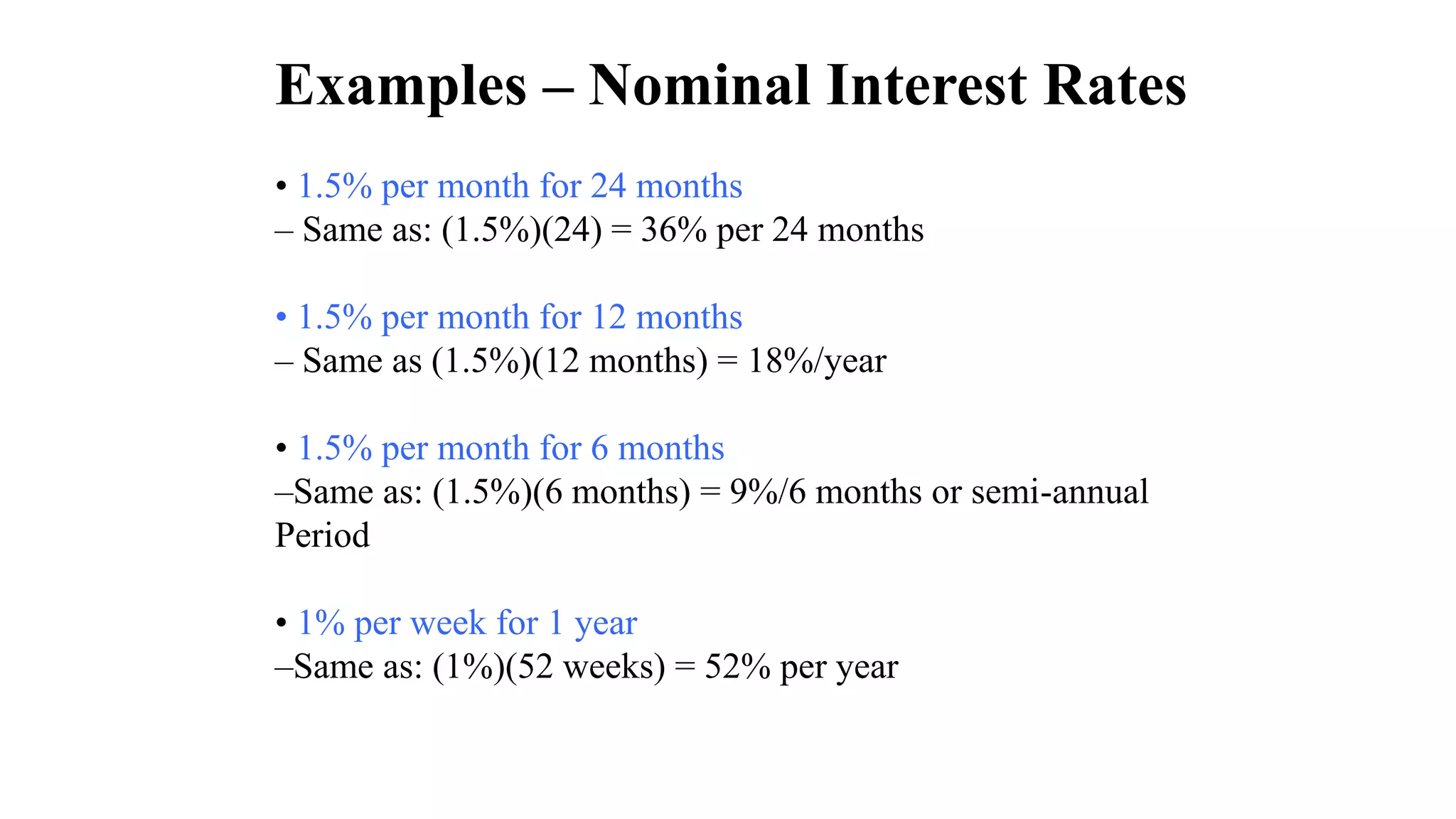

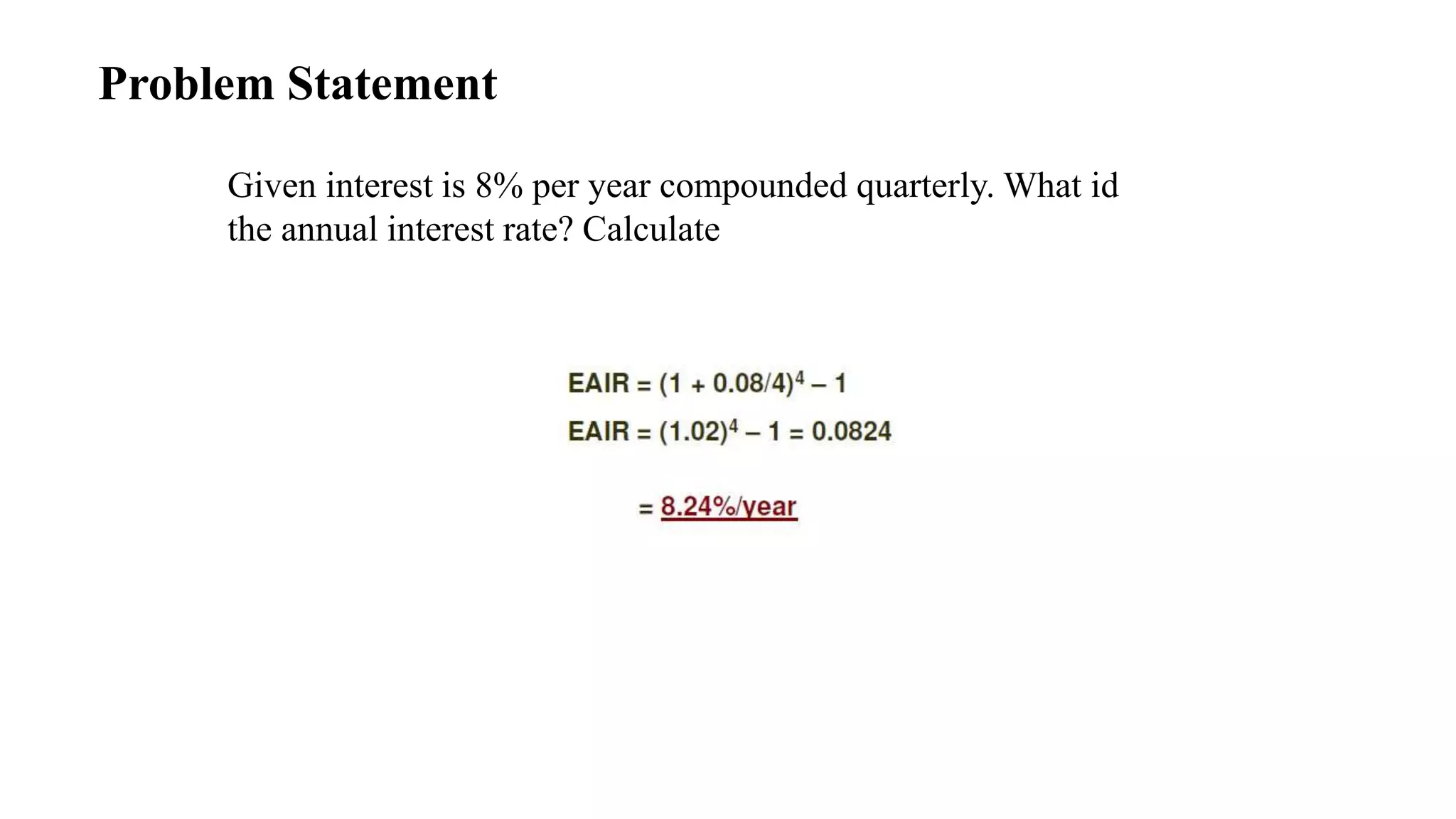

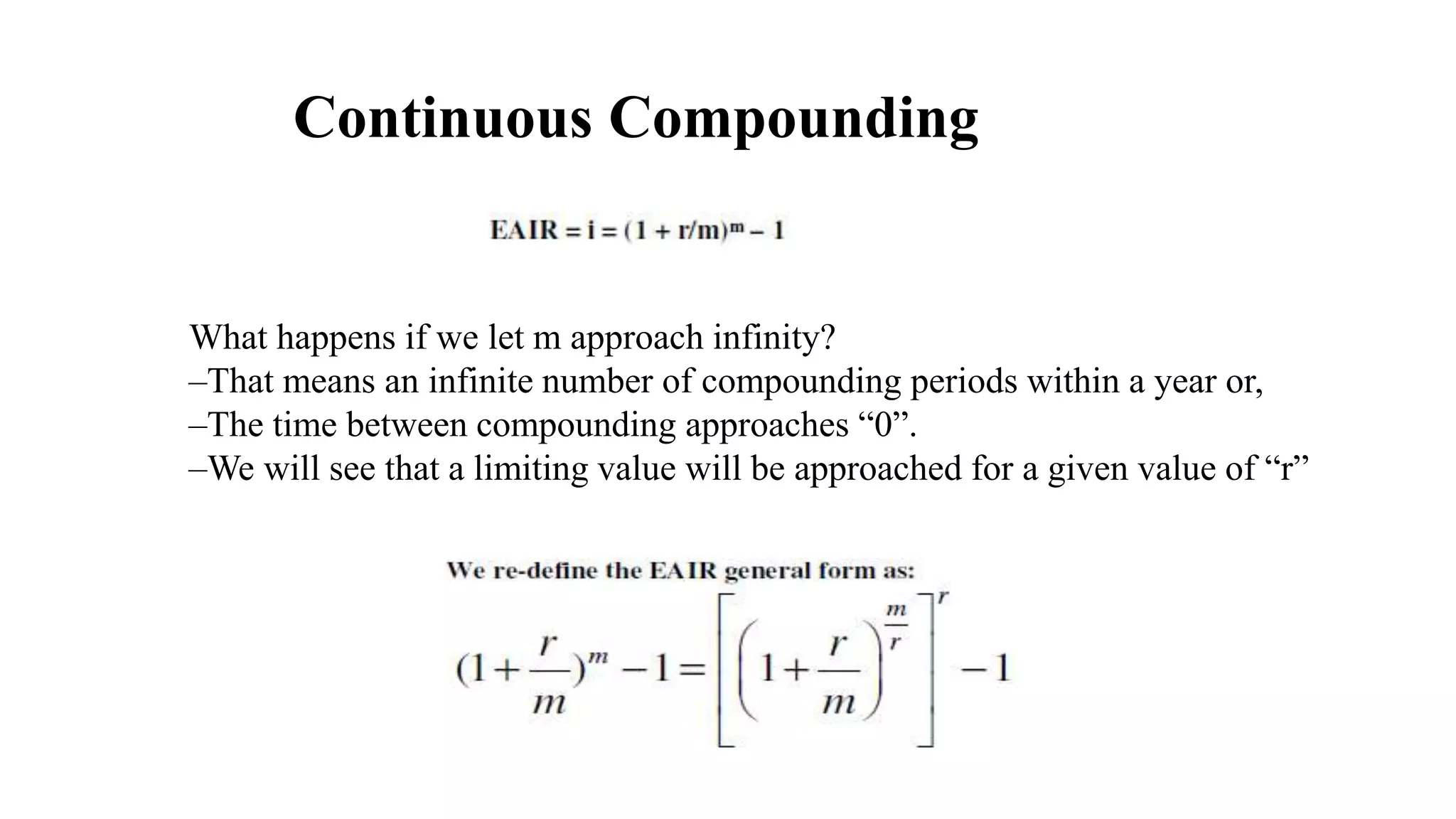

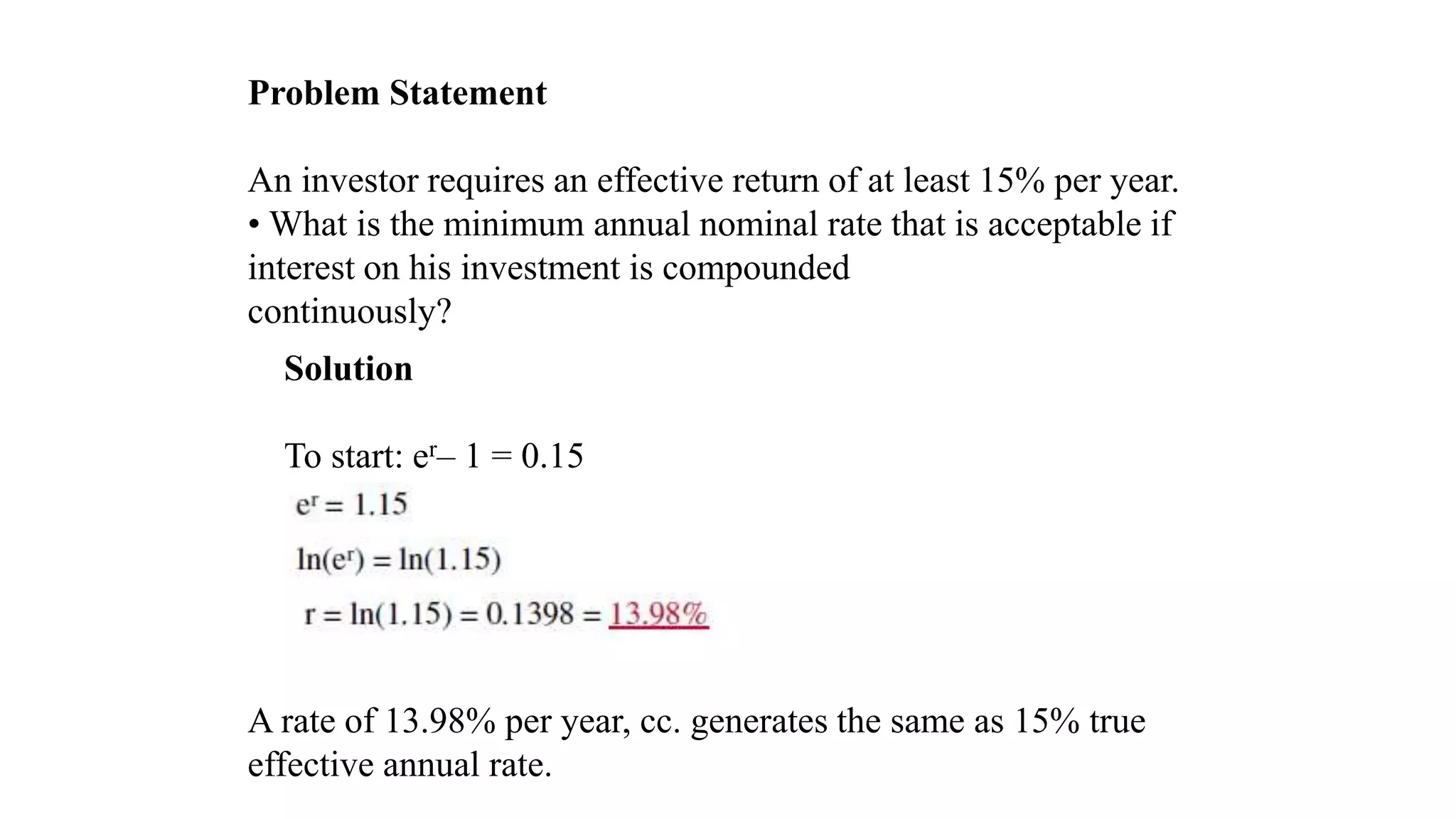

The document explains the difference between nominal and effective interest rates, defining nominal rates as those that do not account for compounding and often expressed annually. It details how effective interest rates represent the true cost of borrowing or investment over time and provides formulas for calculating both types of rates. Additionally, it discusses continuous compounding and illustrates concepts with practical examples and problem statements.