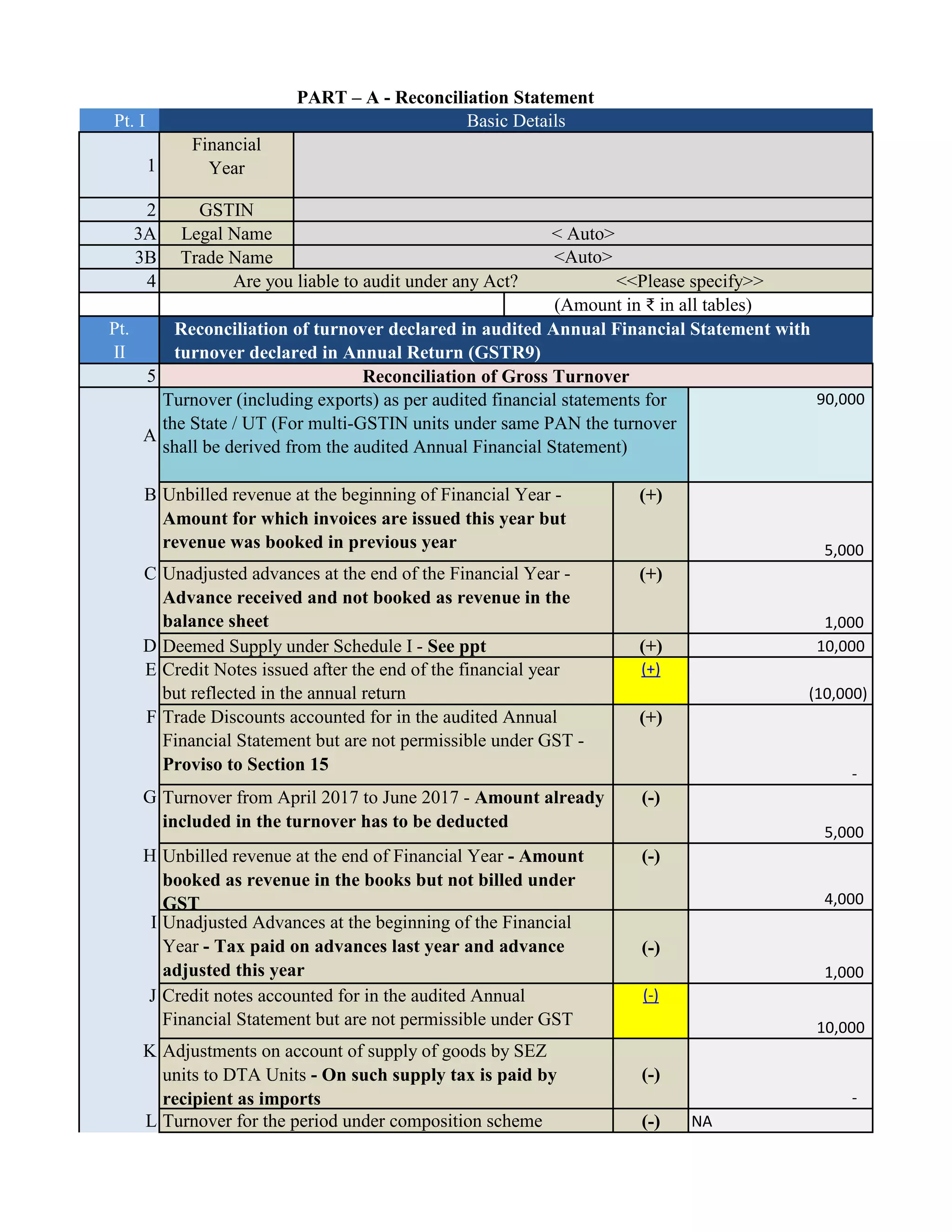

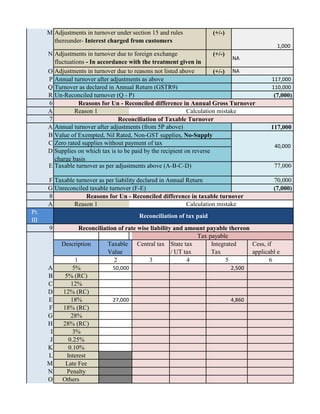

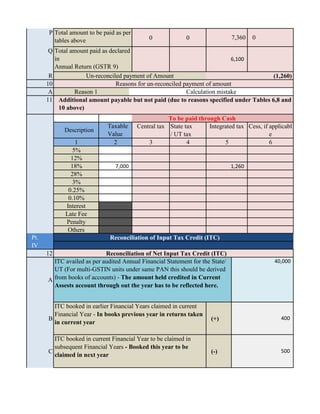

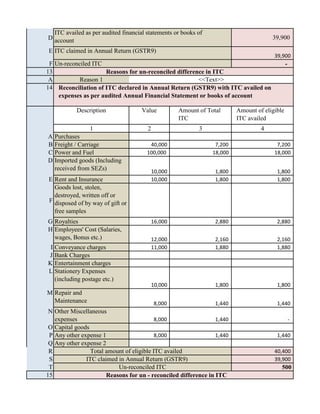

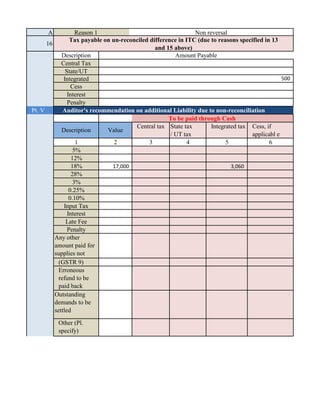

The document outlines a reconciliation statement for a financial year, detailing unbilled revenue, unadjusted advances, and reconciled turnover from various accounts. It provides a comprehensive breakdown of taxable turnover, input tax credit, and the differences due to adjustments that include calculation mistakes and unrecognized payments. Additionally, it discusses liabilities related to late fees, penalties, and recommendations for auditor's additional liabilities due to non-reconciliation.