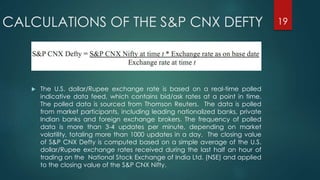

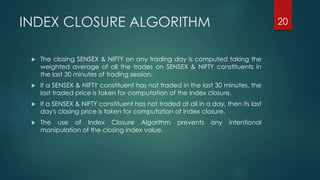

This document provides an overview of the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) in India. It discusses the history and functions of stock exchanges. It describes the key indices used by each exchange - SENSEX for BSE and S&P CNX Nifty for NSE - and how they are calculated. The BSE is the oldest stock exchange in Asia, while the NSE is the largest exchange in India in terms of trading volume. Both exchanges help companies raise capital and provide investment opportunities for investors.