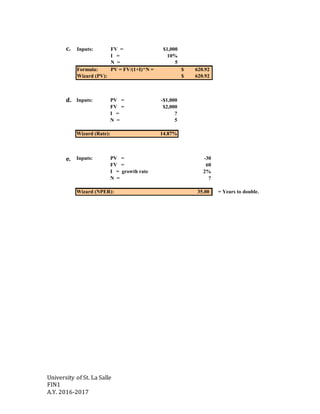

This document contains examples of using financial calculators and formulas to calculate present value, future value, interest rates, payment amounts, and other time value of money concepts for various cash flows over time. It shows inputs and outputs for calculations involving simple and compound interest, annuities, perpetuities, and cash flows with non-periodic payments. The examples demonstrate calculations for nominal and effective interest rates as well as adjustments needed for annuity due versus ordinary annuity calculations.