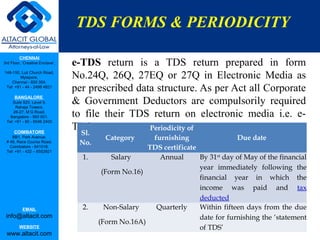

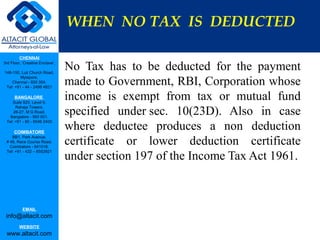

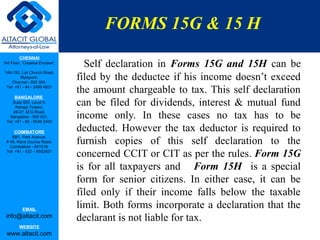

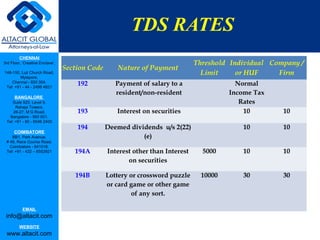

The document provides information about Tax Deducted at Source (TDS) in India, including:

1. TDS is a certain percentage deducted from various payments like salary, commission, rent, interest, and dividends that is remitted to the government and can be adjusted against tax due.

2. The concept of TDS aims for "pay as you earn" taxation where tax is deducted at the time of payment.

3. A deductor is the person/company liable to deduct tax from payments made, while a deductee is the person from whom tax is deducted.

![CHENNAI

3rd Floor, ‘Creative Enclave’,

148-150, Luz Church Road,

Mylapore,

Chennai - 600 004.

Tel: +91 - 44 - 2498 4821

BANGALORE

Suite 920, Level 9,

TAX DEDUCTED AT SOURCE

Raheja Towers,

26-27, M G Road,

Bangalore - 560 001.

Tel: +91 - 80 - 6546 2400 [TDS]

COIMBATORE

BB1, Park Avenue,

# 48, Race Course Road,

Coimbatore - 641018.

Tel: +91 - 422 – 6552921

Presented by

P. Sumathy

Accounts Assistant

EMAIL

info@altacit.com

WEBSITE

www.altacit.com](https://image.slidesharecdn.com/tds-130302032519-phpapp01/75/Tds-1-2048.jpg)

![TYPES OF TDS CERTIFICATE S

CHENNAI

3rd Floor, ‘Creative Enclave’, A tax deductor is required to issue TDS certificate to the

148-150, Luz Church Road,

Mylapore,

Deductee within specified timed under section 203 of the

Chennai - 600 004.

Tel: +91 - 44 - 2498 4821 Income Tax Act. The Deductee should produce the details

BANGALORE

Suite 920, Level 9,

of this certificate to adjust the amount of TDS against the

Raheja Towers,

26-27, M G Road, Tax payable him, during the regular assessment of income

Bangalore - 560 001.

Tel: +91 - 80 - 6546 2400 tax.

COIMBATORE

BB1, Park Avenue, Salaries - Form 16: In case of Salaries, the certificate

# 48, Race Course Road,

Coimbatore - 641018.

Tel: +91 - 422 – 6552921

should be issued in FORM 16 containing the Tax

computation details and the Tax deducted & Paid details.

This refers to the details submitted over Form 24Q.

Non-salaries - Form 16A: In case of Non-Salaries, the

certificate should be issued in FORM 16A containing the

EMAIL Tax deducted & Paid details. Separate certificates should be

info@altacit.com

prepared for each Section [nature of payment]. This refers

WEBSITE

www.altacit.com to the details submitted over Form 26Q and 27Q.](https://image.slidesharecdn.com/tds-130302032519-phpapp01/85/Tds-10-320.jpg)