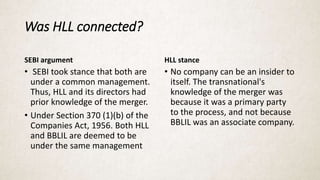

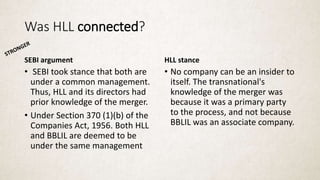

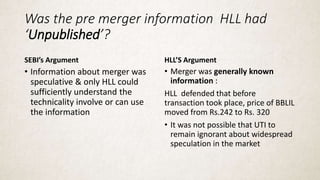

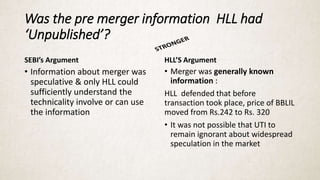

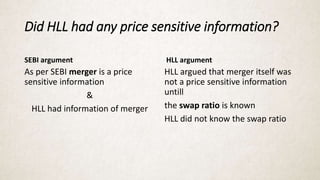

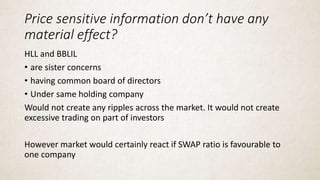

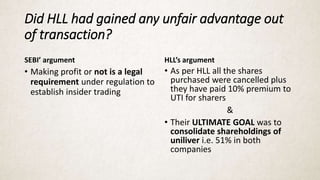

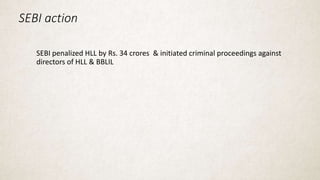

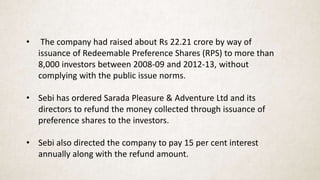

The Securities and Exchange Board of India (SEBI) was established in 1988 to regulate capital markets and protect investor interests. It has the authority to impose penalties and oversee insider trading, with notable cases including the HLL-BBLIL merger, where SEBI found HLL guilty of insider trading but was later overruled by the Securities Appellate Tribunal. SEBI has also addressed lapses by the National Stock Exchange and non-compliance by other companies, enforcing regulatory measures to enhance market stability.