The document provides information about tax deducted at source (TDS) in India. Some key points:

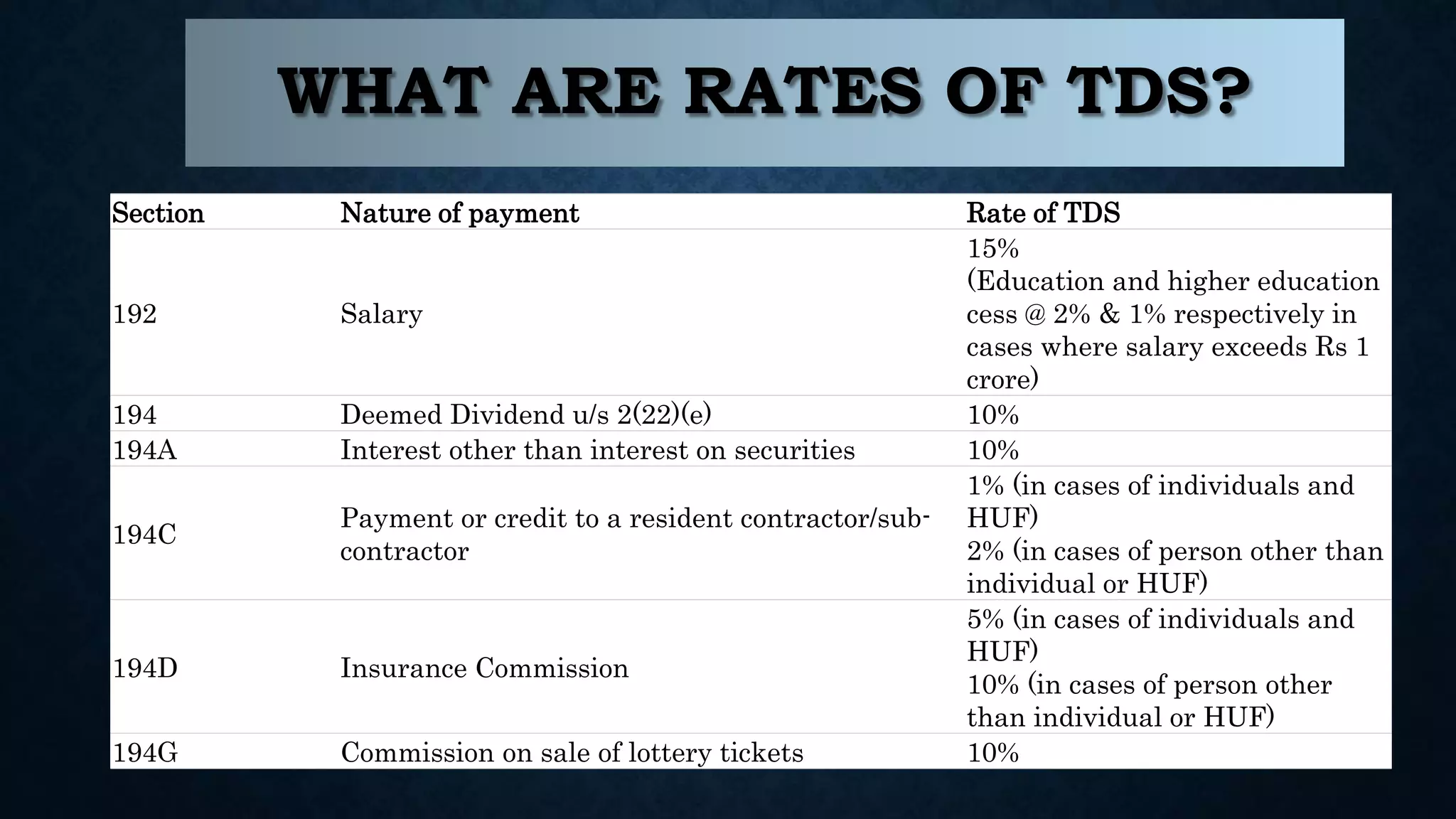

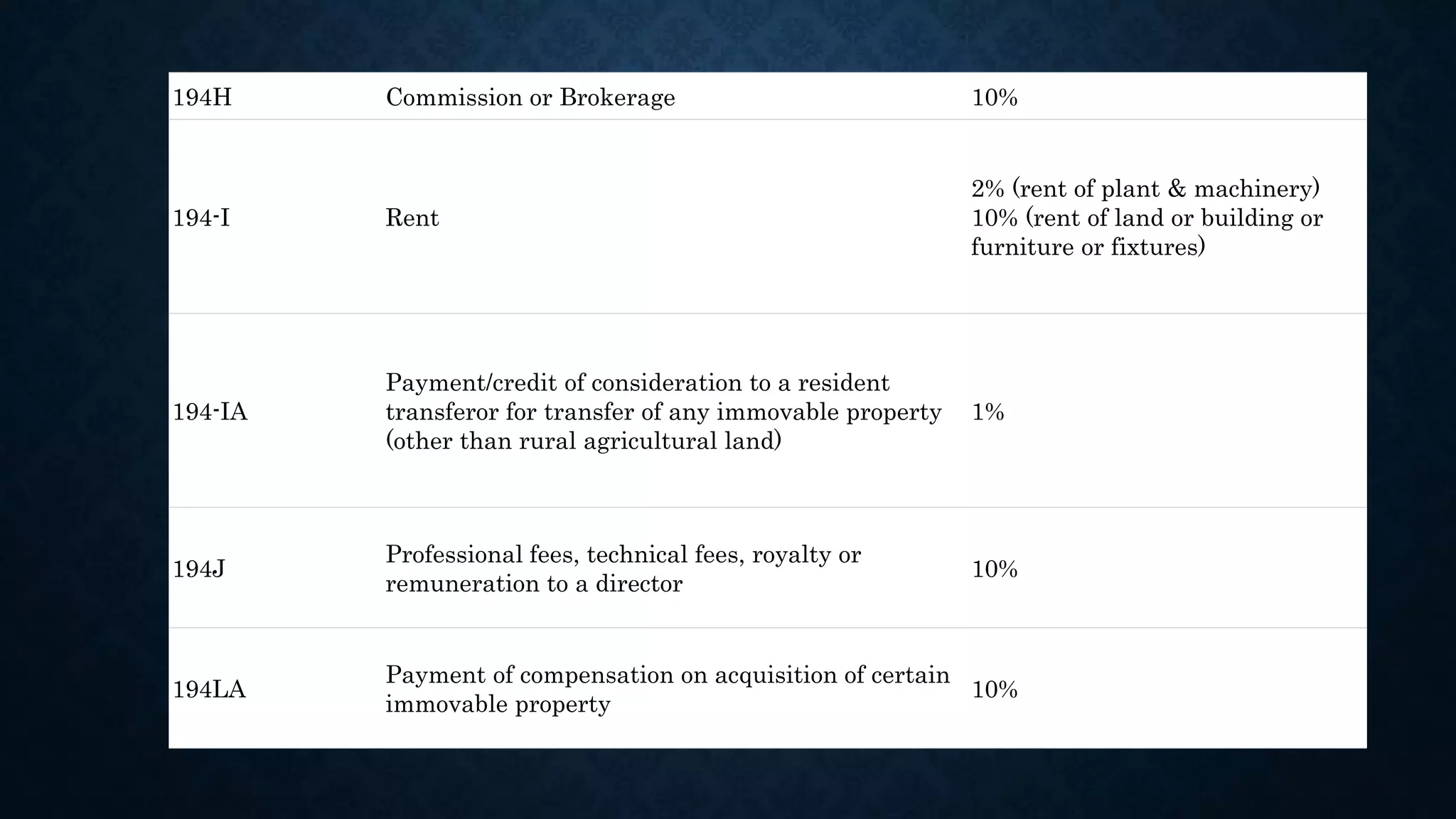

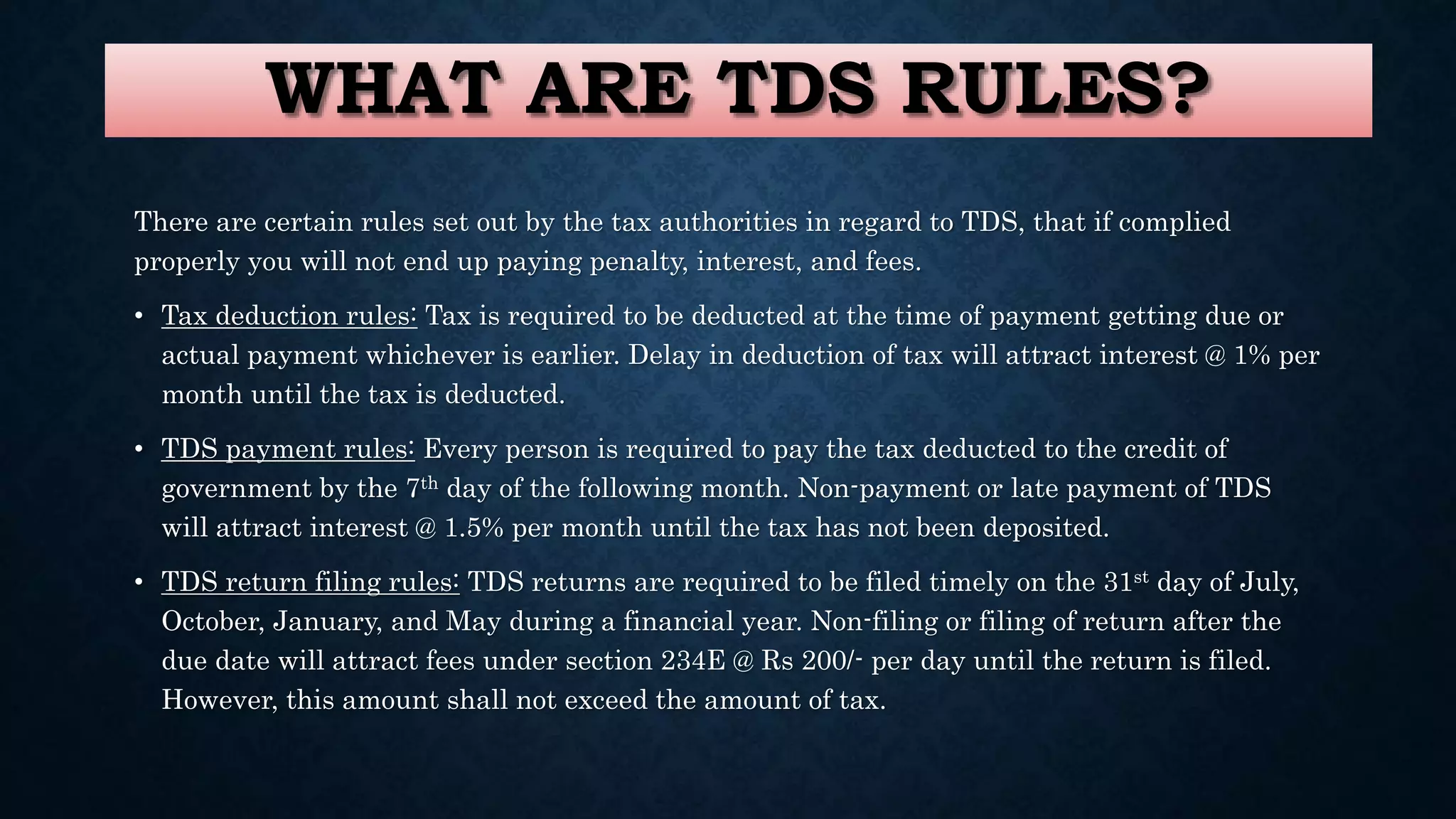

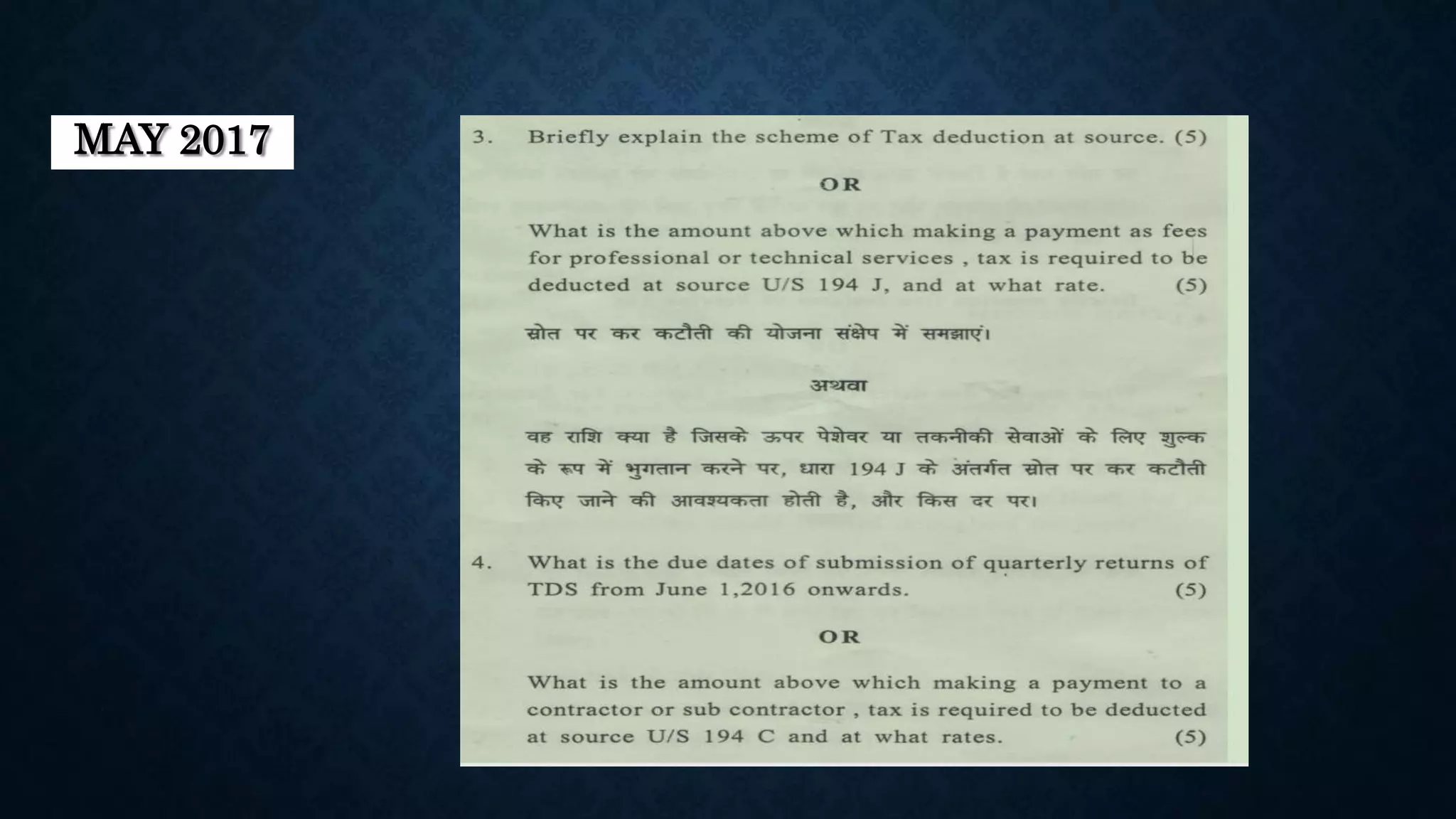

1. TDS is a system where specified payments like salary, rent, professional fees etc are subject to tax deduction at source. The tax deducted is remitted to the government and the deductee gets credit for the tax paid.

2. Every deductor must obtain a Tax Deduction Account Number (TAN) to deduct taxes. TDS must be deducted as per prescribed rates depending on the nature of payment.

3. TDS certificates like Form 16 and Form 16A are issued to deductees stating the tax deducted. These can be used for claiming tax credits.