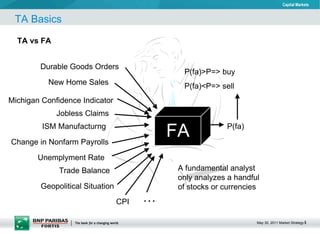

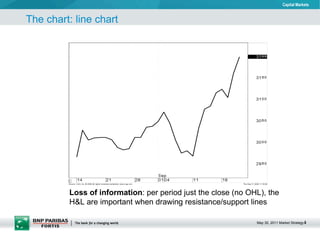

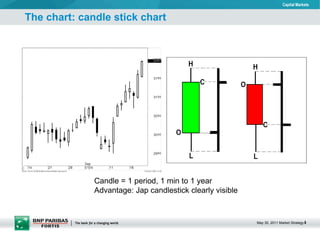

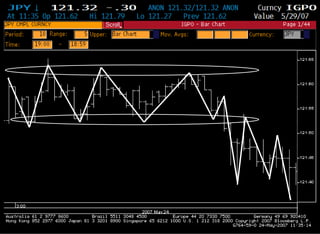

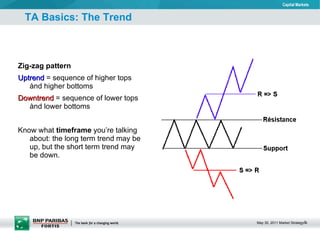

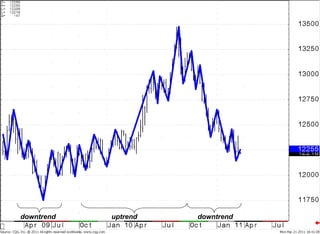

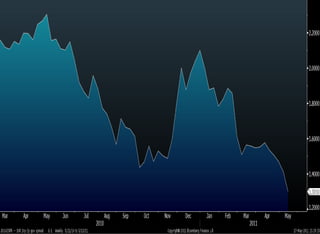

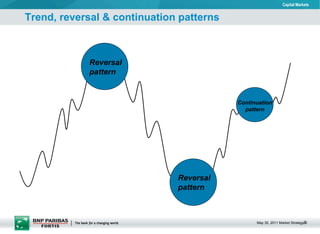

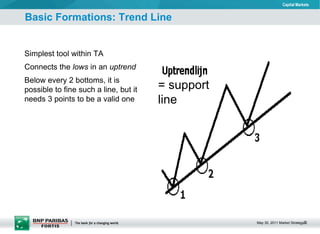

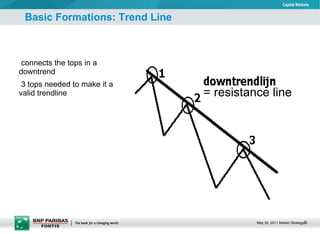

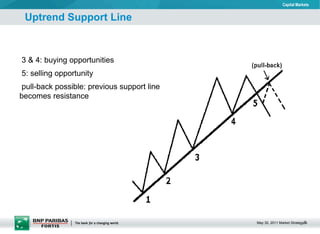

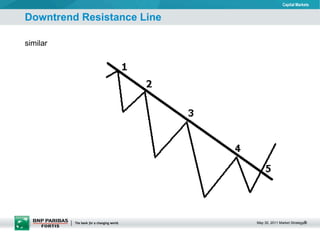

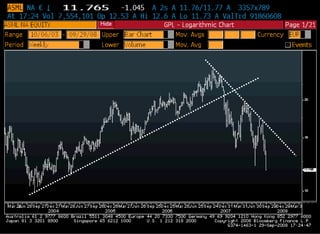

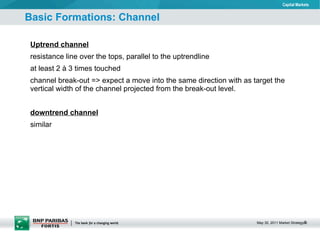

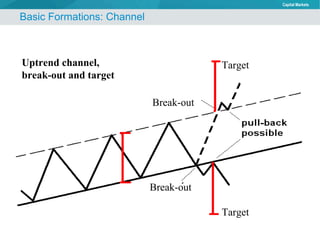

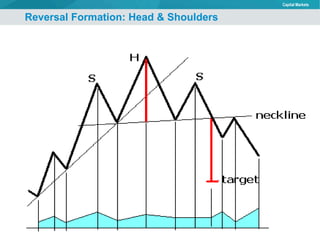

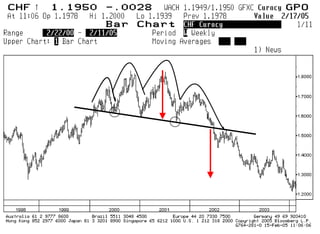

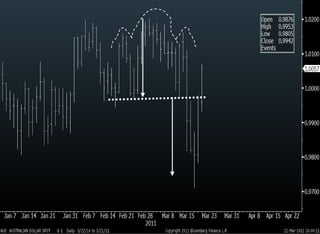

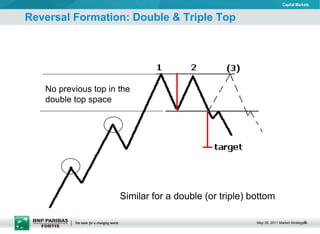

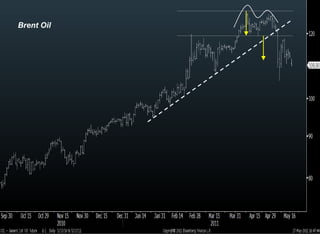

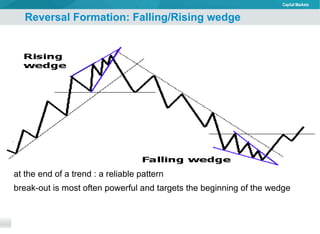

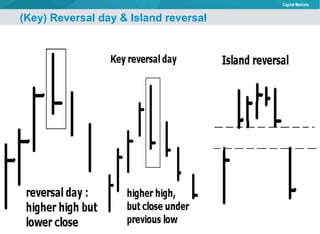

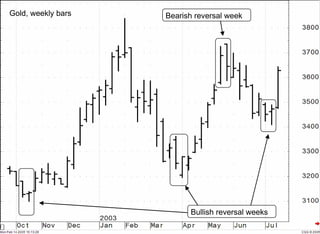

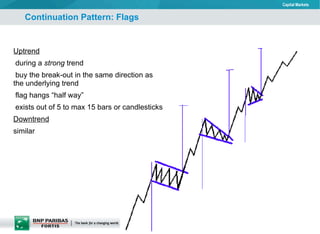

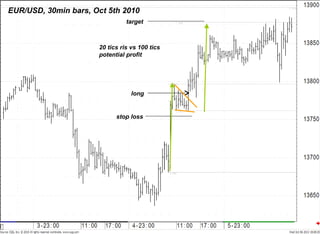

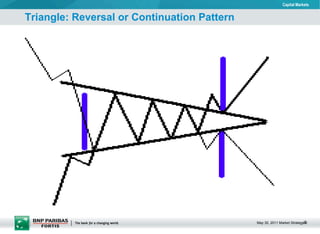

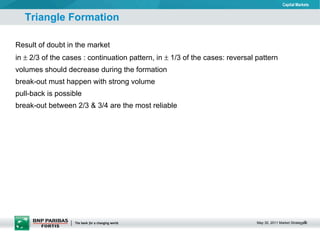

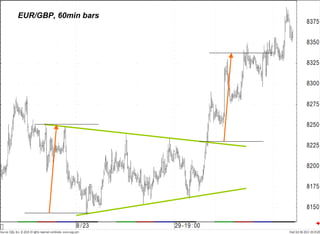

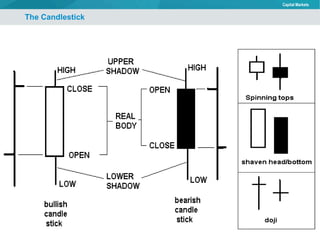

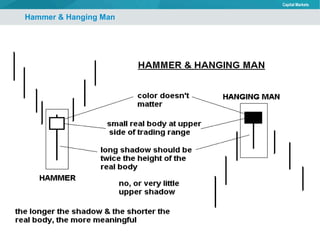

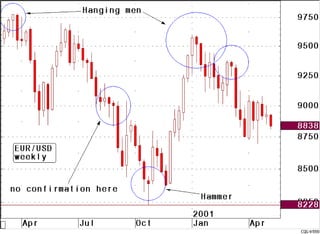

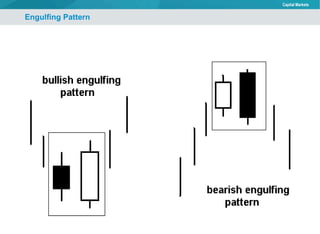

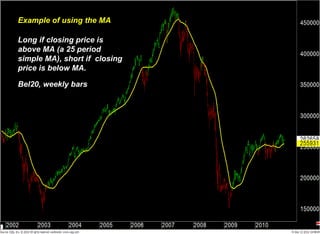

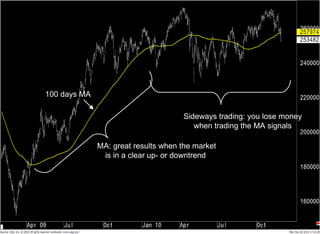

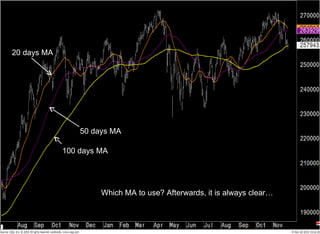

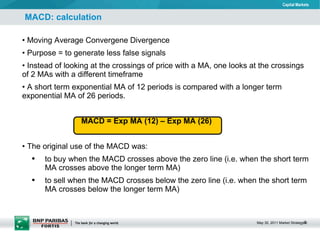

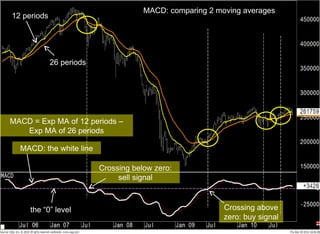

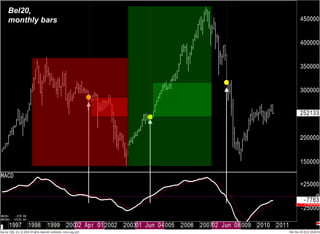

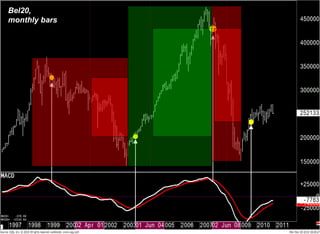

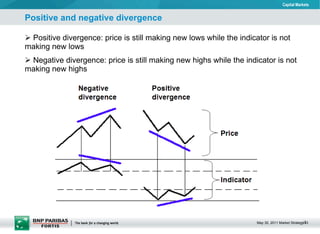

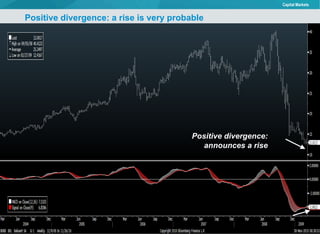

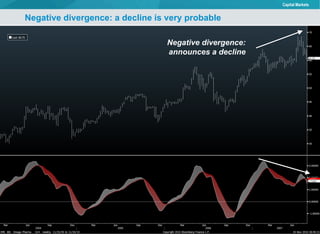

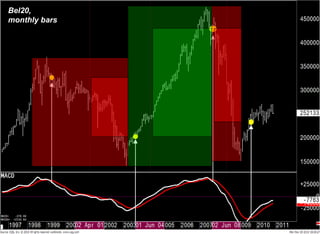

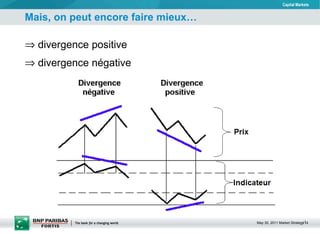

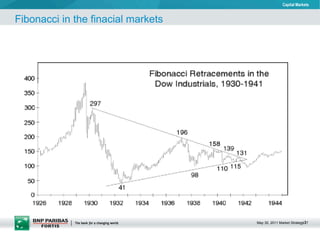

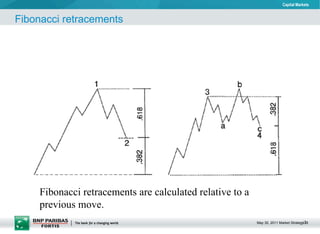

The document provides an introduction to technical analysis (TA), covering some of its basic concepts and techniques. It discusses TA basics like price charts and trends. It then explains common basic formations like trend lines, channels, and reversal patterns. The document also introduces Japanese candlestick patterns and popular technical indicators like moving averages and the MACD. It emphasizes that TA analyzes past price and volume data to identify patterns that may forecast future price movements.