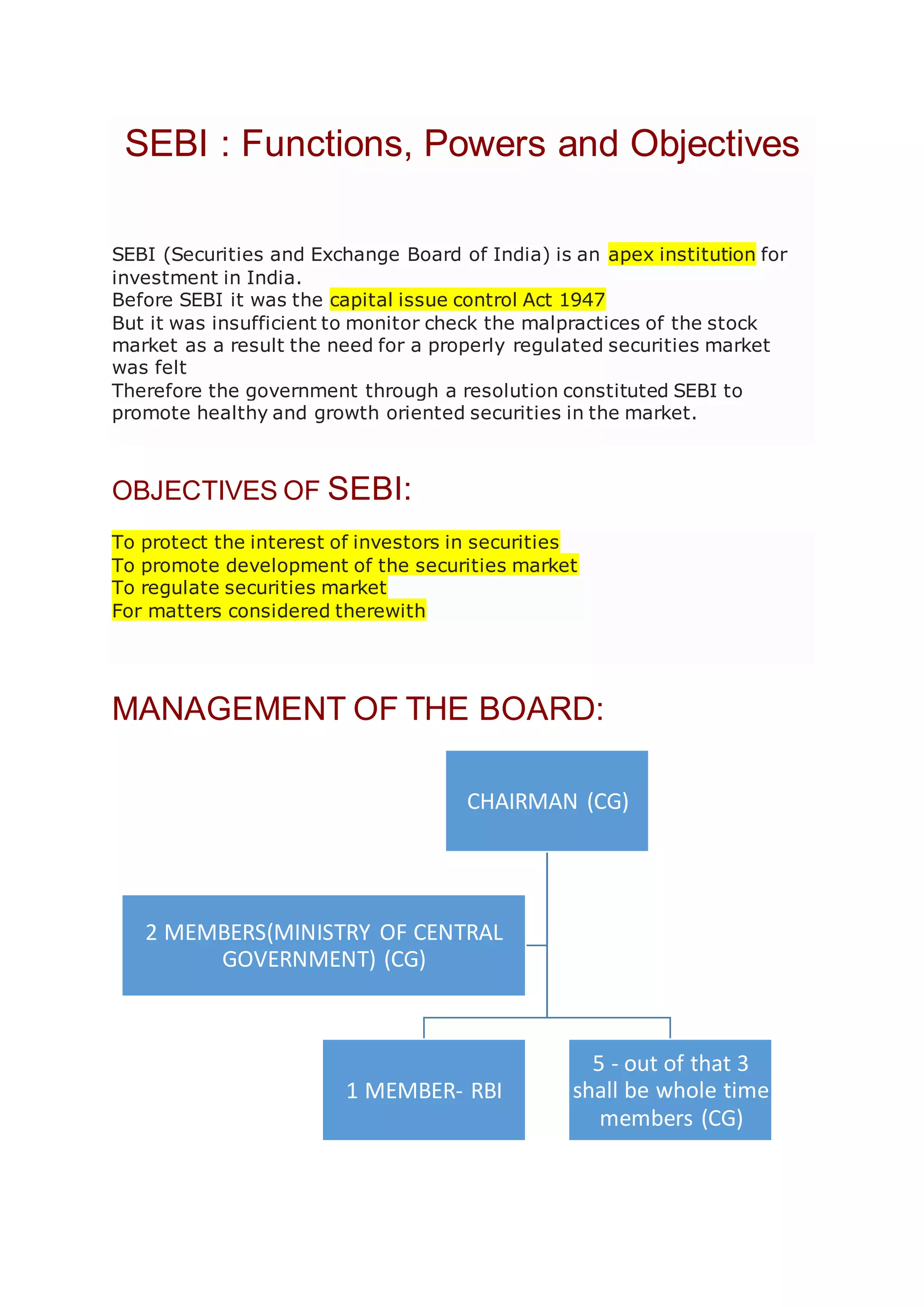

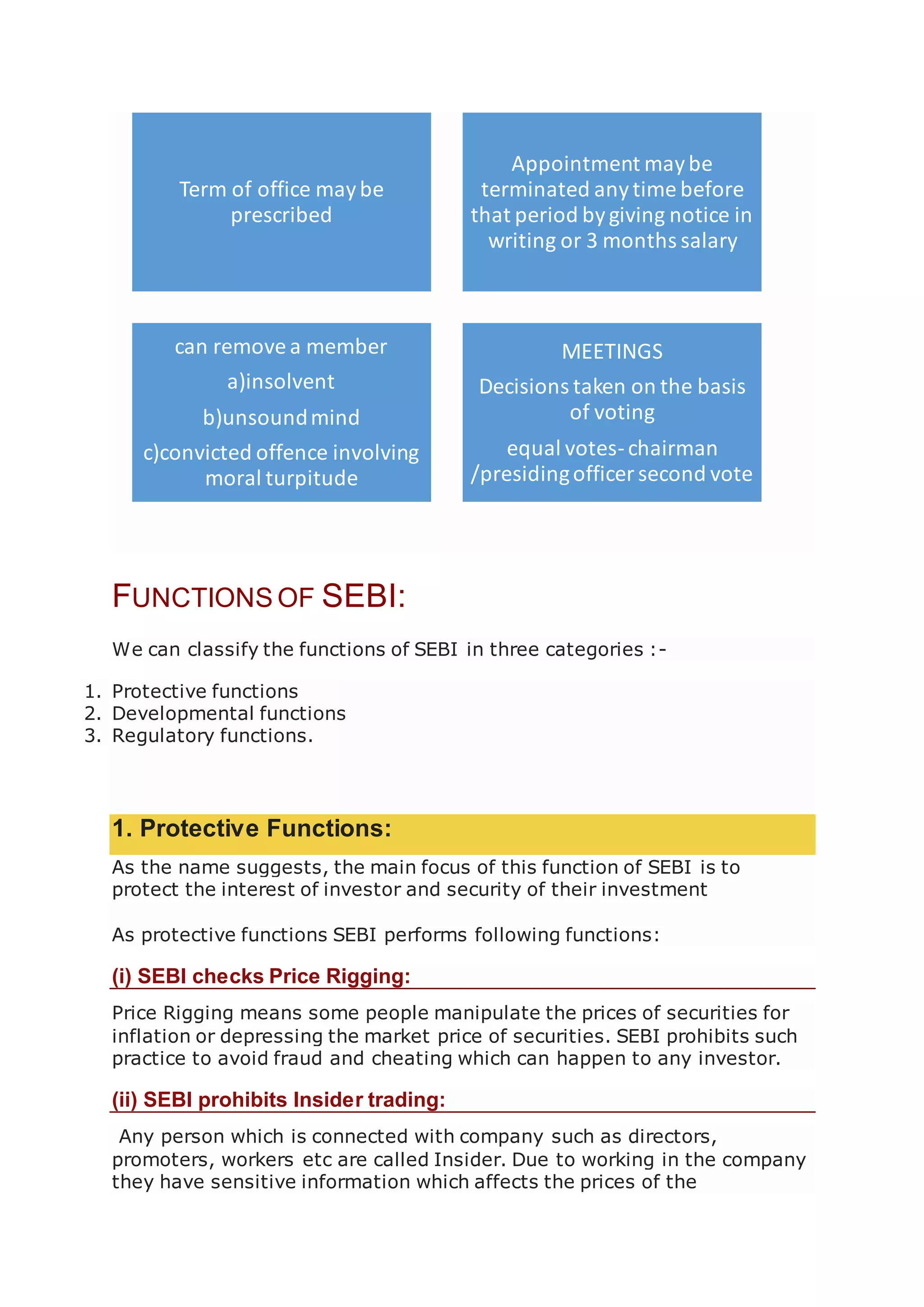

SEBI stands for the Securities and Exchange Board of India, which was established to regulate and promote the healthy growth of India's stock markets. It has several key objectives, including protecting investors, promoting market development, and regulating securities markets. SEBI performs important functions grouped into protective, developmental, and regulatory categories. Some of its main roles are to prevent price manipulation and insider trading, educate investors, and register and regulate various intermediaries and institutions involved in stock trading.