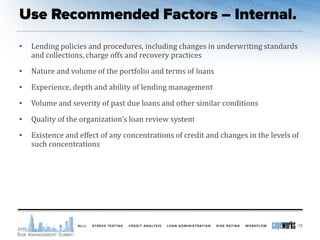

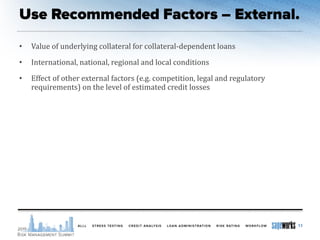

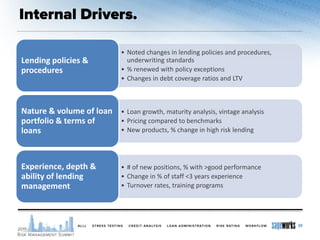

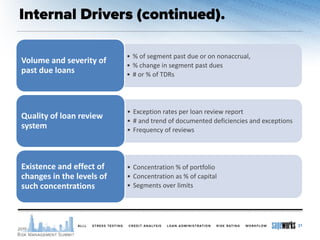

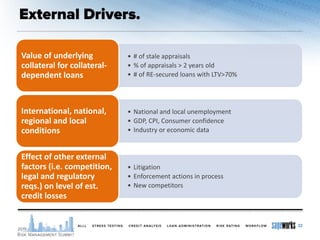

The document discusses qualitative factors in risk management, focusing on how to justify their use in loan portfolio evaluations. It highlights best practices for assessing internal and external drivers that influence credit risk, emphasizing the need for a comprehensive analysis. The future will see a transition to an expected loss model where qualitative factors will play a more significant role in estimating credit losses.

![• Transitioning to an expected loss model

• Forward-looking adjustments

• Q factors will play an expanded role

• Basel Committee’s consultative document alludes to forecasting component of

Q factors in ECL model:

"Examples of factors that may require qualitative adjustments are the existence of

concentrations of credit risk and changes in the level of such concentrations,

increased usage of loan modifications, changes in expectations of macroeconomic

trends and conditions, and/or the effects of changes in the underwriting standards

and lending policies […].”

23](https://image.slidesharecdn.com/summit-qualitativefactors-mcpeak-151016130036-lva1-app6891/85/Justifying-Qualitative-Factors-2015-Risk-Management-Summit-23-320.jpg)