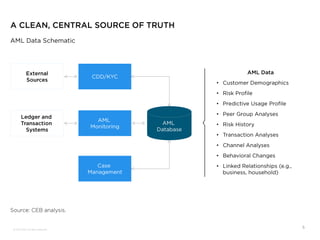

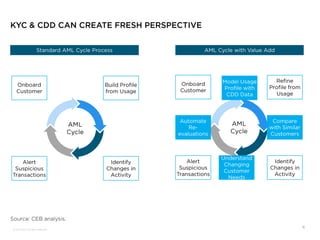

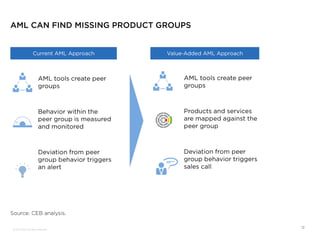

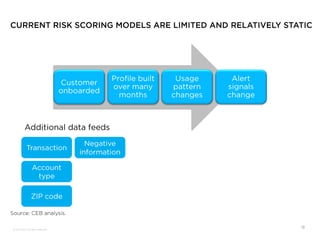

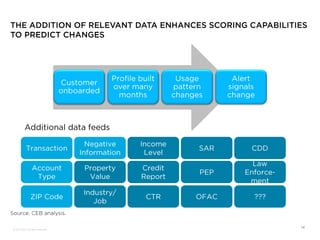

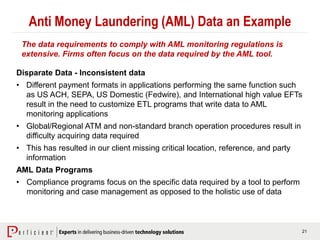

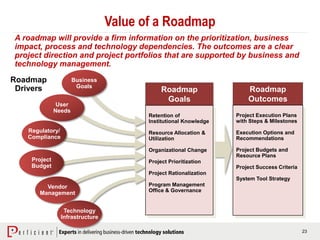

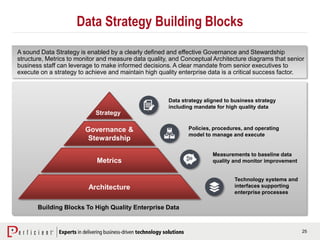

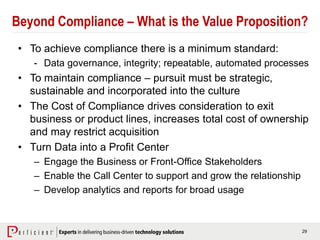

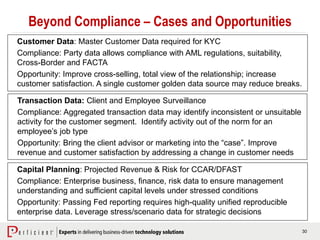

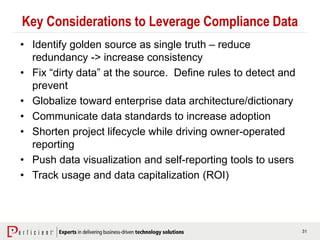

The document discusses how financial institutions can turn regulatory compliance data into opportunities for competitive advantage. It provides examples of how anti-money laundering (AML) and customer data used for compliance can also power initiatives like cross-selling, improving the customer experience, and strategic capital planning. The document recommends a balanced approach between meeting regulatory requirements and building a flexible data architecture that allows data to be reused across business units.