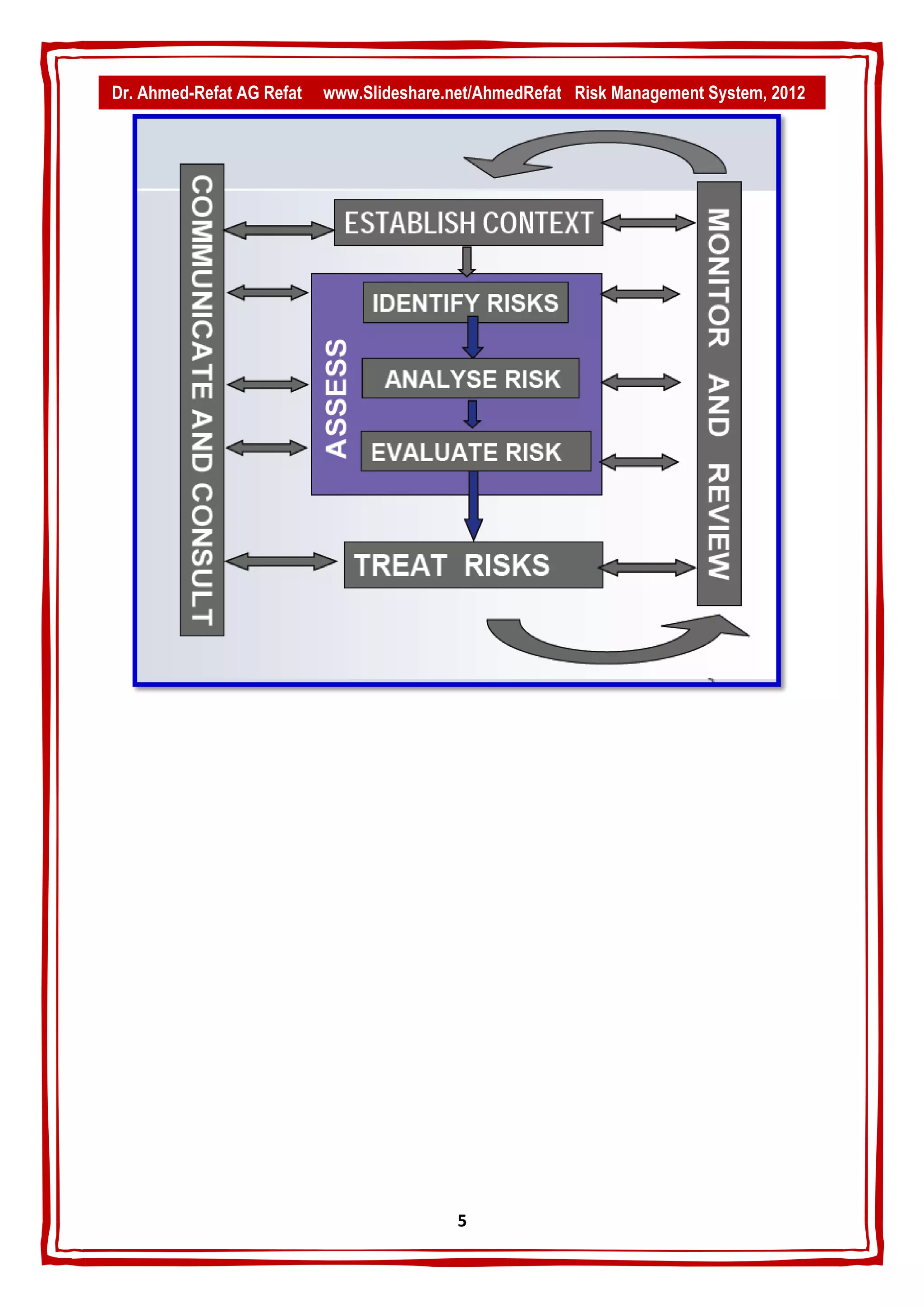

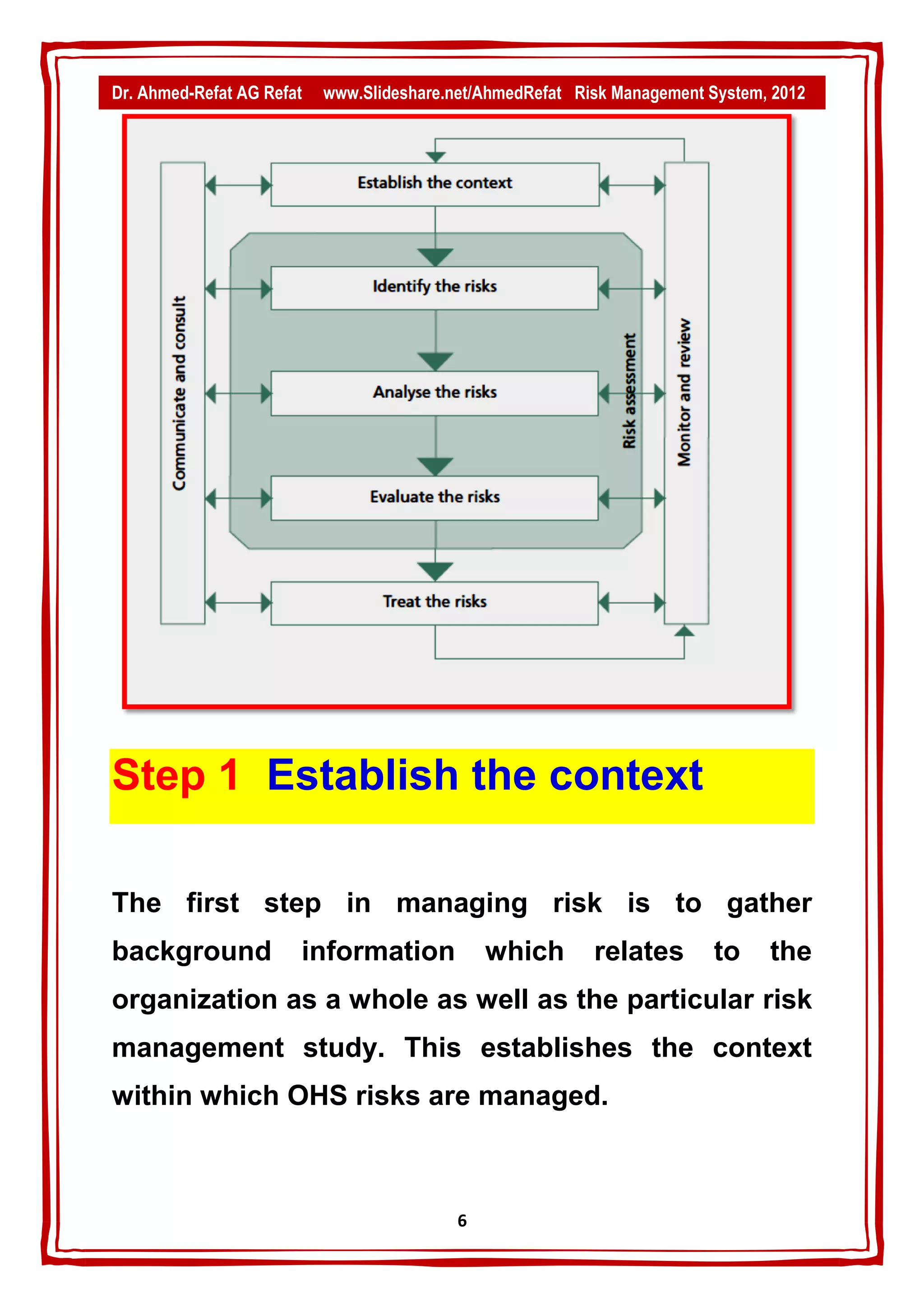

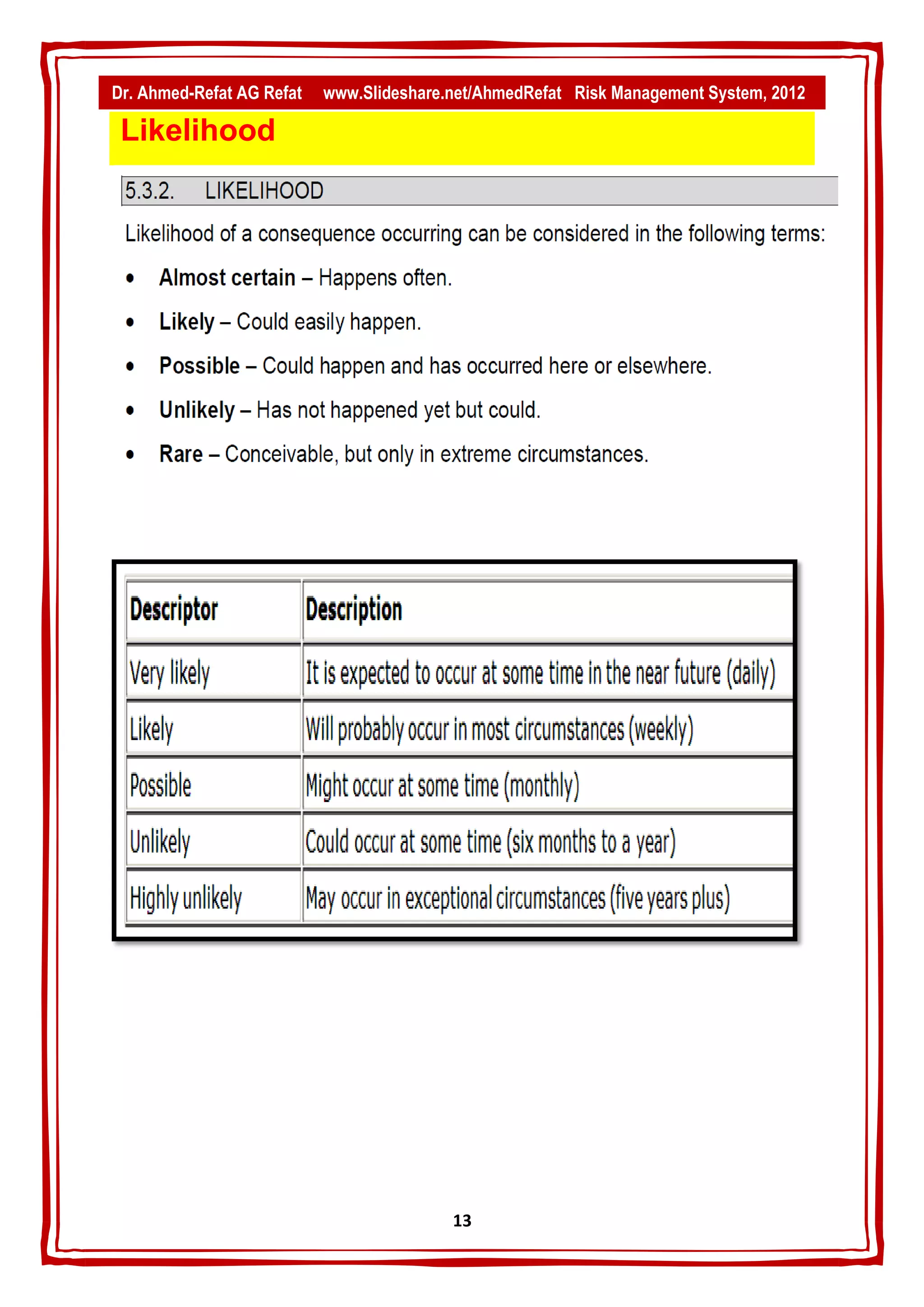

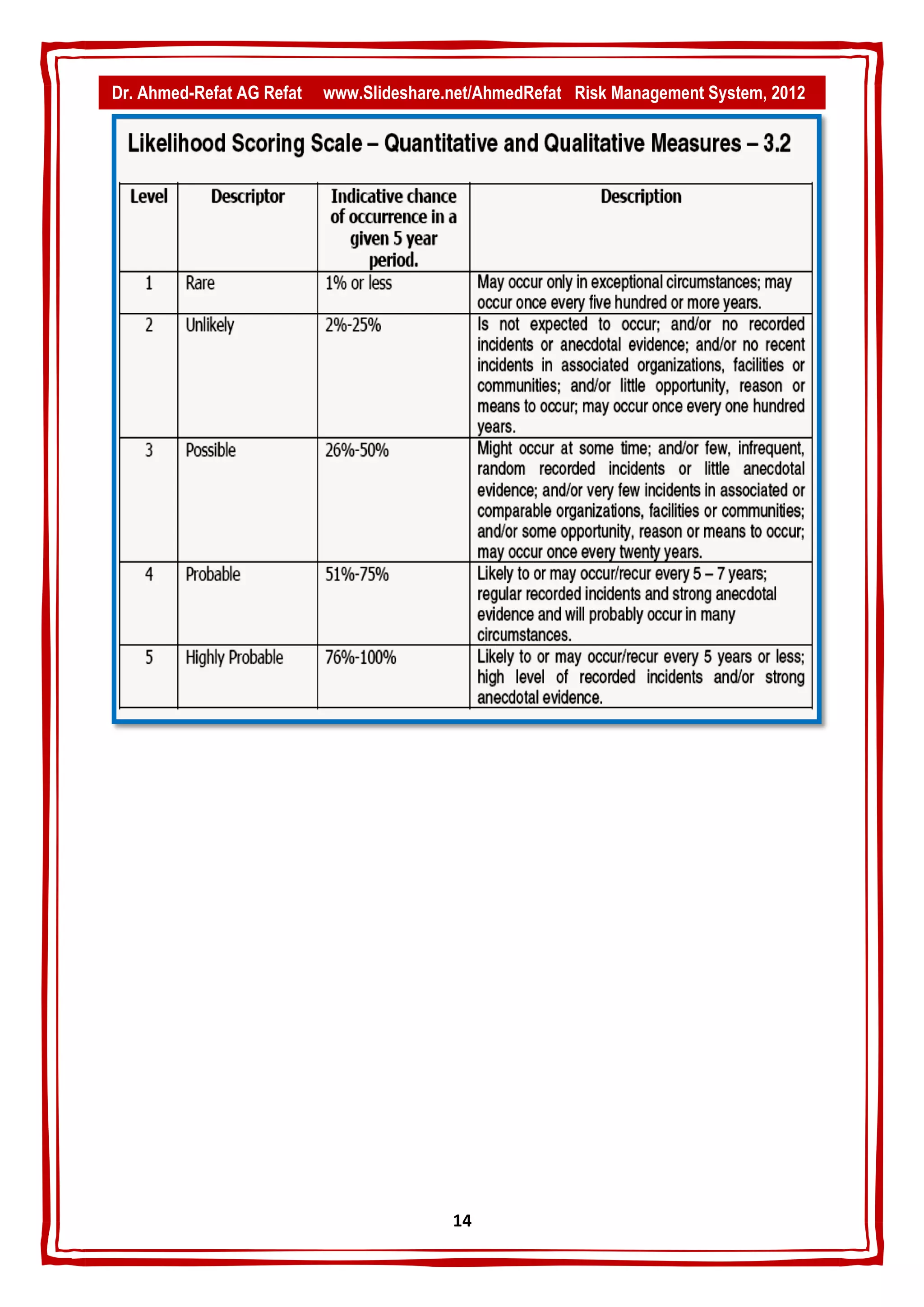

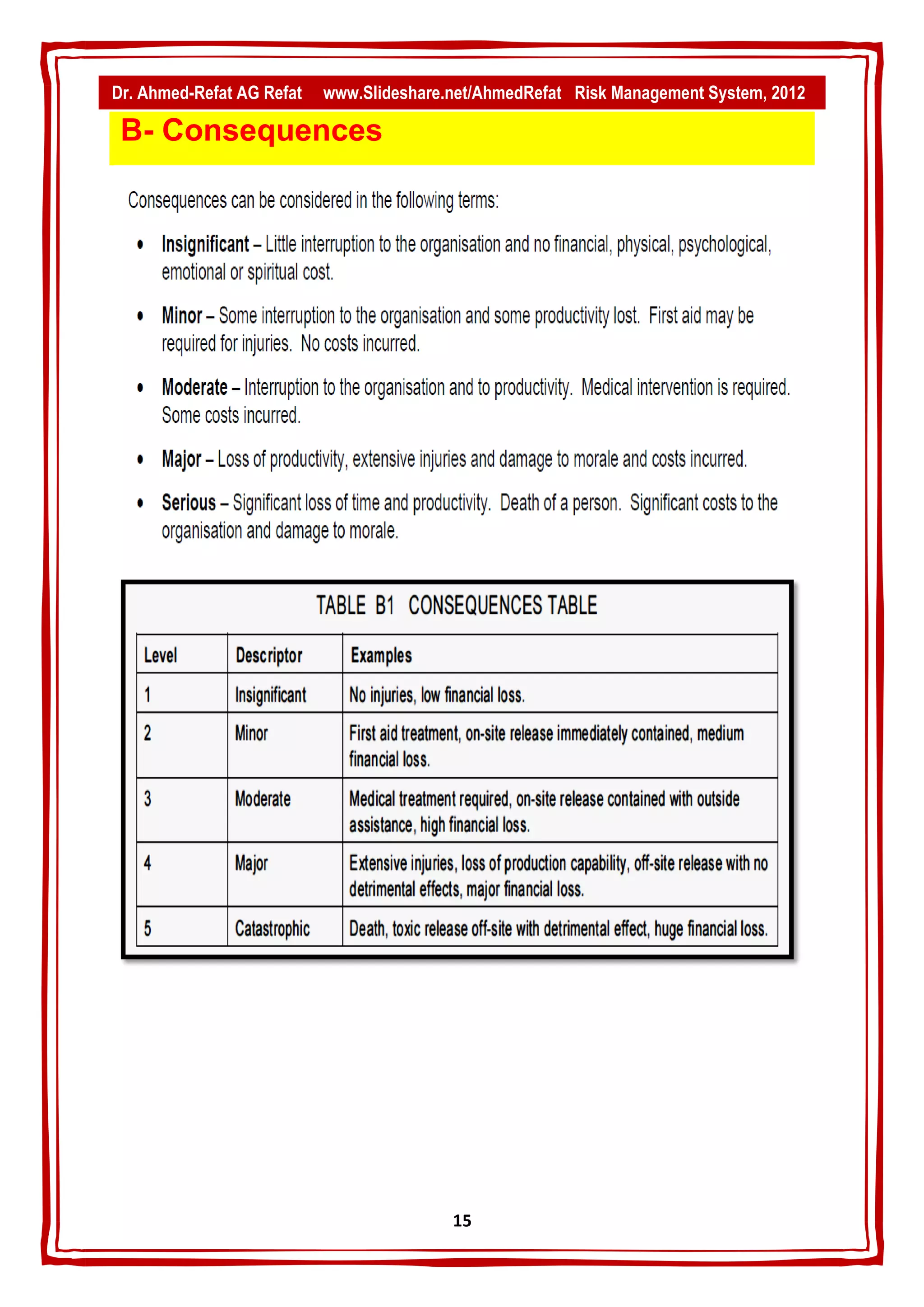

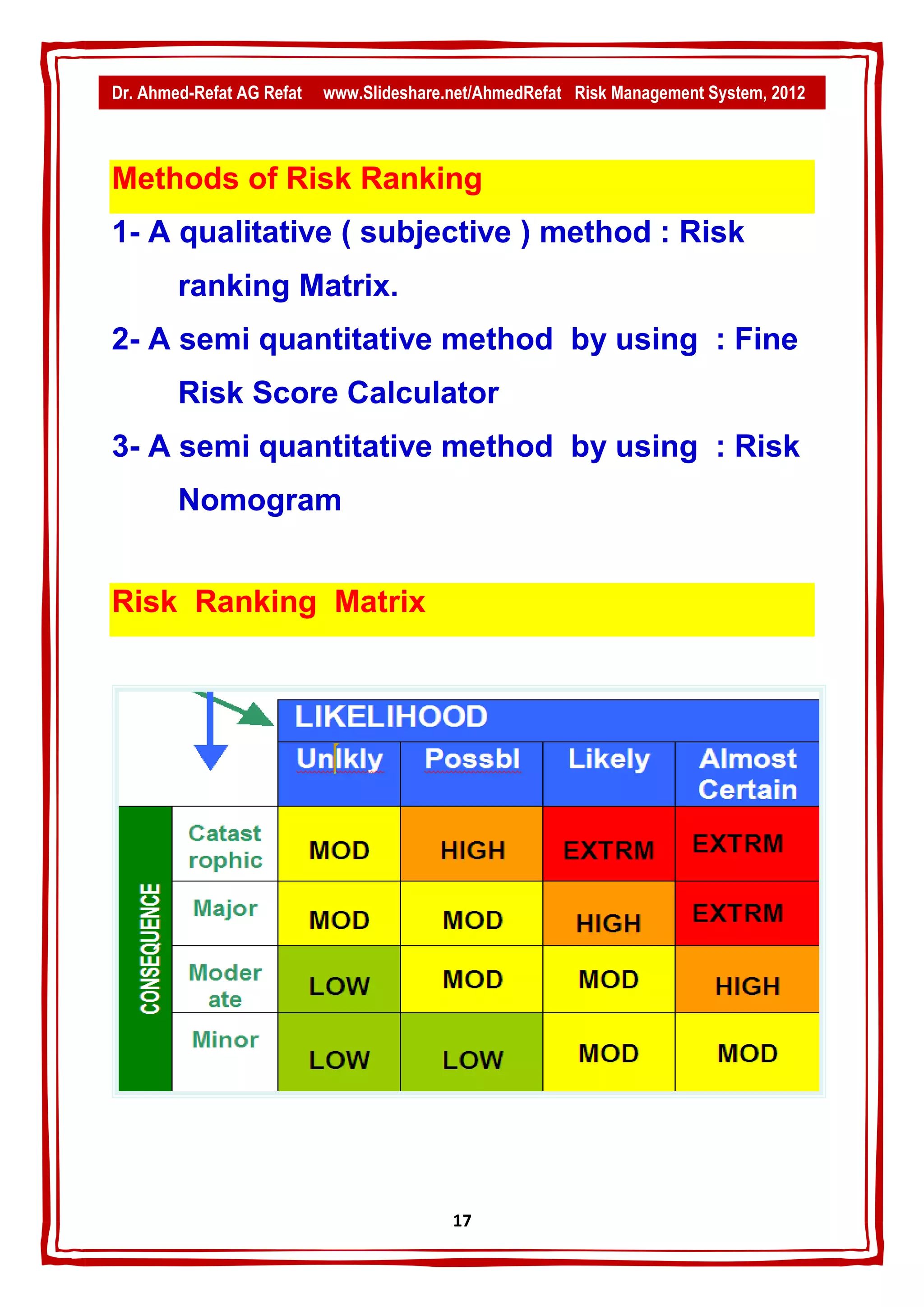

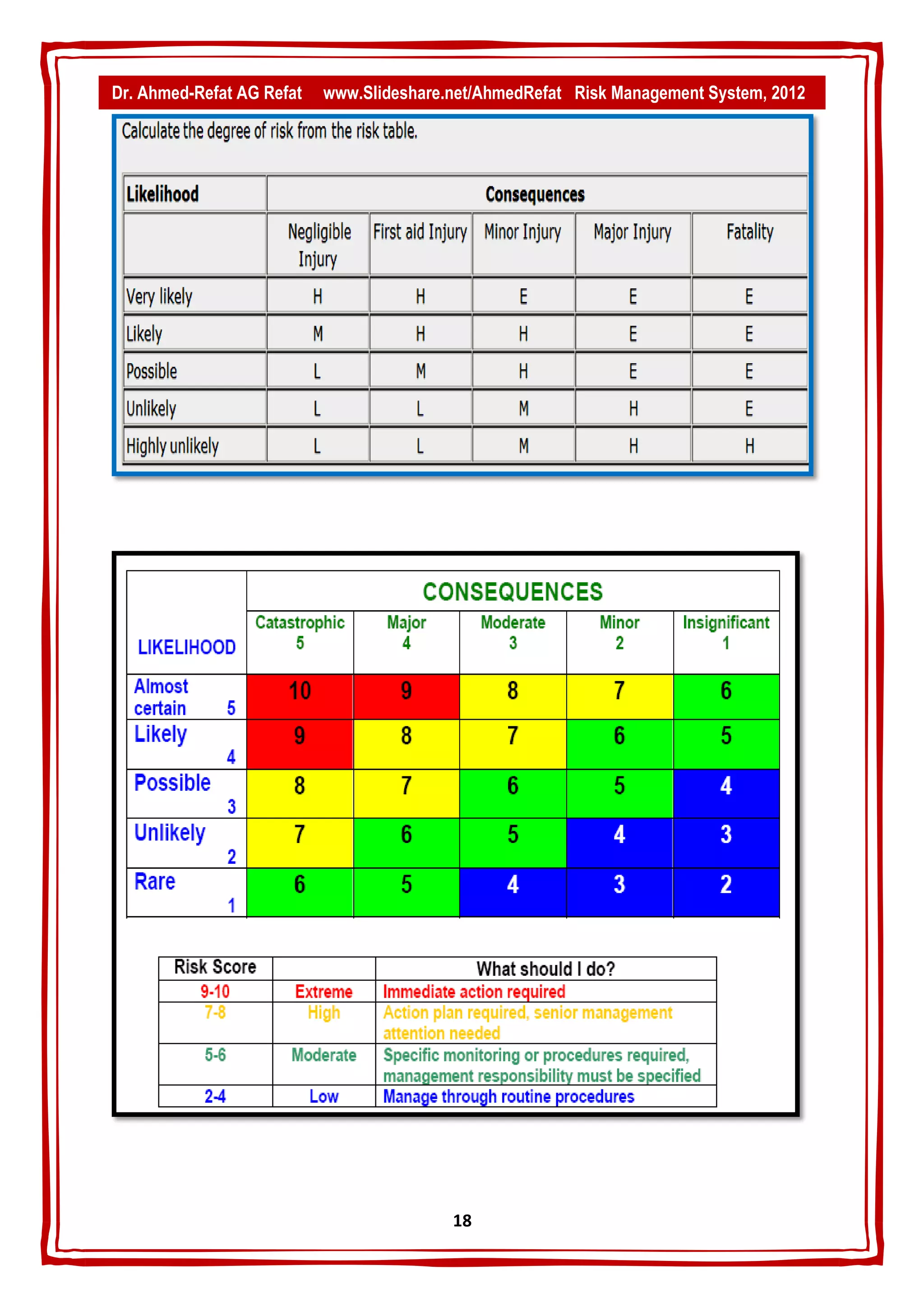

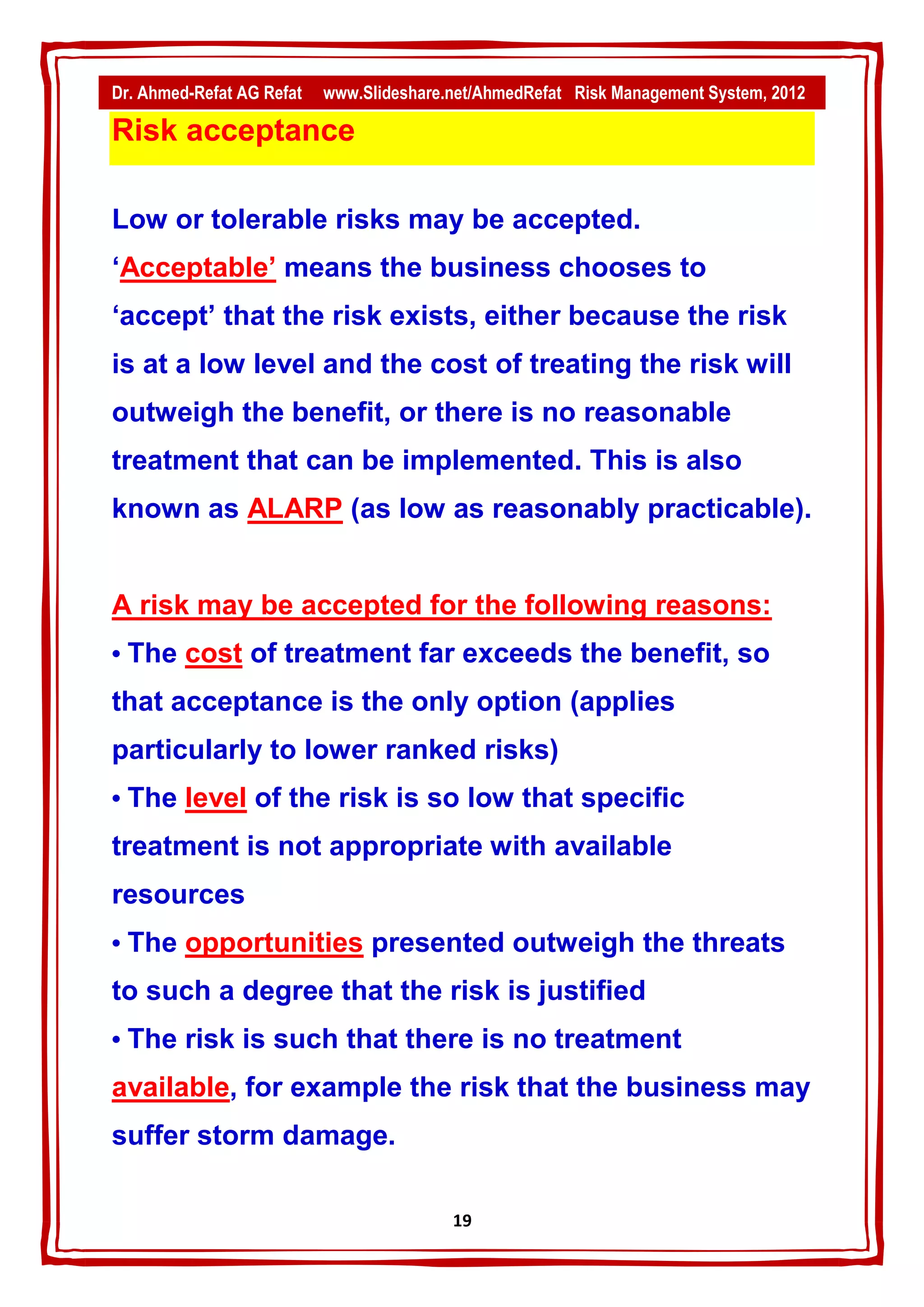

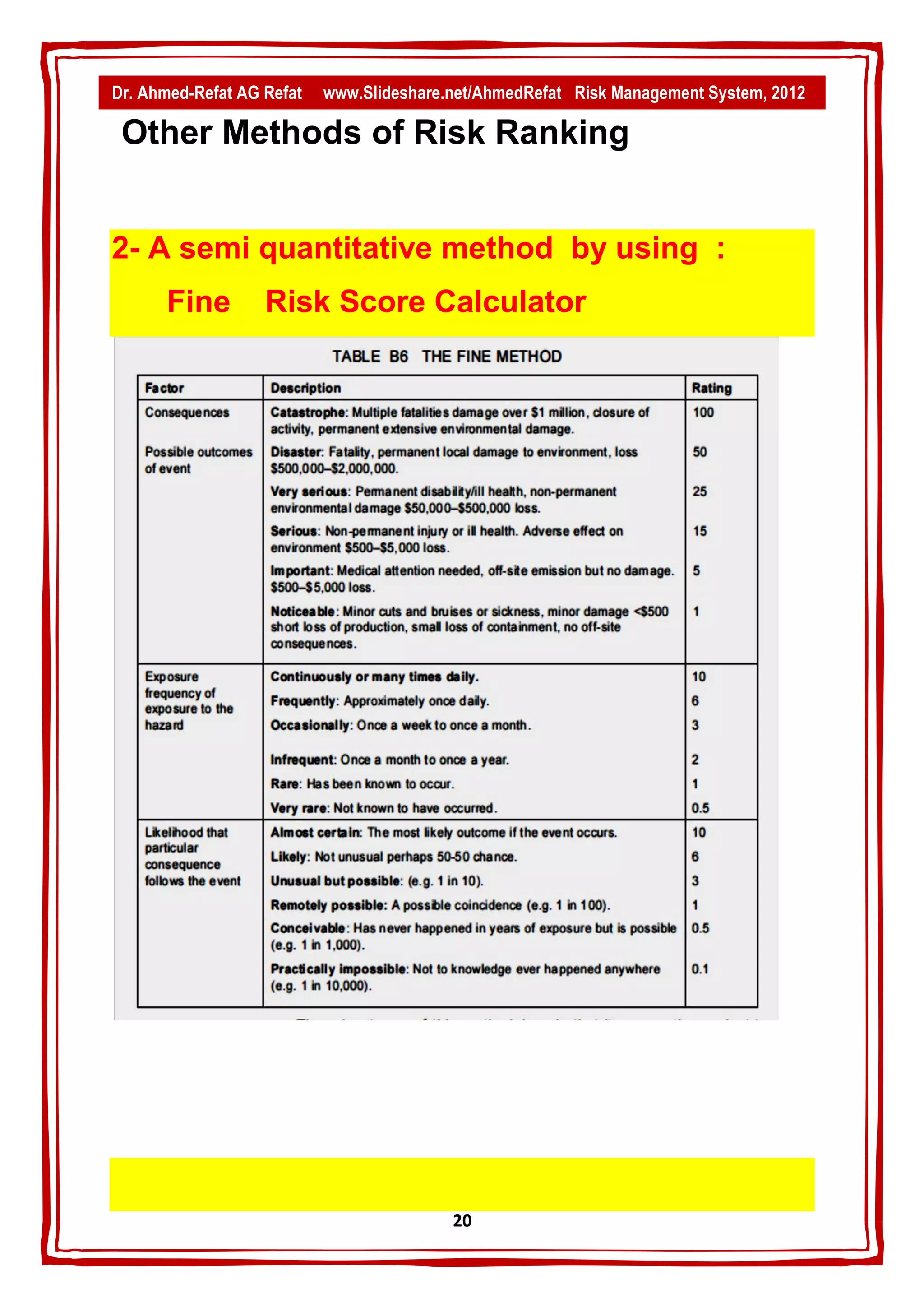

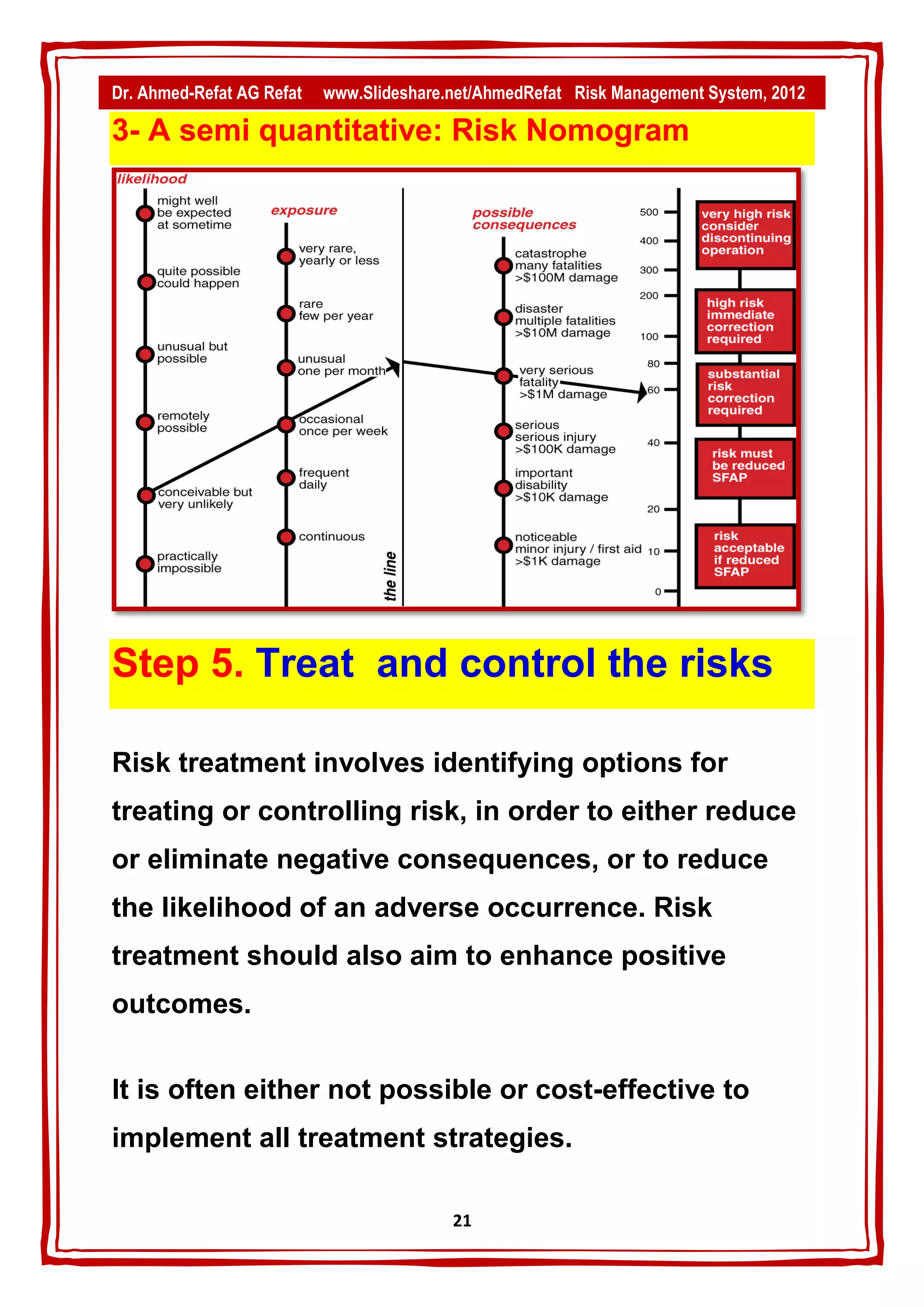

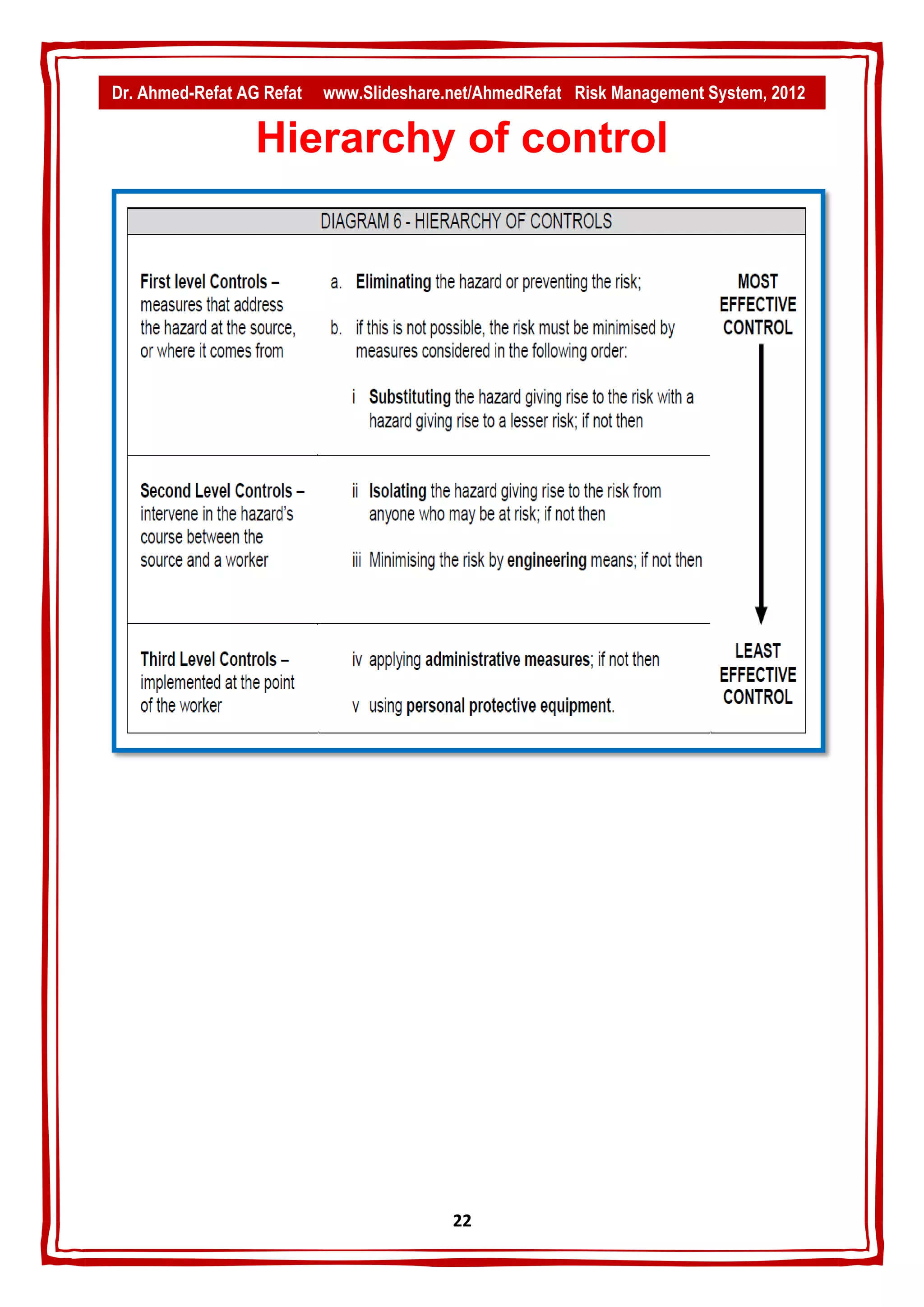

This document discusses risk management in occupational health settings. It defines key terms like hazard, risk, and risk management system. It describes the steps of a risk management process as establishing context, identifying hazards, analyzing risks, evaluating risks, treating risks, and reviewing risks. Various methods are presented for risk analysis, evaluation, and treatment, including risk matrices, risk score calculators, and risk nomograms. Control measures like elimination, substitution, engineering controls, administration controls, and personal protective equipment are also discussed.