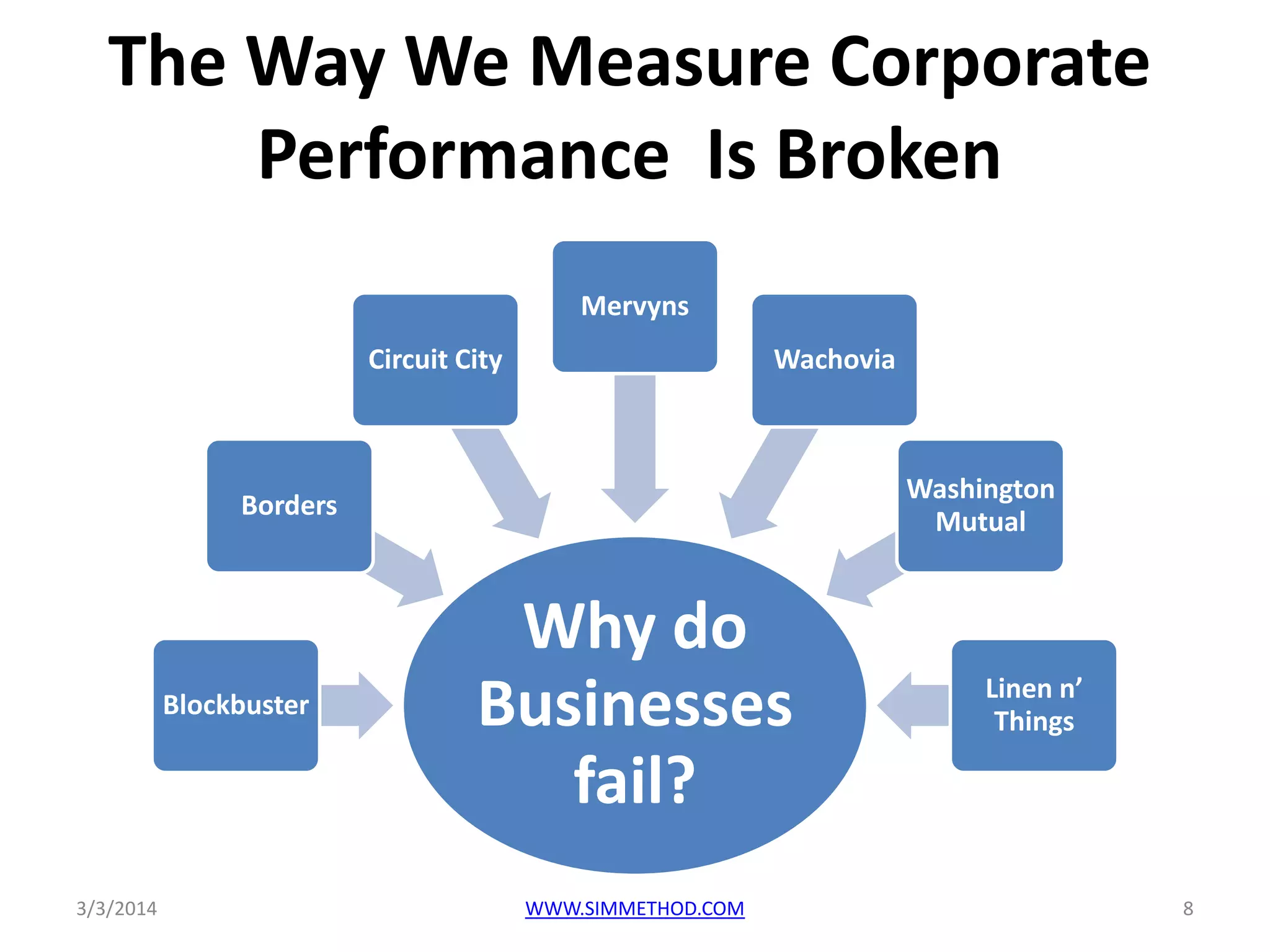

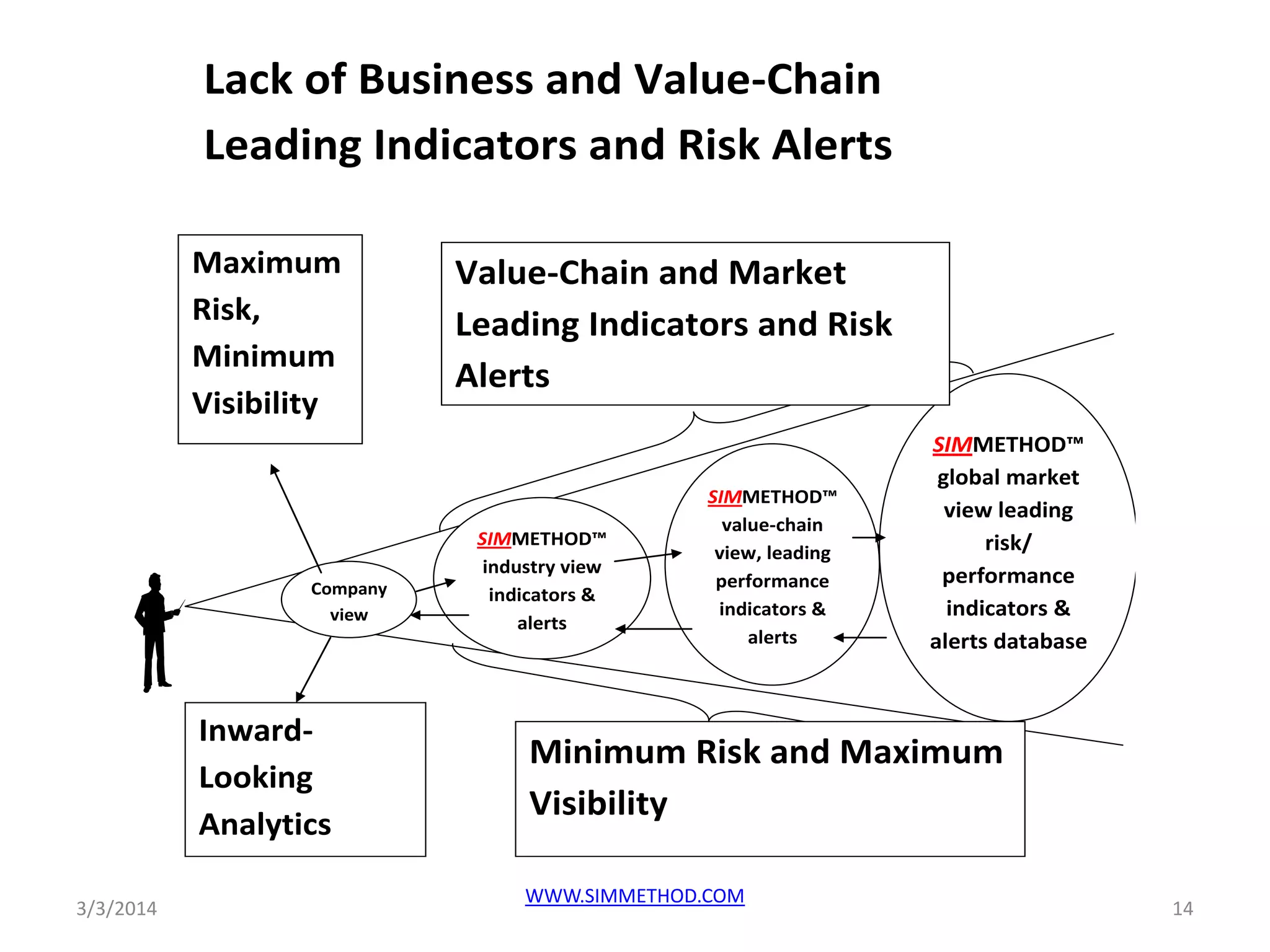

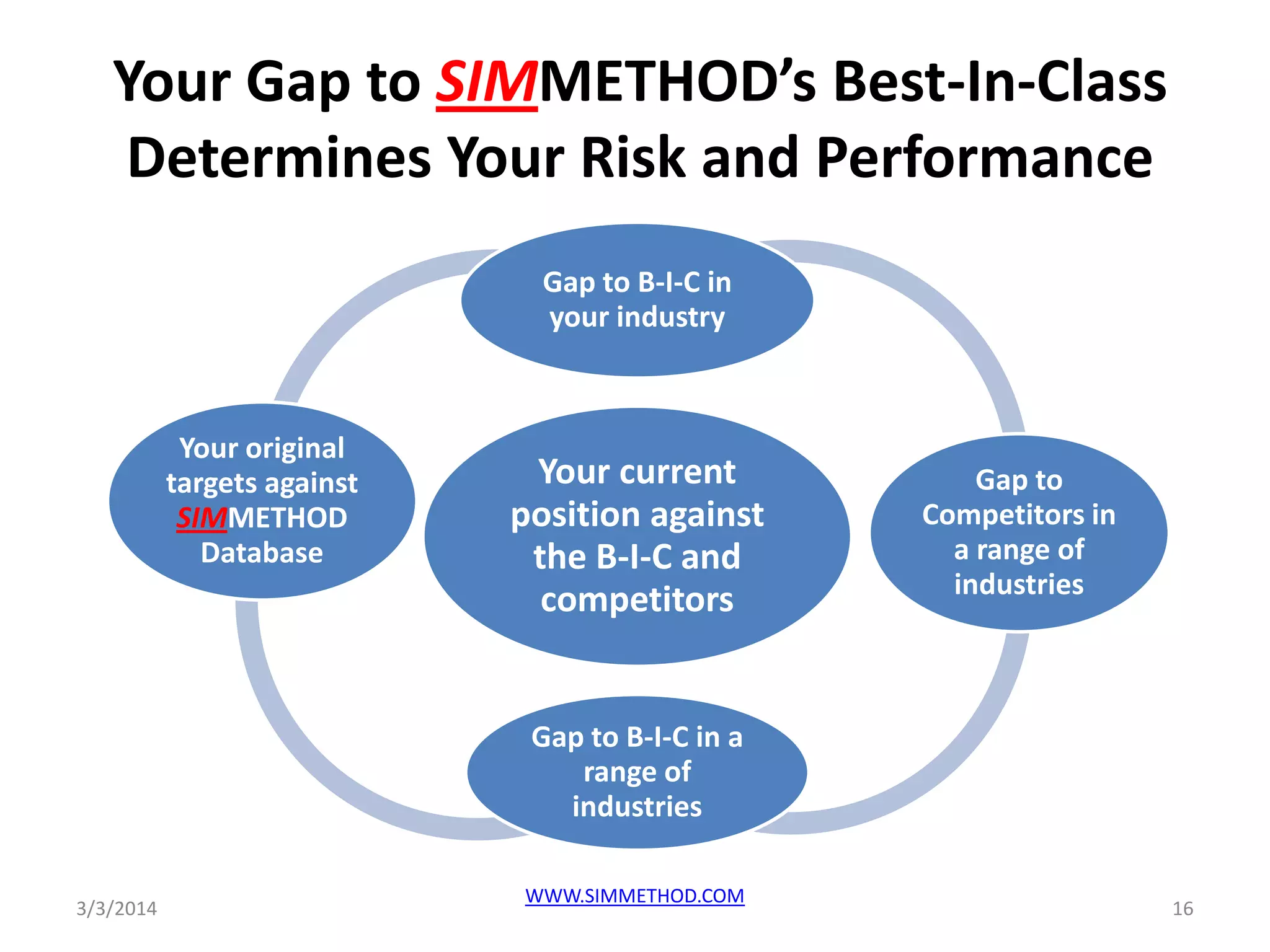

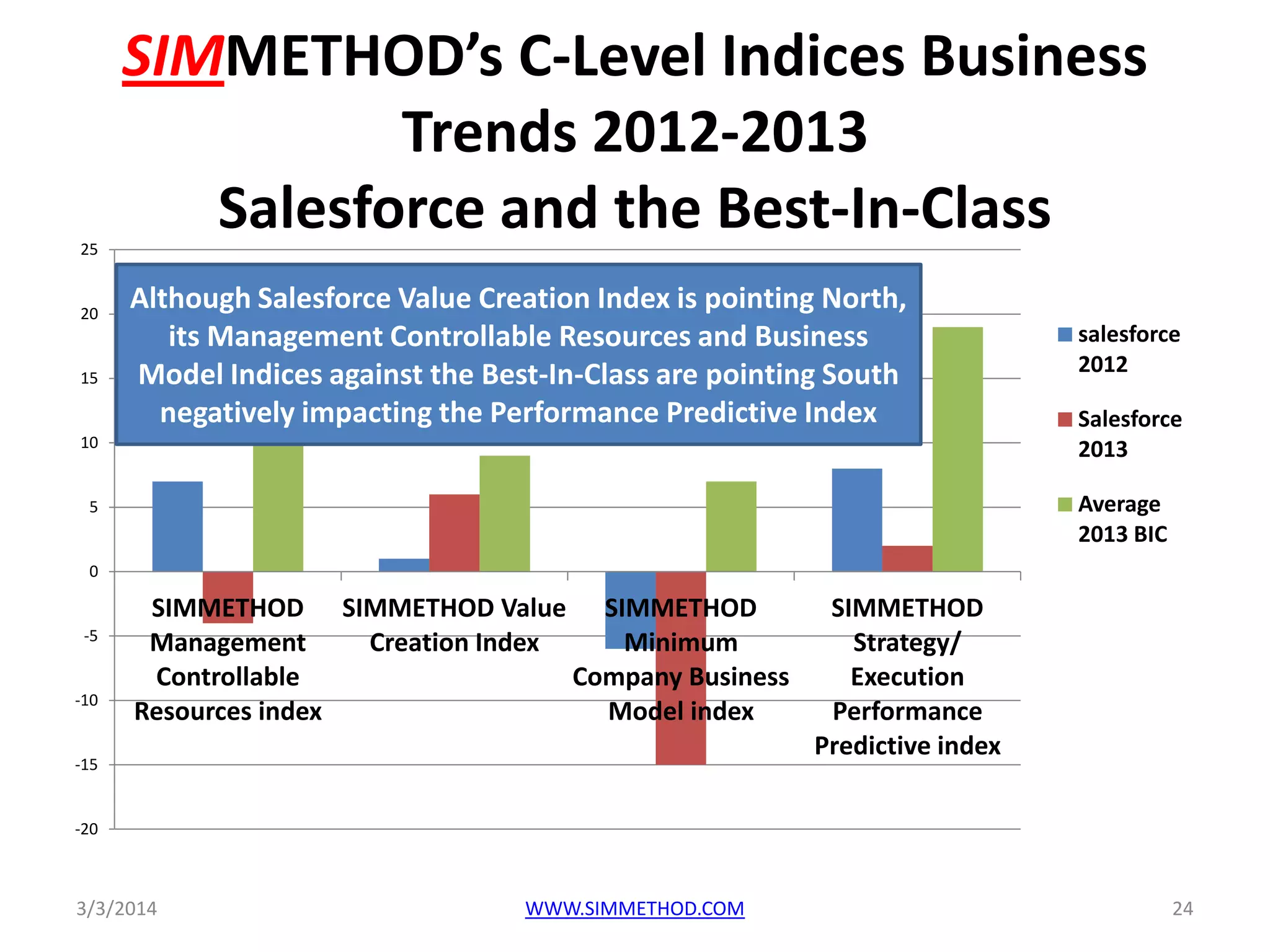

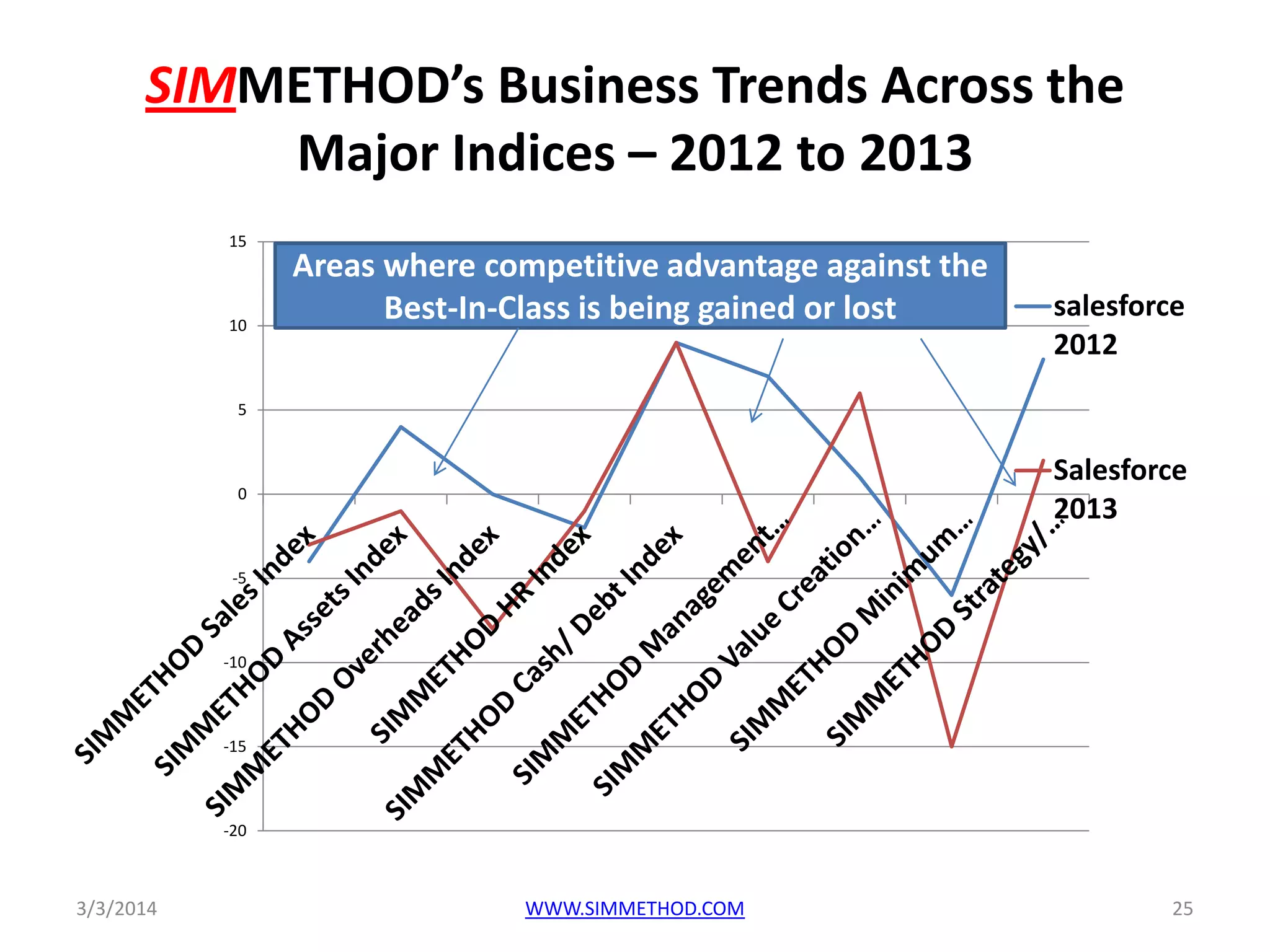

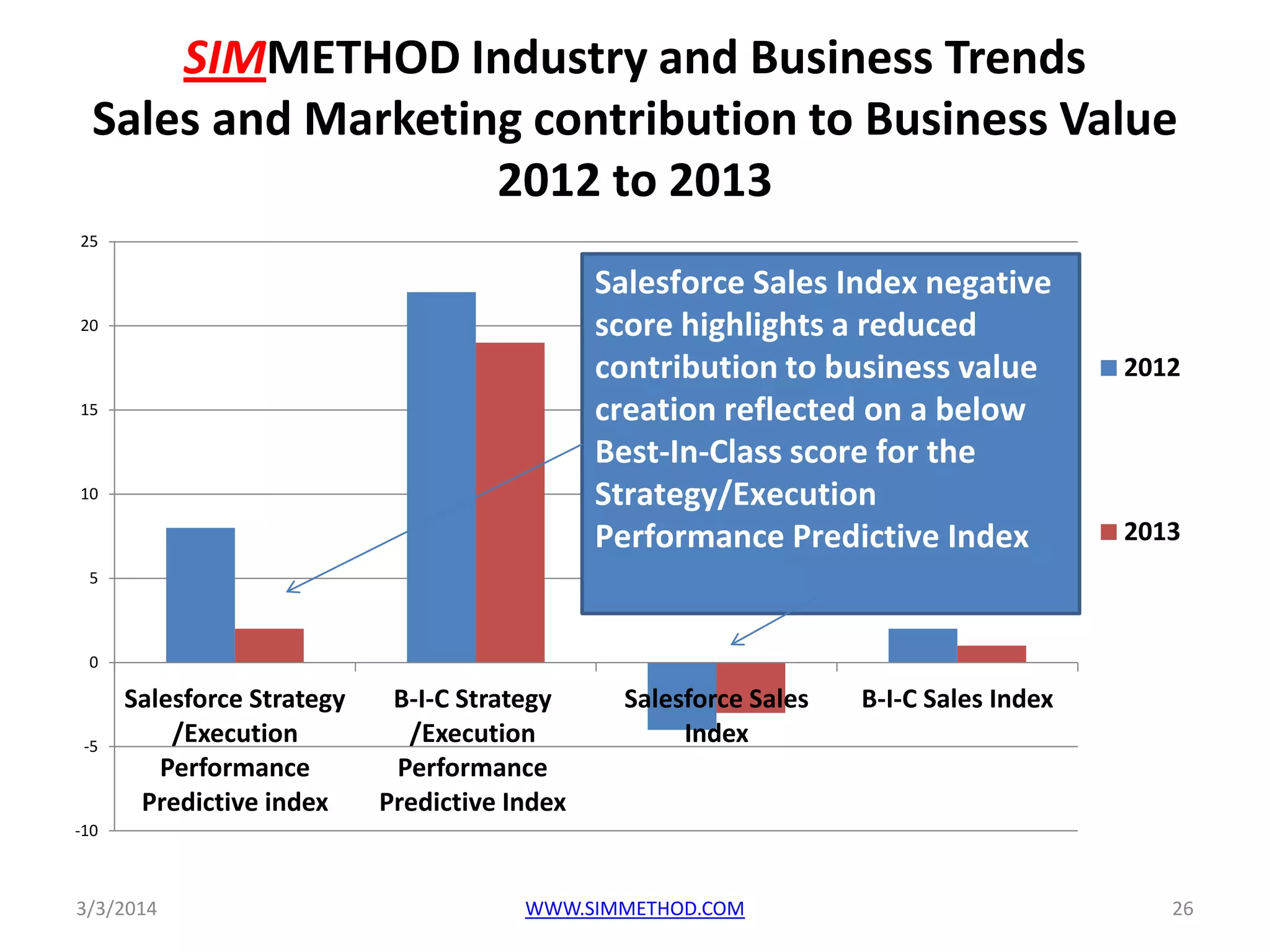

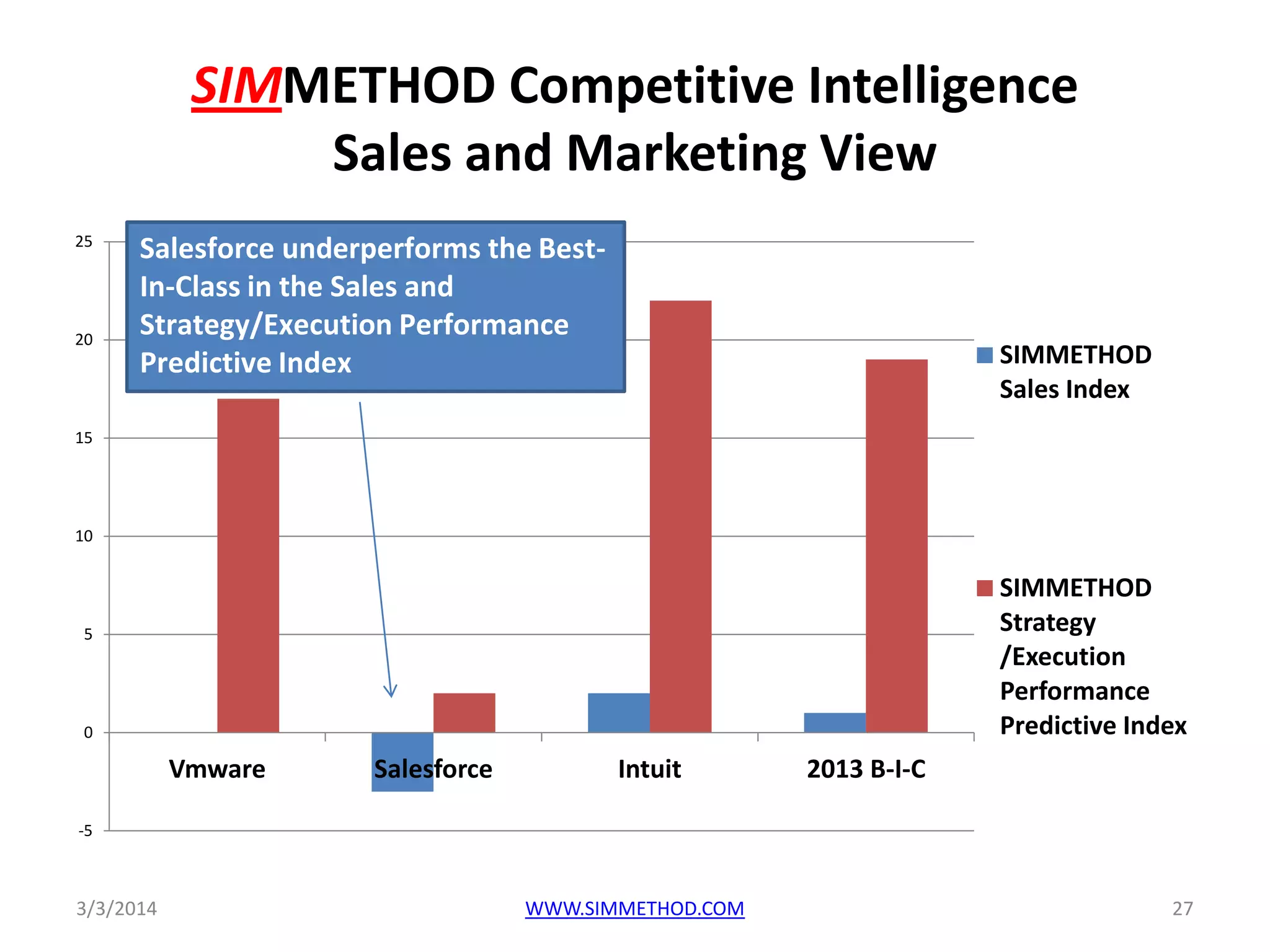

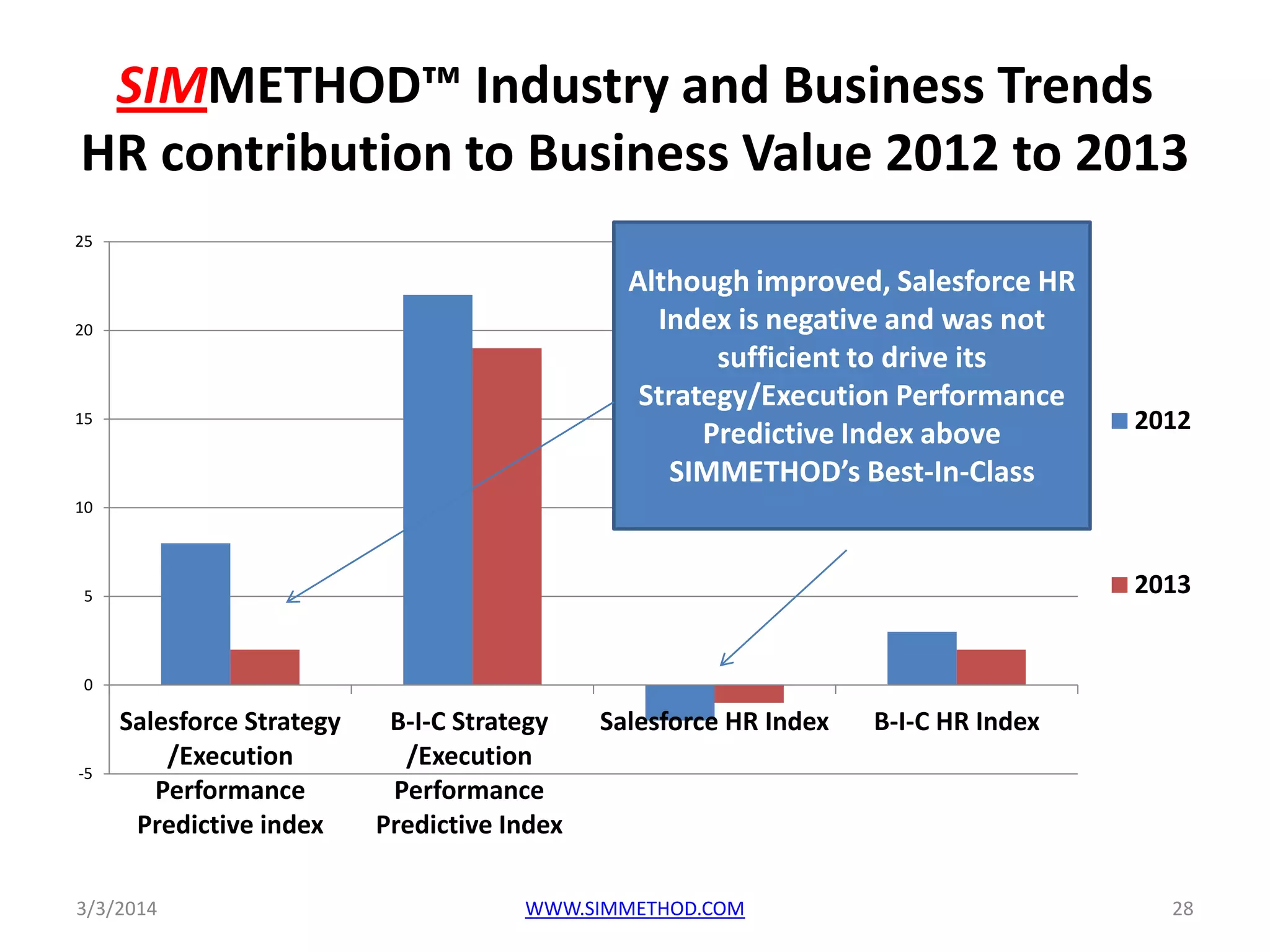

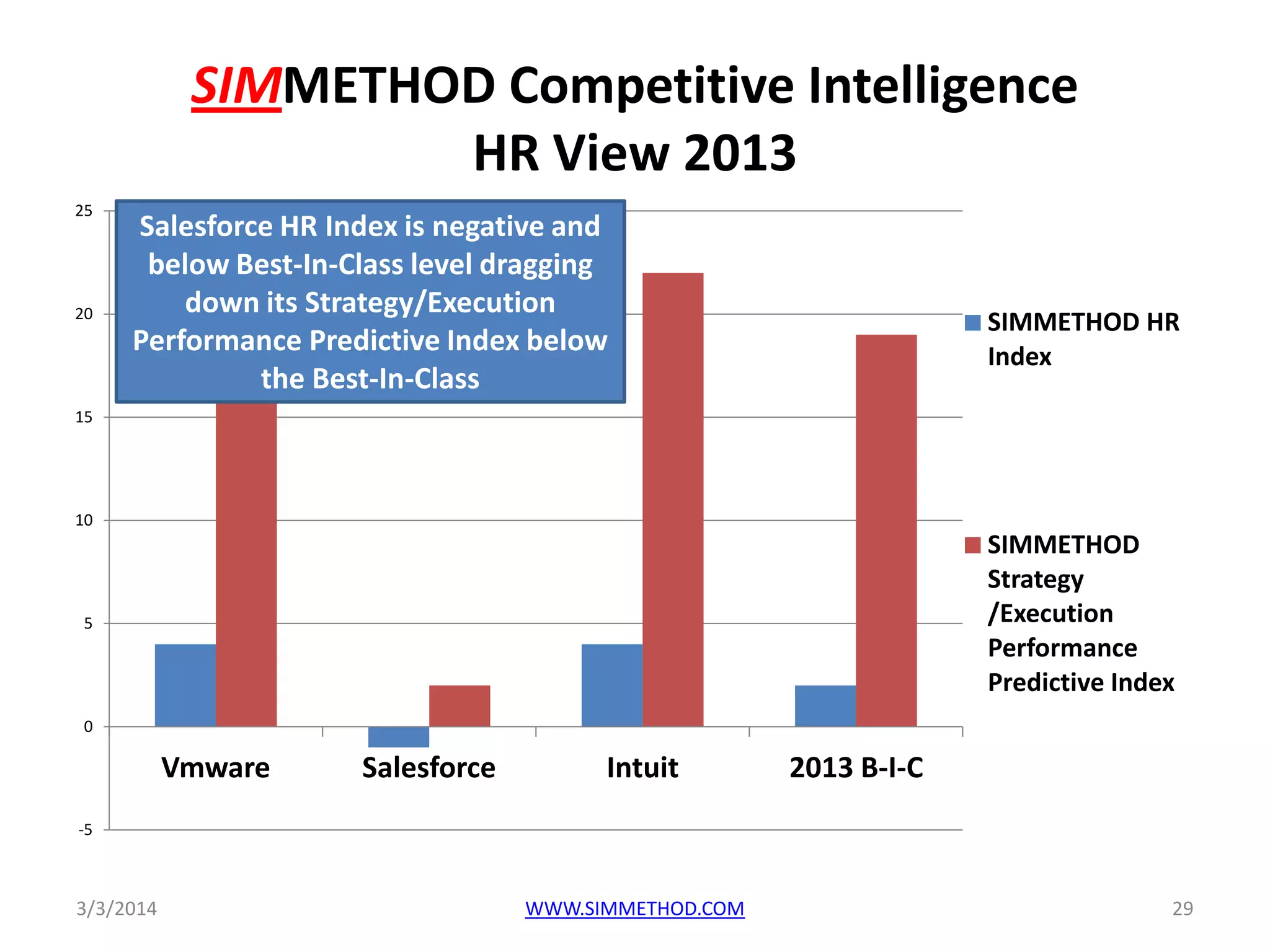

The document discusses Salesforce's corporate performance, highlighting a significant net income decline and operating loss, alongside mounting operational expenses that affect profit margins. It emphasizes the need for improved metrics and analytics to accurately measure corporate strategy and execution, suggesting that current methods fail to provide consistent visibility at the C-level. Additionally, the document outlines Simmethod's approach to creating industry-agnostic performance indices to help businesses better understand their competitive landscape and identify potential risks and opportunities.