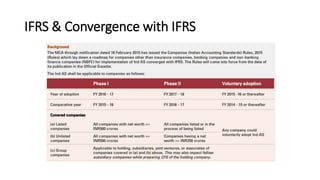

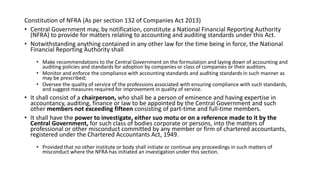

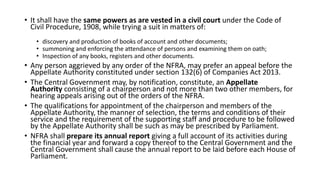

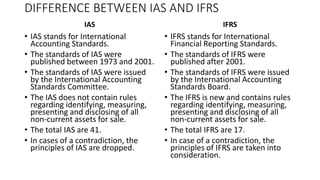

Accounting standards provide guidance on the recognition, measurement, treatment, presentation and disclosures of accounting transactions in financial statements. They aim to bring uniformity and reduce alternatives in accounting practices. The key accounting standards setting bodies in India are the Institute of Chartered Accountants of India (ICAI), National Advisory Committee on Accounting Standards (NACAS) and the newly formed National Financial Reporting Authority (NFRA). ICAI recommends accounting standards to NACAS, which advises the government. NFRA will regulate accounting standards and oversight the auditing profession. The objectives of convergence with IFRS in India are to adopt globally accepted best practices and ensure compliance.