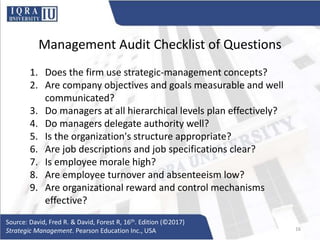

The document discusses the importance of conducting an internal assessment as part of the strategic management process. It describes how an internal assessment involves gathering and prioritizing information about a firm's management, marketing, finance, production, research and development, and information systems to understand how all areas fit together. The internal assessment provides insights into a firm's distinctive competencies and resources that can be leveraged to achieve competitive advantages.