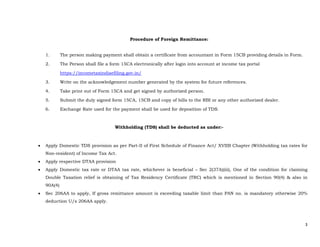

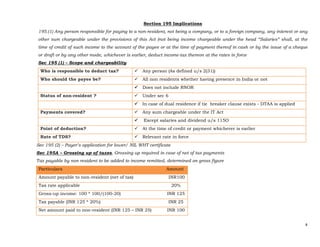

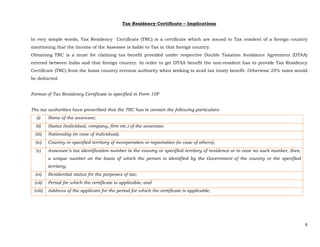

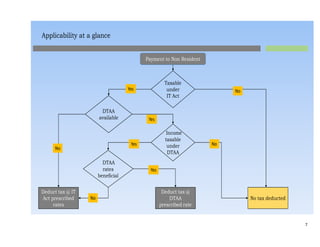

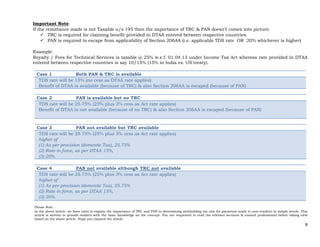

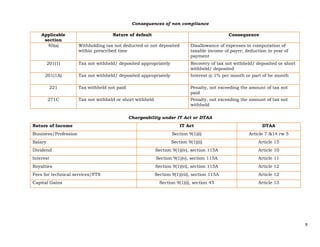

This document provides information on TDS requirements for foreign remittances under Indian law. It notes that TDS must be deducted on payments to non-residents according to section 195 of the Income Tax Act. Form 15CA must be filed for remittances over Rs. 50,000 or Rs. 2.5 lakhs annually along with Form 15CB from a chartered accountant. The proper procedure for deducting and depositing TDS is outlined. Implications of sections 195, 206AA, and tax treaties are discussed. The importance of obtaining a tax residency certificate for claiming treaty benefits is also explained.