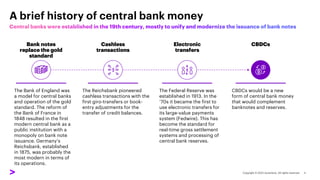

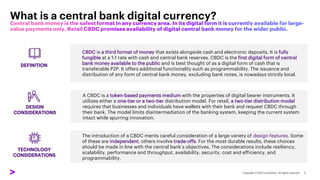

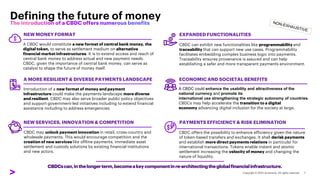

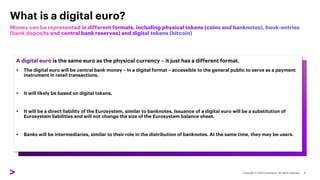

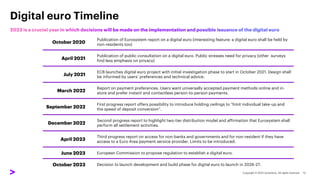

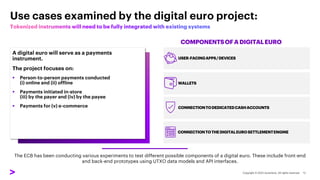

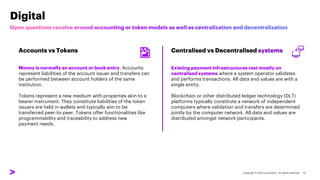

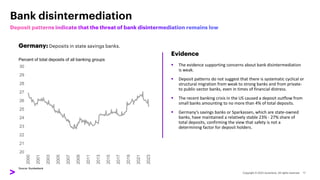

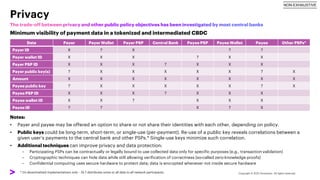

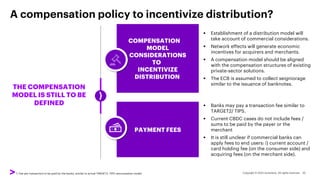

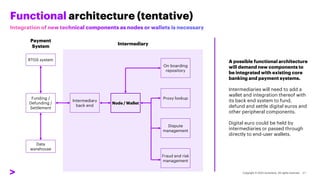

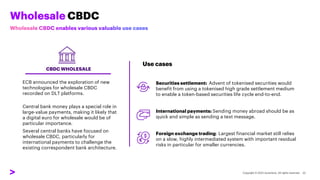

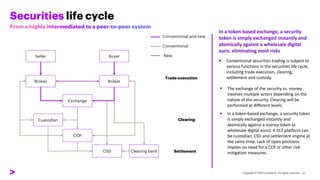

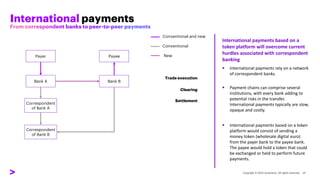

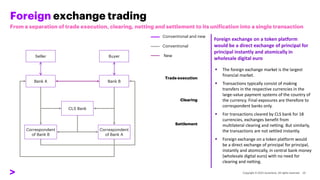

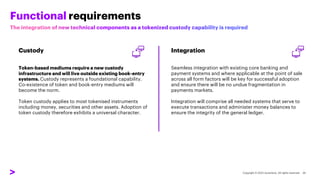

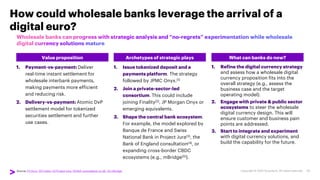

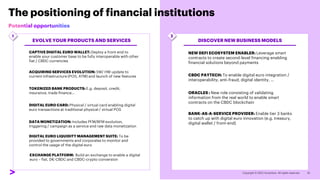

The document discusses the implications of a digital euro for the financial system, defining central bank digital currencies (CBDCs) as a new form of money complementing cash and electronic deposits. It outlines the development timeline, design considerations, and potential benefits, including enhanced payment efficiency, privacy, and programmability, while addressing concerns like bank disintermediation and the role of intermediaries. The digital euro aims to modernize the payment landscape and support broader public policy objectives, ultimately shaping the future of monetary transactions.