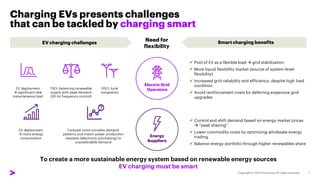

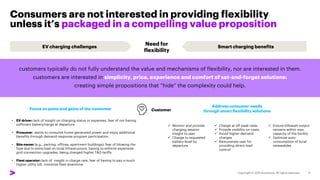

La movilidad eléctrica y la carga inteligente de vehículos eléctricos (EV) están en auge, y su adopción a gran escala es vital para el éxito en la cadena de valor de la emobility. Para impulsar esta adopción, se deben ofrecer soluciones simples y asequibles que mejoren la experiencia del cliente. Además, las empresas deben superar desafíos relacionados con la carga y la gestión de la demanda energética para maximizar los beneficios de la carga inteligente.