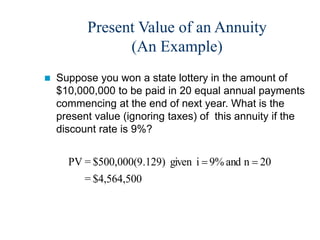

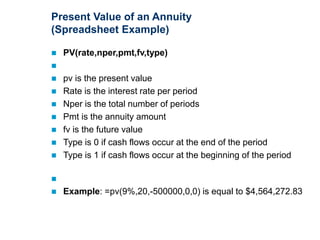

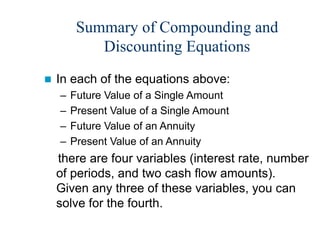

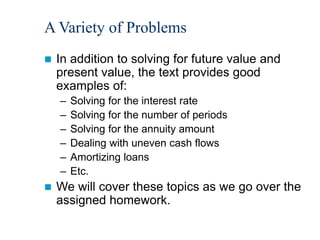

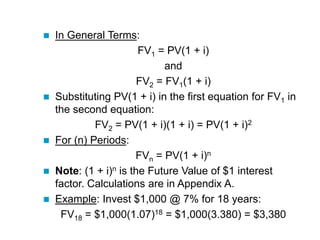

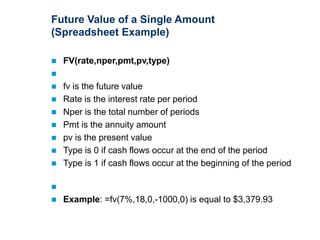

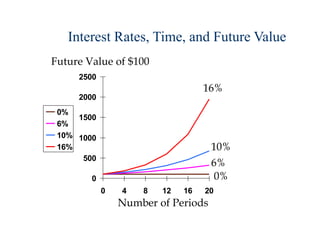

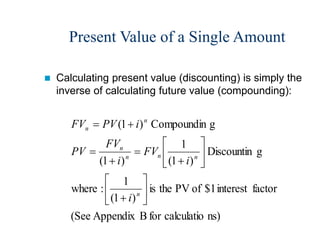

This document discusses key concepts related to the time value of money, including:

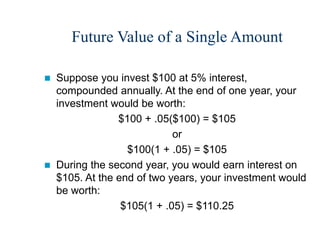

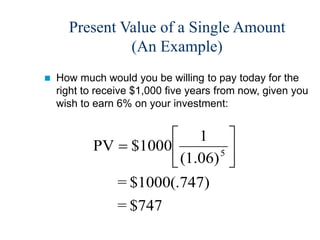

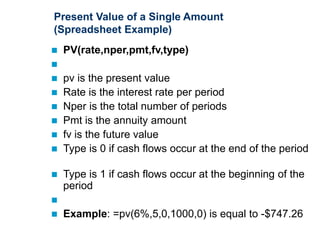

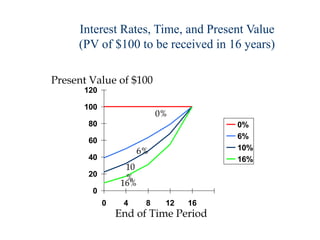

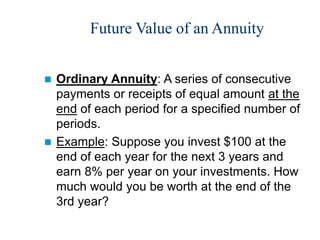

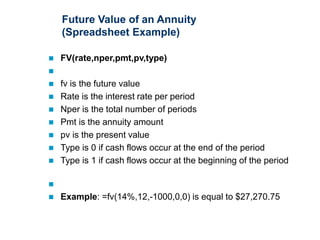

- Calculating the future and present value of a single amount and an annuity using compound interest formulas.

- Examples of using financial calculators and spreadsheets to solve time value of money problems.

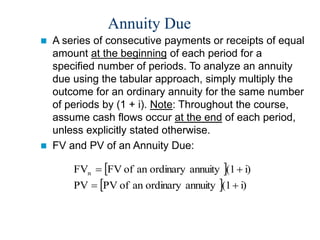

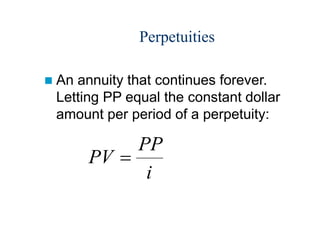

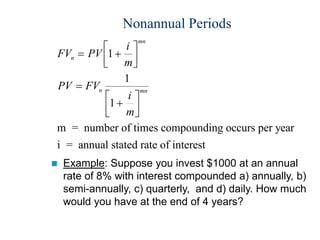

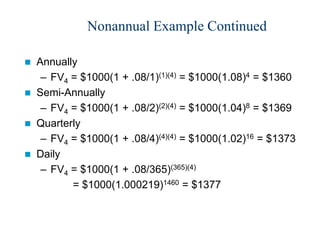

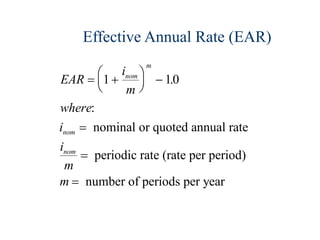

- Additional topics covered include annuities due, perpetuities, non-annual periods, and effective annual rates. Students are encouraged to use financial calculators to simplify solving discounted cash flow problems.

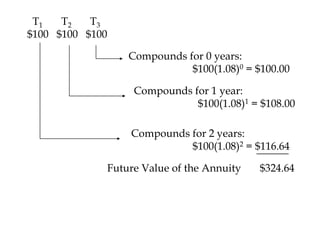

![FV3 = $100(1.08)2 + $100(1.08)1 +$100(1.08)0

= $100[(1.08)2 + (1.08)1 + (1.08)0]

= $100[Future value of an annuity of $1

factor for i = 8% and n = 3.]

(See Appendix C)

= $100(3.246)

= $324.60

FV of an annuity of $1 factor in general terms:

)

calculator

financial

-

non

a

using

when

(useful

i

1

i)

(1 n

](https://image.slidesharecdn.com/133chapter092002-230704042119-c9a6b1fe/85/133chapter092002-ppt-14-320.jpg)

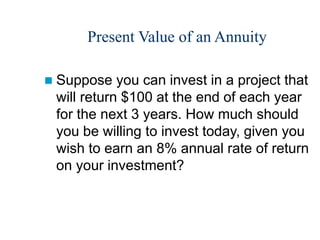

![T0 T1 T2 T3

$100 $100 $100

Discounted back 1 year:

$100[1/(1.08)1] = $92.59

Discounted back 2 years:

$100[1/(1.08)2] = $85.73

Discounted back 3 years:

$100[1/(1.08)3] = $79.38

PV of the Annuity = $257.70](https://image.slidesharecdn.com/133chapter092002-230704042119-c9a6b1fe/85/133chapter092002-ppt-18-320.jpg)

![s)

calculator

financial

-

non

with

(useful

)

1

(

1

1

:

terms

general

in

factor

$1

of

annuity

an

of

PV

$257.70

)

$100(2.577

D.)

Appendix

(See

3]

n

and

8%

i

for

factor

$1

of

annuity

an

of

nt value

$100[Prese

=

]

)

08

.

1

/(

1

)

08

.

1

/(

1

)

08

.

1

/(

1

[

100

$

=

]

)

08

.

1

/(

1

[

100

$

]

)

08

.

1

/(

1

[

100

$

]

)

08

.

1

/(

1

[

100

$

3

2

1

3

2

1

i

i

PV

n

](https://image.slidesharecdn.com/133chapter092002-230704042119-c9a6b1fe/85/133chapter092002-ppt-19-320.jpg)