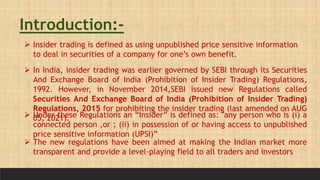

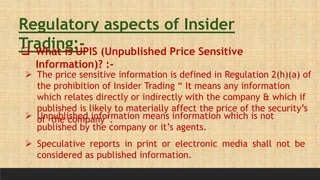

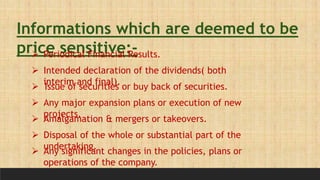

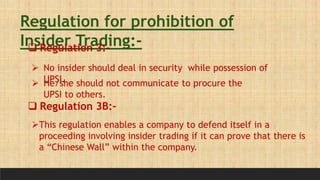

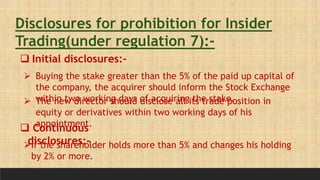

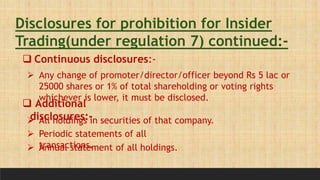

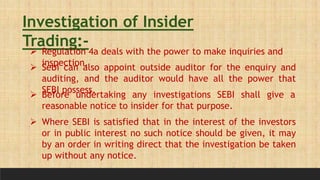

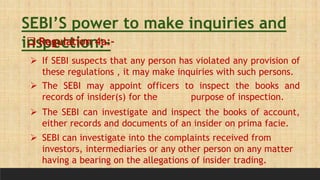

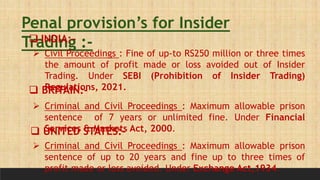

This document presents a study on insider trading. It defines insider trading and outlines the objectives of studying it. It discusses the various forms insider trading can take, such as by corporate employees, consultants, friends and family of employees. It explains the regulatory aspects of insider trading in India including the definitions of unpublished price sensitive information and continuous disclosure requirements. The document analyzes why insider trading needs to be curbed and presents two case studies as practical examples. It concludes by discussing challenges faced by SEBI in investigating insider trading cases.