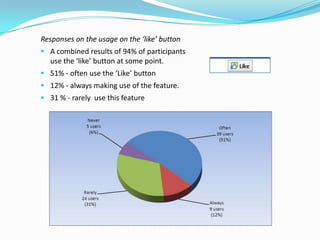

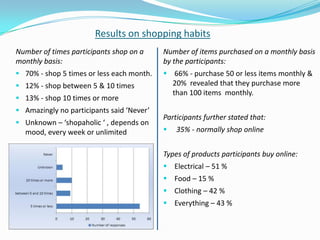

This document describes an investigation into why social networking sites incorporate e-commerce features. It begins by outlining the reasons for conducting the investigation and defining social commerce. It then provides examples of social media platforms that have integrated e-commerce. The document discusses how retailers benefit from targeting social networking users and the marketing techniques used in social commerce. It also outlines the costs for retailers to implement social commerce features and describes the results of a survey on social networking usage and shopping habits.