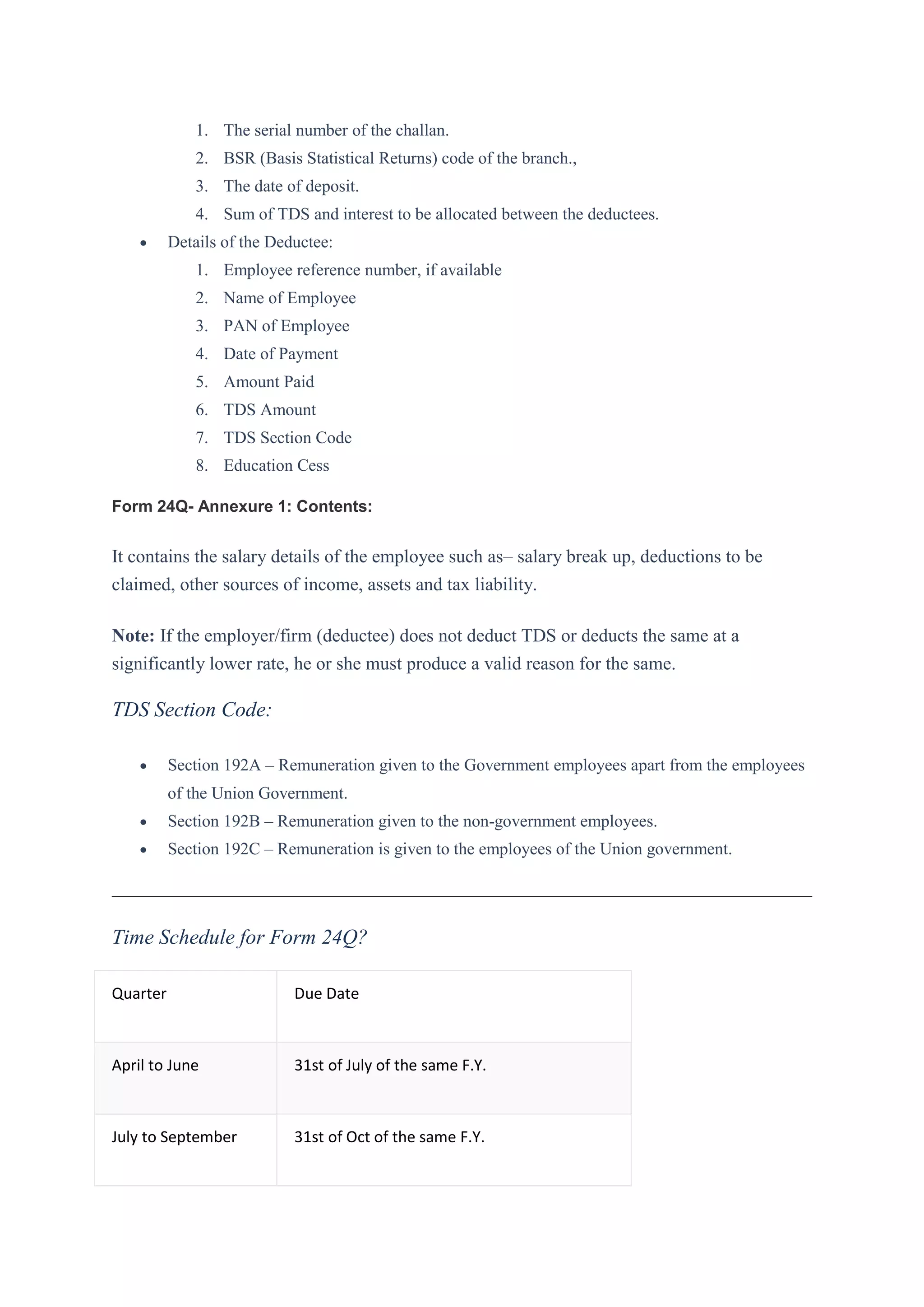

Form 24Q is the TDS return form that must be filed quarterly by employers to report tax deducted from employees' salaries under section 192. It contains details of tax deducted, employee names and PAN numbers, dates and amounts of salary payments, and tax deducted. Filing must be done online for employers above certain thresholds. The form has two annexures - Annexure I is filed for all quarters while Annexure II containing full-year salary details is only for the last quarter. Employers must provide a TDS certificate to all employees and meet filing deadlines to avoid penalties.