1) The document discusses the envelope theorem and its application to optimization problems with parameters. The envelope theorem describes how optimal values of decision variables change with parameters.

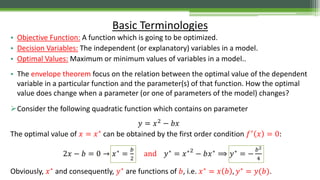

2) It provides an example of optimizing a quadratic function with respect to a single parameter b, showing how the optimal values of x and y vary with b.

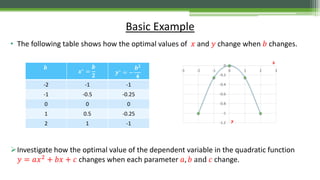

3) The envelope theorem can be applied to constrained and unconstrained optimization problems. It allows calculating the rate of change of the optimal objective value with respect to parameters.

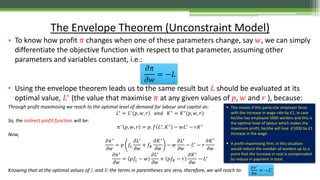

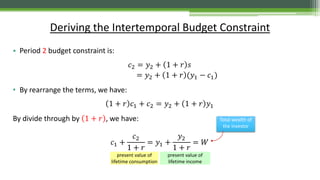

![• Case 2 (constraint model): It rarely happens to optimise a function without any constraint. In the real

world any optimisation is subject to one or more constraints. Again, imagine a simple example of

optimisation with two independent variables and one parameter 𝛼:

𝑍 = 𝑓(𝑥, 𝑦, 𝛼)

Subject to the constraint

𝑔 𝑥, 𝑦, 𝛼 = 𝑐

The Lagrangian Function can be written as:

𝐿(𝑥, 𝑦, 𝜆, 𝛼) = 𝑓 𝑥, 𝑦, 𝛼 + 𝜆[𝑐 − 𝑔 𝑥, 𝑦, 𝛼 ]

Setting the first partial derivatives of 𝐿 equal to zero,

𝐿 𝑥 = 𝑓𝑥 − 𝜆𝑔 𝑥 = 0

𝐿 𝑦 = 𝑓𝑦 − 𝜆𝑔 𝑦 = 0

𝐿 𝜆 = 𝑔(𝑥, 𝑦, 𝛼) = 𝑐

Assuming the second-order conditions are satisfied, solving these equations gives the optimal values of

𝑥, 𝑦 and 𝜆, in terms of the parameter 𝛼.

The Envelope Theorem (Constraint Model)

A

𝑐 is a constant

𝜆 is the Lagrange

Multiplier](https://image.slidesharecdn.com/specifictopicsinoptimisation-150114150913-conversion-gate02/85/Specific-topics-in-optimisation-10-320.jpg)

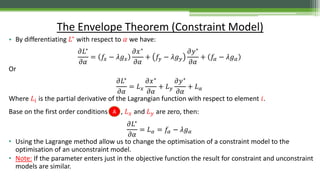

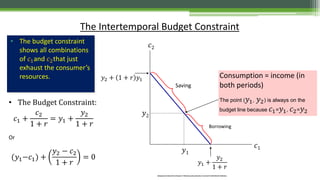

![𝑥∗

= 𝑥∗

(𝛼)

𝑦∗

= 𝑦∗

(𝛼)

𝜆∗

= 𝜆∗

(𝛼)

And the indirect objective function will be:

𝑍∗ = 𝑓 𝑥∗ 𝛼 , 𝑦∗ 𝛼 , 𝛼 = 𝜑(𝛼)

𝜑(𝛼) is the maximum value of 𝑍 for all values of 𝑥 and 𝑦 that satisfy the constraint and also it shows

the maximum value of 𝑍 for any value of 𝛼.

How does 𝜑(𝛼) change when 𝛼 changes? To answer this, we need somehow to consider the

constraint function 𝑔 𝑥, 𝑦, 𝛼 = 𝑐 in our analysis. To do that, we make indirect Lagrangian function 𝐿∗

, using

optimal values 𝑥∗

and 𝑦∗

and then differentiate the new indirect function with respect to 𝛼.

𝐿∗ 𝑥∗ 𝛼 , 𝑦∗ 𝛼 , 𝜆, 𝛼 = 𝜑 𝛼 + 𝜆[𝑐 − 𝑔 𝑥∗ 𝛼 , 𝑦∗ 𝛼 , 𝛼 ]

By maximising 𝐿∗

we have, in fact, maximised 𝜑 𝛼 , why?

The Envelope Theorem (Constraint Model)

Indirect objective

function

= 0](https://image.slidesharecdn.com/specifictopicsinoptimisation-150114150913-conversion-gate02/85/Specific-topics-in-optimisation-11-320.jpg)

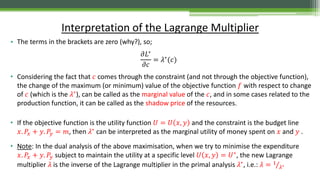

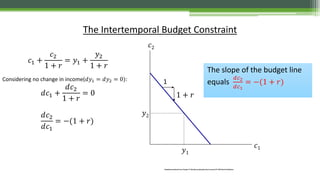

![• But more information about 𝜆 can be obtained through the envelope theorem:

By solving all equations in simultaneously (again consider 𝛼 as a constant), the optimal values for

variables and 𝜆 will be:

𝑥∗

= 𝑥∗

𝑐 , 𝑦∗

= 𝑦∗

𝑐 , 𝜆∗

= 𝜆∗

𝑐

Substituting these results into the Lagrangian function 𝐿(𝑥, 𝑦, 𝜆), we have:

𝐿∗ 𝑥∗ 𝑐 , 𝑦∗ 𝑐 , 𝜆∗ 𝑐 = 𝑓 𝑥∗ 𝑐 , 𝑦∗ 𝑐 , 𝜆∗ 𝑐 + 𝜆∗ 𝑐 [𝑐 − 𝑔 𝑥∗ 𝑐 , 𝑦∗ 𝑐 ]

Differentiating with respect to 𝑐, we have:

𝜕𝐿∗

𝜕𝑐

= 𝑓𝑥

𝜕𝑥∗

𝜕𝑐

+ 𝑓𝑦

𝜕𝑦∗

𝜕𝑐

+ 𝑐 − 𝑔 𝑥∗, 𝑦∗

𝜕𝜆∗

𝜕𝑐

+ 𝜆∗ [1 − 𝑔 𝑥

𝜕𝑥∗

𝜕𝑐

− 𝑔 𝑦

𝜕𝑦∗

𝜕𝑐

]

By rearranging, we get:

𝜕𝐿∗

𝜕𝑐

= 𝑓𝑥 − 𝜆∗

𝑔 𝑥

𝜕𝑥∗

𝜕𝑐

+ 𝑓𝑦 − 𝜆∗

𝑔 𝑦

𝜕𝑦∗

𝜕𝑐

+ 𝑐 − 𝑔 𝑥∗

, 𝑦∗

𝜕𝜆∗

𝜕𝑐

+ 𝜆∗

Interpretation of the Lagrange Multiplier

A](https://image.slidesharecdn.com/specifictopicsinoptimisation-150114150913-conversion-gate02/85/Specific-topics-in-optimisation-14-320.jpg)

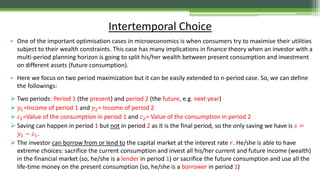

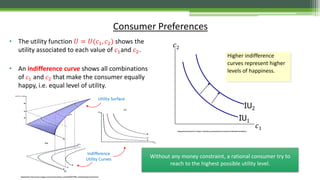

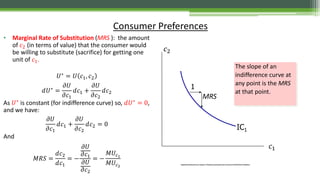

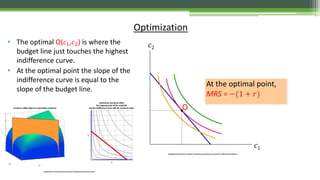

![Maximisation of the Intertemporal Utility

• Maximise: 𝑈 = 𝑈(𝑐1, 𝑐2) , subject to:(𝑦1−𝑐1) +

𝑦2−𝑐2

1+𝑟

= 0

• The Lagrange function for this problem is:

𝐿 𝑐1, 𝑐2, λ = 𝑈 𝑐1, 𝑐2 + λ[(𝑦1−𝑐1) +

𝑦2 − 𝑐2

1 + 𝑟

]

Producing the first-order conditions:

𝐿1 =

𝜕𝑈

𝜕𝑐1

− 𝜆 = 0

𝐿2 =

𝜕𝑈

𝜕𝑐2

−

𝜆

1 + 𝑟

= 0

𝐿 𝜆 = (𝑦1−𝑐1) +

𝑦2 − 𝑐2

1 + 𝑟

= 0

Solving for the first two equations:

𝜕𝑈

𝜕𝑐1

𝜕𝑈

𝜕𝑐2

= 1 + 𝑟 ⟹

𝑀𝑈𝑐1

𝑀𝑈𝑐2

= 1 + 𝑟

In the optimal point the slope of the

indifference curve should be equal to the

slope of the constraint.](https://image.slidesharecdn.com/specifictopicsinoptimisation-150114150913-conversion-gate02/85/Specific-topics-in-optimisation-23-320.jpg)