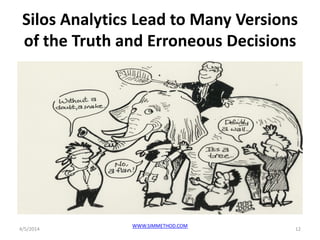

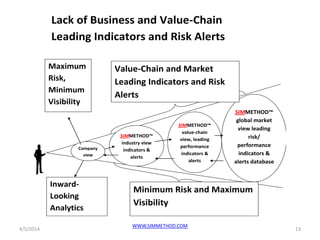

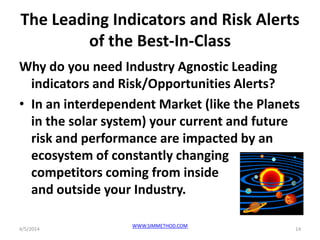

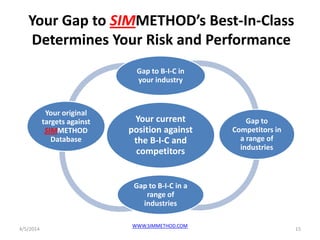

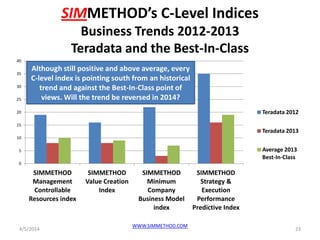

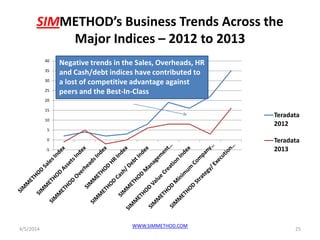

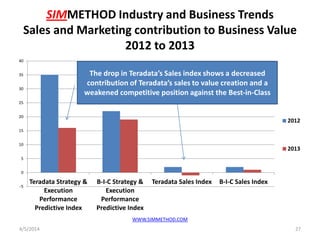

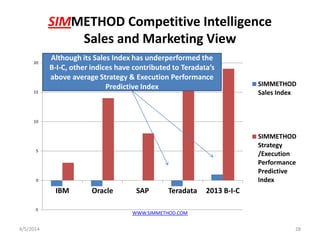

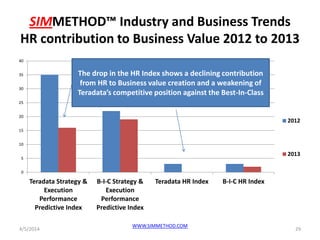

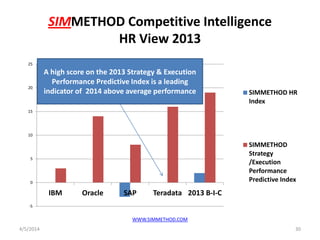

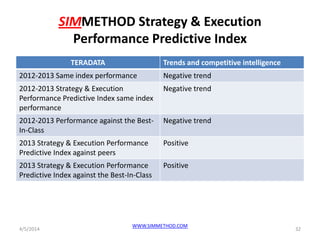

The document presents the simmethod Strategy & Execution Performance Predictive Index, which aims to measure and predict corporate risk and performance amidst rising competition in the marketplace. It highlights Teradata's current challenges and outlook, emphasizing the need for industry-agnostic metrics to better assess corporate strategies and decision-making. The report suggests that understanding these predictive indices could enhance management's ability to navigate risks and capitalize on opportunities in a dynamic competitive environment.