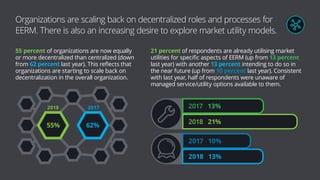

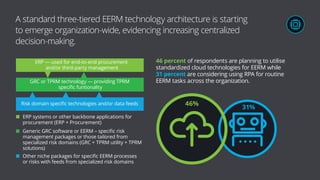

The 2018 Global Survey on Extended Enterprise Risk Management highlights a renewed focus on enhancing risk maturity, particularly concerning third-party dependencies, although progress remains slow. Key findings include that 55% of organizations have seen an increase in inherent risks and that 48% are investing in eerm for cost reduction, while decentralization in eerm roles is decreasing. Furthermore, accountability for eerm is largely established in the c-suite, with concerns around skill and clarity in roles being prominent among organizations.