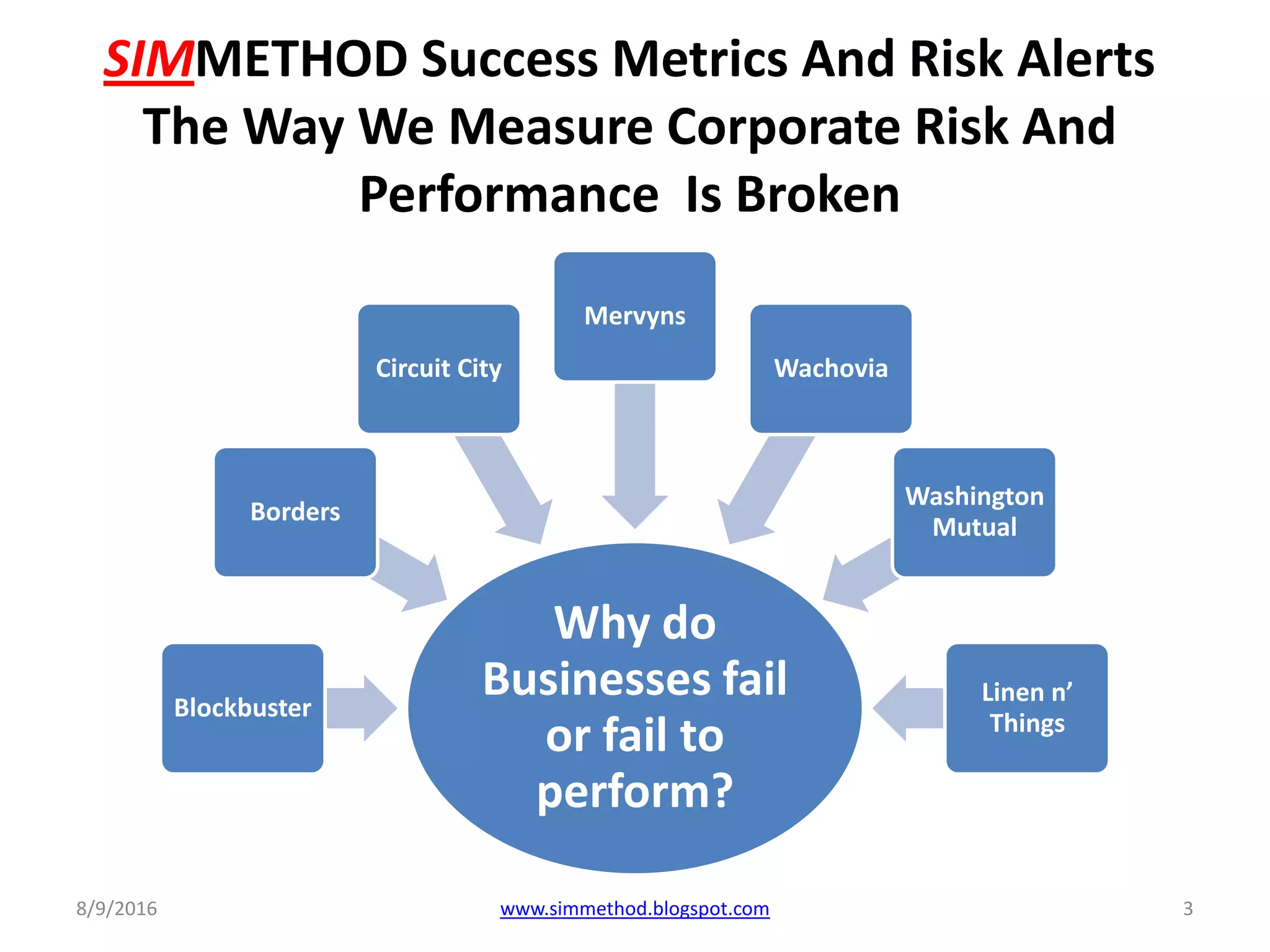

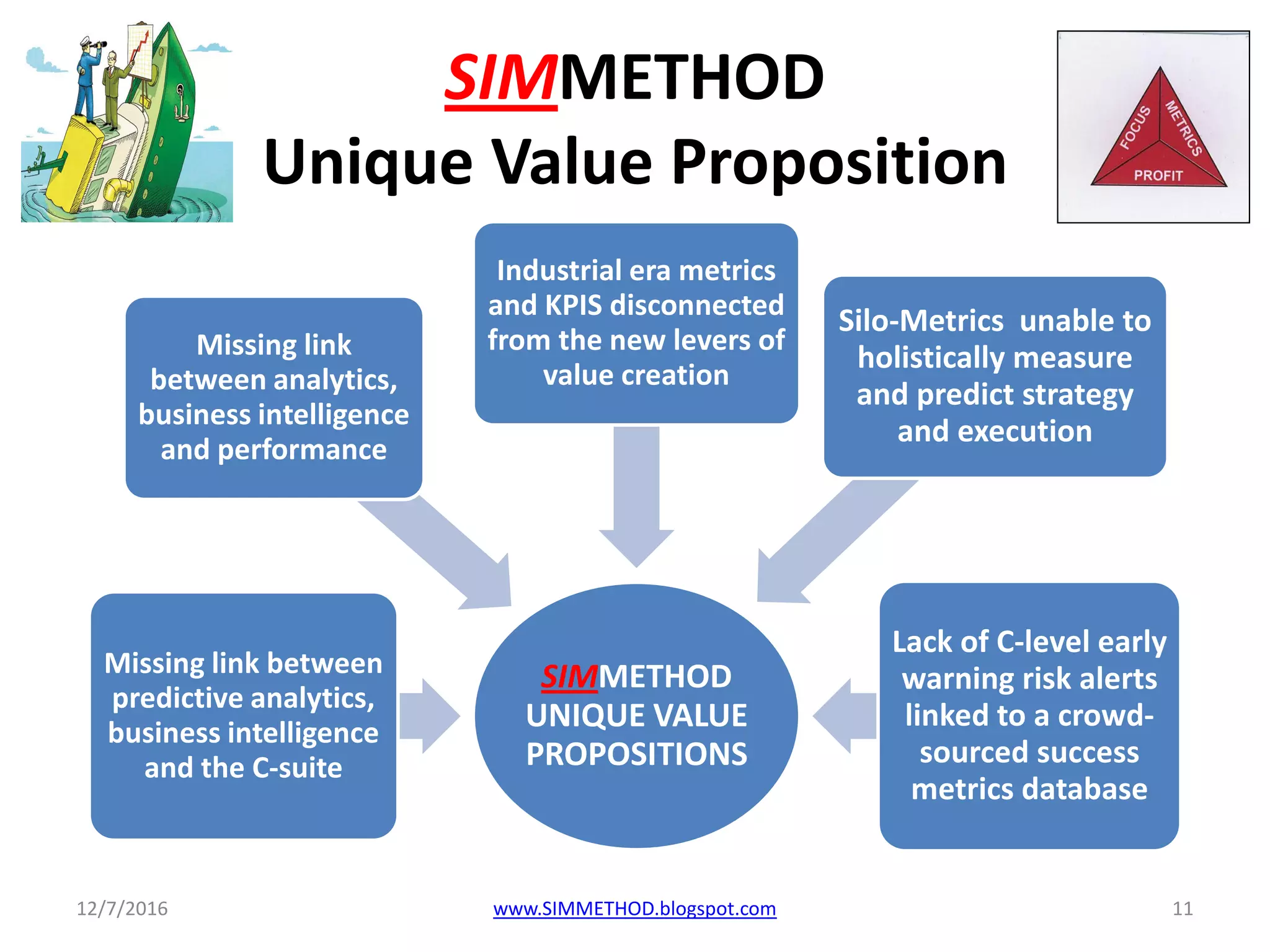

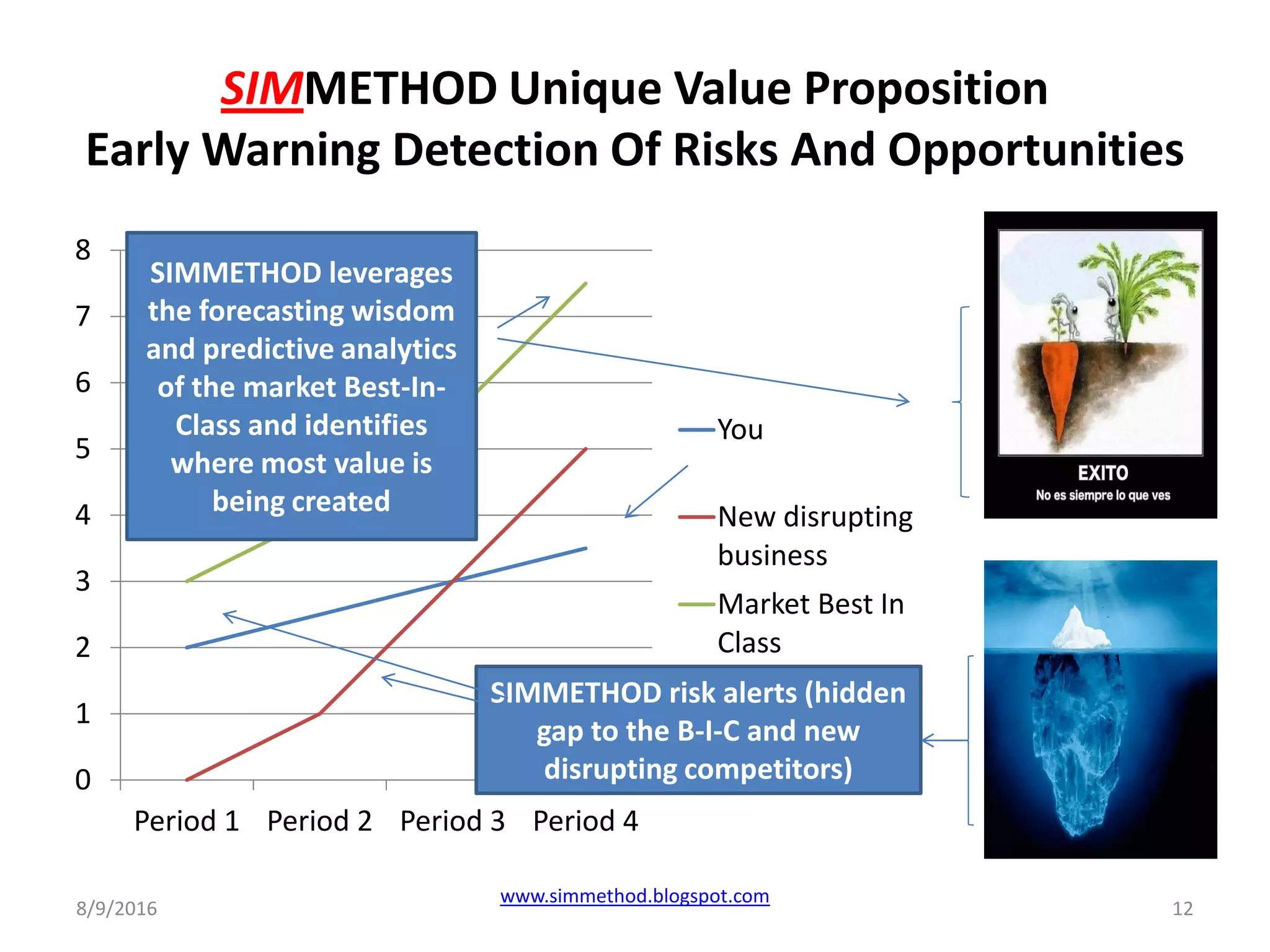

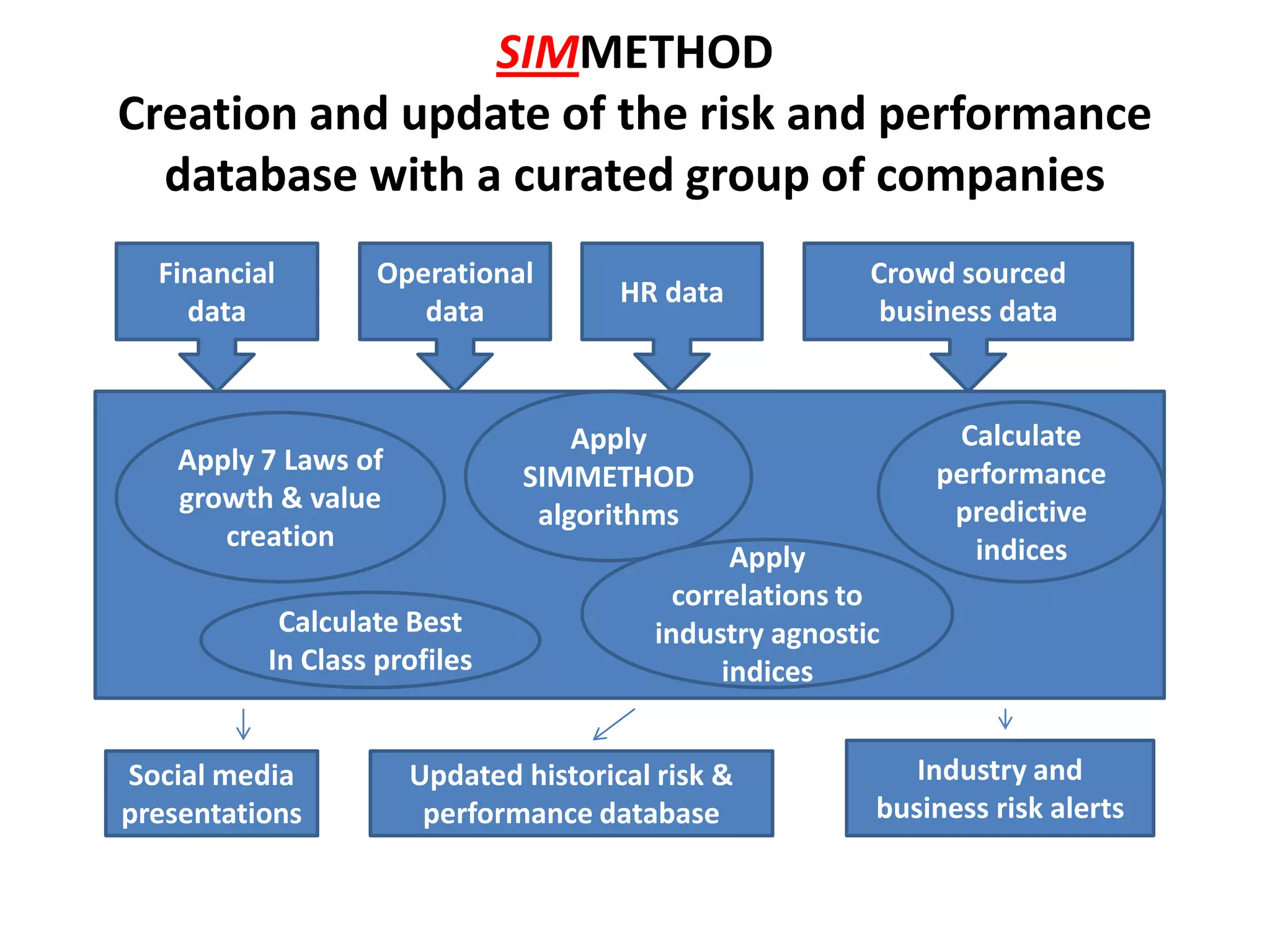

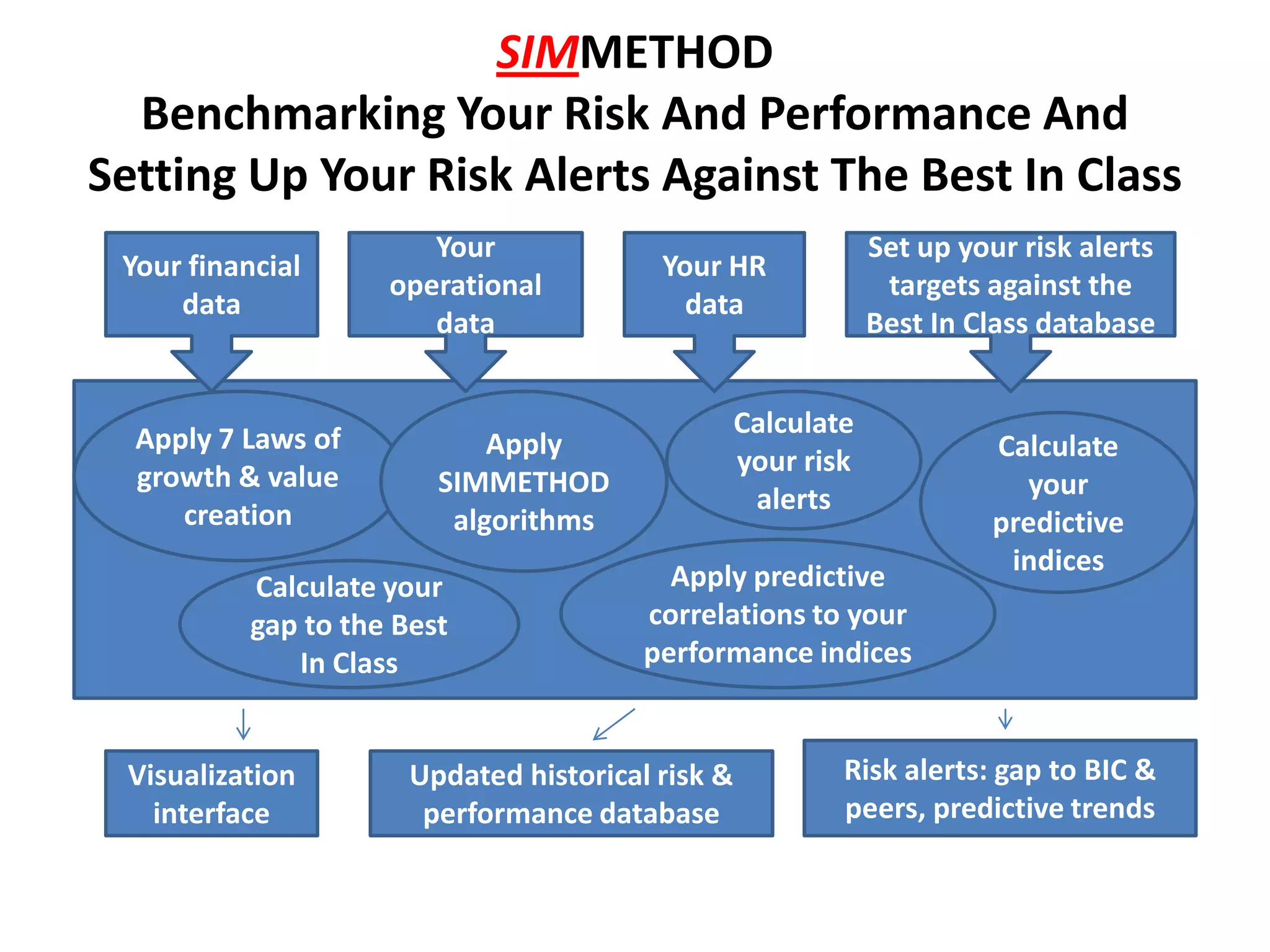

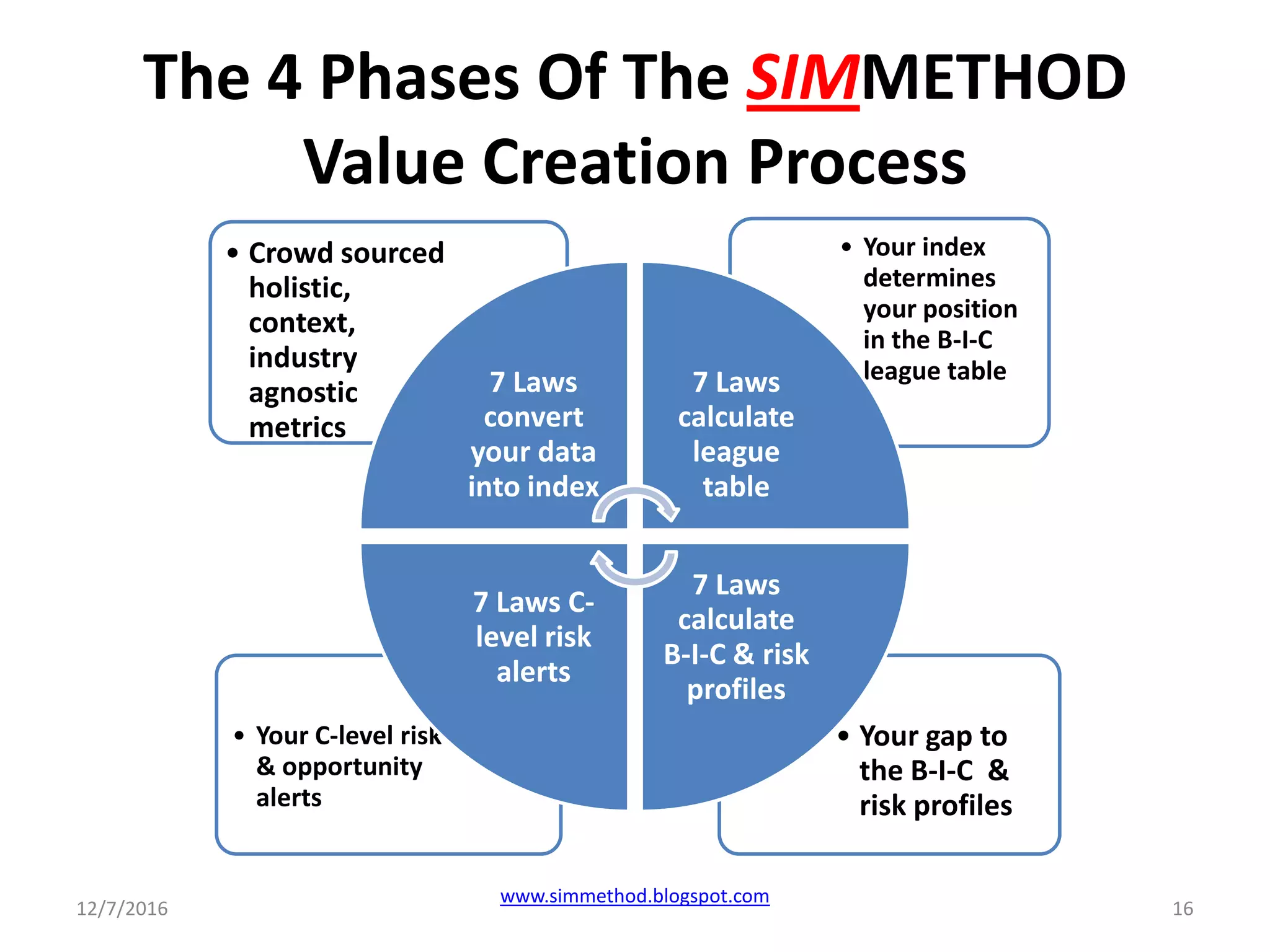

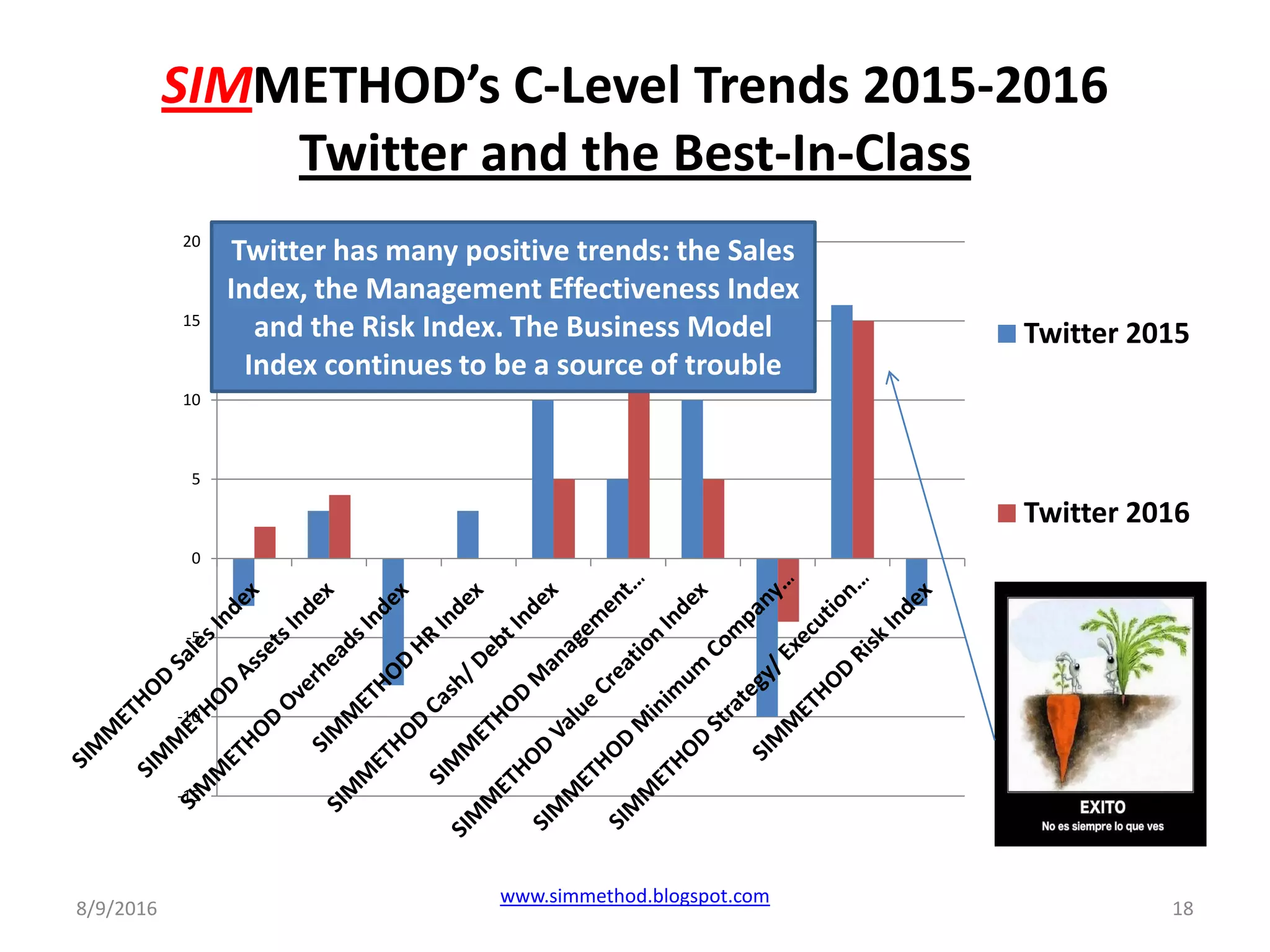

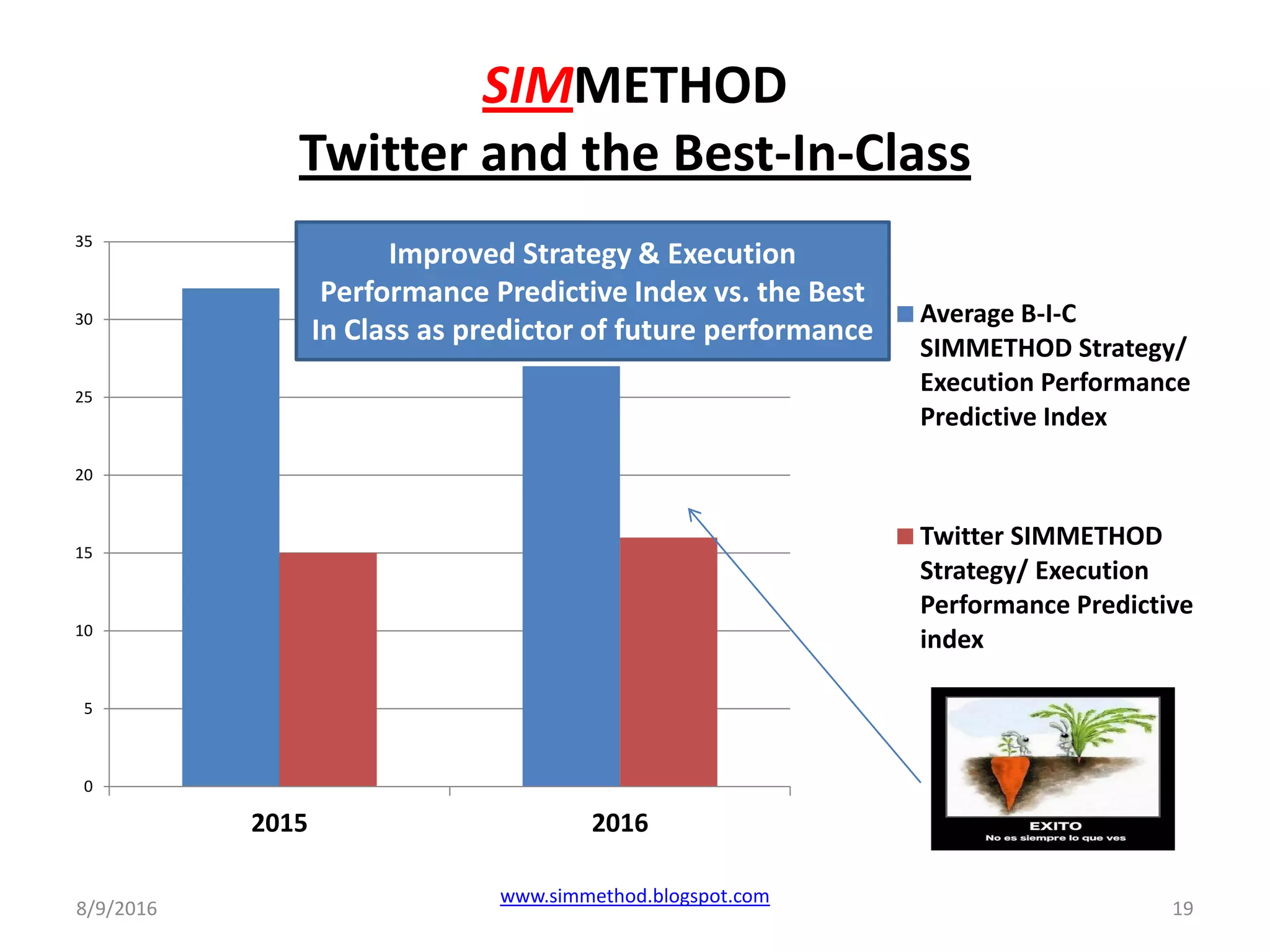

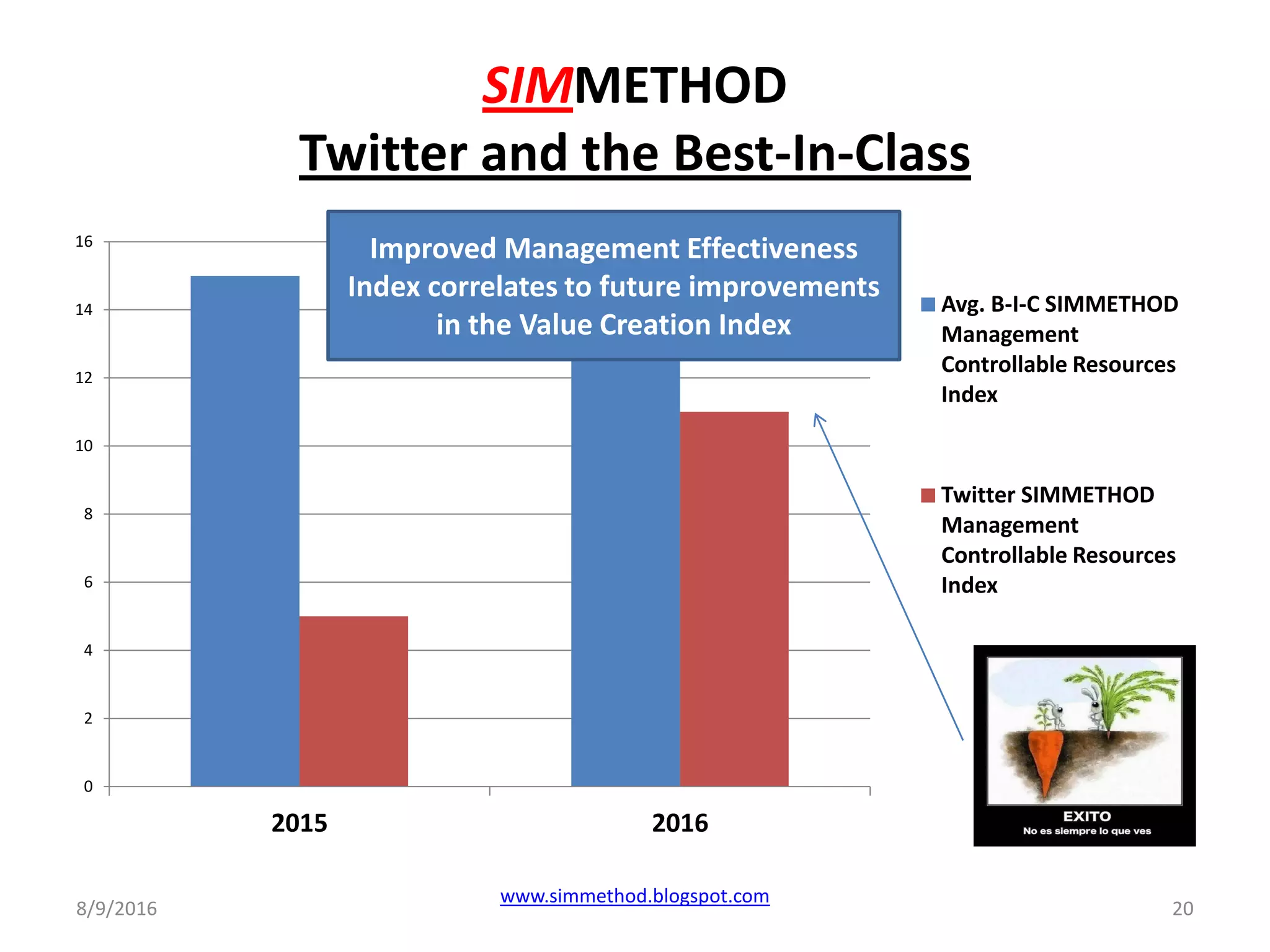

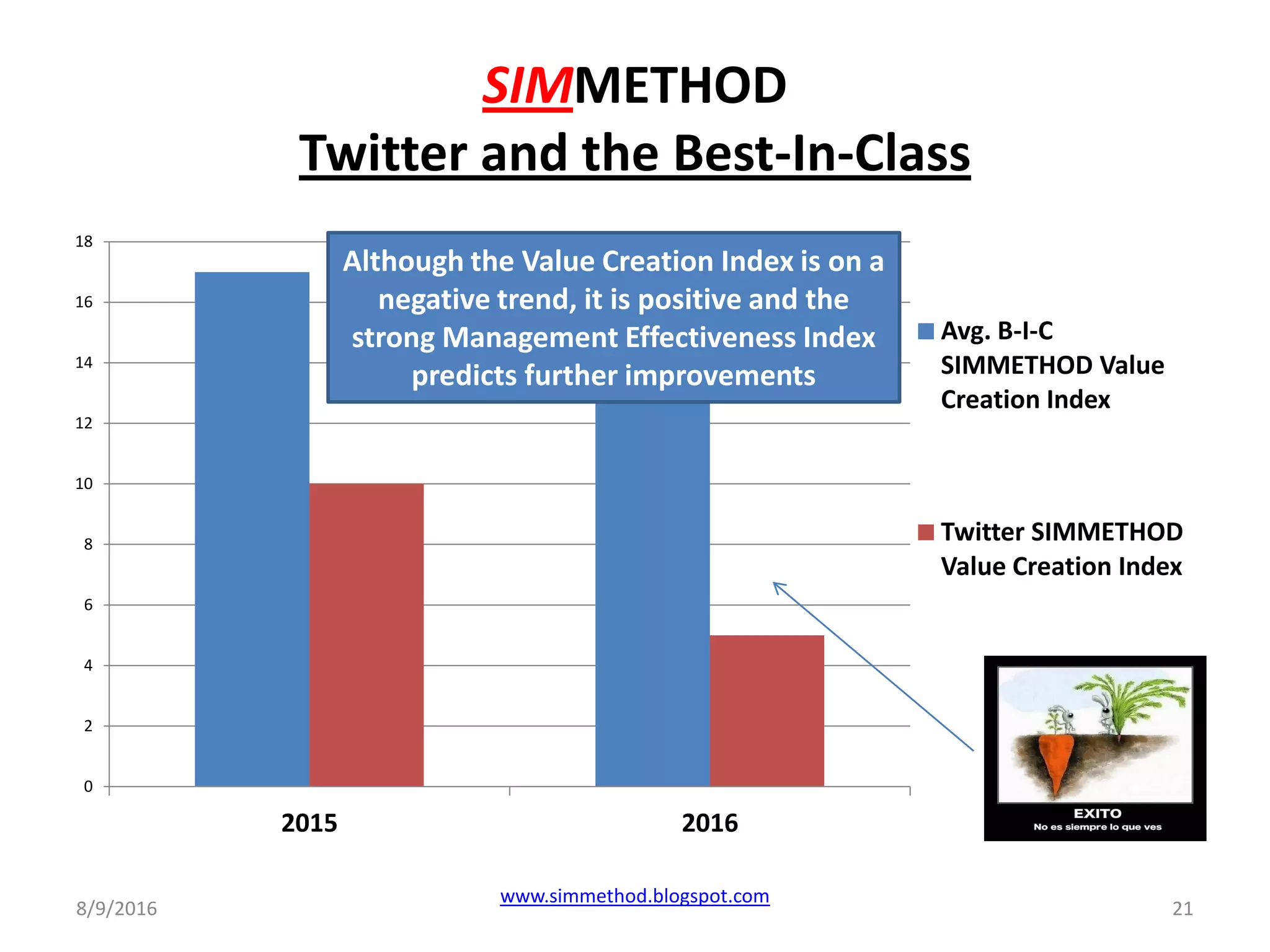

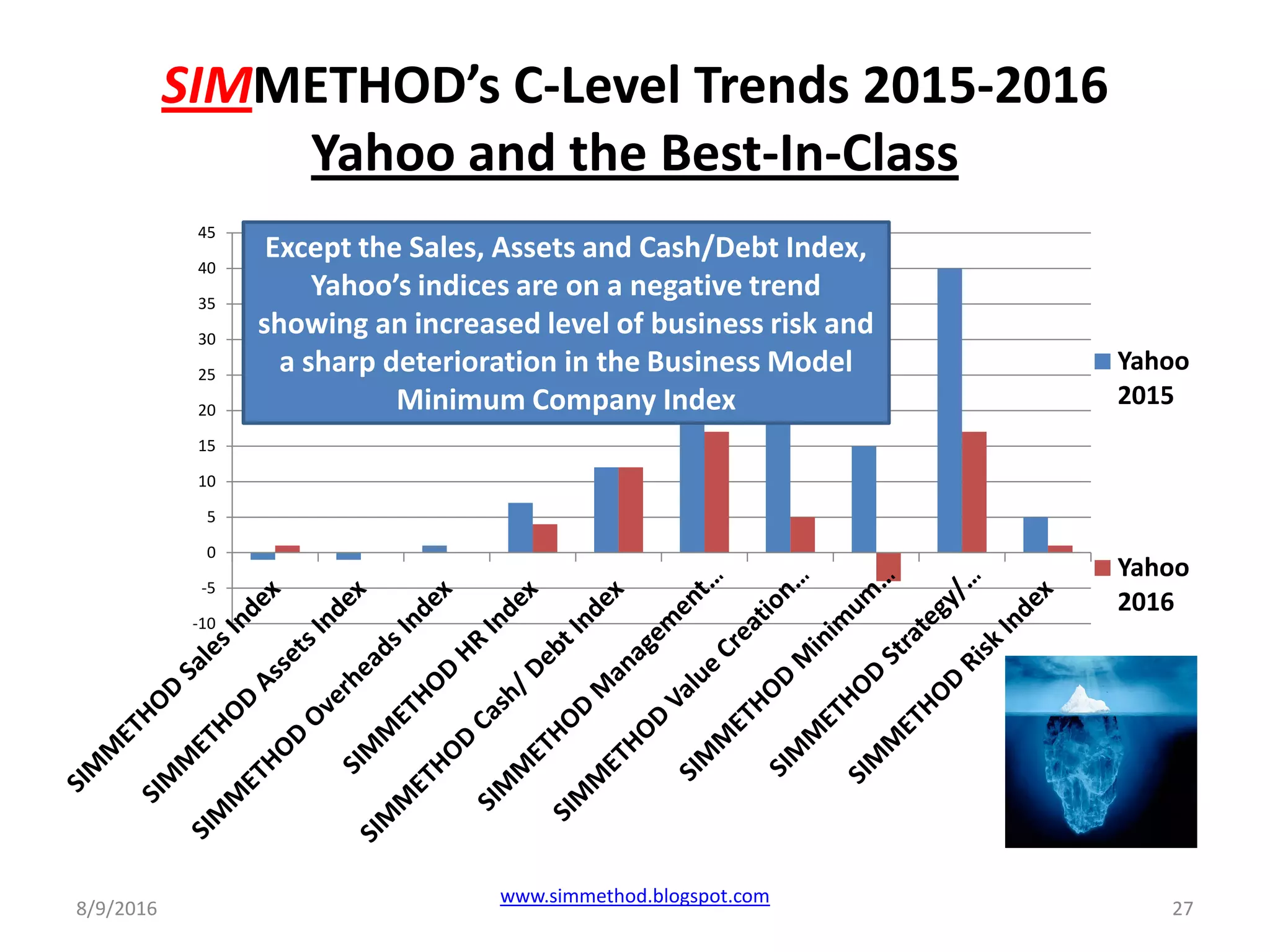

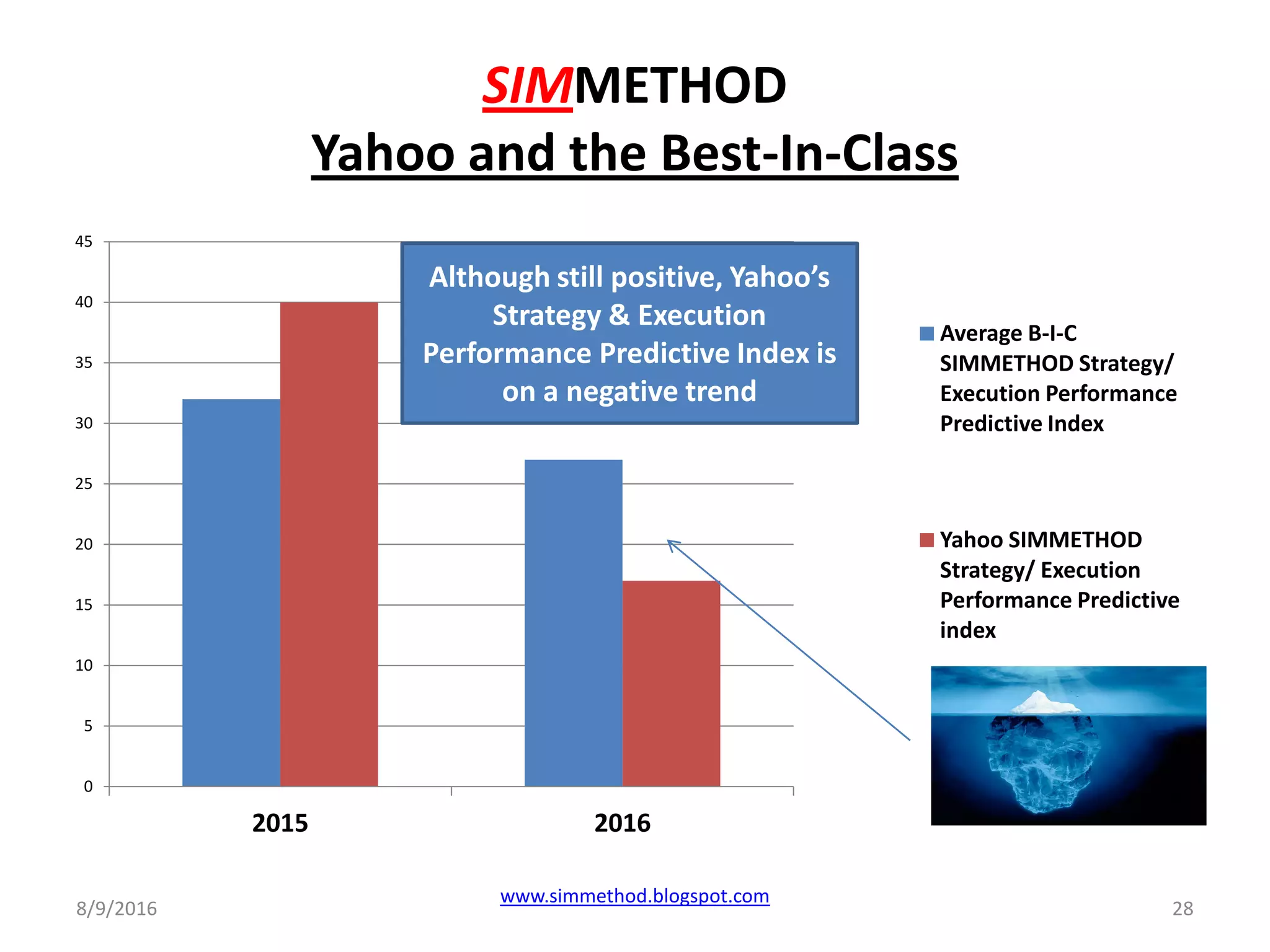

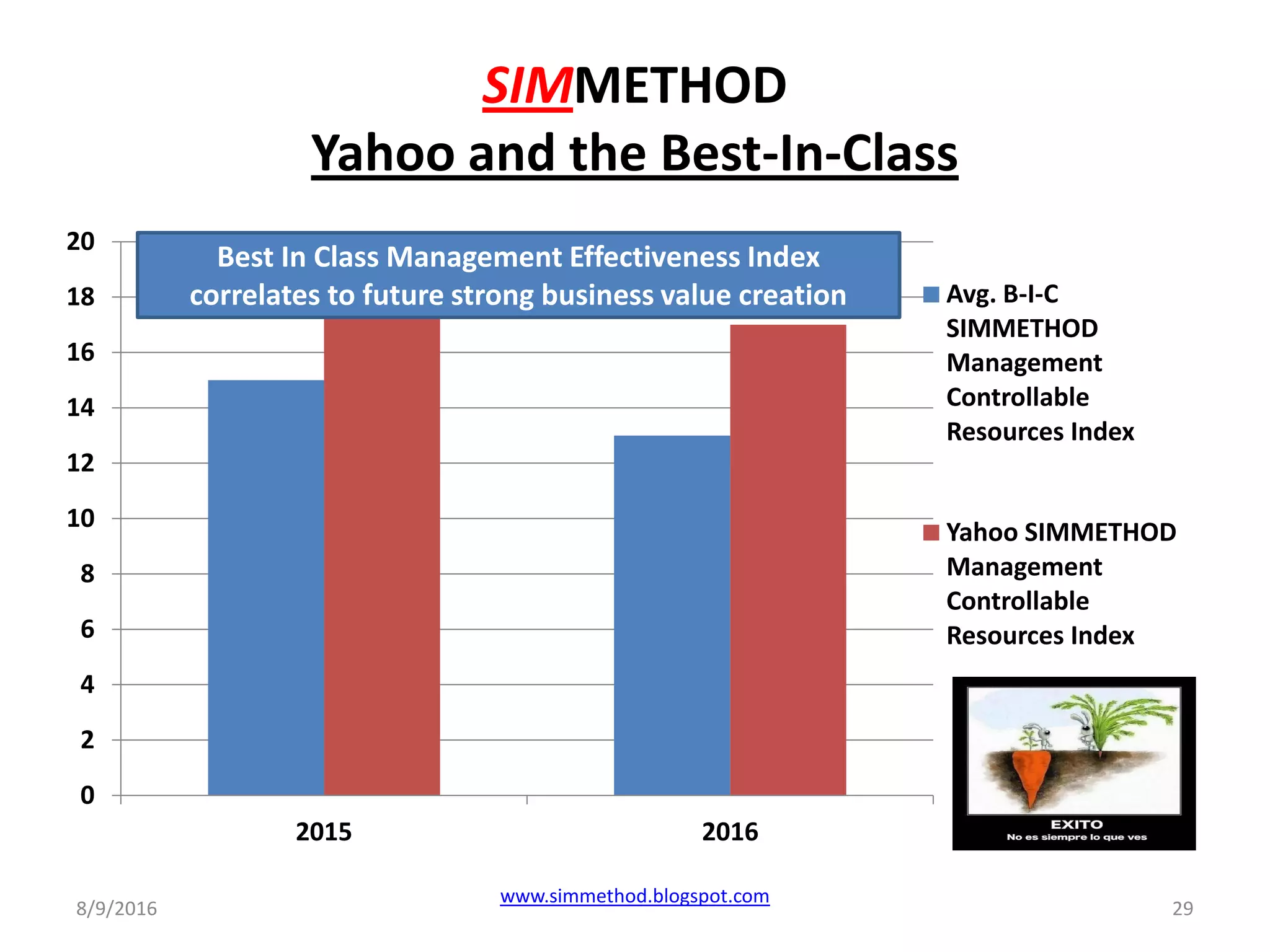

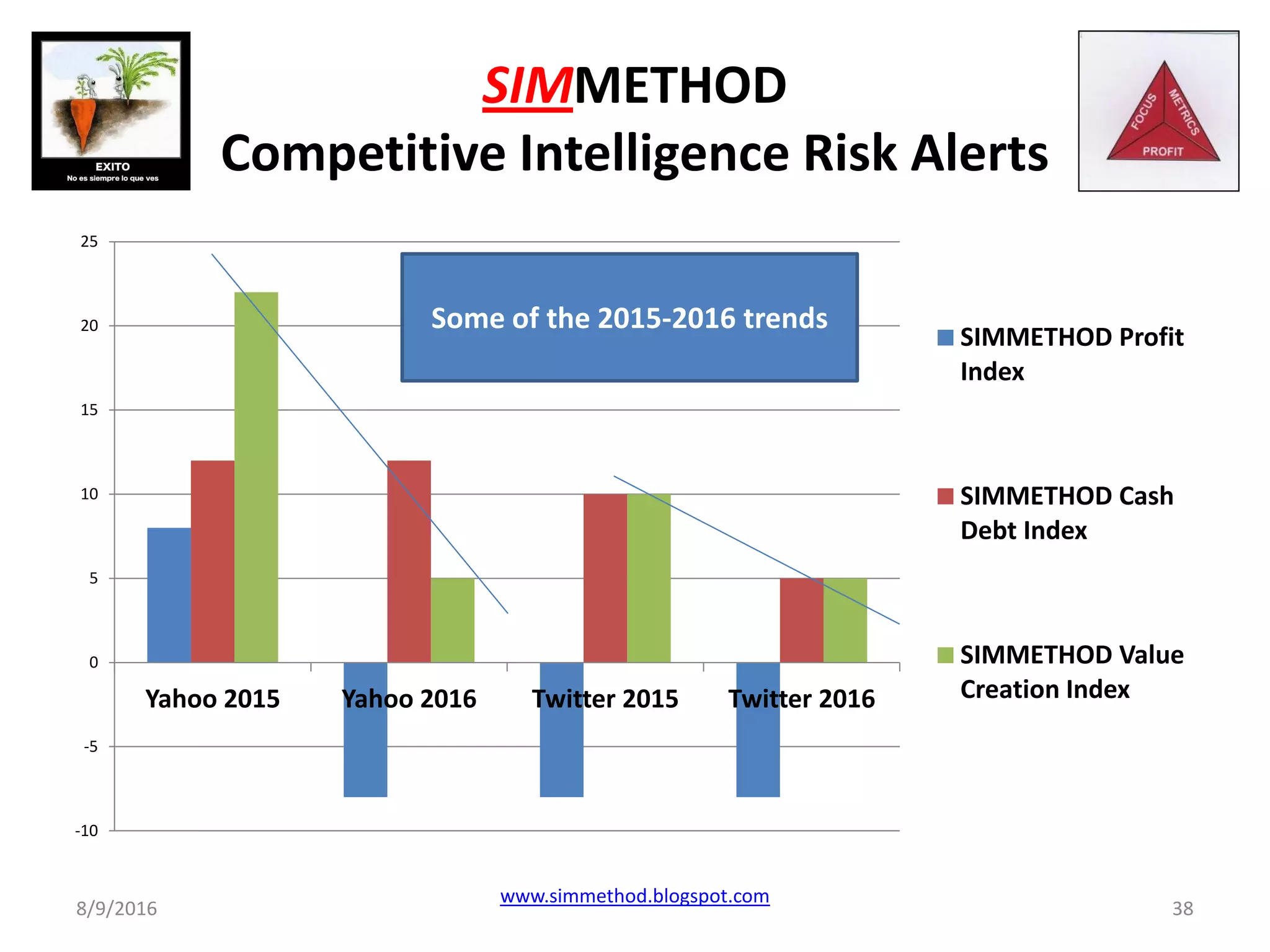

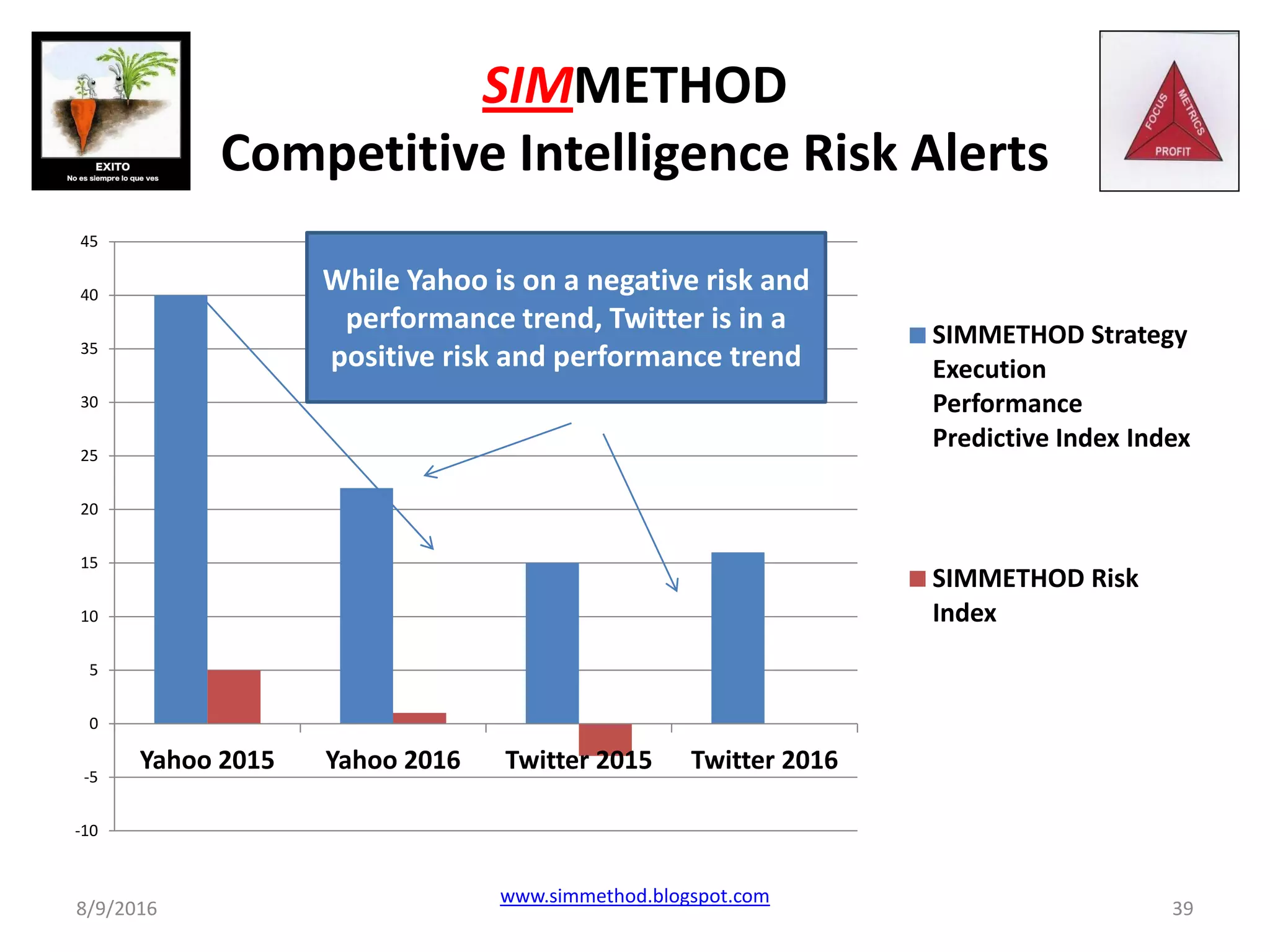

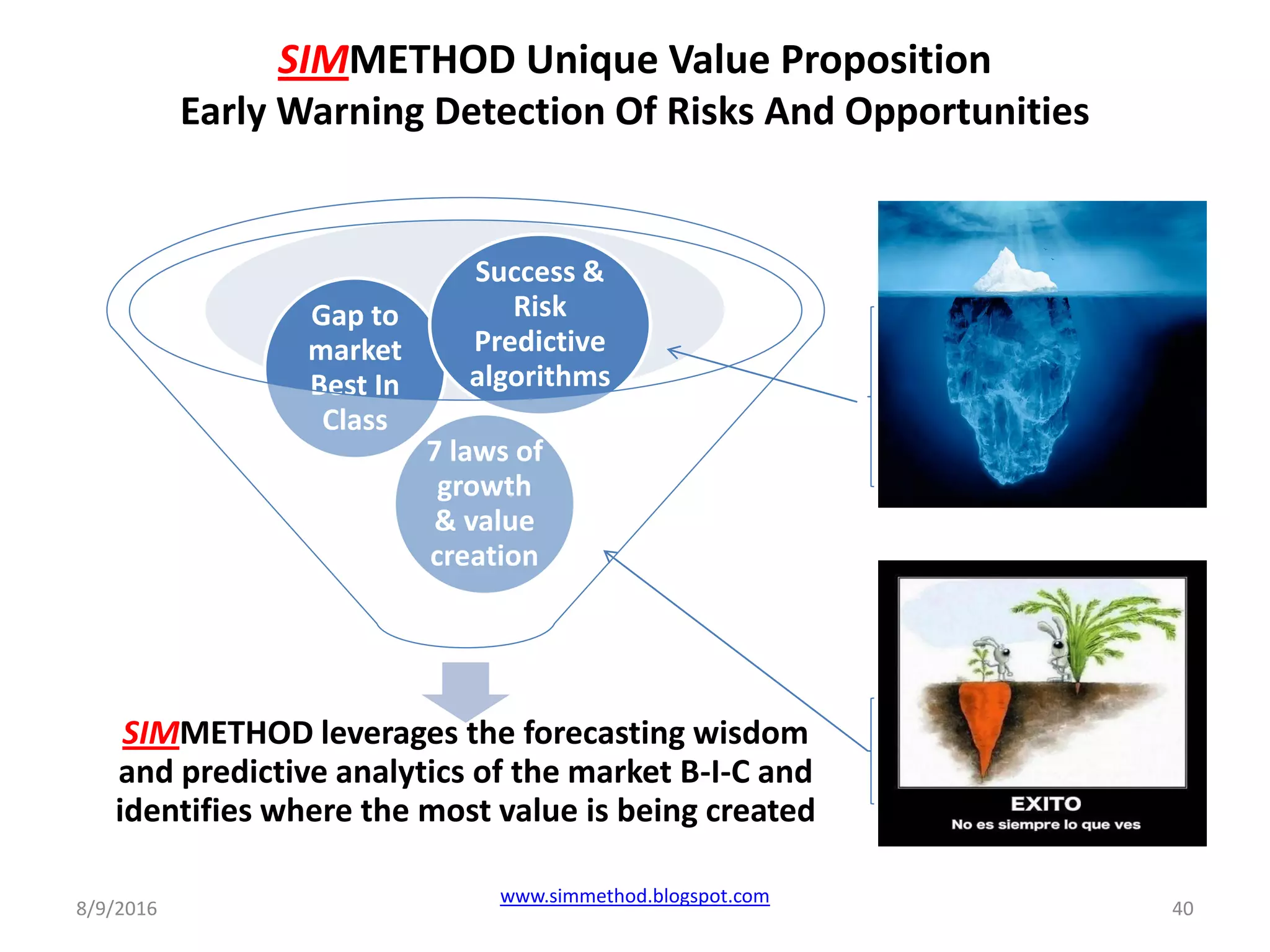

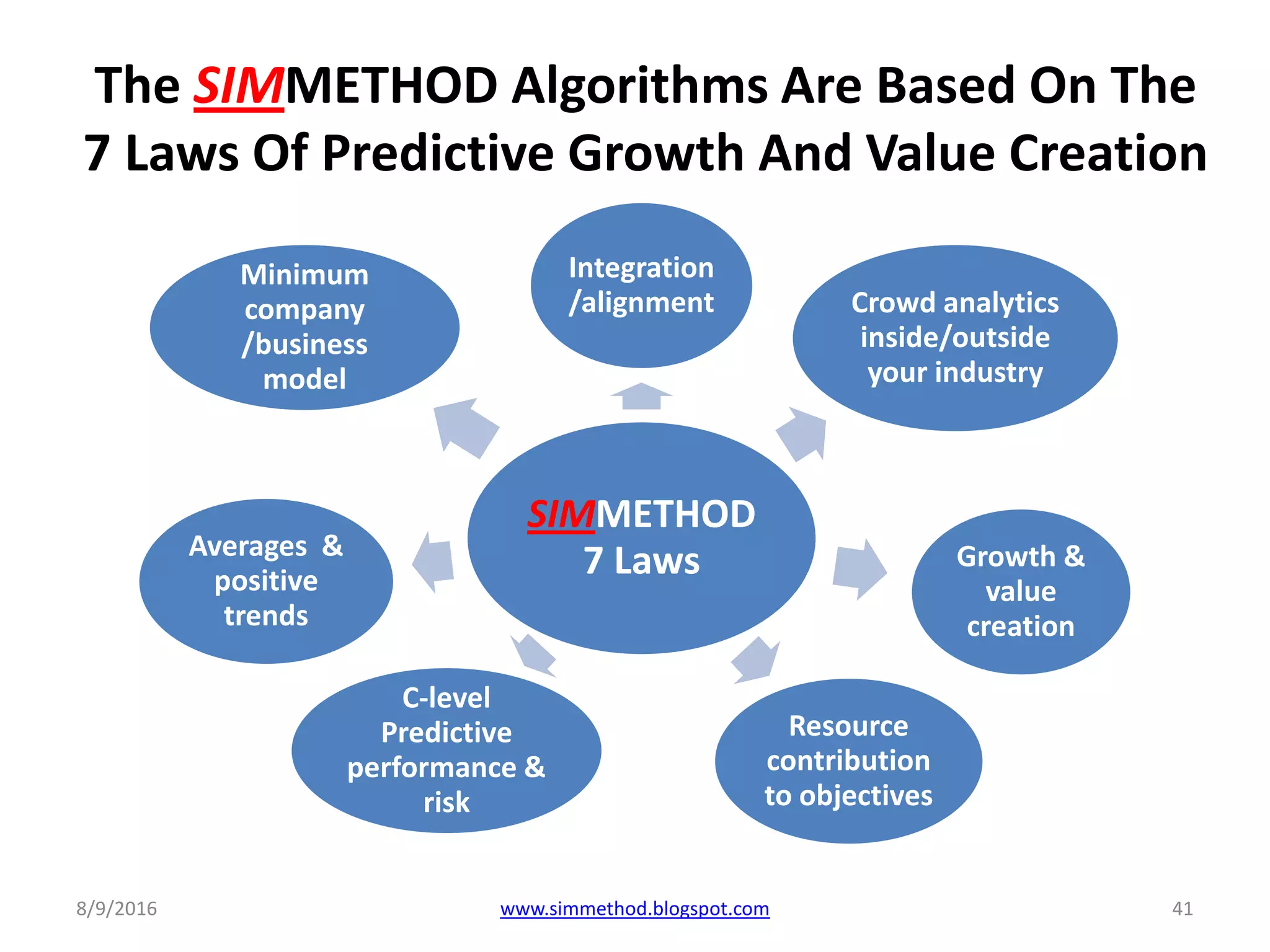

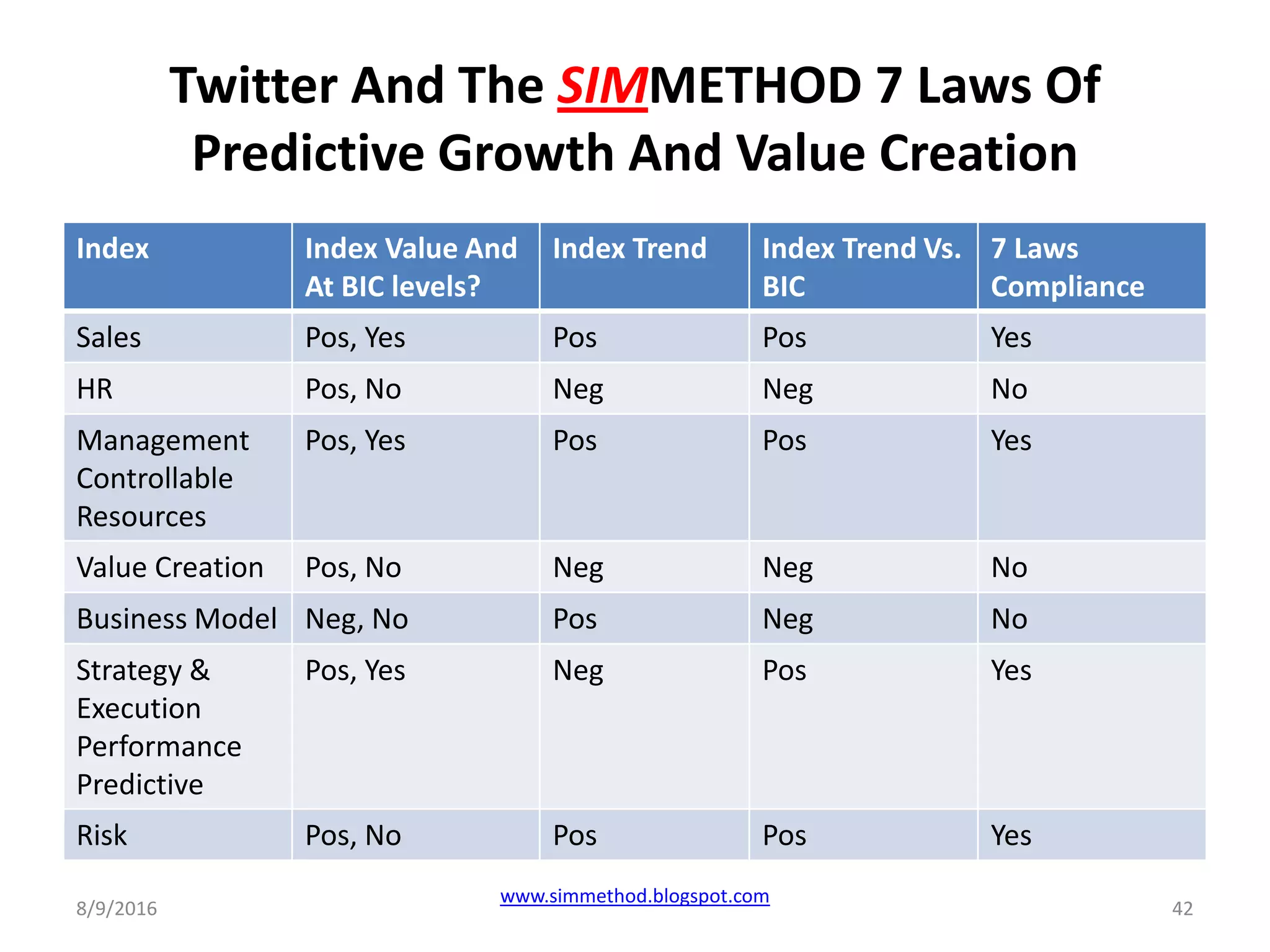

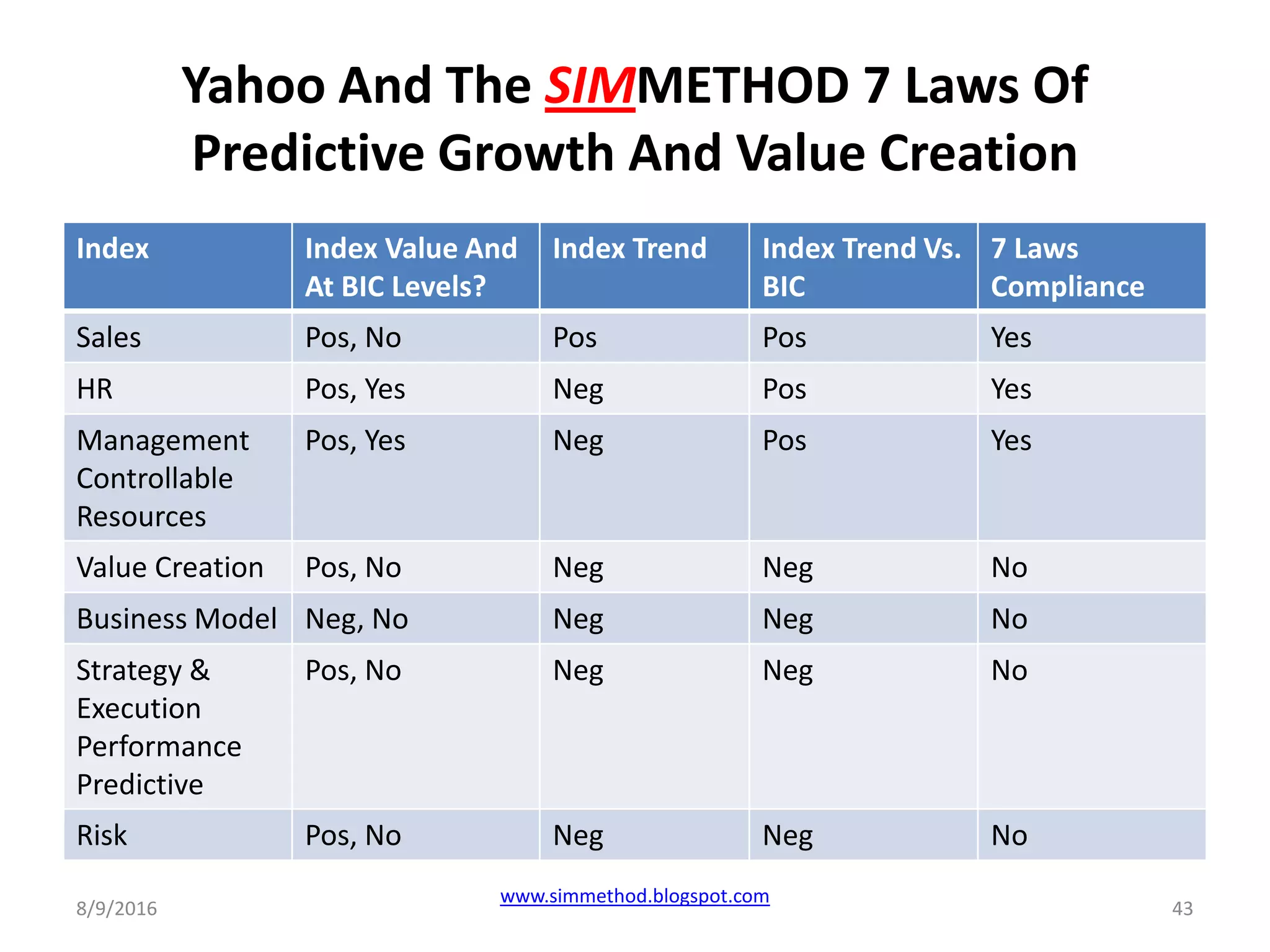

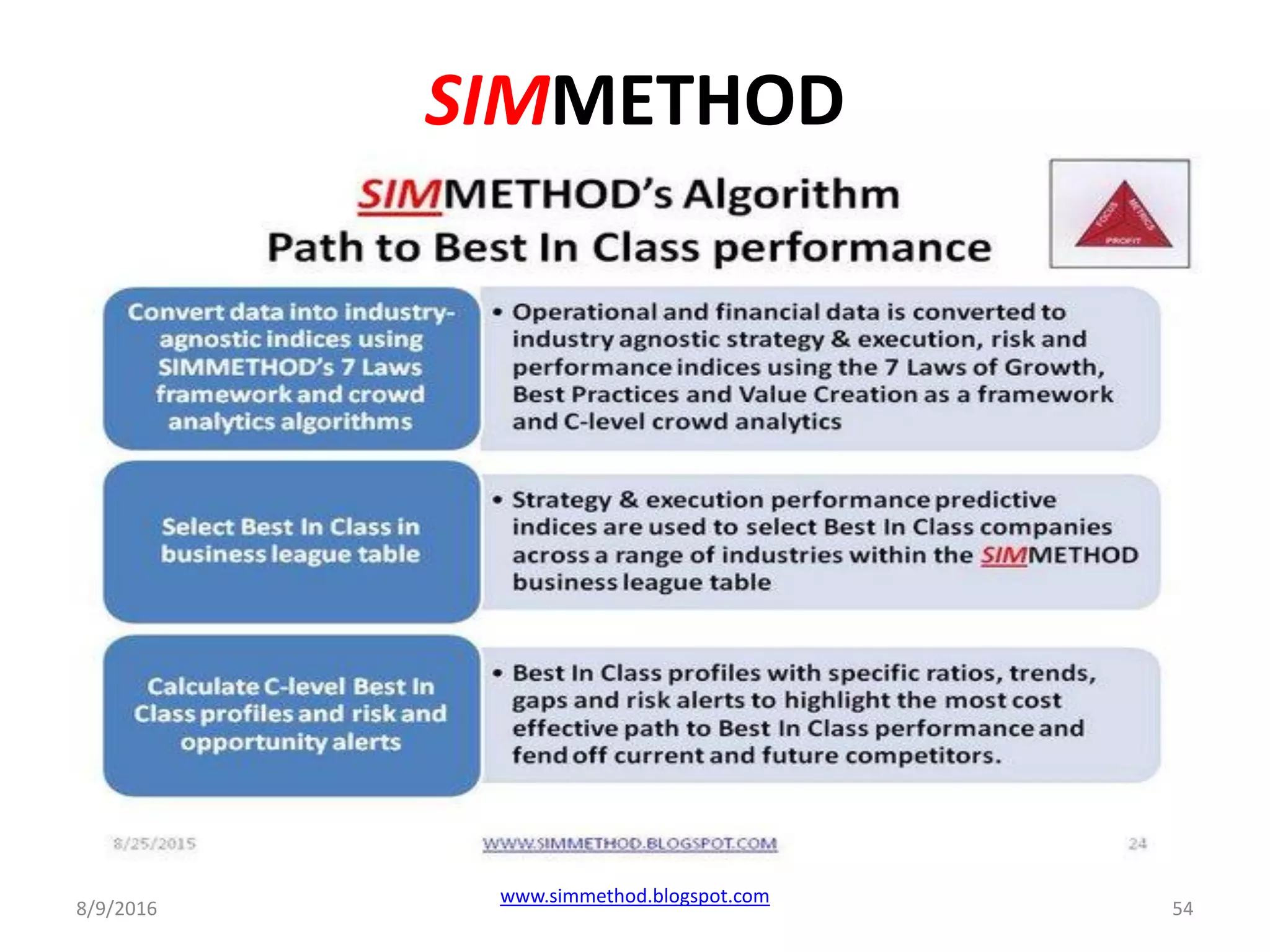

The document discusses the inadequacies of traditional corporate risk and performance measurement systems, emphasizing the need for a shift towards industry-agnostic metrics that account for external market trends. Simmethod proposes a framework that integrates predictive analytics and competitive intelligence, enabling businesses to identify risks and opportunities more effectively. The aim is to enhance decision-making processes at the C-suite level by offering a holistic view of performance relative to best-in-class benchmarks.