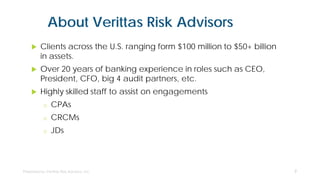

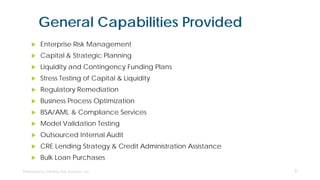

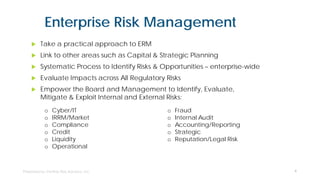

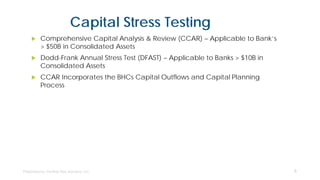

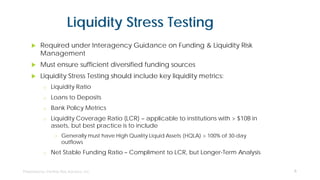

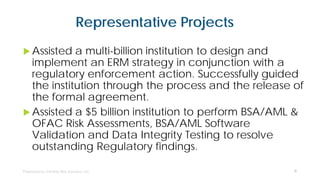

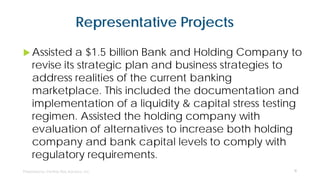

Verittas Risk Advisors offers enterprise risk management and a range of consulting services to clients with assets between $100 million and over $50 billion, leveraging over 20 years of banking expertise. Their capabilities include capital planning, liquidity management, compliance services, and stress testing, with a focus on practical risk identification and mitigation. The firm has successfully aided numerous institutions in regulatory compliance and strategic planning to navigate the complexities of the banking environment.