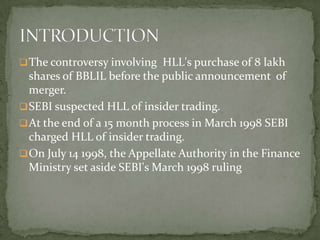

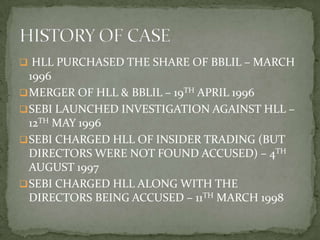

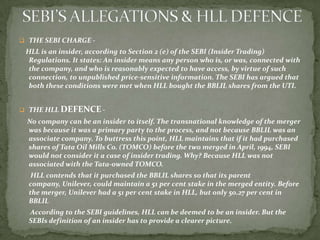

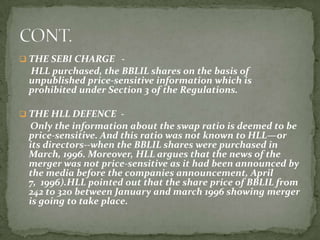

This document summarizes a case study involving SEBI's allegations of insider trading against HLL for purchasing shares of BBLIL before publicly announcing a merger. The key points discussed are: SEBI's position that HLL was an insider with non-public information; HLL's defense that it was a party to the merger negotiations and the information was generally known; and the Ministry of Finance ultimately ruled that HLL was not guilty as it did not gain any unfair advantage from the share purchase.