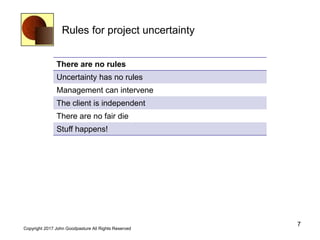

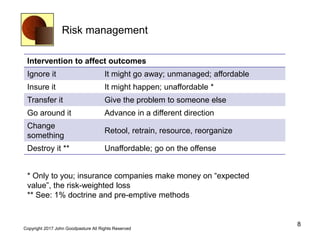

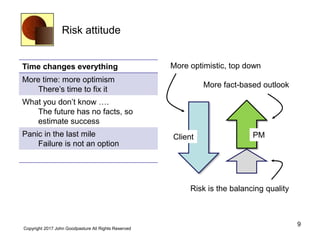

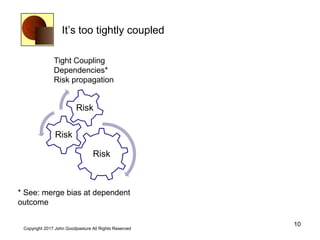

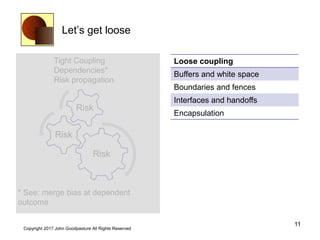

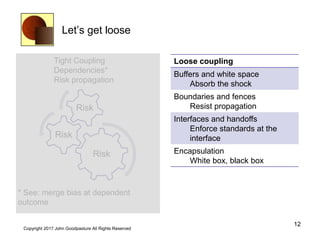

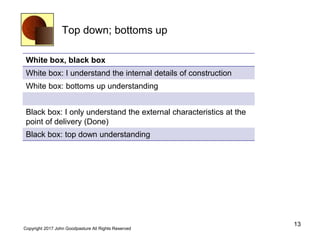

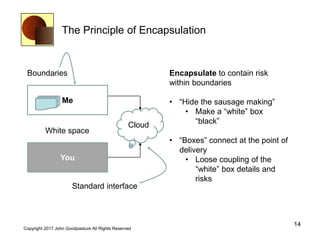

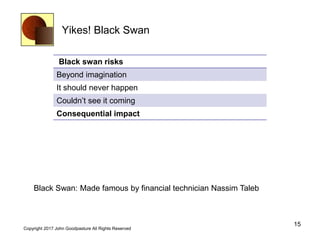

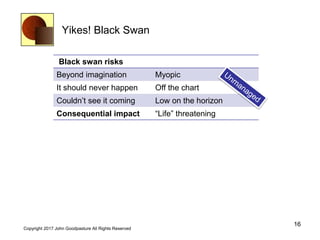

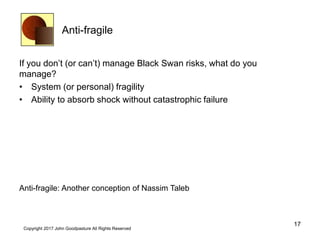

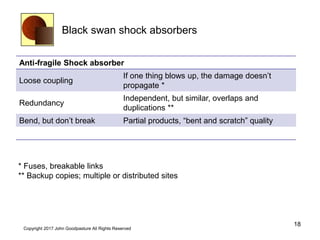

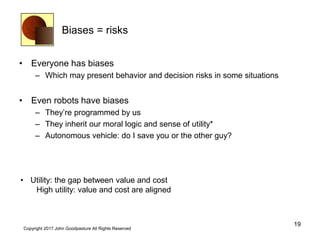

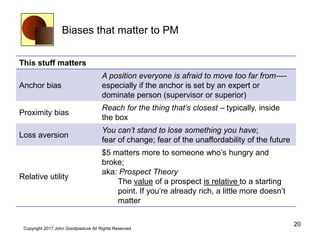

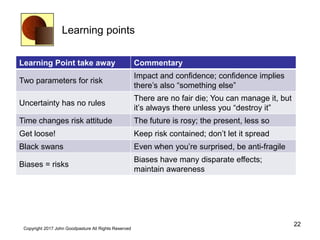

This document discusses key concepts in risk management. It defines risk as an event, outcome or circumstance with some degree of uncertainty. There are two parameters of risk - the potential impact and the likelihood or confidence of it occurring. While some risks have rules governing them, project risks have no rules so management must intervene. Various risk management strategies are outlined such as ignoring small risks, insuring against large risks, transferring risks, changing aspects to reduce risks, or directly addressing very large risks. The concepts of loose coupling, encapsulation, and top-down versus bottom-up understanding are also covered in relation to risk management.