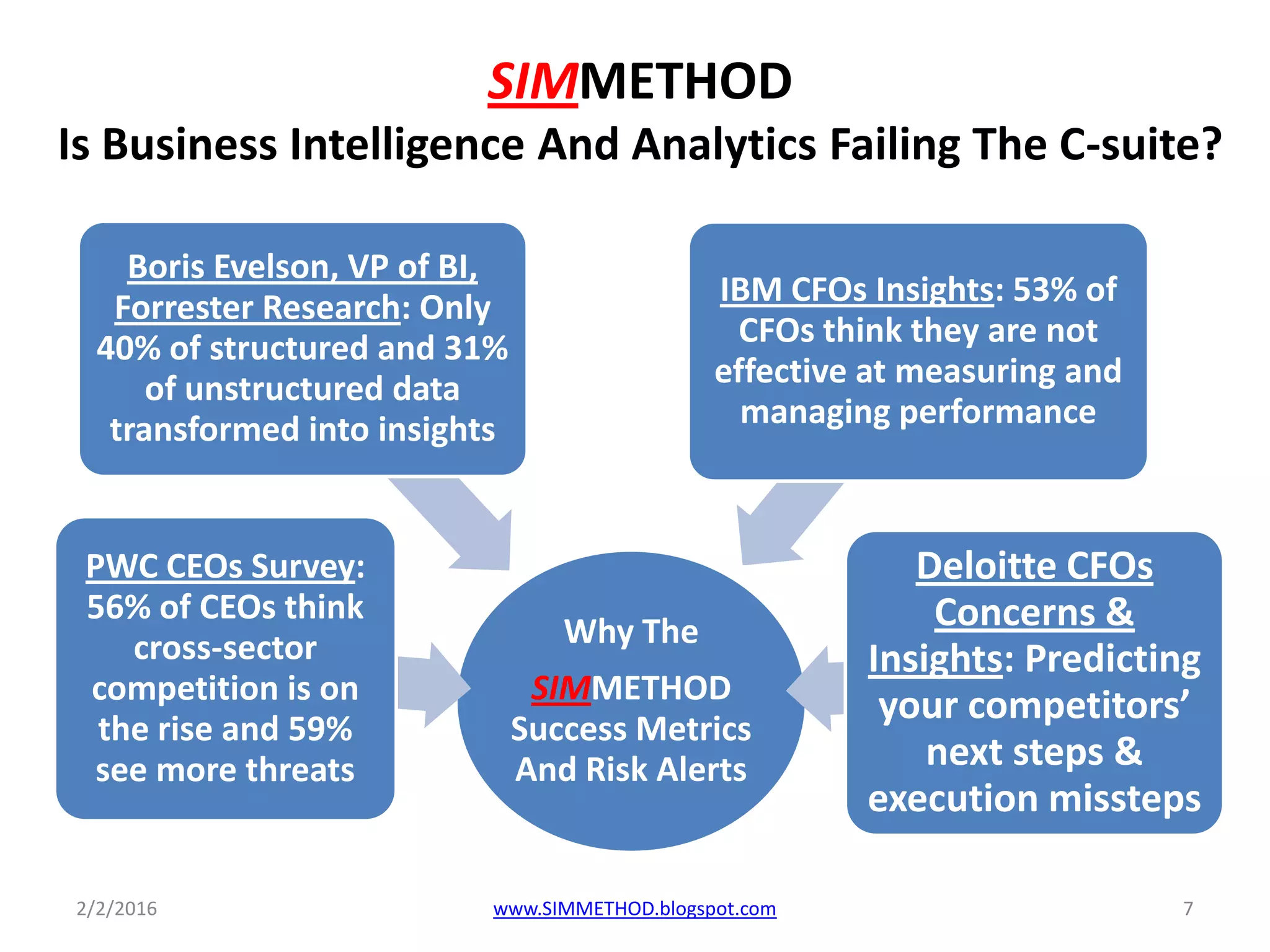

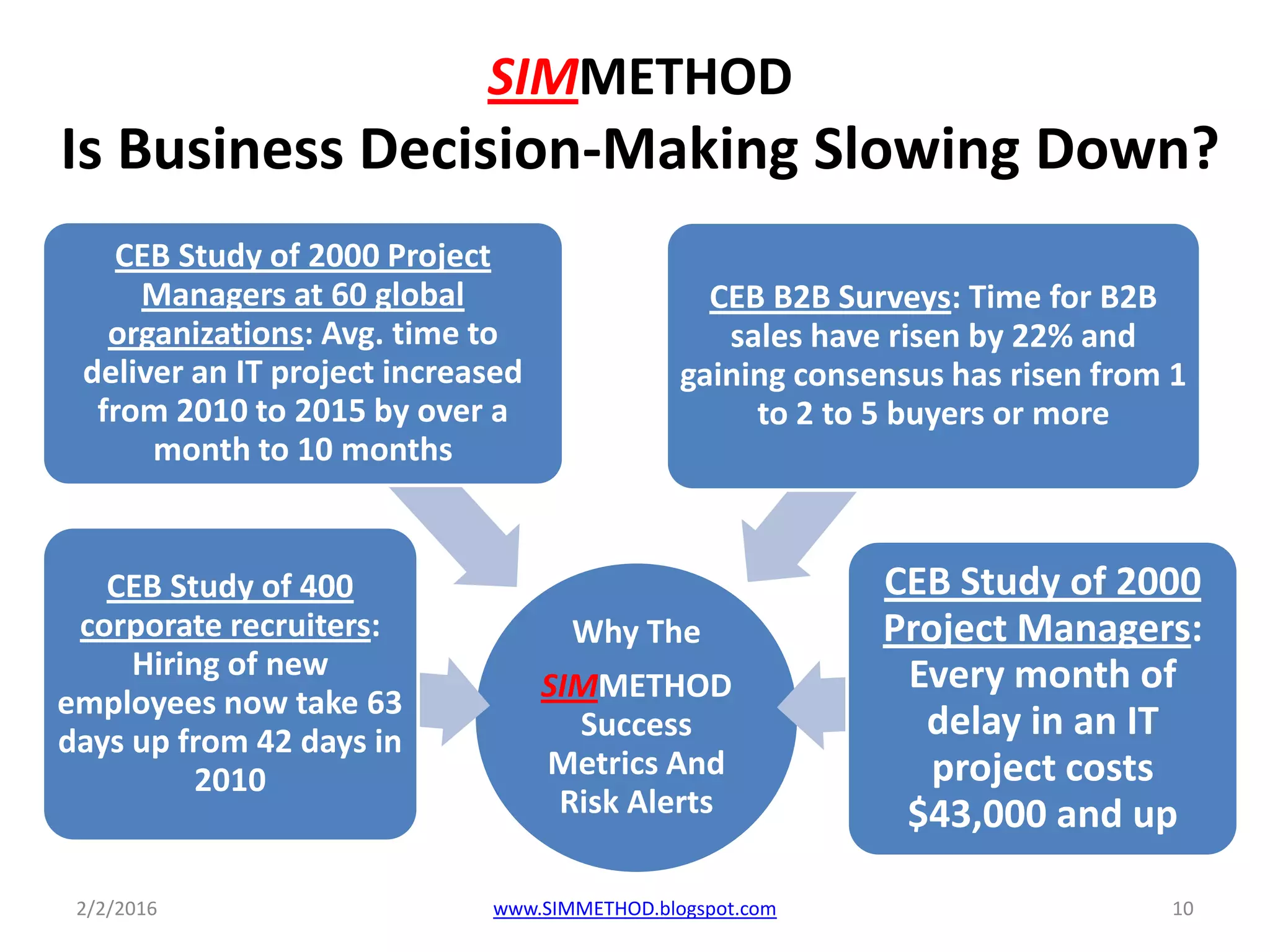

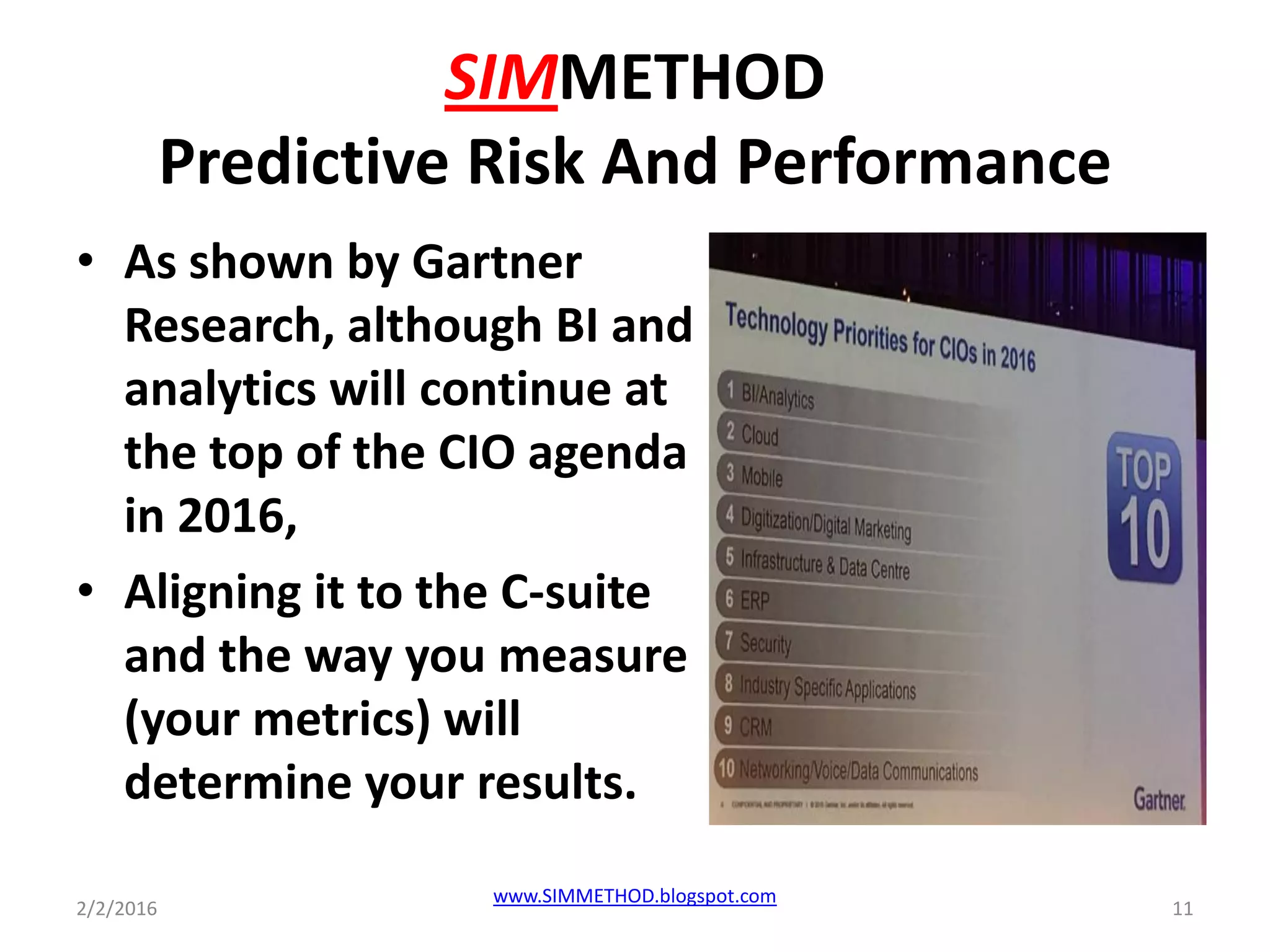

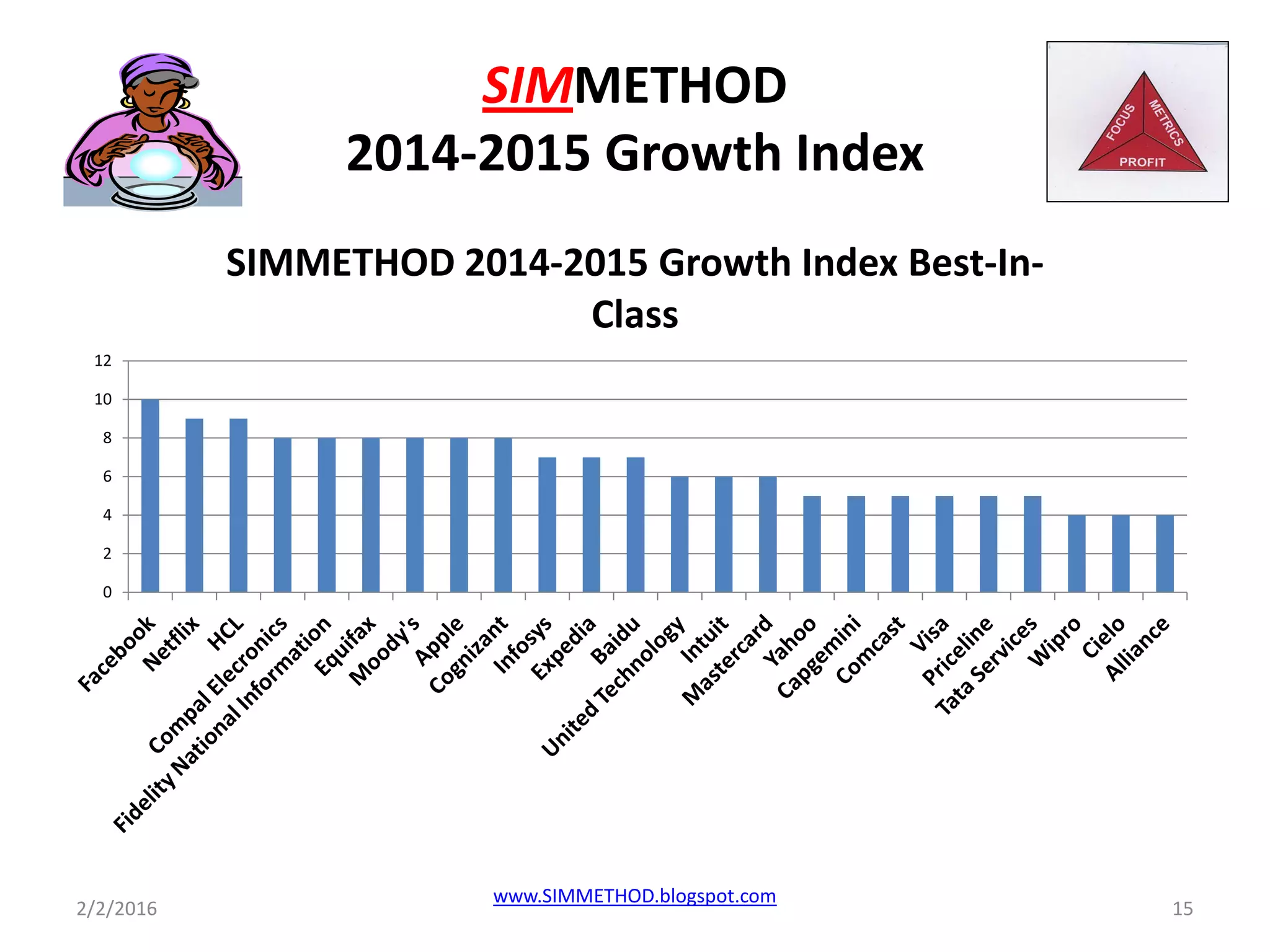

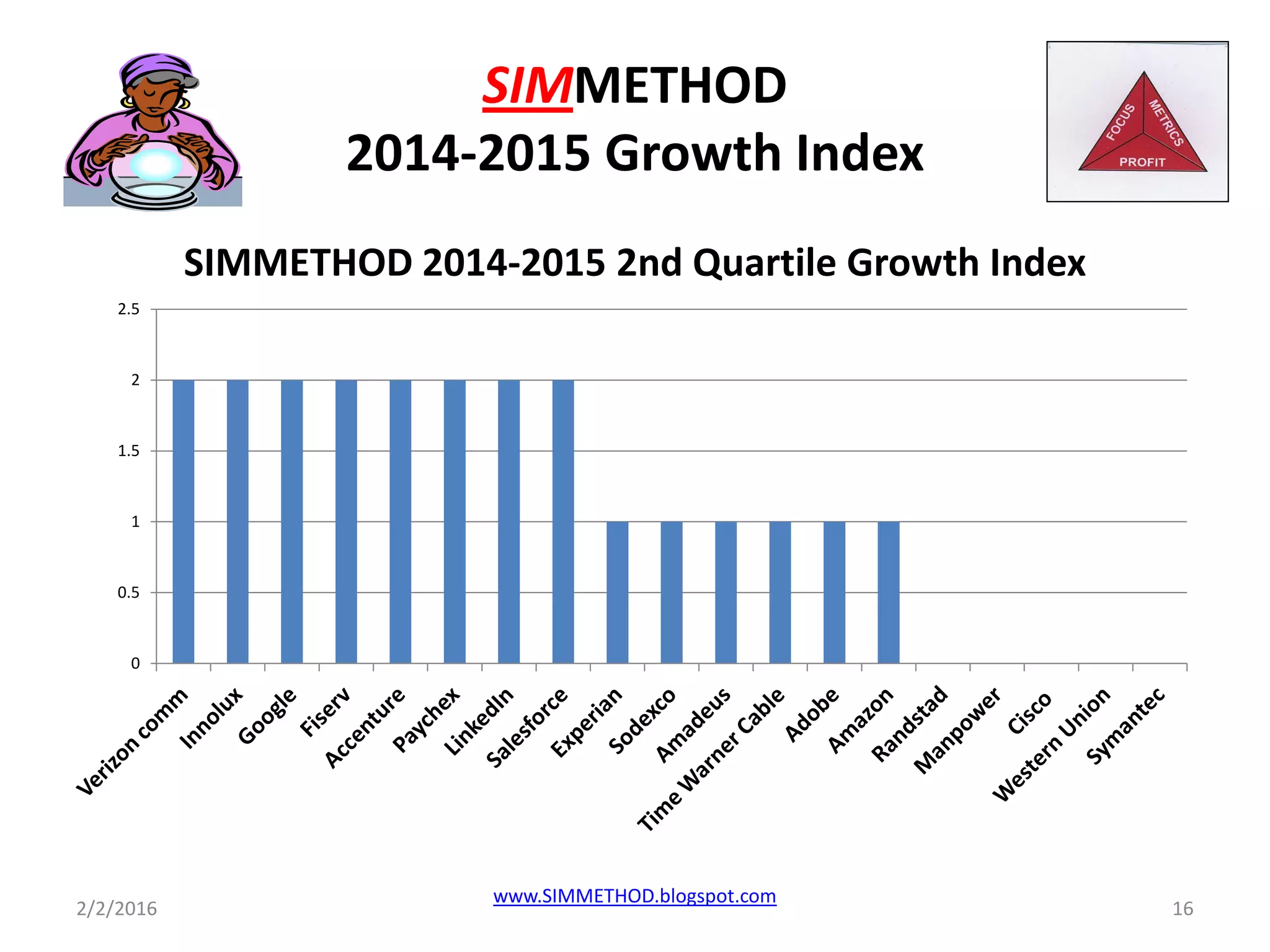

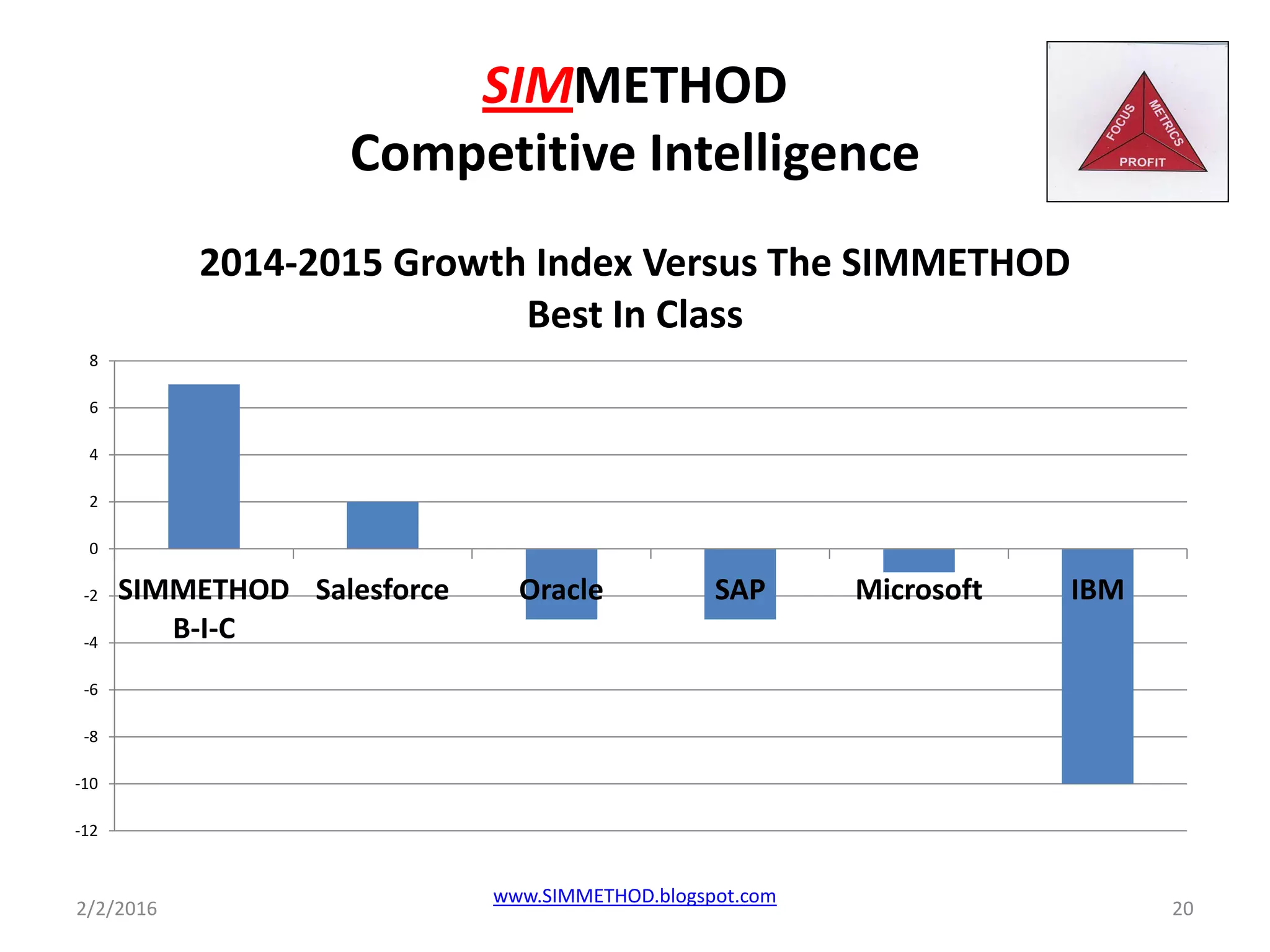

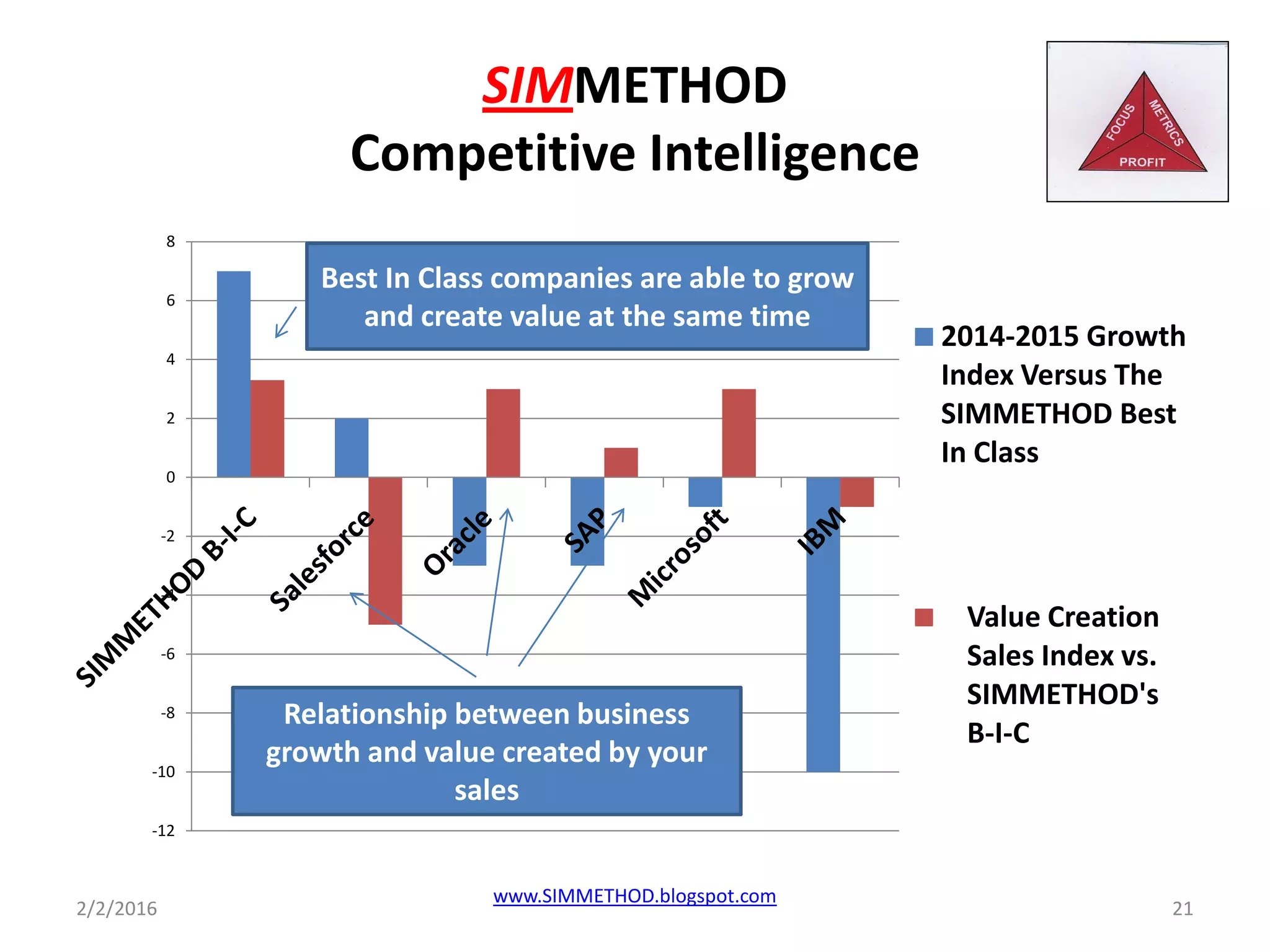

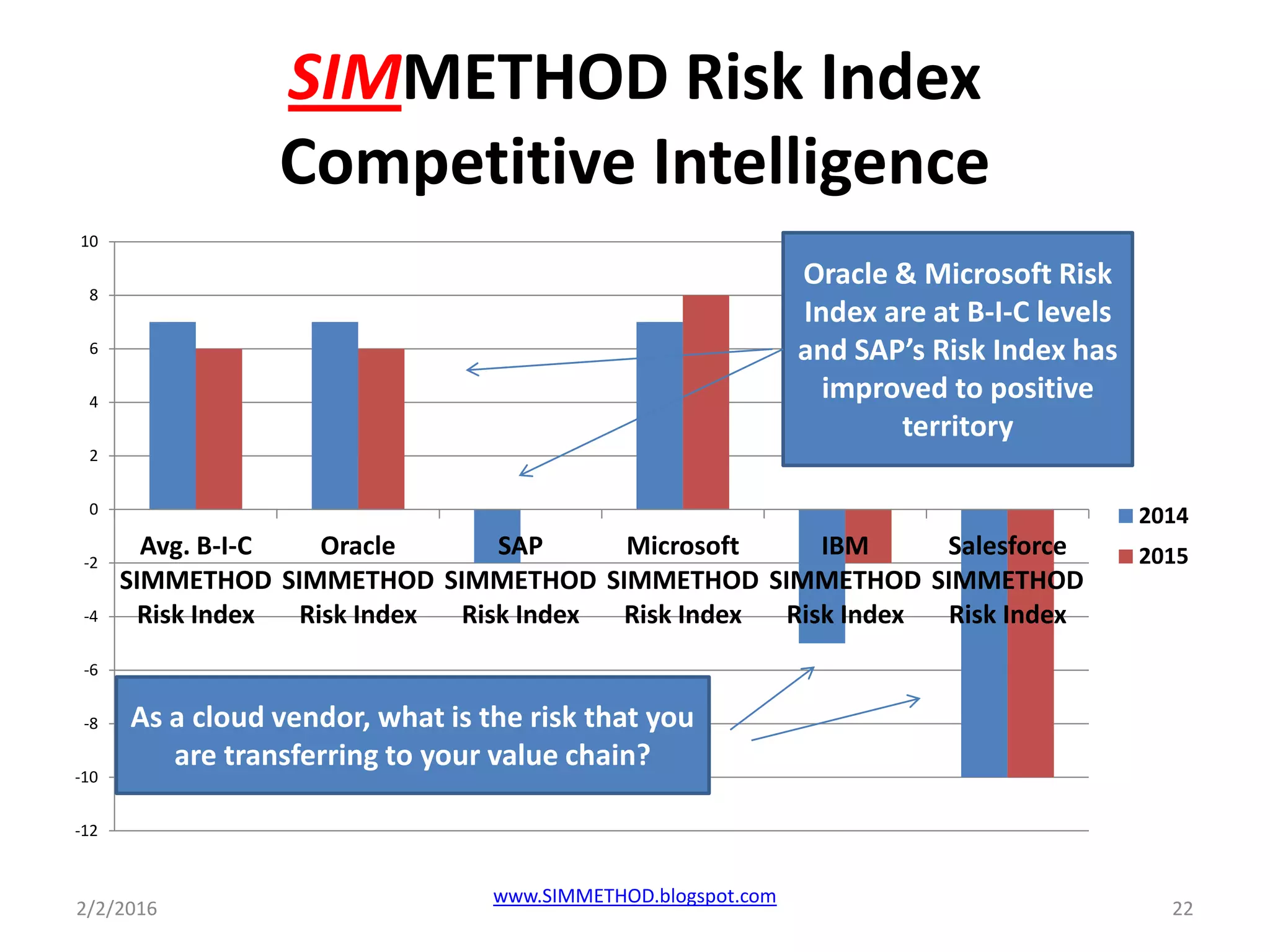

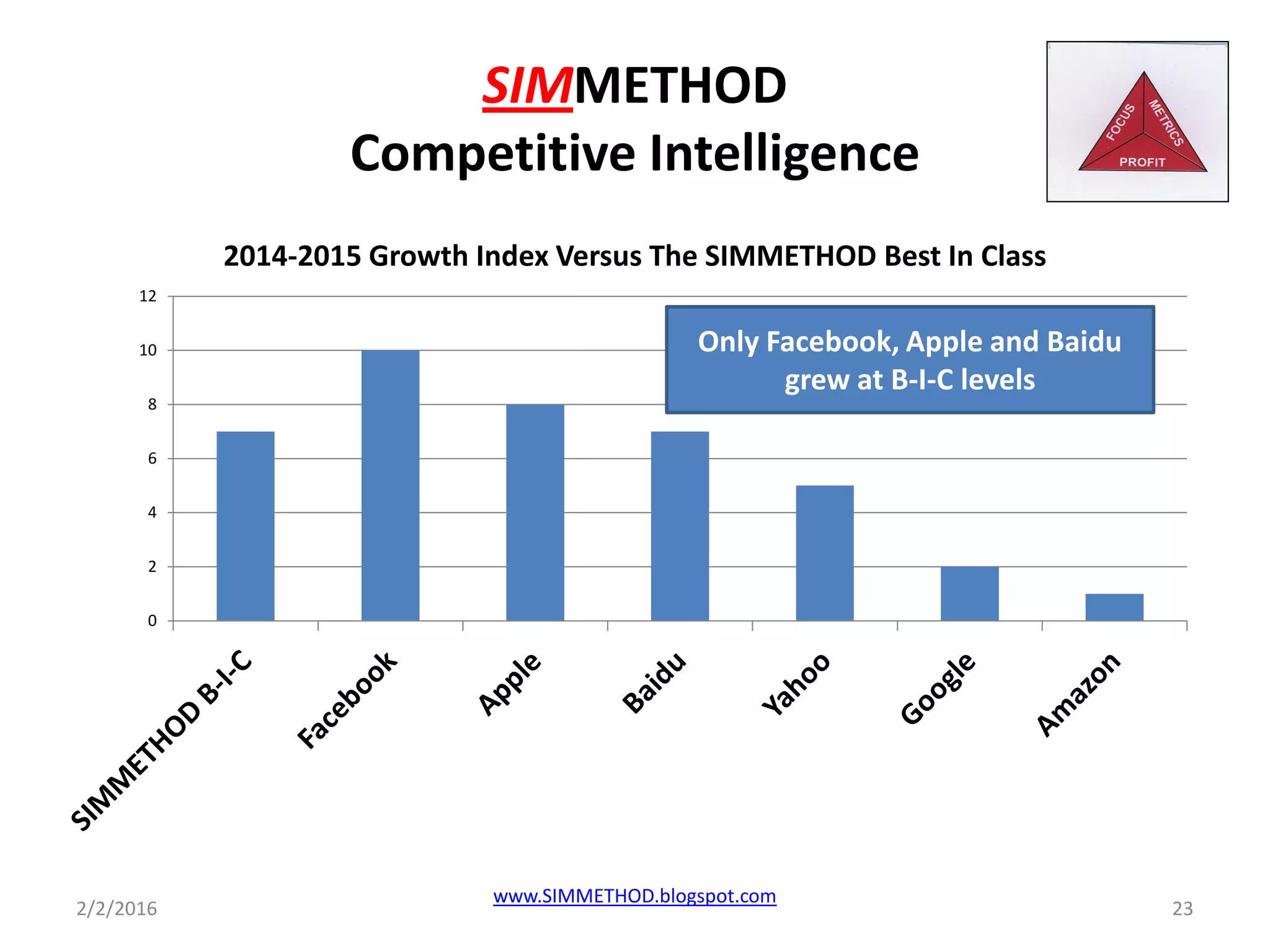

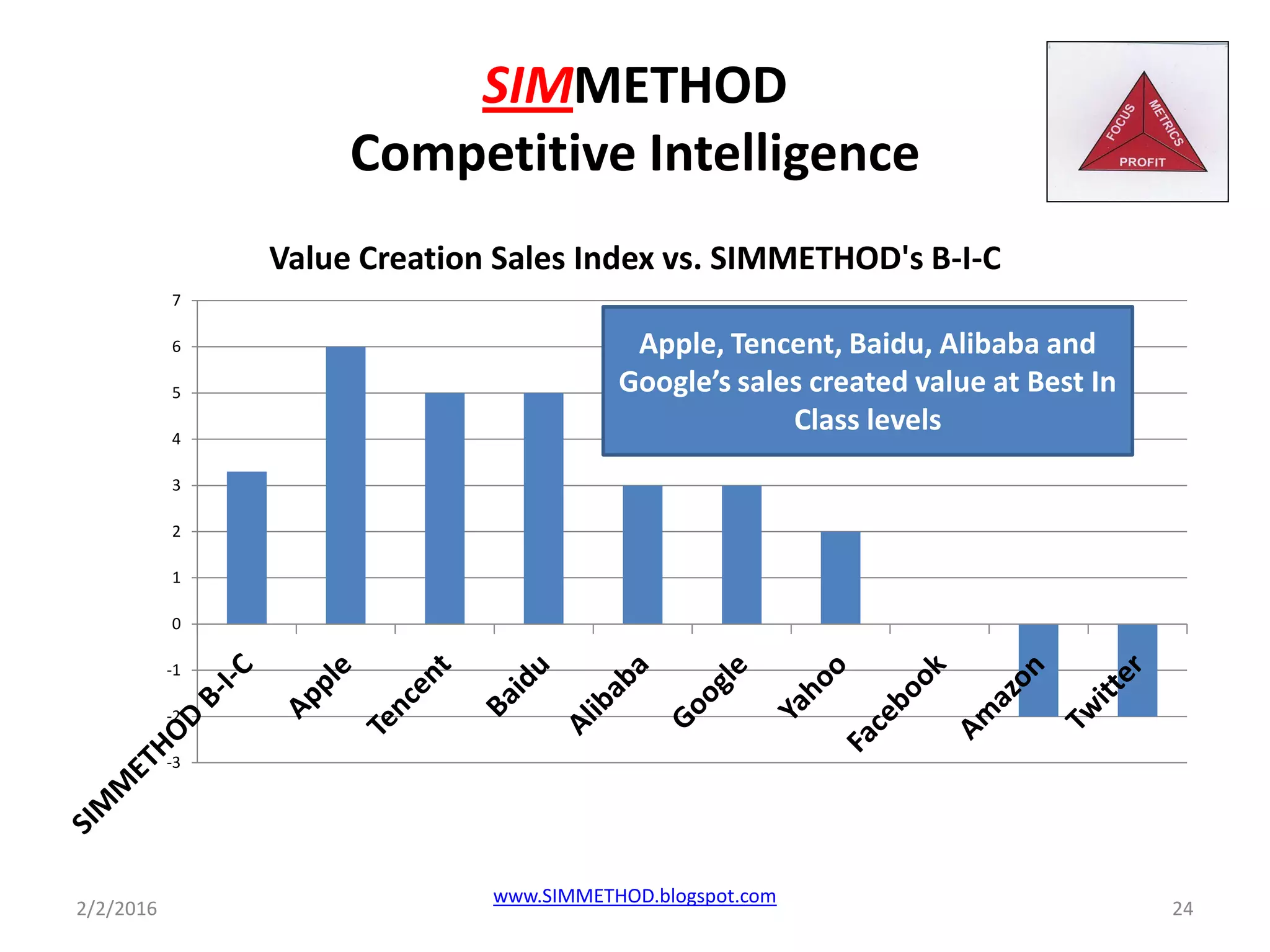

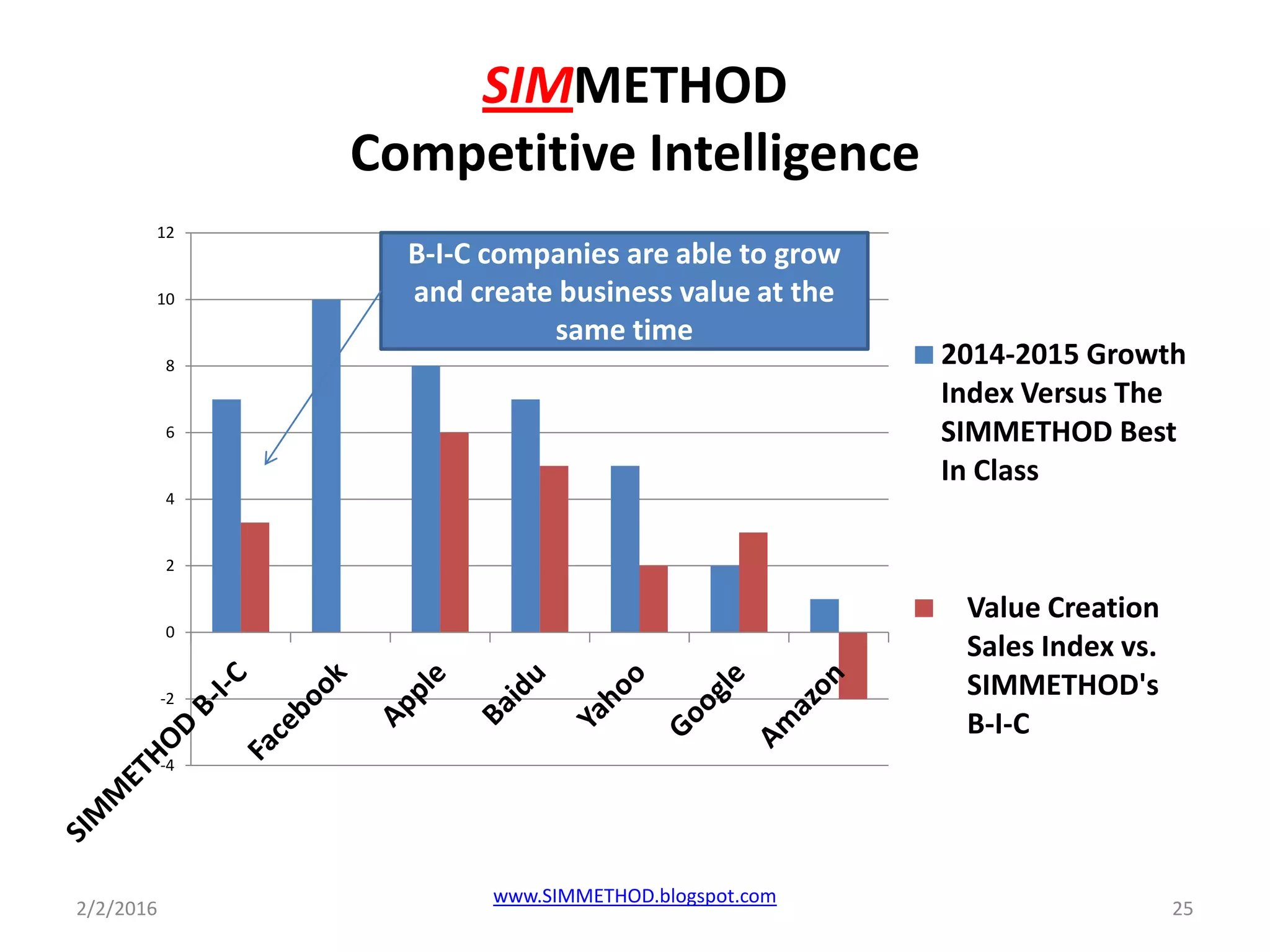

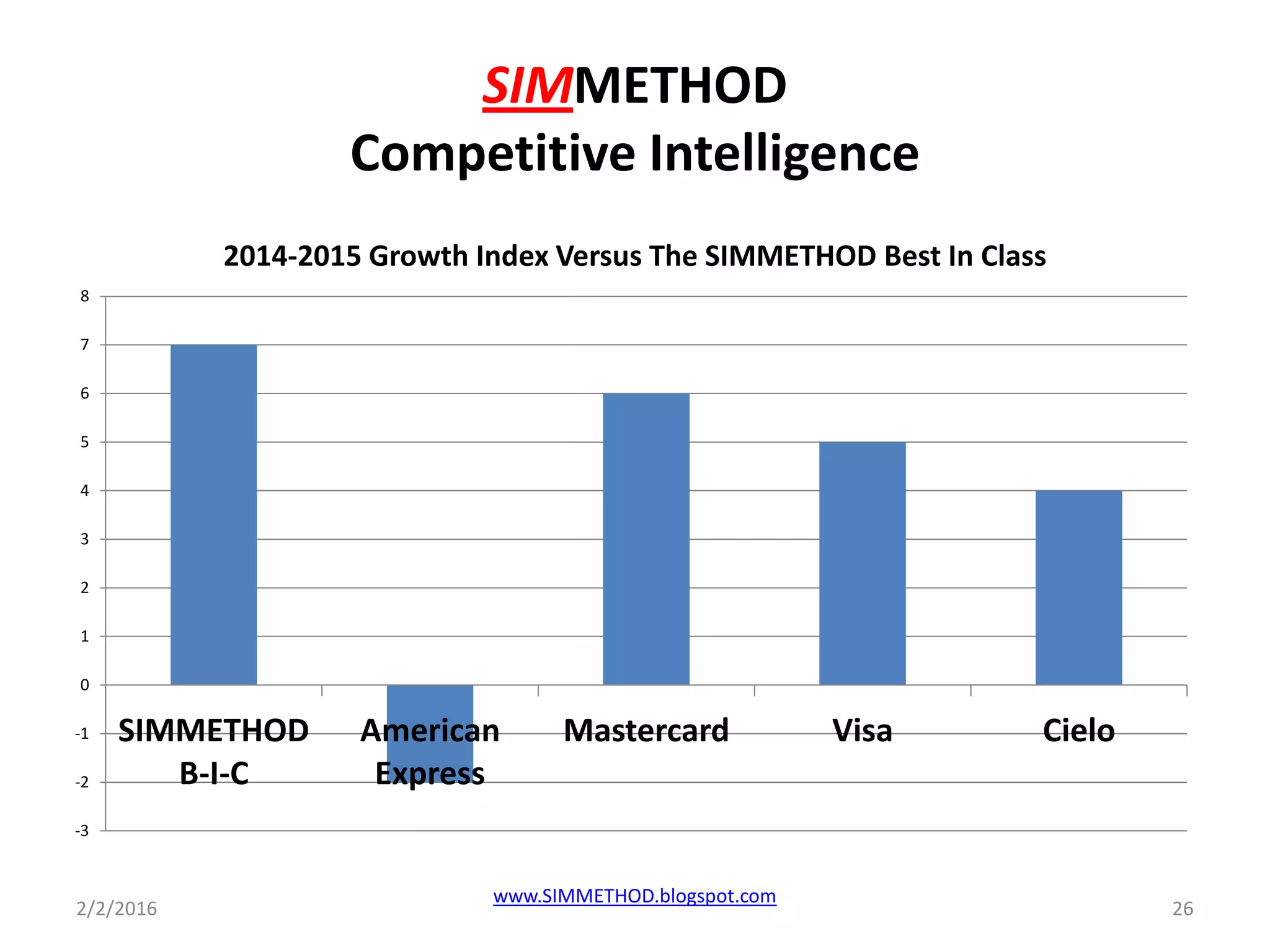

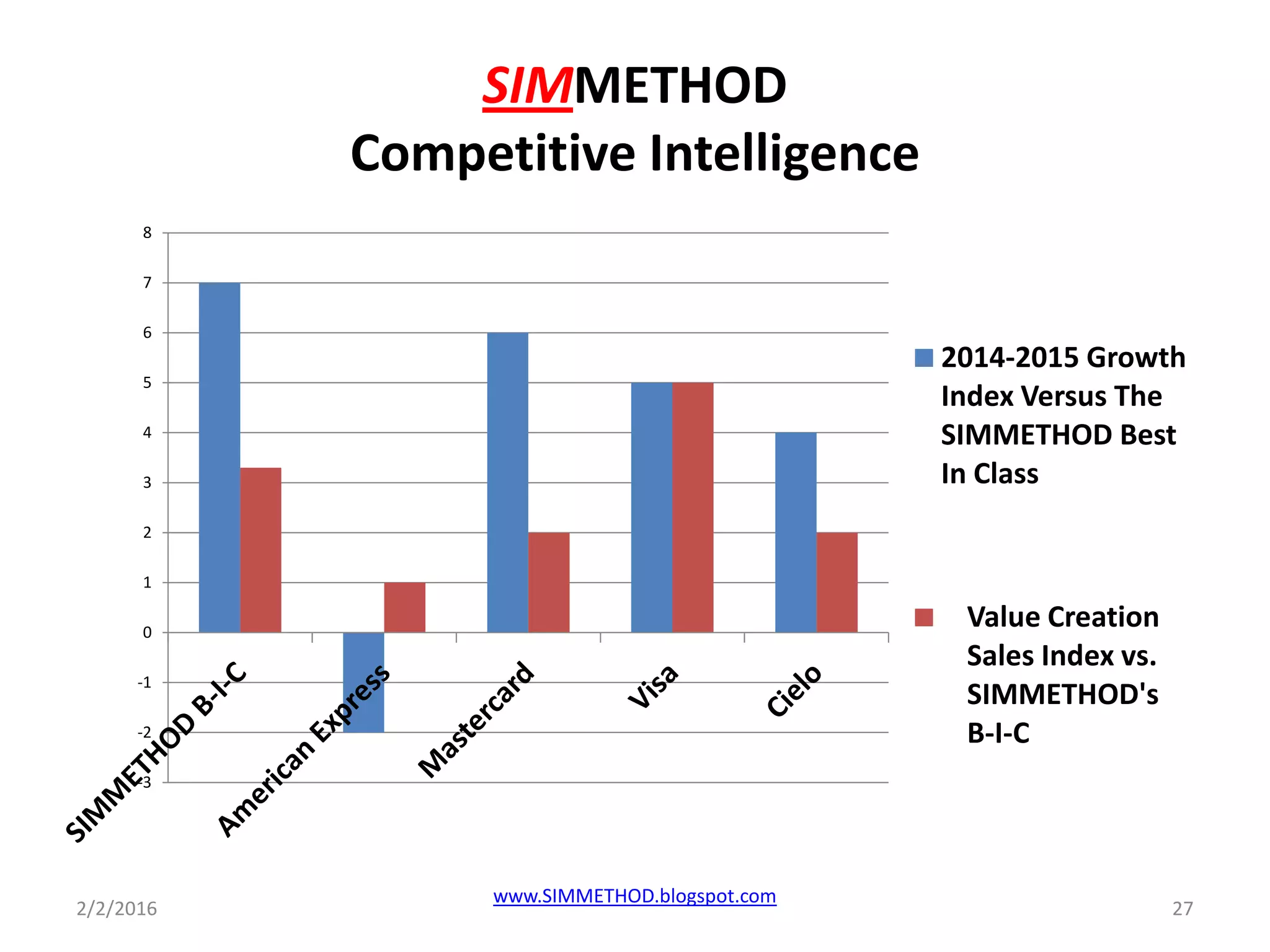

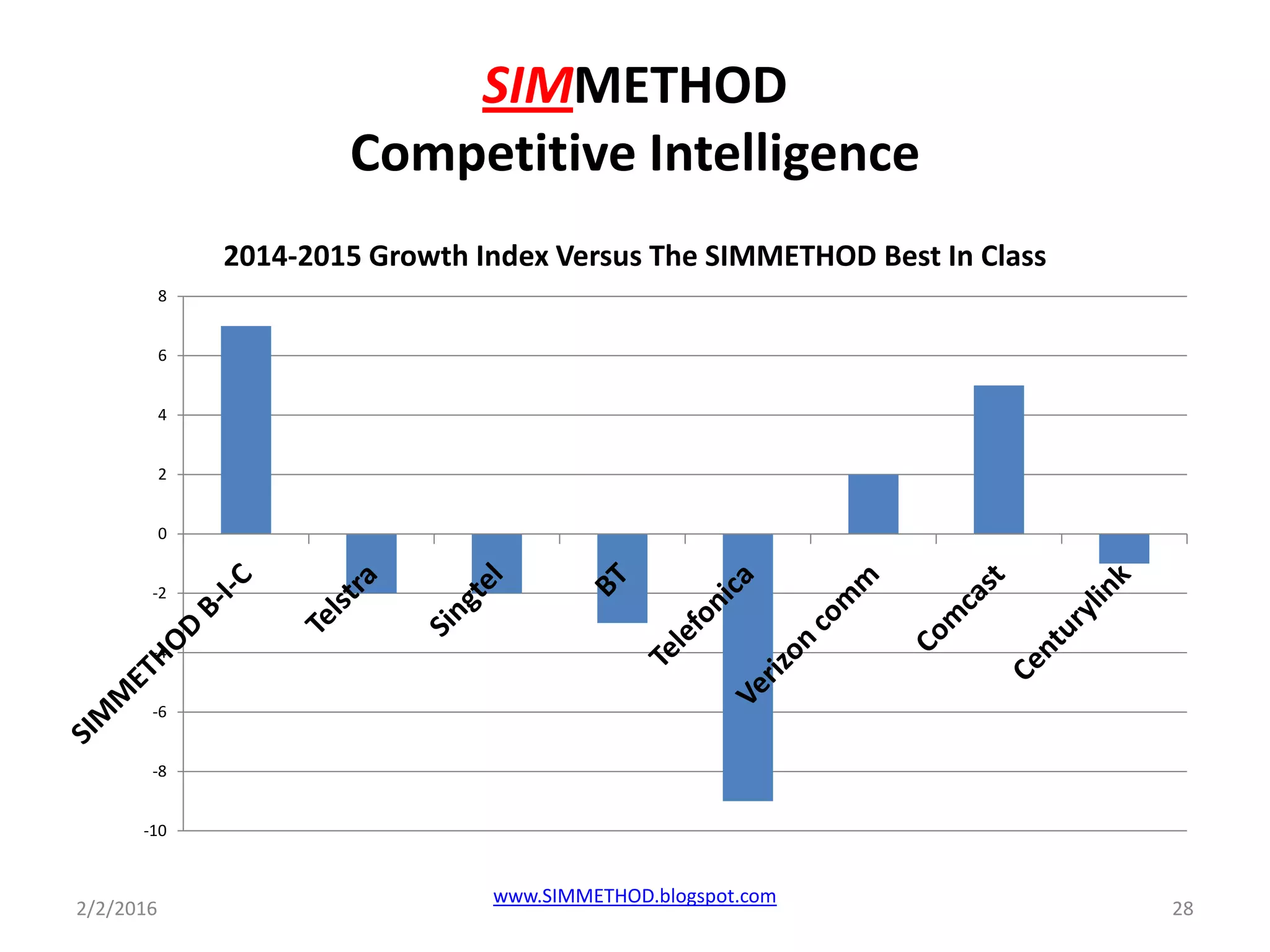

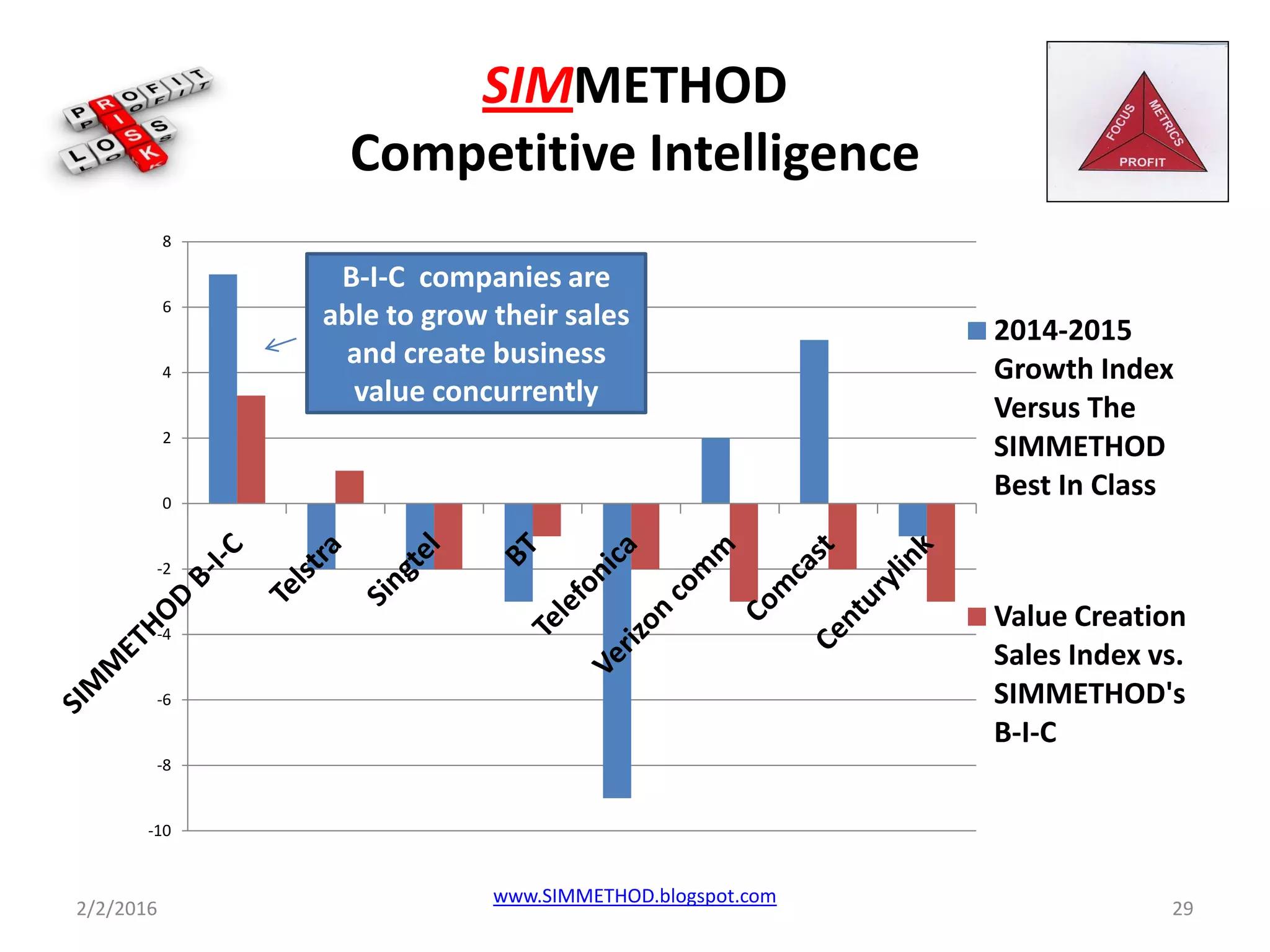

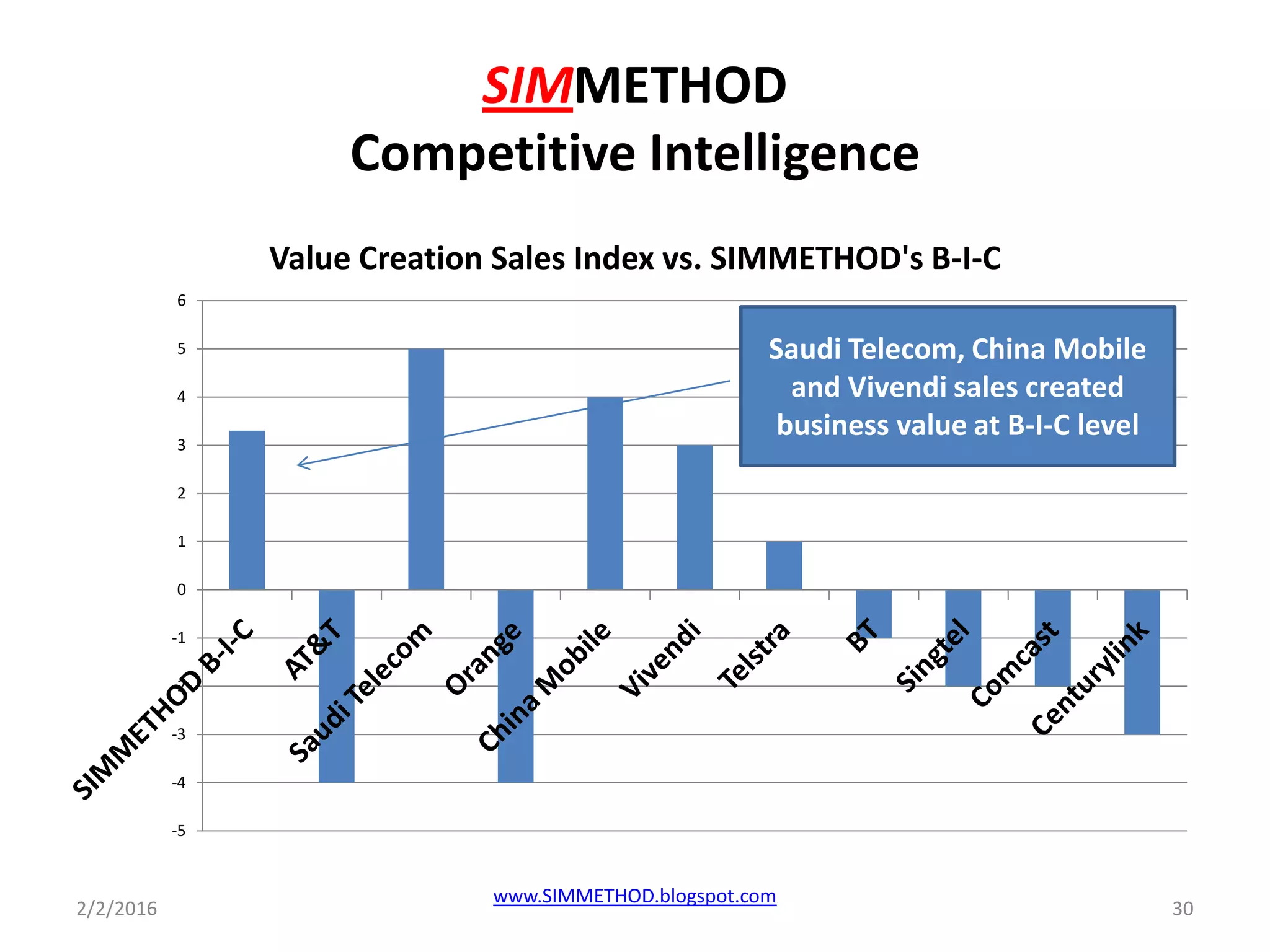

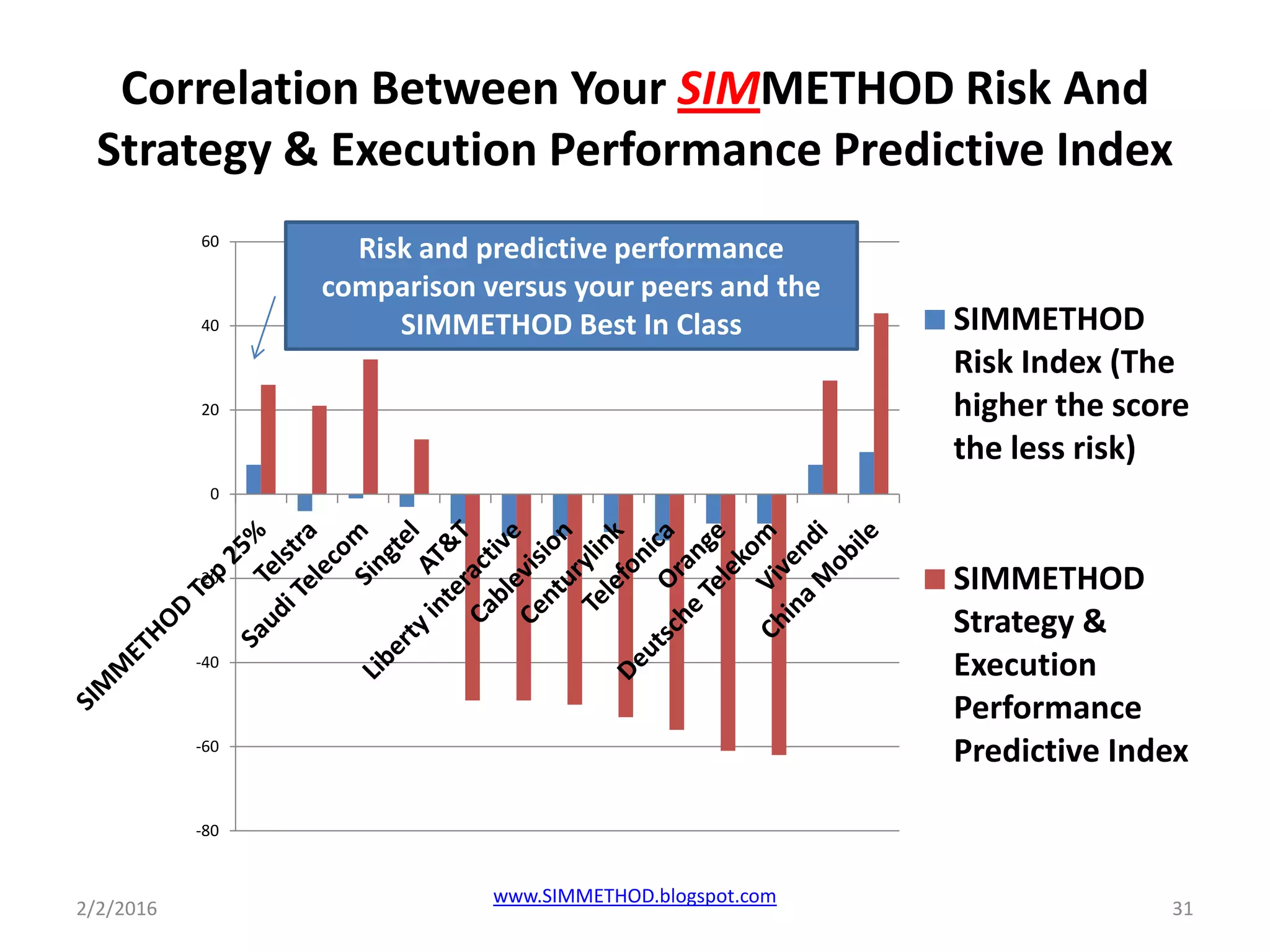

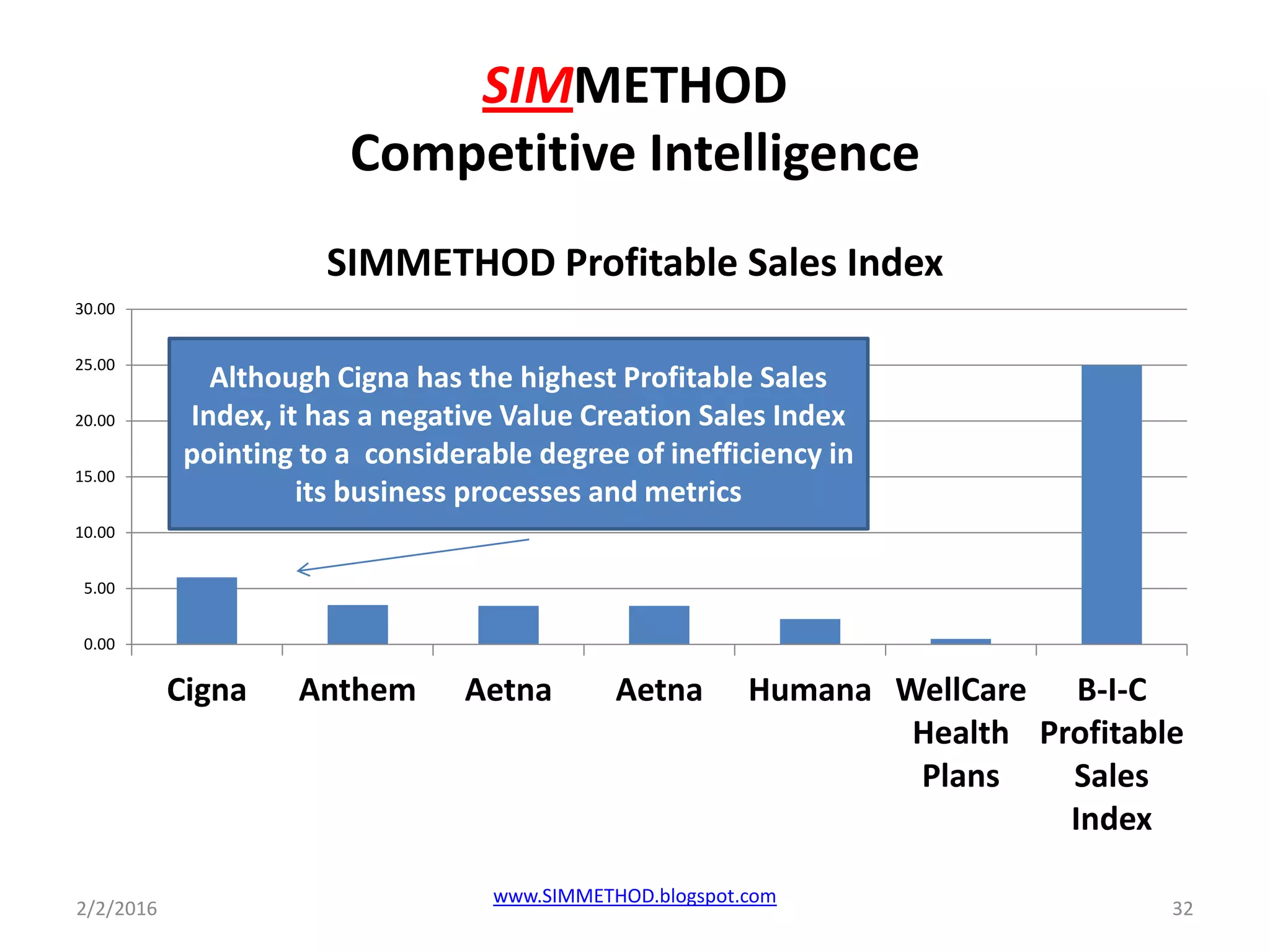

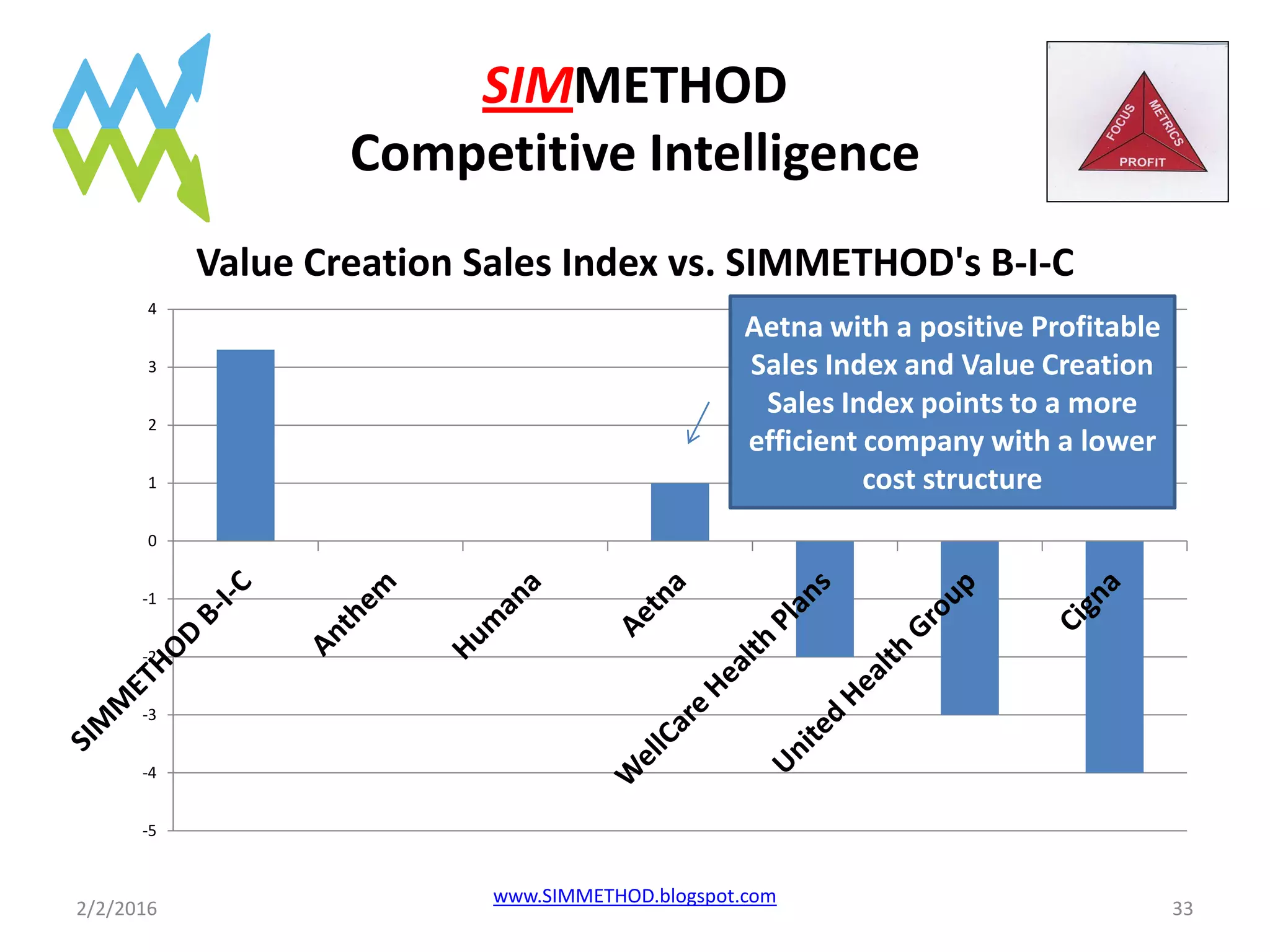

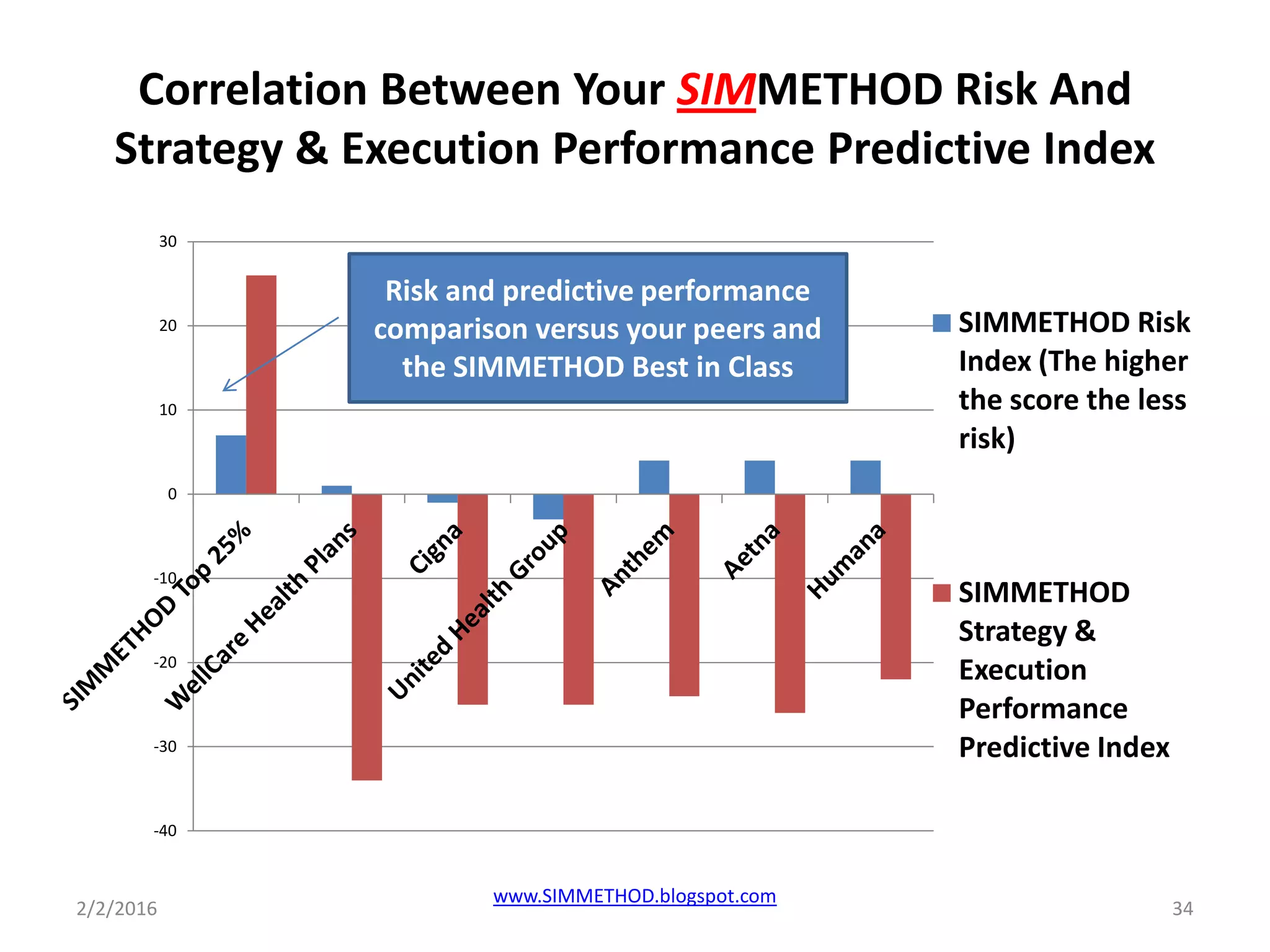

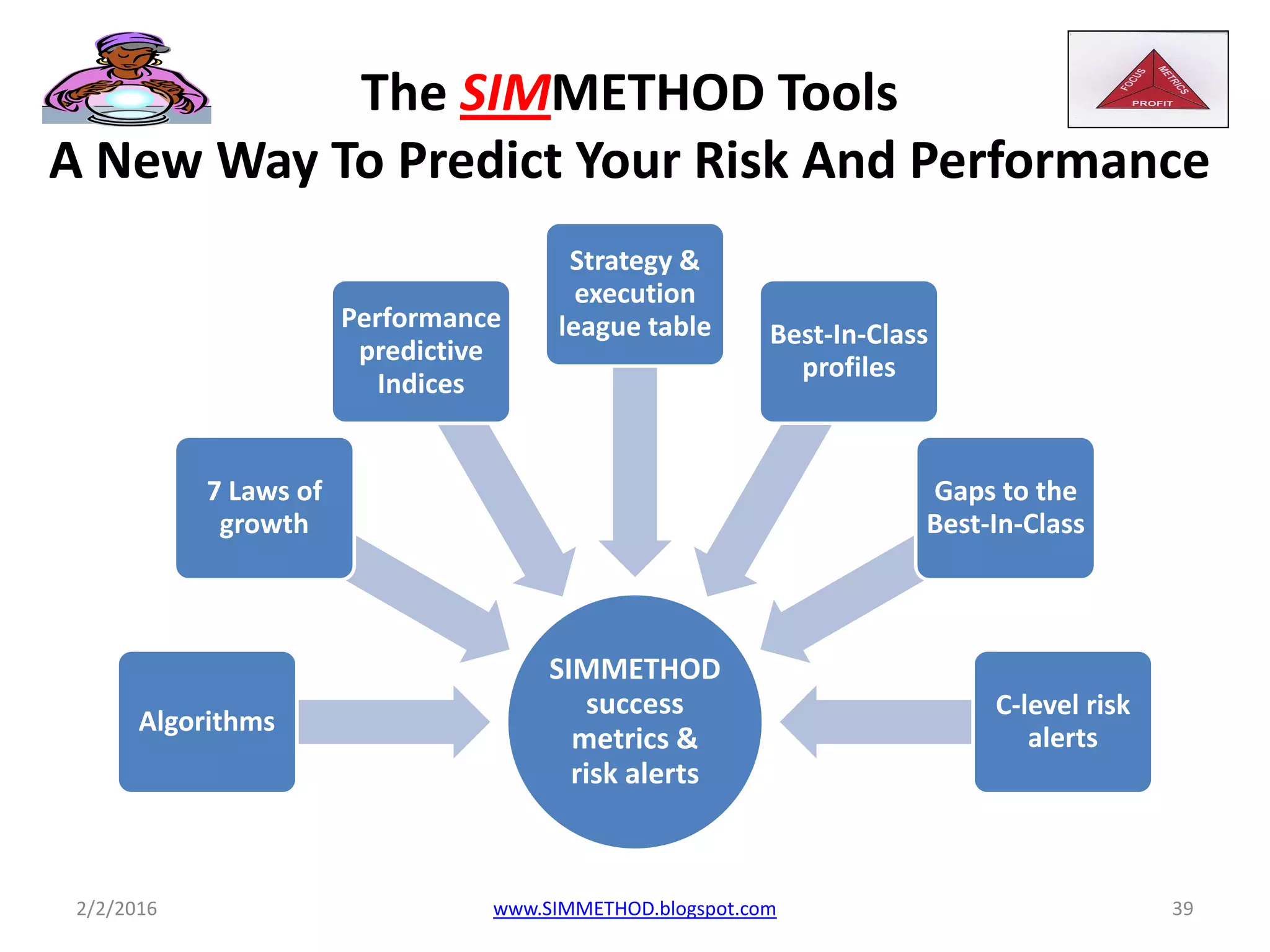

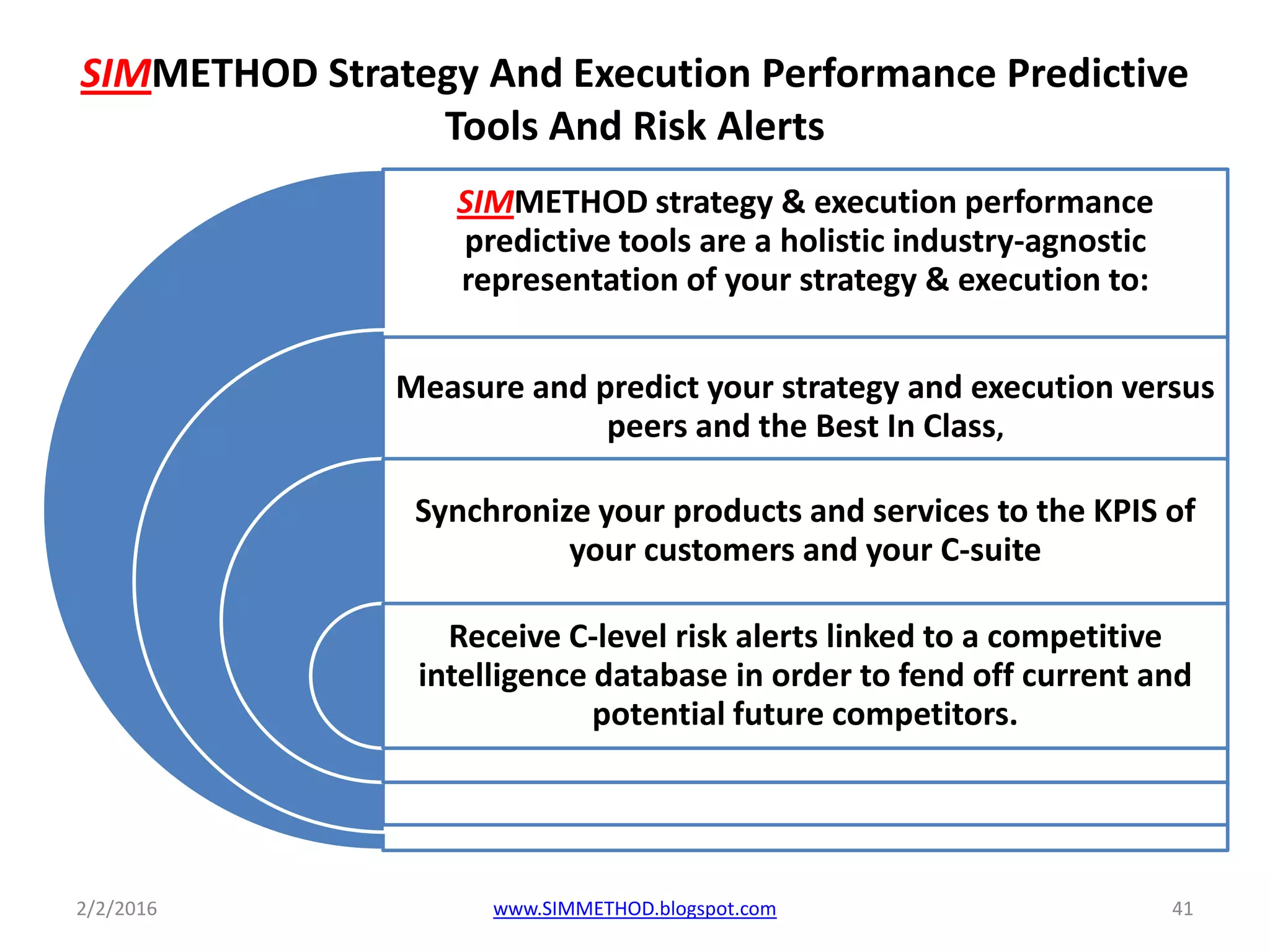

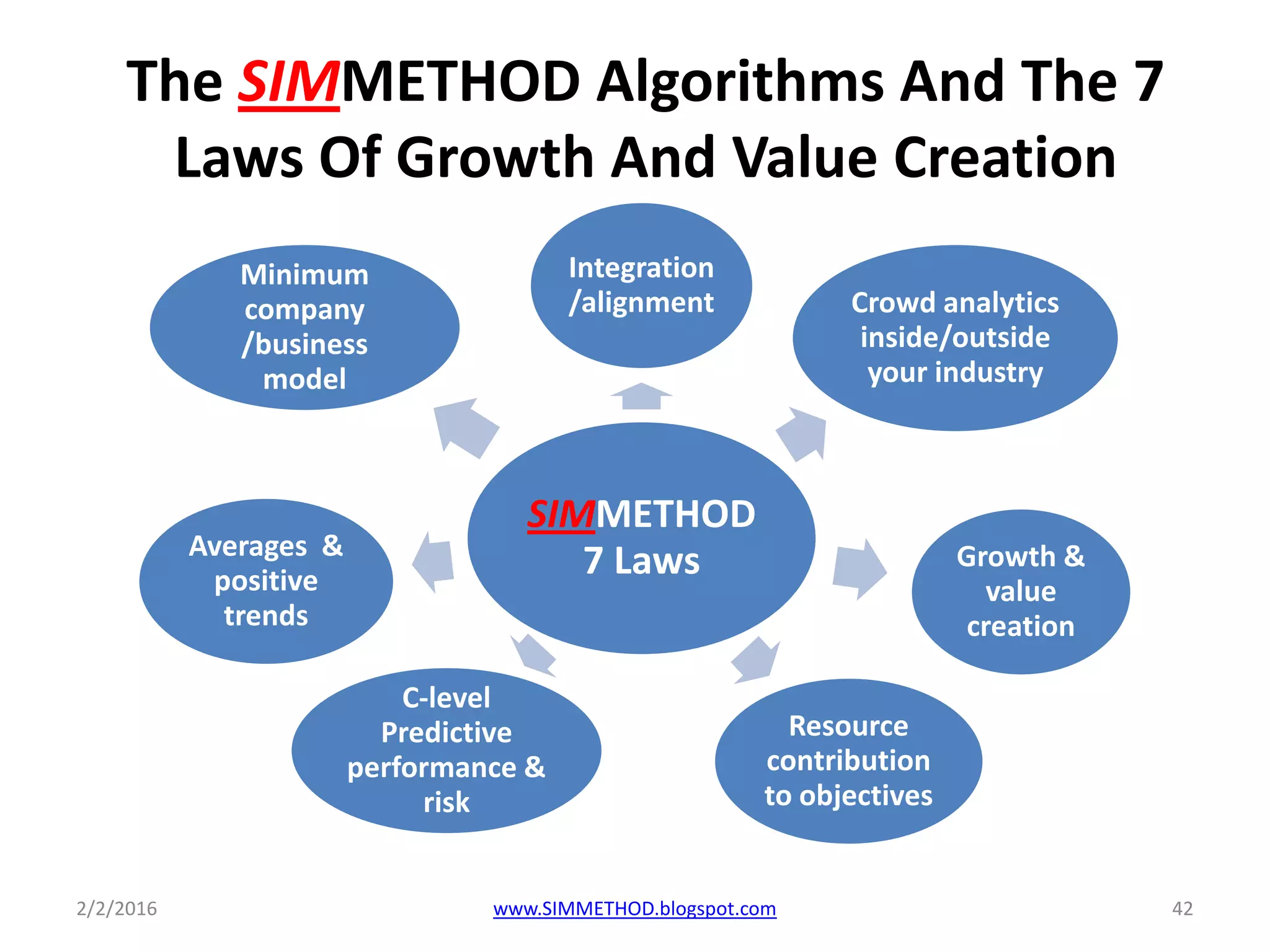

The document introduces 'simmethod,' a new approach for measuring and predicting risk and performance in the digital economy, highlighting that traditional metrics are ineffective and lead to slower decision-making processes. It emphasizes the importance of new predictive indices and alerts that are designed for an industry-agnostic context to better align with C-suite demands. Additionally, it discusses the need for competitive intelligence tools to enhance business value and achieve growth while addressing the complexities of modern business environments.