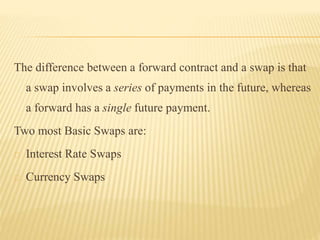

The document discusses the spot and forward foreign exchange markets. The spot market involves transactions that are settled within two business days at the spot exchange rate. The forward market involves contracts agreed upon today but settled at a predetermined future date at a fixed exchange rate. There are various types of participants and transactions in each market, including spot deals between currencies, outright forwards that lock in rates for future delivery, and swaps that involve simultaneous spot and forward currency trades.

![SPOT VS FORWARD

Spot Market

If the operation is of daily nature, it is

called spot market or current market.

Handles only spot transactions or

current transactions in foreign

exchange.

The exchange rate that prevails in the

spot market for foreign exchange is

called Spot Rate.

Spot rate of exchange refers to the

rate at which foreign currency is

available on the spot.

Not Quoted in Premium or Discount

Here no specified reasons.

Forward Market

•A market in which foreign exchange is

bought and sold for future delivery is

known as Forward Market.

•It deals with transactions (sale and

purchase of foreign exchange) which are

contracted today but implemented

sometimes in future.

•Exchange rate that prevails in a forward

contract for purchase or sale of foreign

exchange is called Forward Rate.

•Forward rate is the rate at which a future

contract for foreign currency is made.

•Quoted in Premium or Discount

•(i) To minimize risk of loss due to

adverse change in exchange rate (i.e.,

hedging) and [ii] to make a profit (i.e.,

speculation).](https://image.slidesharecdn.com/spotmarket-141006112249-conversion-gate01/85/Spot-market-17-320.jpg)