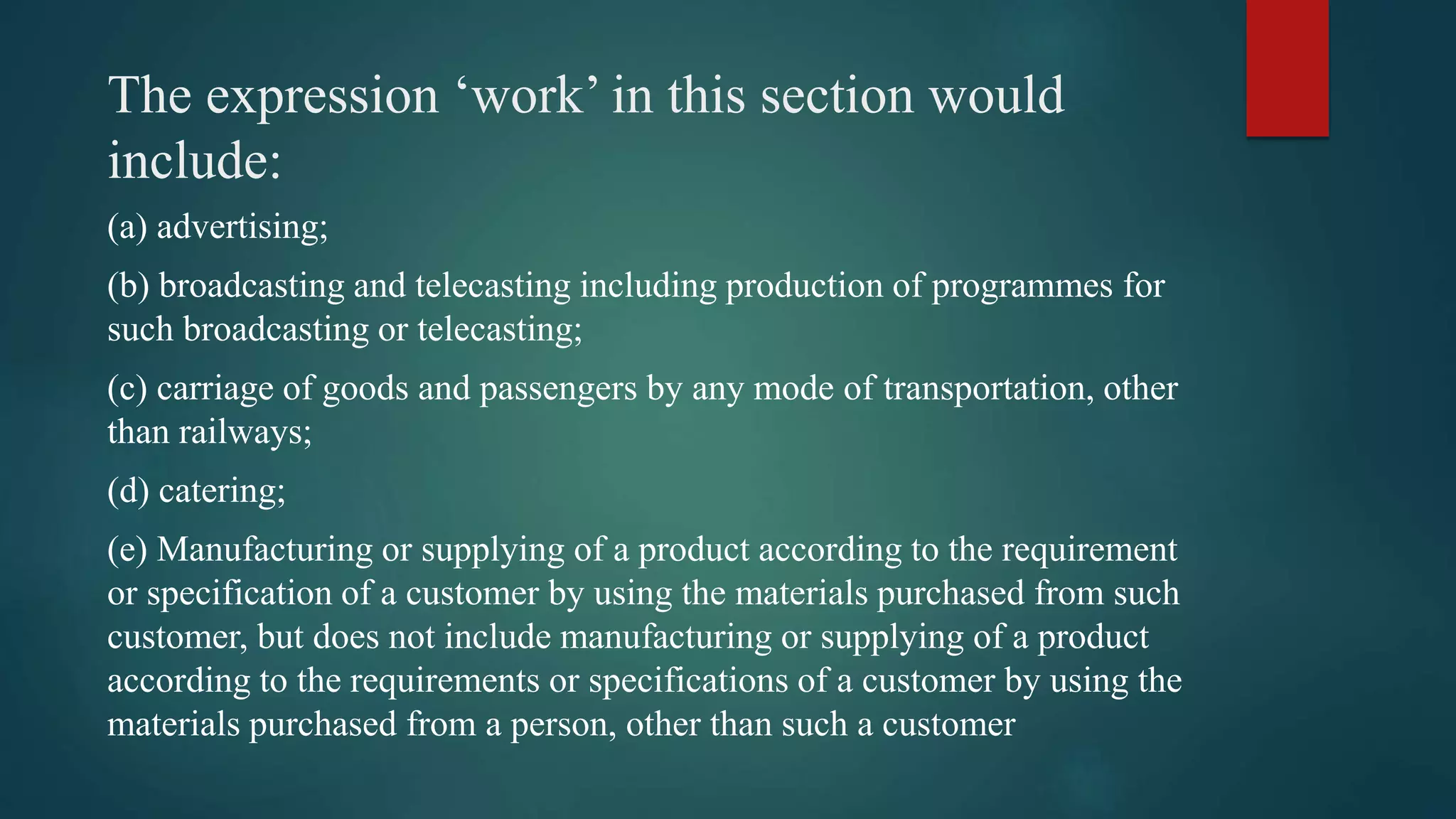

The contract can be between contractor & following :

a) The Central Government or any State Government;

b) Any local authority;

c) Any corporation established by or under a Central, State or Provisional Act;

d) Any company;

e) Any co-operative society; or

f) Any authority constituted in India by or under any law.

g) Any society registered under the Society Registration Act, 1980 or under any such

corresponding law to the Act in any Part of India;

h) Any trust;

i) Any university or deemed university;

j) Any firm;](https://image.slidesharecdn.com/31df1b56-3c81-49c5-933e-22213c8e40e5-151205080348-lva1-app6891/75/TDS-194C-194I-4-2048.jpg)