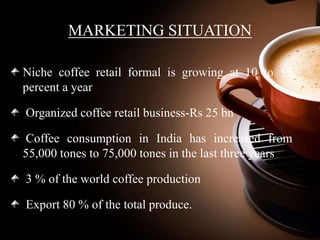

India has traditionally been a tea-drinking nation, but coffee consumption is growing, especially among youth in urban areas. While India is one of the top coffee producers globally, domestic consumption is low at around 85 grams per capita annually compared to over 10 kilograms in other countries. However, the market is untapped and coffee chains are expanding rapidly. Major players like Cafe Coffee Day have over 1,000 outlets but face challenges from low prices, high real estate costs, and increasing competition from new entrants. Developing new strategies around customer experience and locations will be key to further growth in India's percolating coffee market.