The document outlines five rules for risk management:

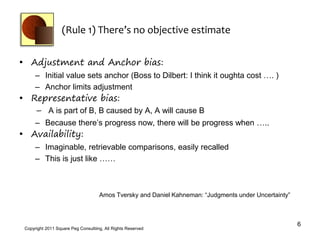

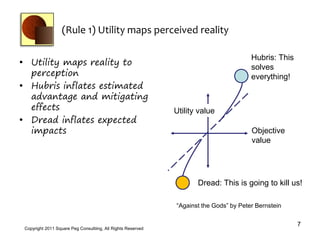

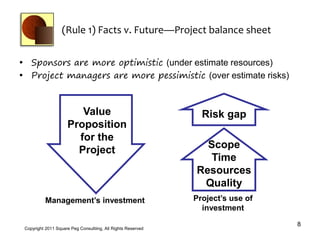

1) There are no objective estimates of the future due to cognitive biases like anchoring and availability. Facts are in the past while estimates rely on perception.

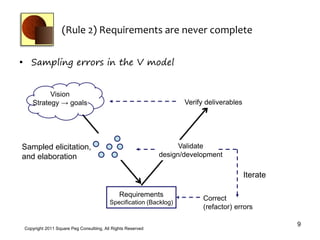

2) Requirements are never fully complete since it's impossible to imagine everything.

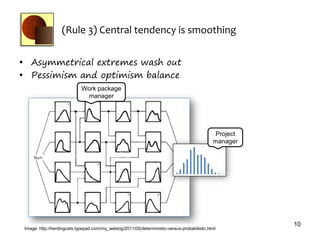

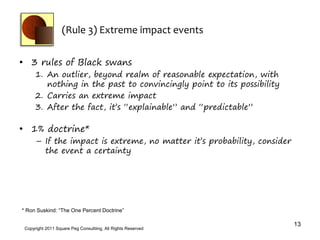

3) Central tendency smoothing washes out asymmetrical extremes, with pessimism and optimism balancing out.

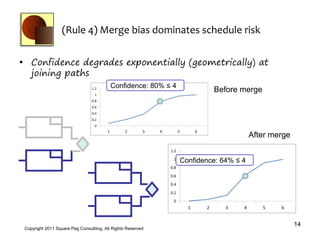

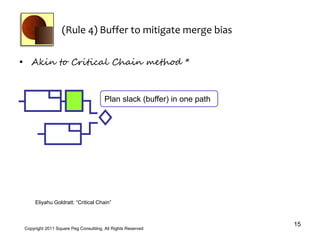

4) Confidence in schedules degrades exponentially after work streams merge due to merge bias.

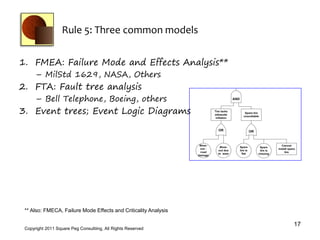

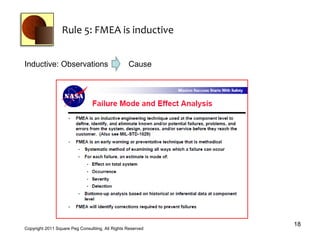

5) Probabilistic risk analysis models like FMEA are needed for systems with many interdependent parts, to understand behavior and failures.