HAW (HOW AND WHY)

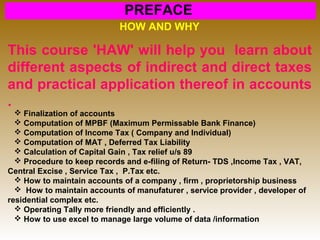

- 1. PREFACE HOW AND WHY This course 'HAW' will help you learn about different aspects of indirect and direct taxes and practical application thereof in accounts . Finalization of accounts Computation of MPBF (Maximum Permissable Bank Finance) Computation of Income Tax ( Company and Individual) Computation of MAT , Deferred Tax Liability Calculation of Capital Gain , Tax relief u/s 89 Procedure to keep records and e-filing of Return- TDS ,Income Tax , VAT, Central Excise , Service Tax , P.Tax etc. How to maintain accounts of a company , firm , proprietorship business How to maintain accounts of manufaturer , service provider , developer of residential complex etc. Operating Tally more friendly and efficiently . How to use excel to manage large volume of data /information

- 2. TAXES IN INDIA DIRECT TAX INDIRECT TAX

- 3. Indirect Tax : It is collected by intermediary Indirect Taxes in India : VAT STDS CST ENTRY TAX ENTERTAINMENT TAX LUXURY TAX STT CENTRAL EXCISE CUTOM DUTY SERVICE TAX

- 4. VAT (VALUE ADDED TAX IN WEST BENGAL) • It is a multi-point tax and rate of which varies from state to state • As on 31.01.2016 VAT rate is 1% ,5% and 14.5% in West Bengal . • In some cases VAT rate varies according to capacity and price of goods ,for example 14.5% for AC having capacity above 1 ton , Motor Car (price exceeding 10 lacs)

- 5. Registration Procedure : a) Compulsory Registration : Turnover > 10 Lacs b) Voluntary Registration : Turnover <=10 lacs

- 6. E-Application for VAT registration : FORM 1 Select online Application Type www.wbcomtax.nic.in Fill up " Dealer Info/Dealer details" Addl. place of business Contact person

- 7. Warehouse & factory address Commodity details Bank details Annexure B Applicant (Dealer/ Firm /Pvt. Company) Annexure A Proprietorship / Partnership Firm

- 8. Specified by " * " Mandatory Field : Name, Trade Name, Address of Principle Place of Business, Status of Business , Nature of Business, Occupancy Status of Applicant Acknowledgement Slip along with Application Number Print the Acknowledgement Slip and Copy of Application with data Pay Rs. 100/- as Registration Fees , In case of voluntary registration pay Rs. 25000/- as security deposit

- 9. Submit all the necessary documets as mentioned below along with printed copy of Application and Acknowledgement Slip within 3 days from date of application • Trade License • PAN • Professional Tax Enrolment Certificate • Partnership Deed / Articale of Association /Memorandum/ Company's Registration Certificate • Voter Card • Rental Bill , Agreement Paper, Municipal Tax Bill , NOC (No Objection Certificate) • Purchase and Sale Bill of Rs. 50000/- to be submitted as a proof of transaction being a dealer • Bank Statement • Passport photo • Transporter /Transporting Agent shall apply for enrollment in prescribed format i.e. Form-10

- 10. After application you will get TIN (Tax payer's Identification Number) / VAT No. containing 11 digits .Significance of the digits are as follows : First Two Digits : State Code Next Two Digits : Charge Code Next Four Digits : Registration Number Nineth Digit : ' 0 ' (Registered under VAT Act ' 1' (Registered under Sales Tax Act 1994) ' 2 ' (Registered under CST Act )

- 11. A) COMPOUND VAT RATE (COPOSITION SCHEME) a)This scheme is not applicable for : i) Manufaturer ii) Importer / Exporter iii) Works Contractor iv) Branch Transfer and the dealer registered under CST Act 1956 • Form 1CR is applicable for Composition Registration

- 12. How to pay tax under composition scheme : i) 0.25% of total turnover in a financial year or a) 7000/- per annum if turnover <= 30 Lacs b) 12000/- per annum if turnover > 30 Lacs but <= 50 Lacs. To continue this scheme Form 16 is to be submitted every year to Deputy / Addl.Commissioner . A composite dealer is not entitled to levy VAT while selling goods and must mention 'Composition Scheme' (either in printed form / by using rubber stamp) in the invoice .

- 13. COMPOUND • Goods can be procured without paying VAT against Form H • A dealer can purchase goods paying VAT and can apply directly to the Commissioner .Within 3 months from the date of application the dealer will be entitled to avail 100% ITC (Input Tax Credit) .In this case Declaration Form 32,35, 36 and 37 are used according to requirement . B) VAT regarding goods purchased for 100% export

- 14. Computation of VAT for Works Contract • Works Contract : Execution of jobs like construction of building , fabrication and installation , repairing bridge , building , involves service and transfer of goods. Method of calculation of turnover sales : a) Aggregate of CTP (Contractual Transfer Price) 20000 Less :i) Expenditure for design 1000 ii) Payment to Sub Contractor 3000 iii) Consumable items 6000 (Fuel, Electricity etc.) iv) Administrative expns. 1500 Taxable Turnover 9500

- 15. b) Aggregate of CTP 20000 Add : VAT @5% on 50 % of 20000 500 VAT@14.5% on 25 % of 20000 725 rest 25 % is labour cost _____________________________________ Total 21225 This method is as simple as safe to apply where expenditures can not be sagregated due to keeping records improperly .

- 16. Different rate of percentage according to nature of job • Sl. No. Nature of Job Percentage of deduction from CTP % of CTP on which VAT @ 5% levied % of CTP on which VAT @ 14.5% levied 1 Fabrication and installation of plant and machinery 25 50 25 2 Installation of frame , doors , windows 20 10 70 3 Supply and Installation of Air Cooler 15 5 80 4 Supply and installation of electrical equipments 20 50 30 Supply and fixing of tiles ,

- 17. STDS (Sales Tax Deducted at Source) • It is a type of TDS which is deducted from payment to works contractor . It is not applicable for pure labour contractor . 3% for registered contractor Rate 5% for unregistered contractor The following company/board/society can apply for enrollment for STDS :

- 18. Central Government State Government Central & State Govt. undertaking Gram Panchayat Panchayat Samiti Zilla Parishad Municipality Corporation Co-operative Society Company Partnership Firm Joint Venture Comapny Promoter (other than Individual / Proprietor) Bank Educational Institute Hospital Nurshing Home Diagonastic Centre LLP (Limited Liability Partnership)

- 19. • Time Limit : User can e-file Form 19 (Details of deduction from the contractors for the month) within 20 days from end of month • STDS is not applicable for transaction not exceeding Rs.10000/- in a financial year • Payment of STDS : TR Form 12A (Two copies) • Deductor will issue a STDS certificate i.e.18A within 25 days from end of the month

- 20. Guideline for availing ITC (Input Tax Credit) : Goods purchased Nature of Business ITC Reason Computer Interior Decoration √ Designing purpose Computer Cement manufacturer X ink for printing Printing and Advertisement √ Banner printing Electrical Item Any type X used for repairing Consumabl e Item like petrol, electricity , water etc. Any Type X Negative List key points : • Purpose of purchase • How purchased item is related to output . • If goods are purchased from unregistered dealer and such goods are directly used for manufacturing than no purchase tax is rquired to pay .But if the goods are transfered as such to other in lieu of a valuable consideration other than sale ,tax is payable on such transaction

- 21. Payment of Tax U/S 31 :Due date within 20 days every month following preceding month Return U/S 32 : Return must be submitted within the month after completion of quarter Form 14 General Form 14A for registered re-seller Form 14B for registered manufacturer Form 14C for registered works contractor