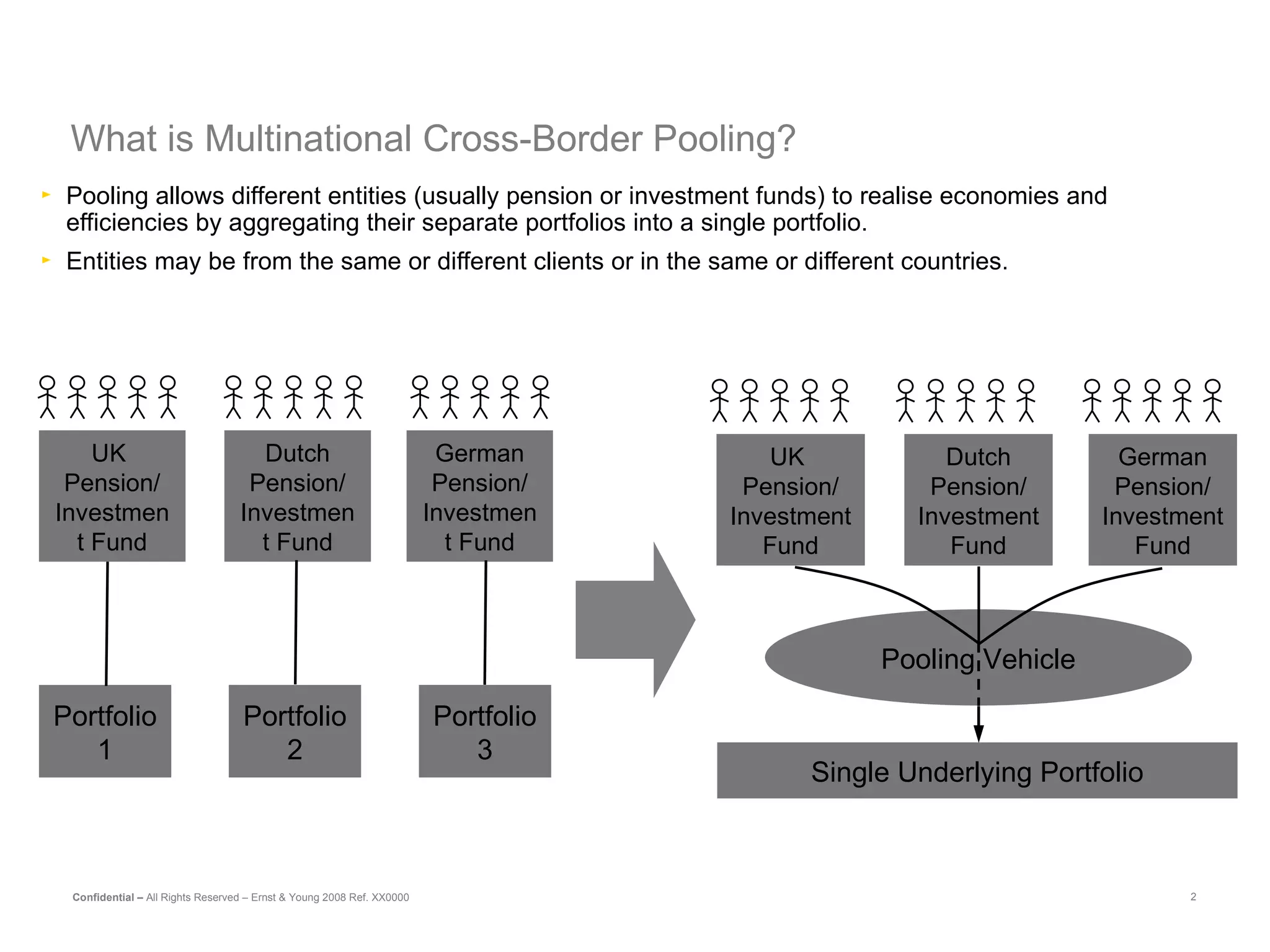

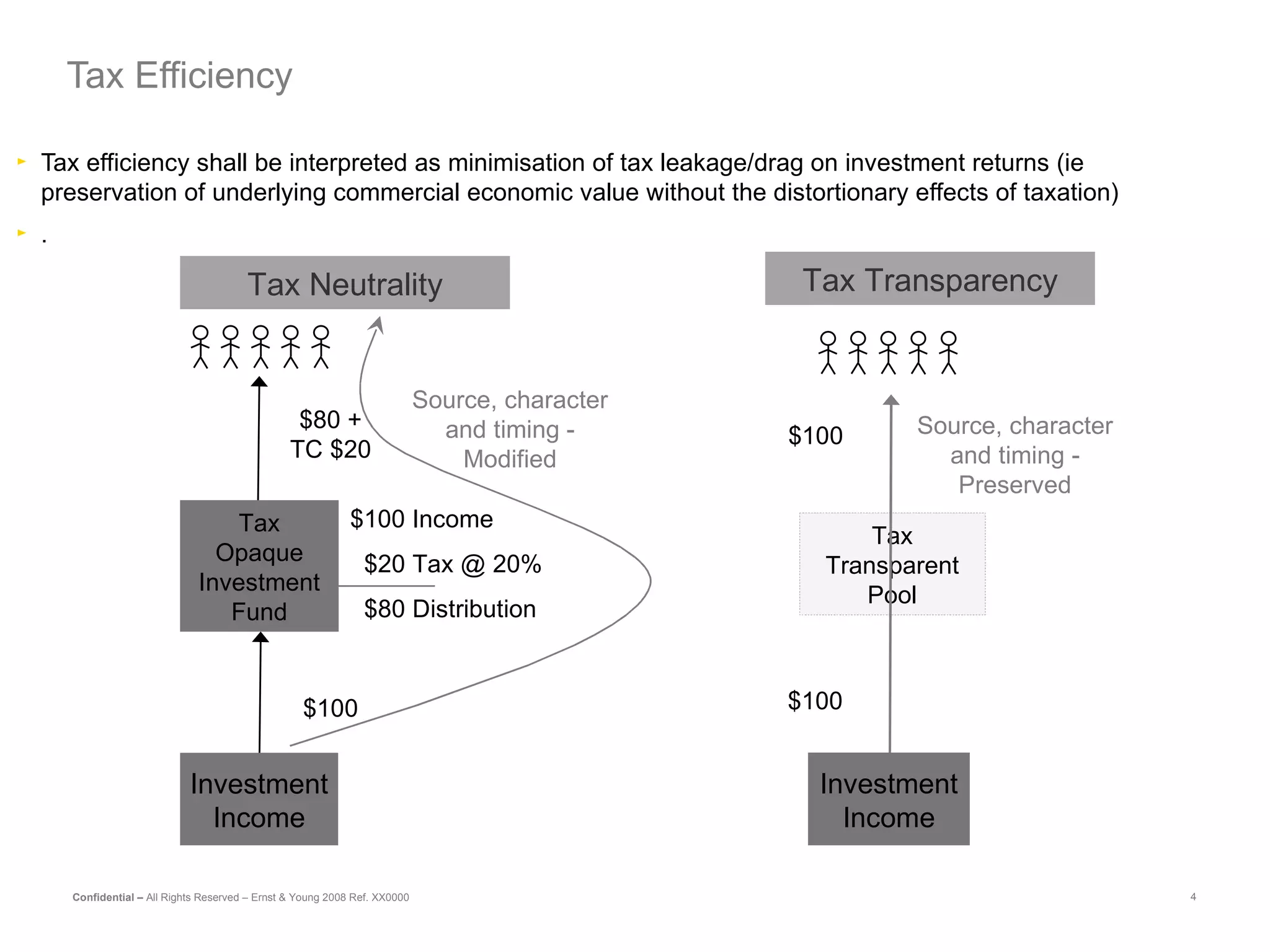

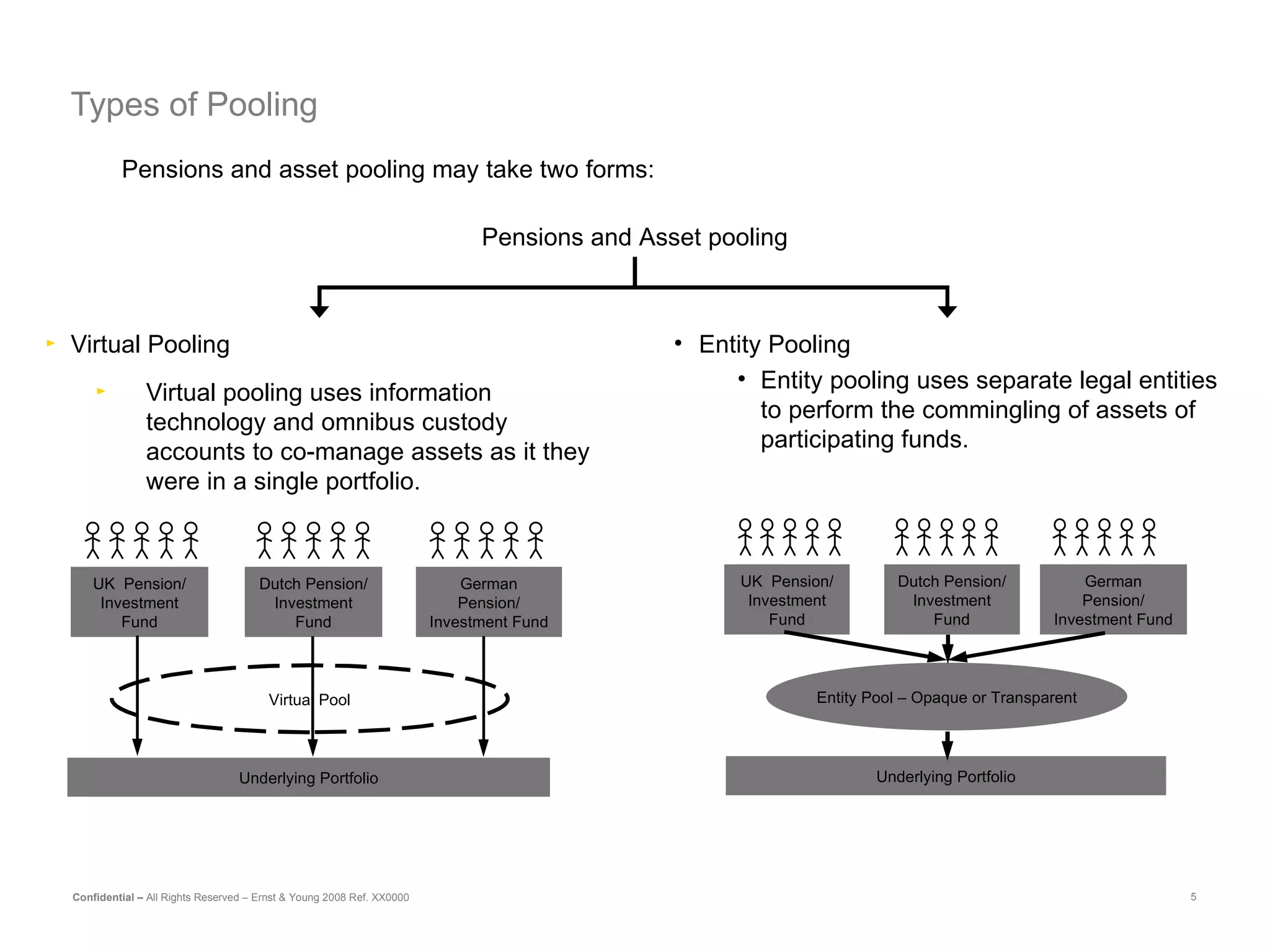

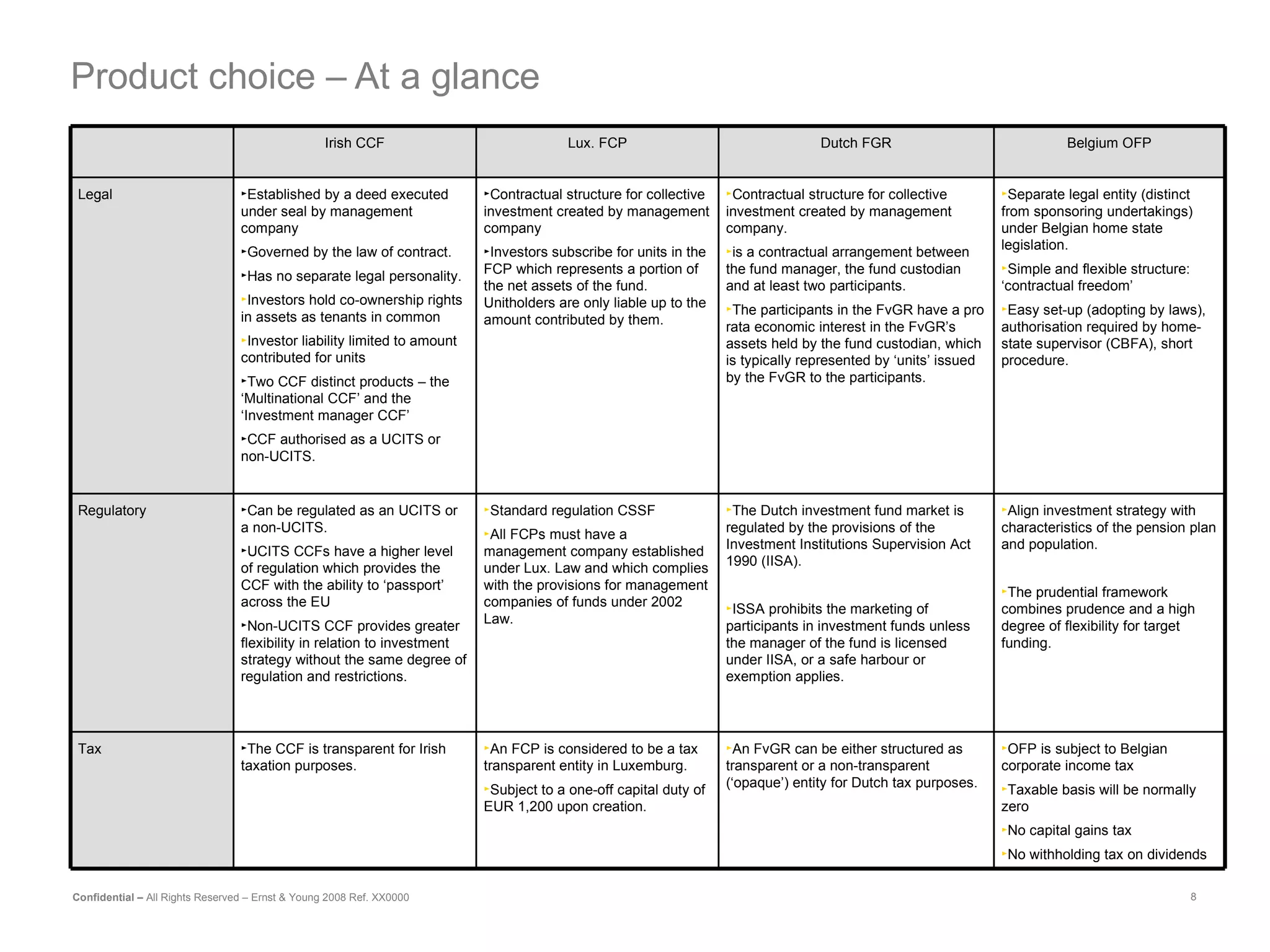

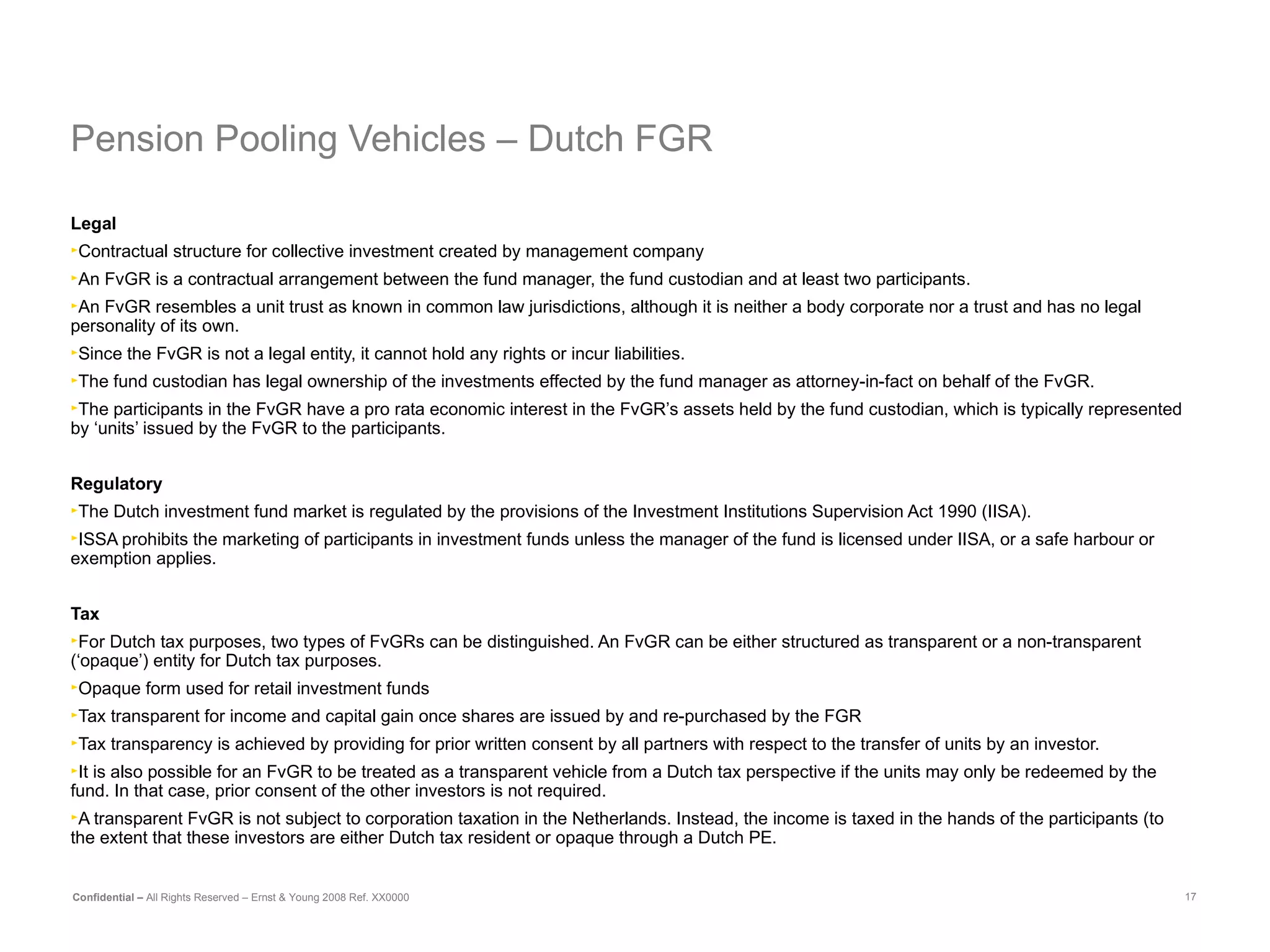

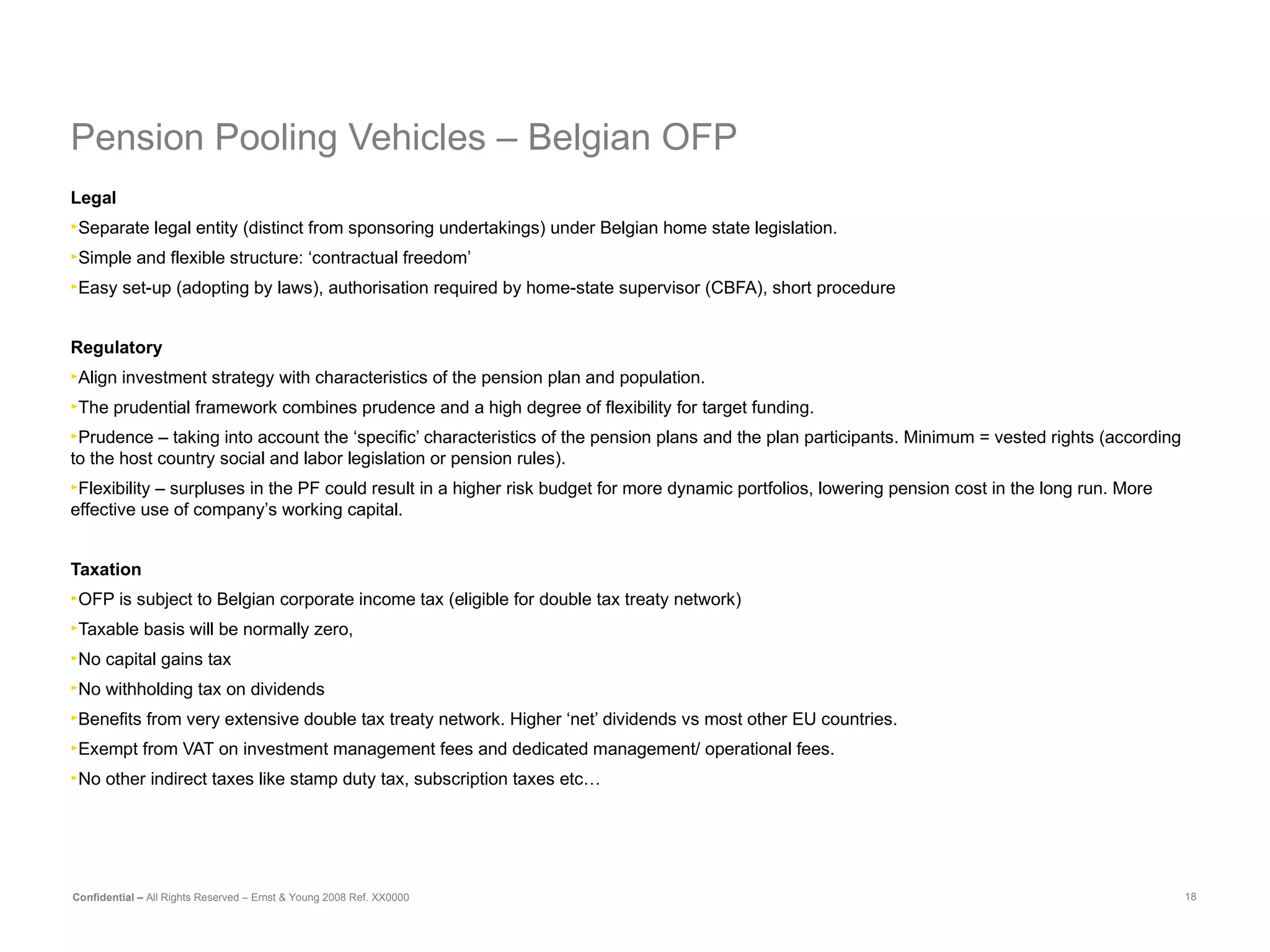

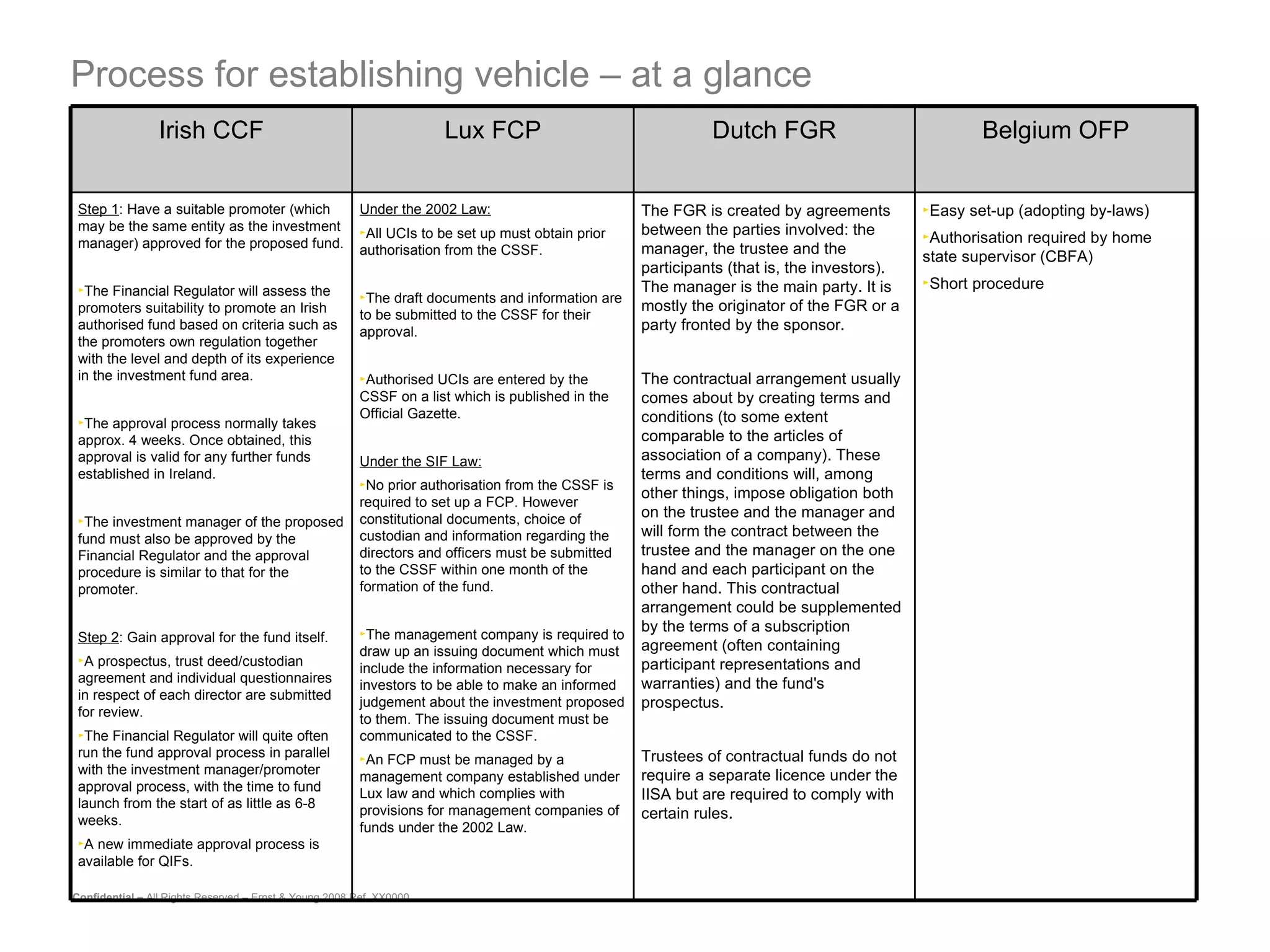

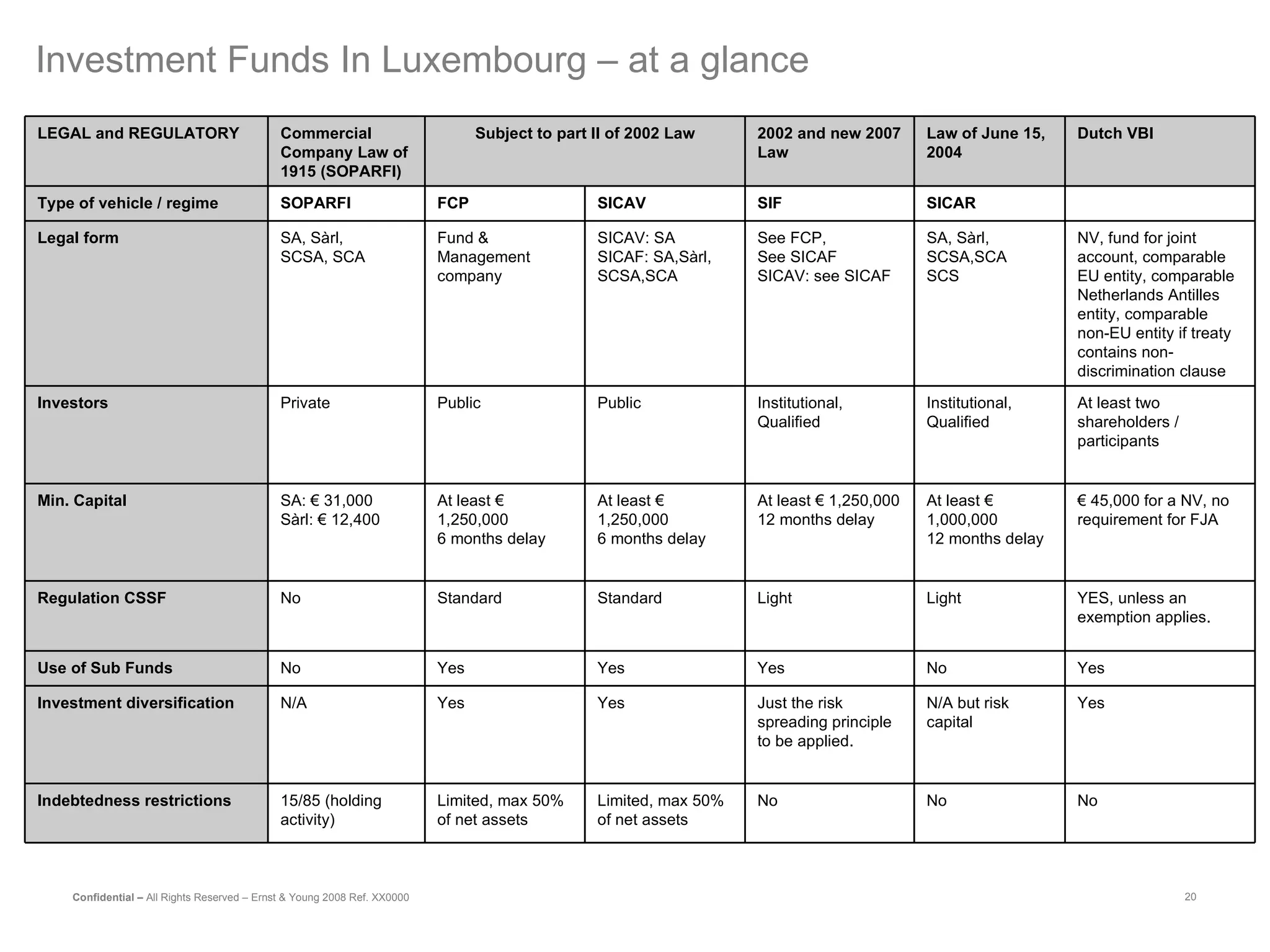

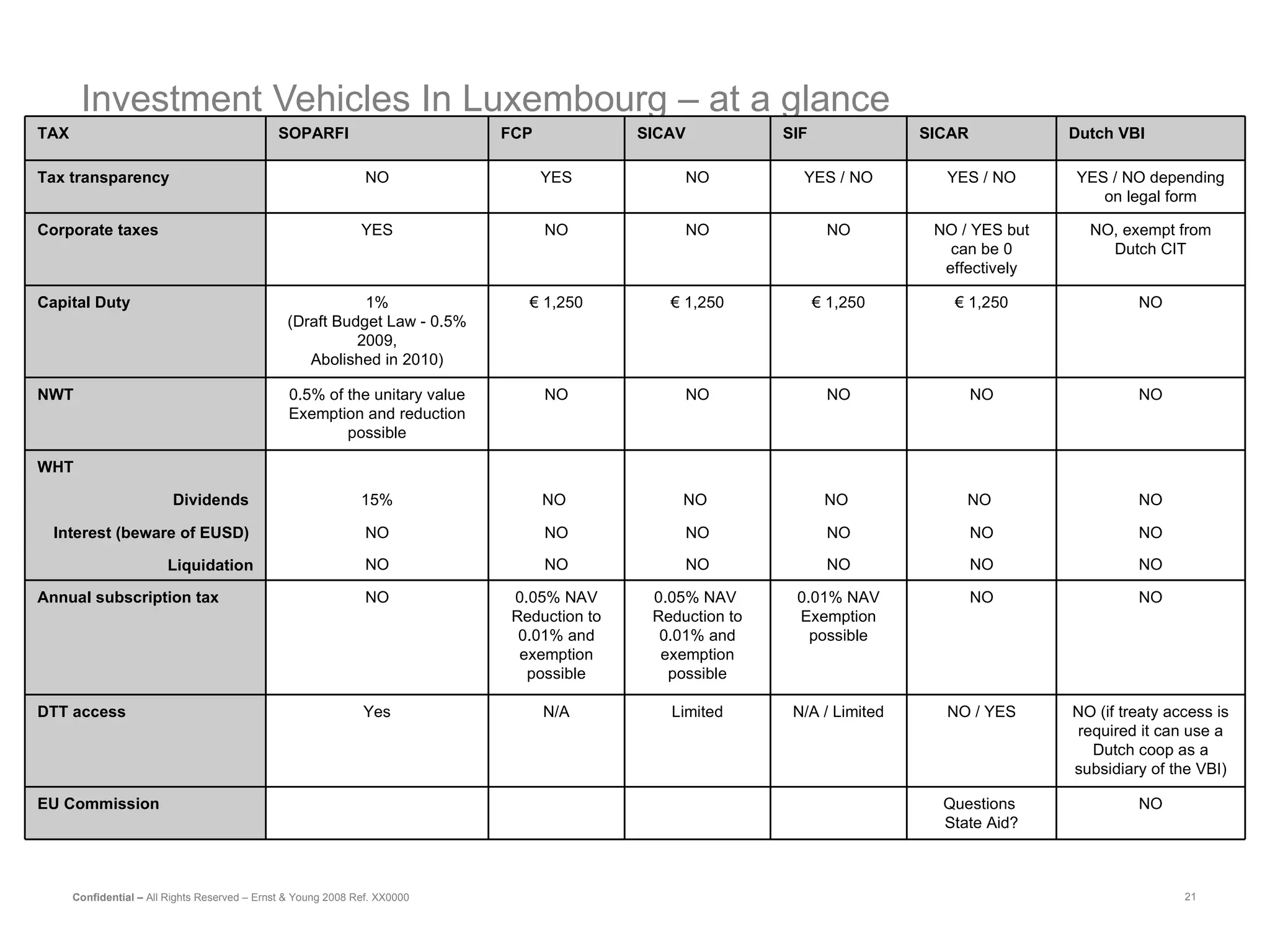

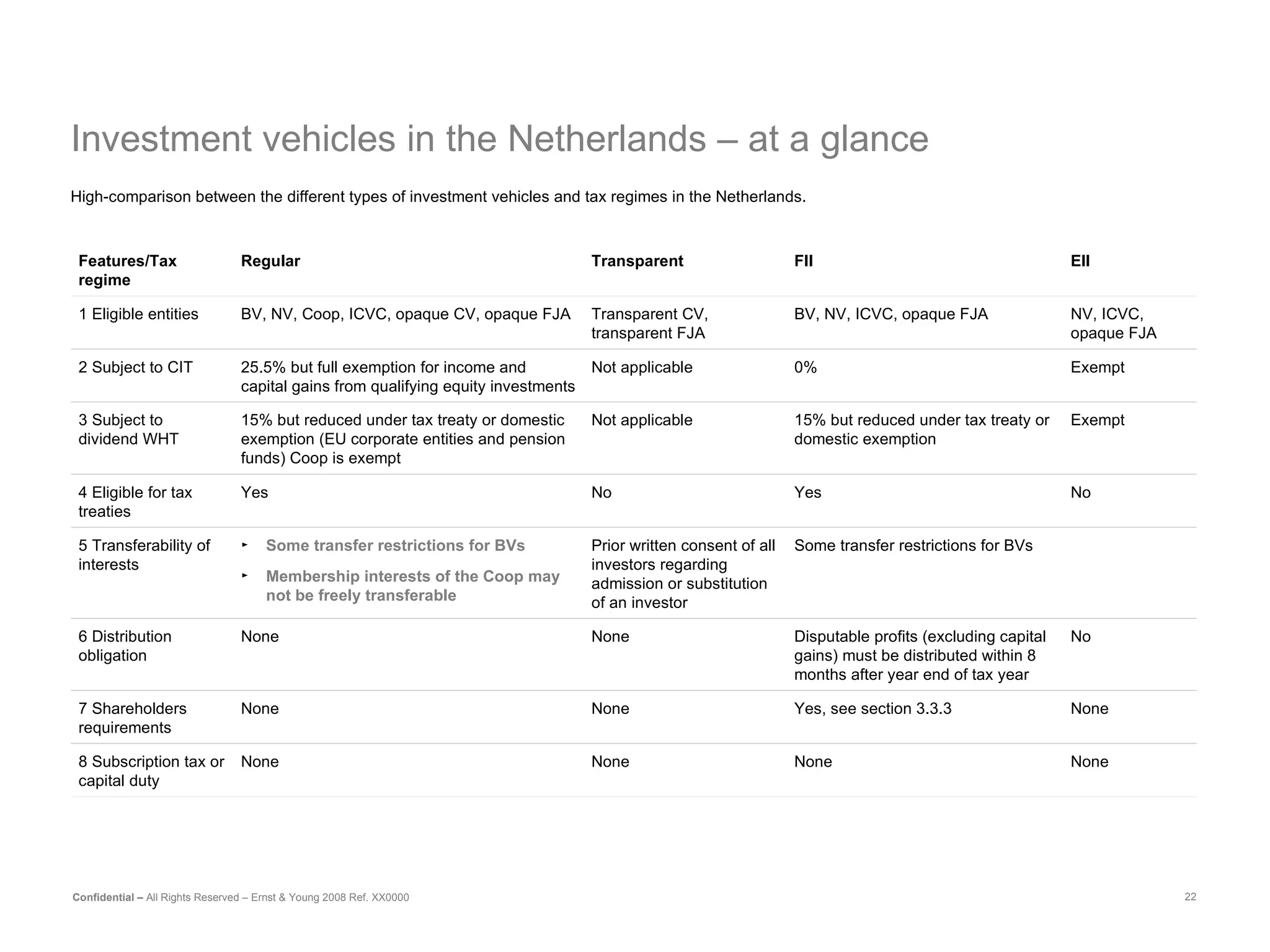

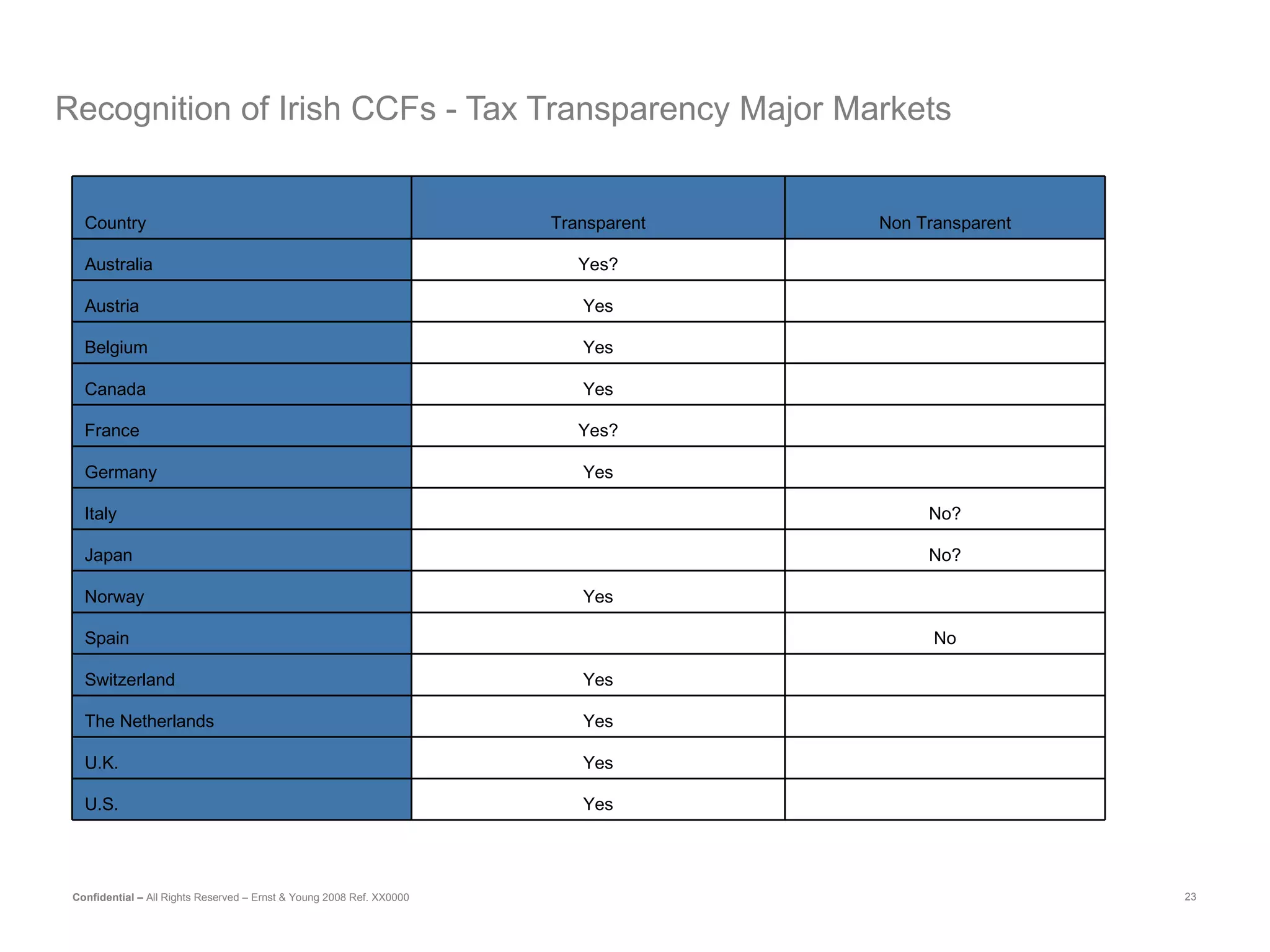

The document discusses various offshore tax efficient vehicles for pooling pension and investment assets, including common contractual funds (CCFs) in Ireland, fonds commun de placement (FCPs) in Luxembourg, and funds for joint account (FGRs) in the Netherlands. These pooling vehicles allow participating funds to realize economies of scale while providing tax transparency or neutrality. Recent developments have expanded the available vehicles and jurisdictions to include specialized investment funds in Luxembourg, funds of alternative funds in the UK, and institutional collective investment schemes in Belgium. Key considerations for these cross-border pooling vehicles include regulatory approval, tax treatment, and investment restrictions across jurisdictions.