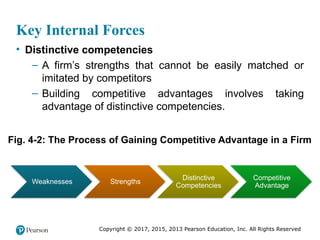

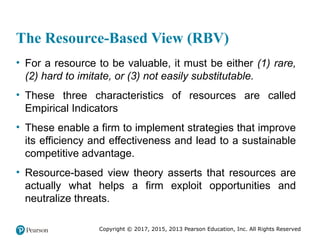

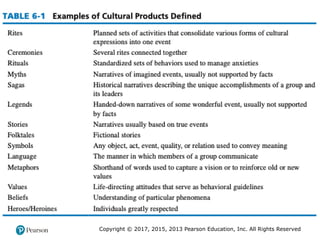

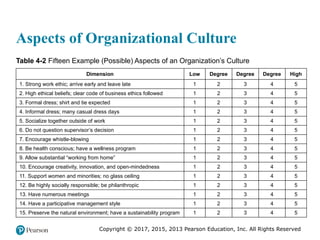

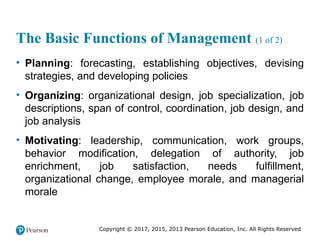

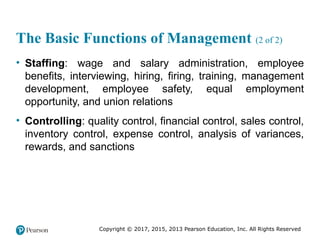

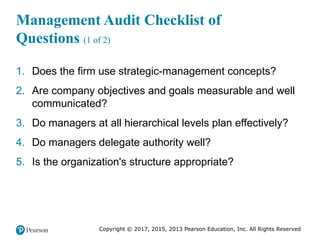

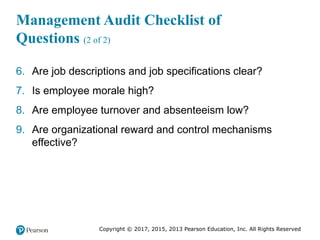

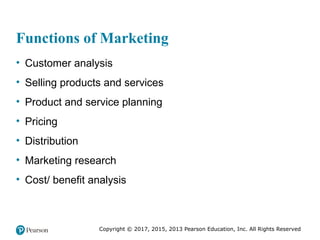

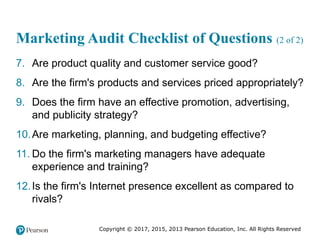

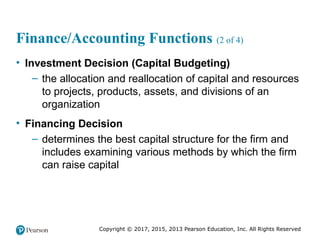

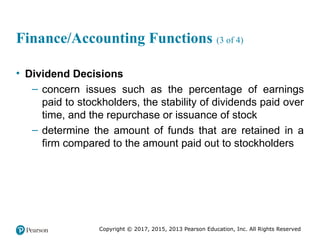

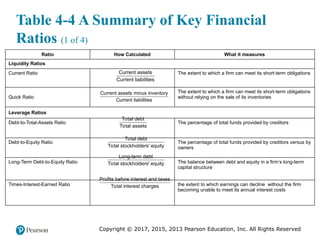

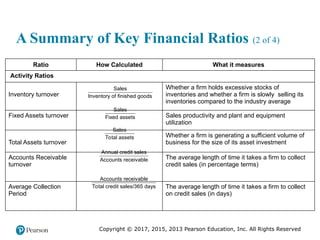

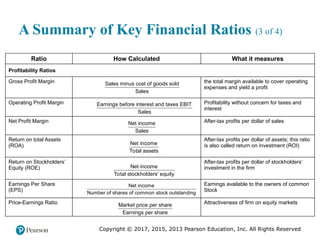

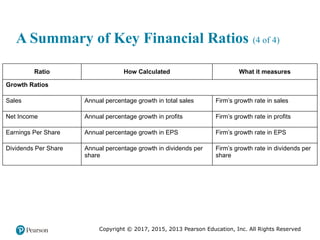

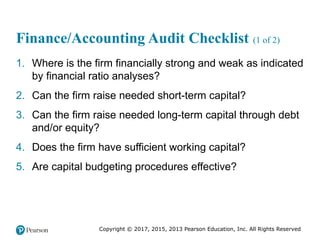

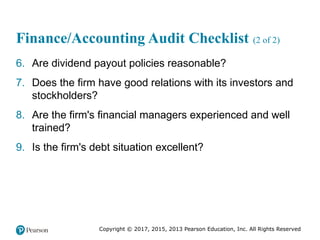

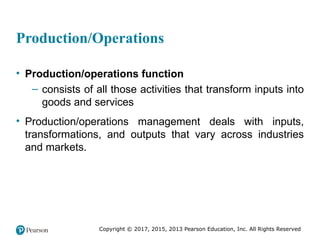

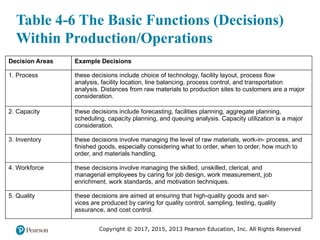

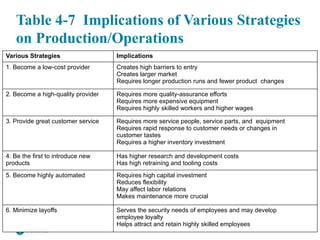

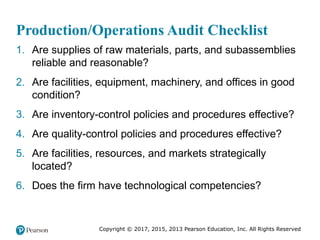

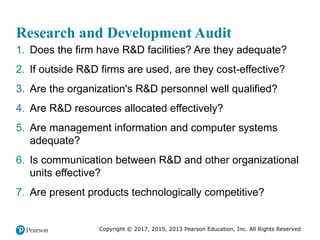

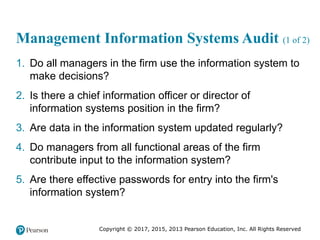

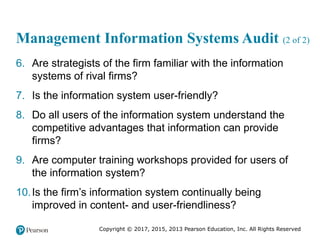

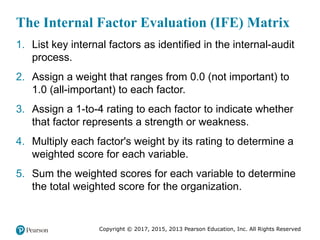

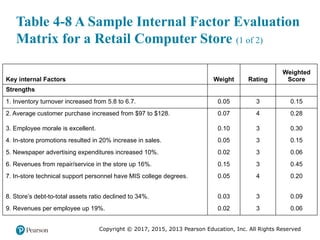

The document outlines the importance of internal assessments in strategic management, focusing on areas such as organizational culture, management functions, and finance. It provides an overview of key concepts, including distinctive competencies, the resource-based view, and strategies for various business functions. Additionally, it includes audit checklists for management, marketing, and finance to evaluate the effectiveness of organizational strategies.