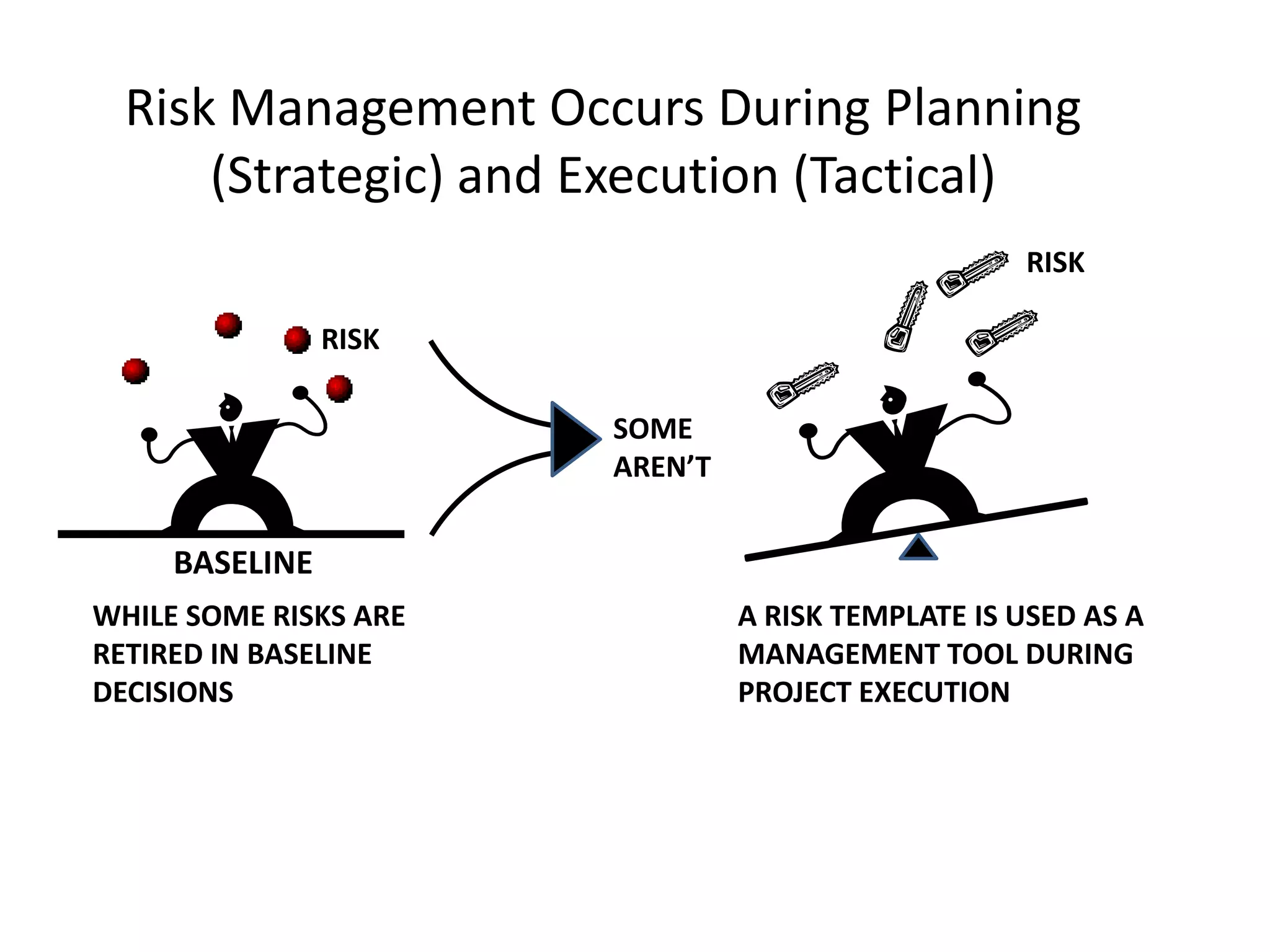

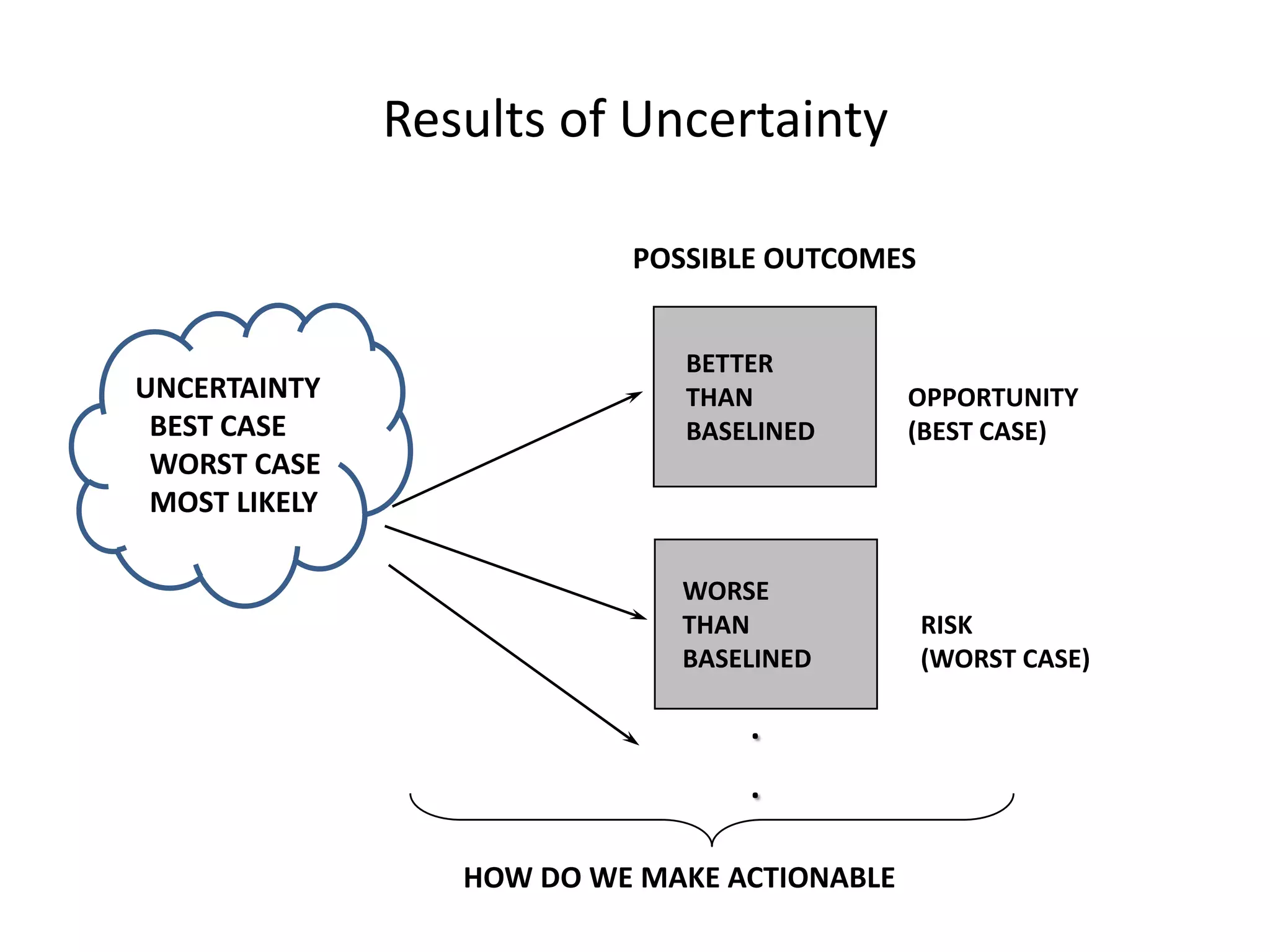

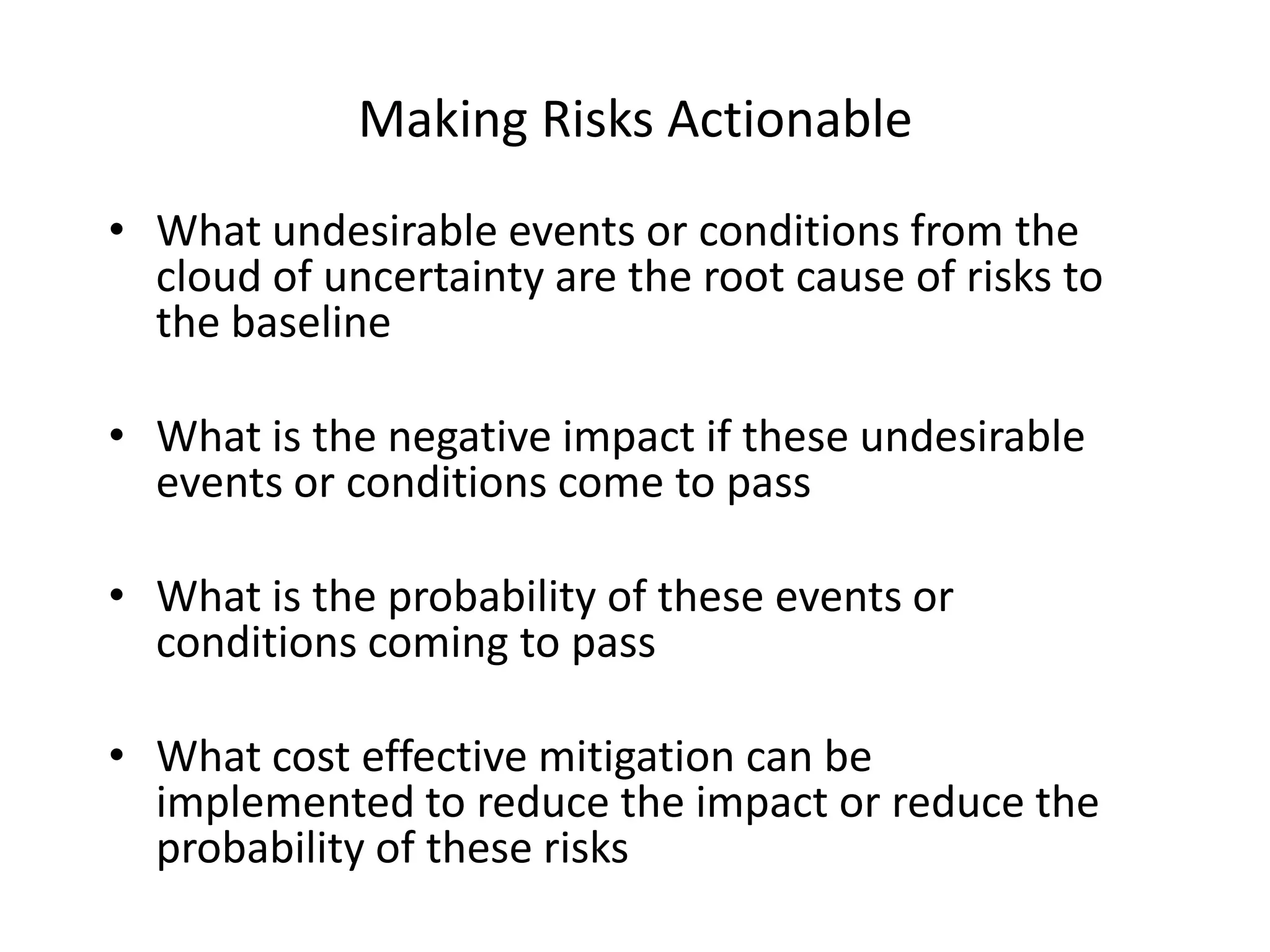

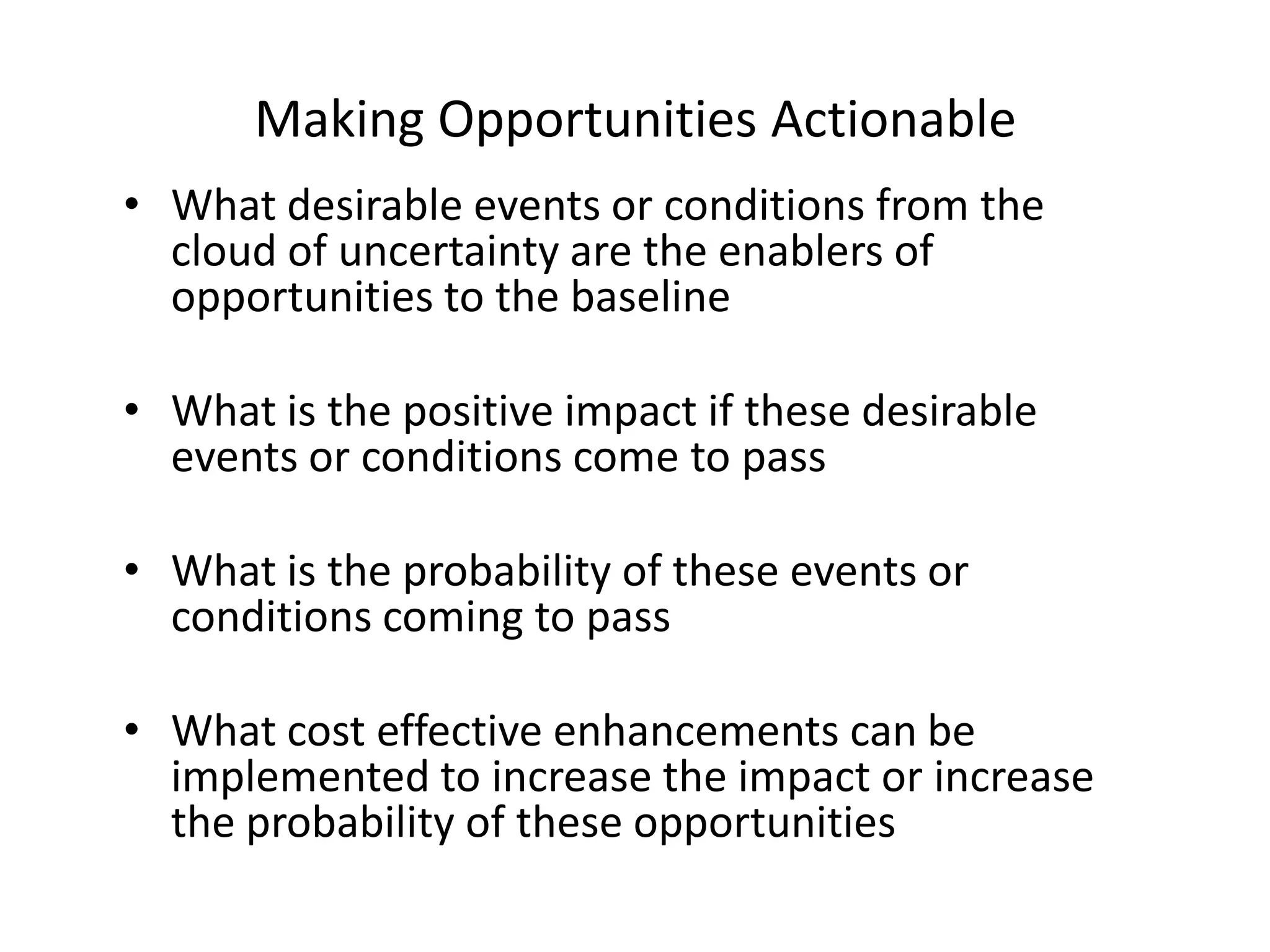

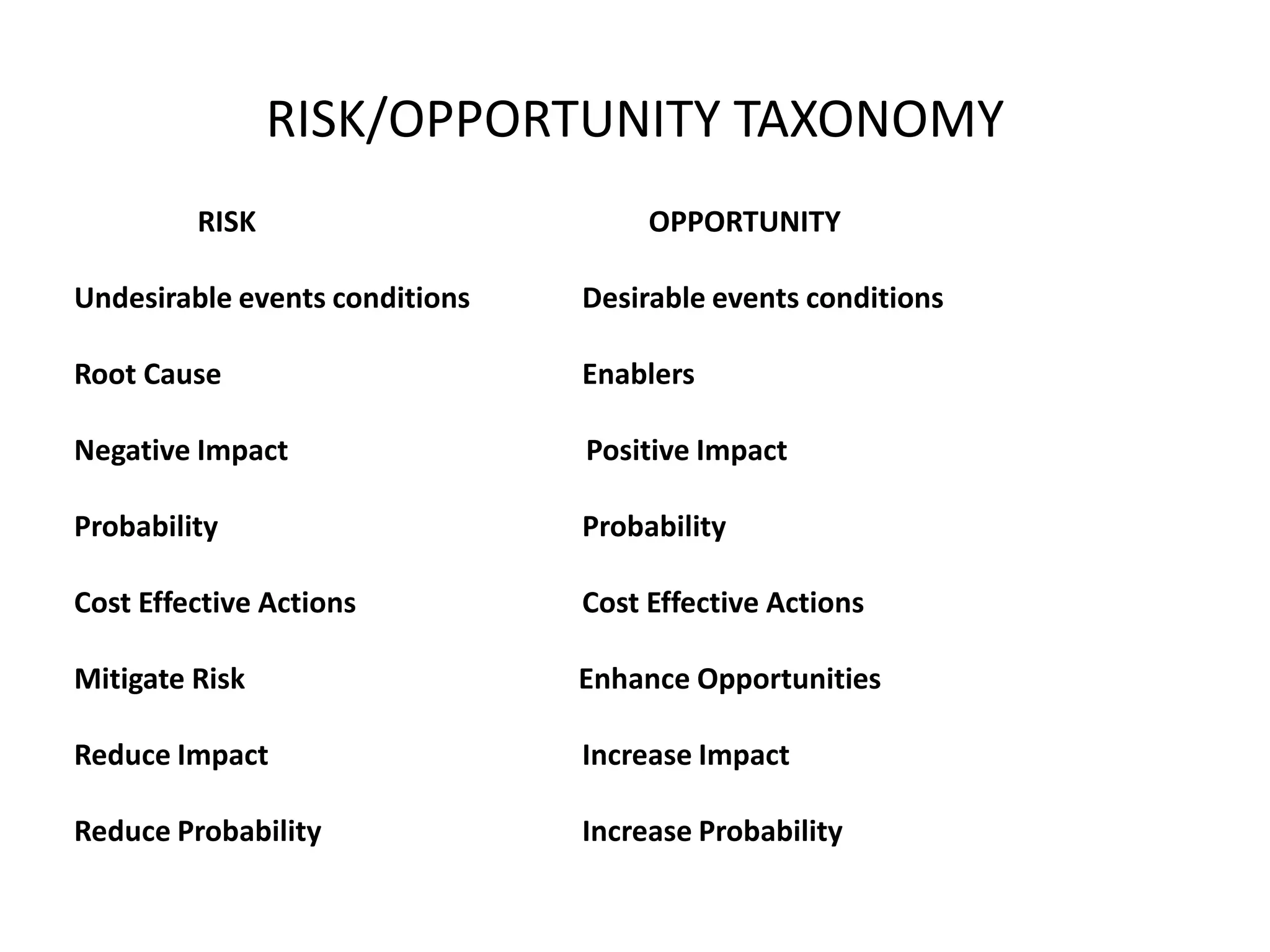

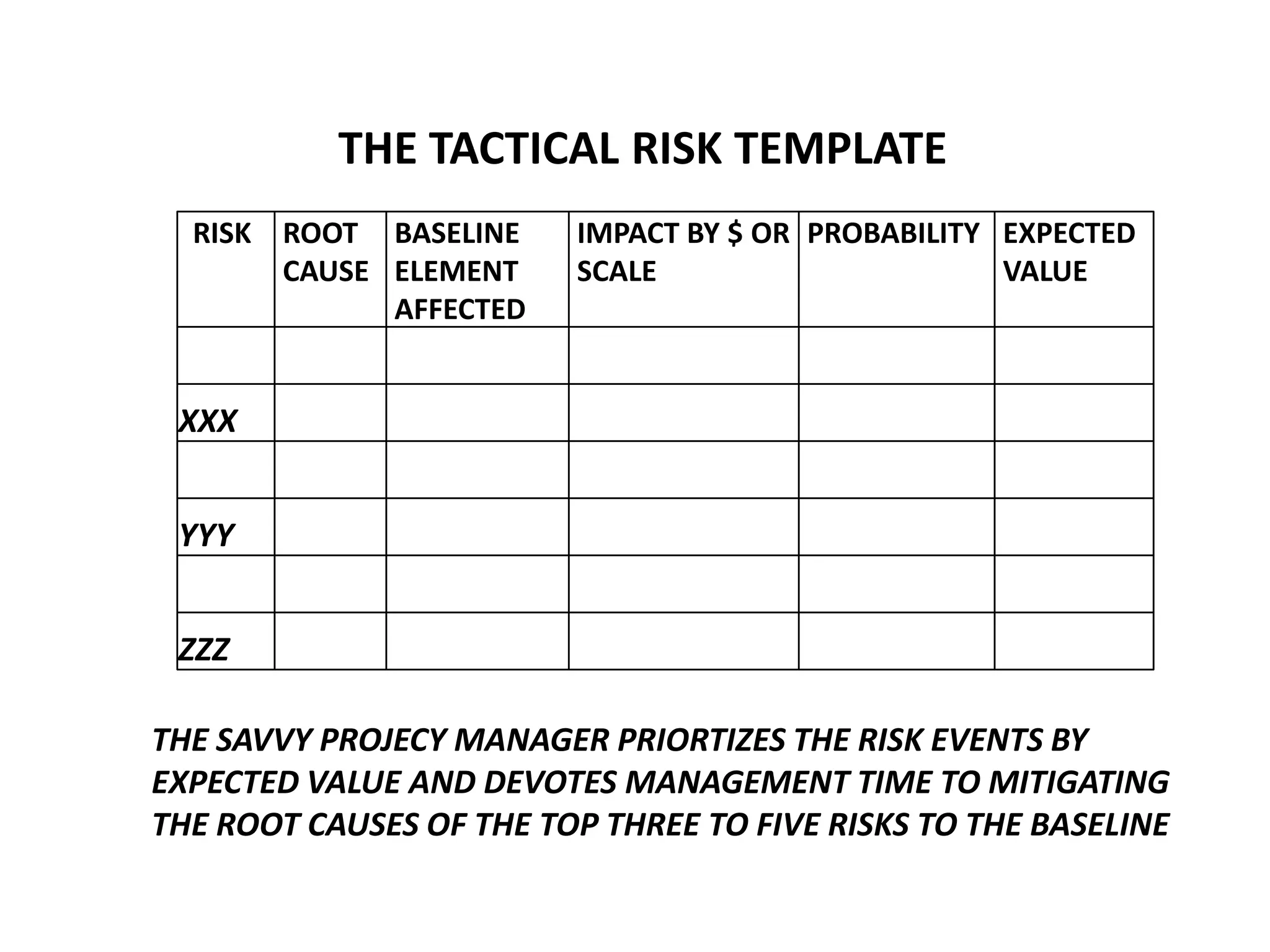

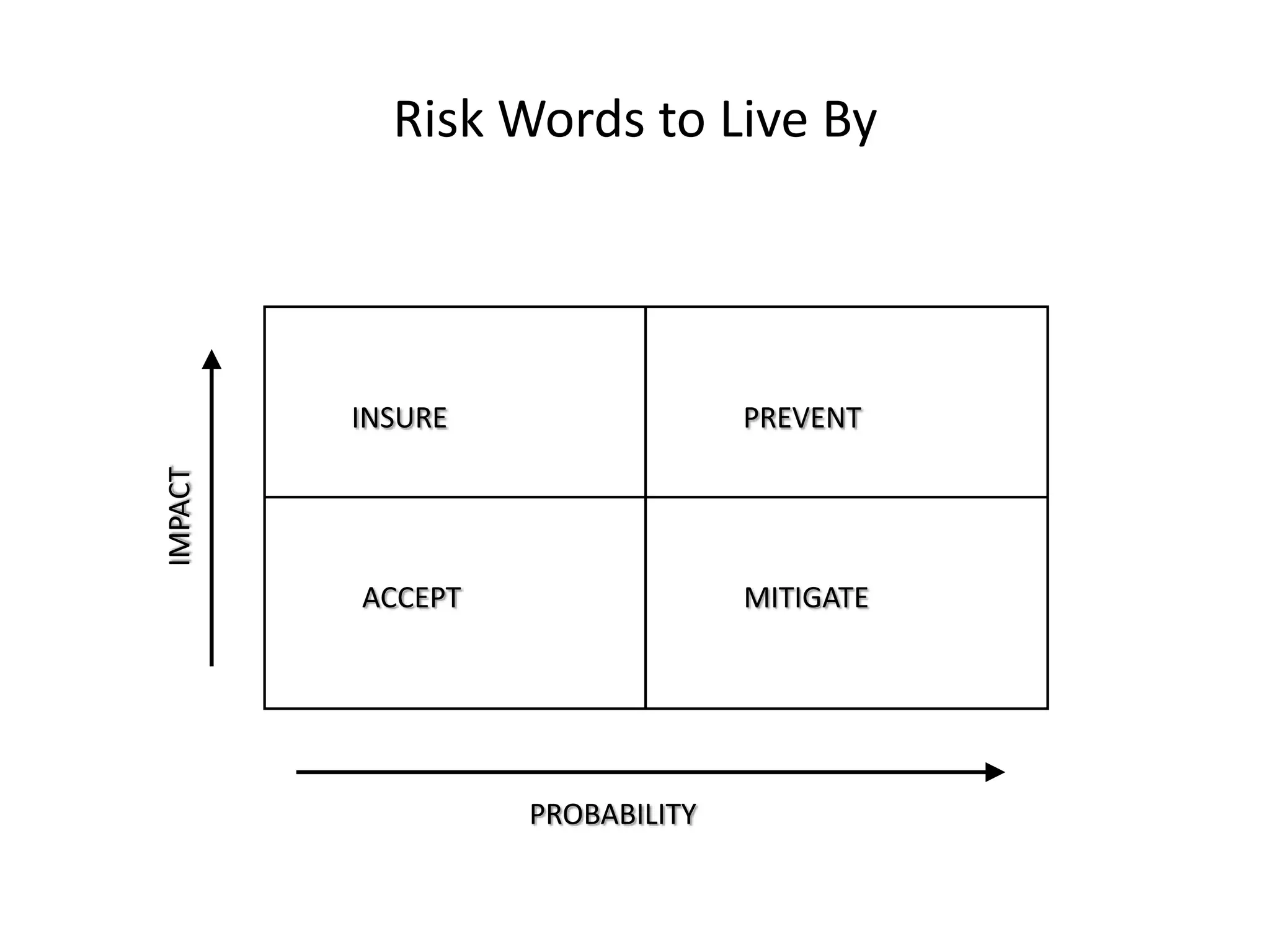

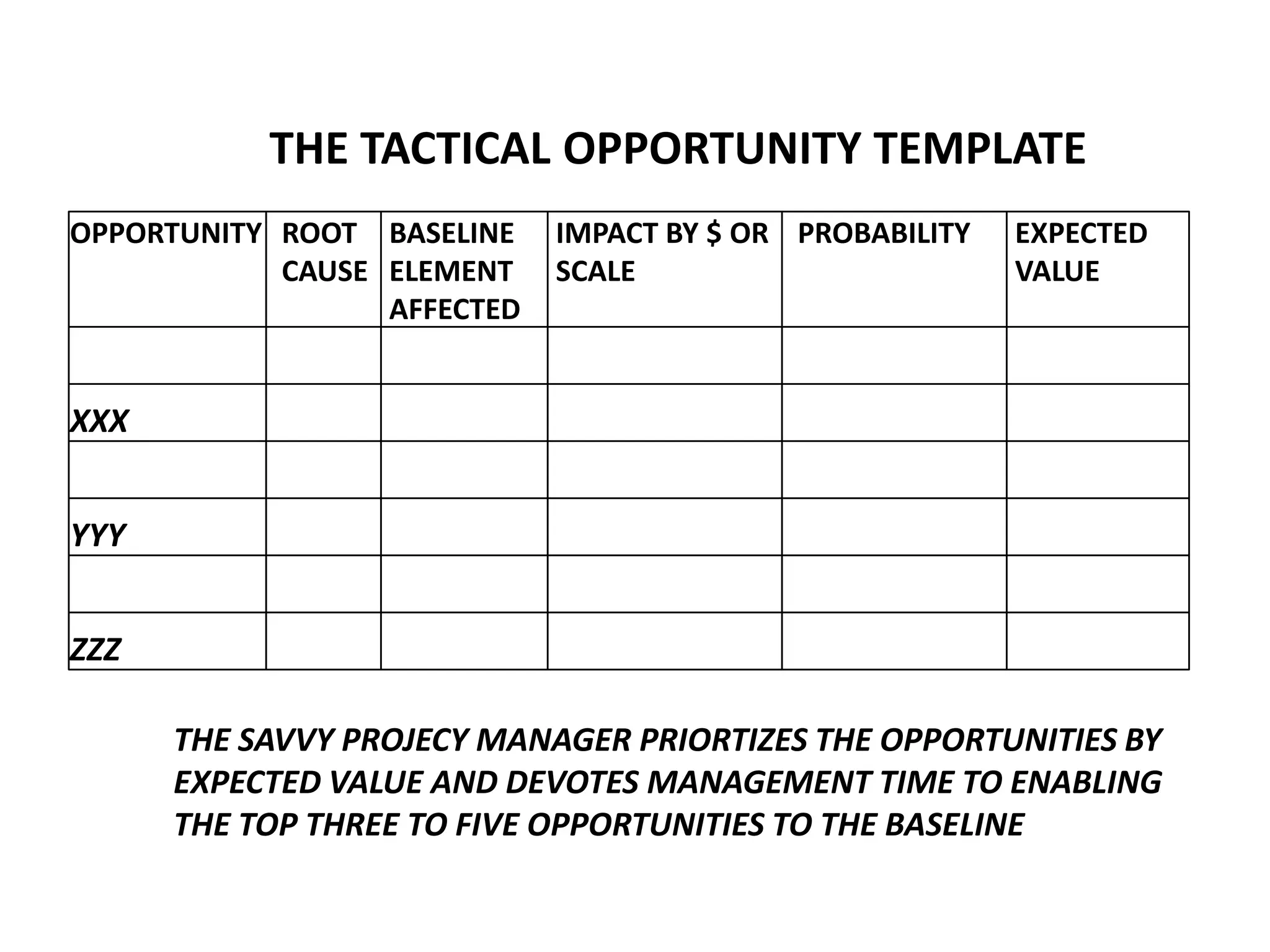

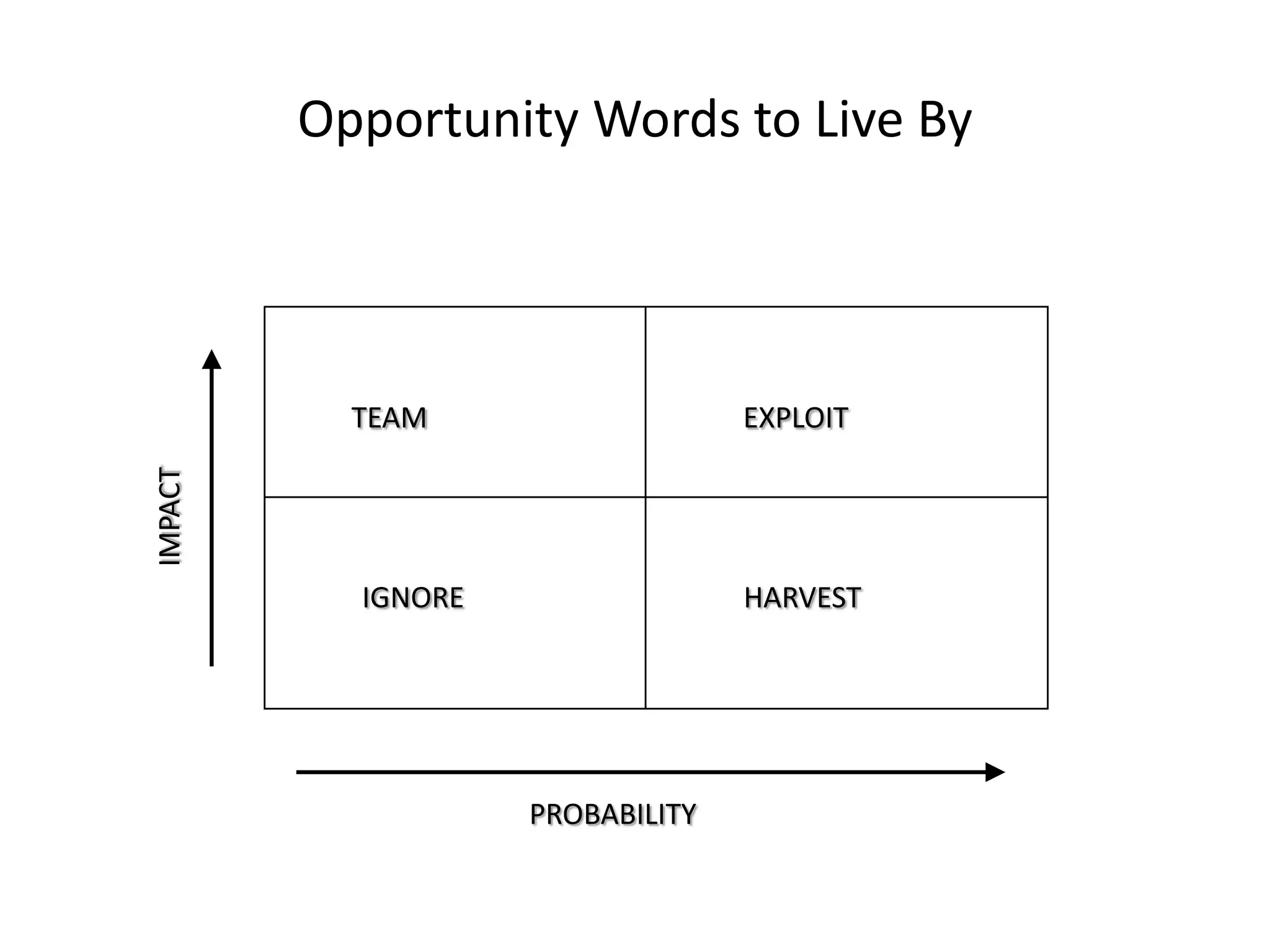

The document discusses risk management in project management. It argues that while humans cannot predict the future, project managers must commit to baselines to keep stakeholders happy. Risk management involves identifying risks strategically during planning and tactically during execution. Strategic risk management addresses marketplace forces using tools like SWOT analyses, while tactical risk management makes risks actionable by determining root causes, impacts, and mitigation strategies. The document provides templates for categorizing risks and opportunities to prioritize the top threats and enablers to the project baseline. Overall it presents a formal approach to risk management as a tool for project success.