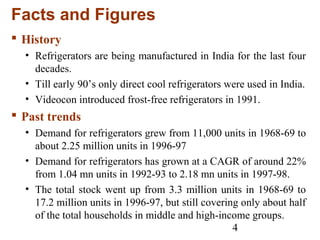

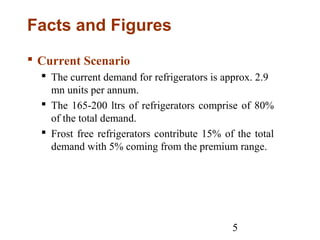

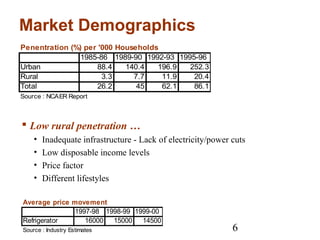

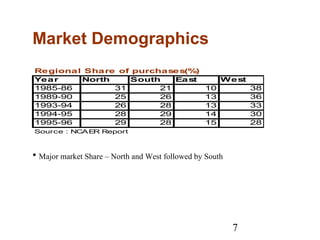

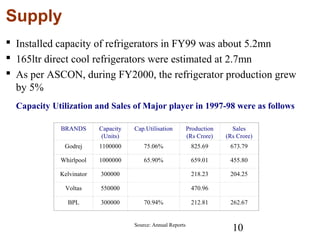

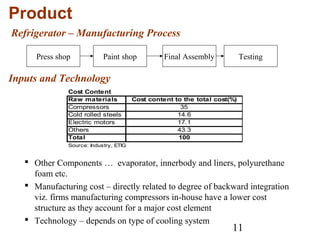

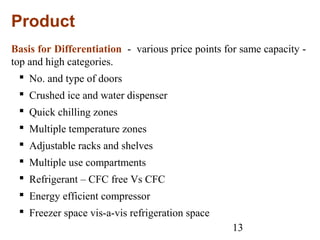

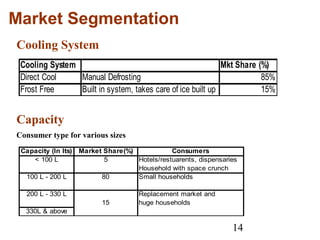

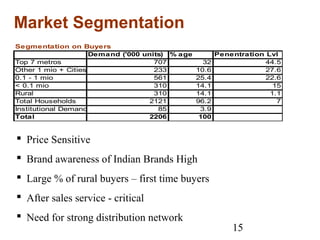

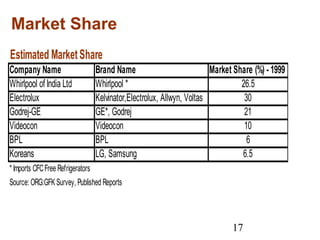

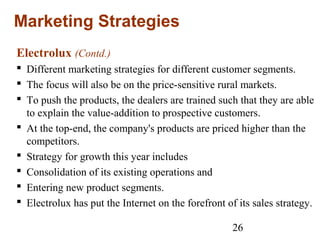

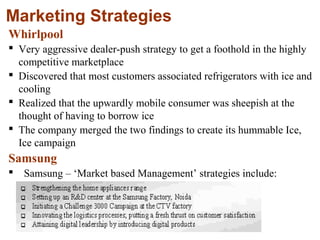

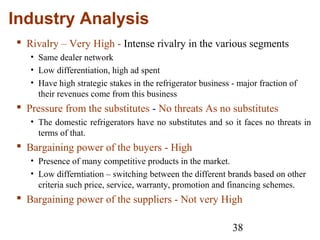

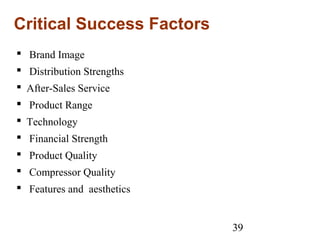

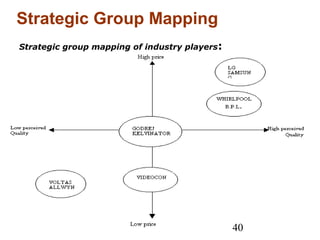

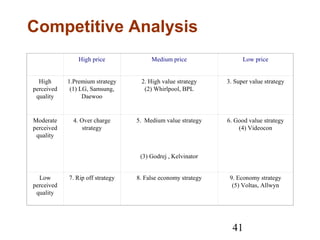

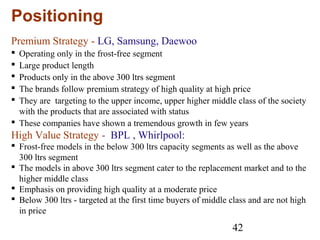

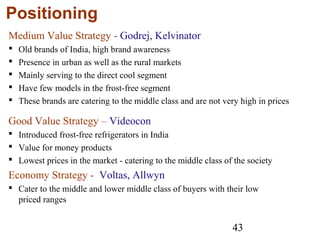

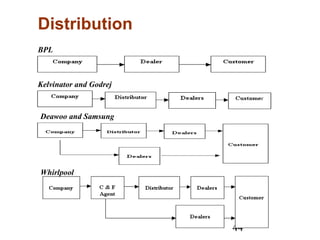

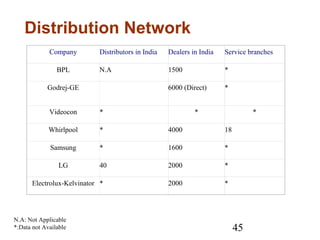

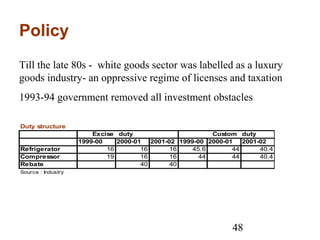

The document provides an overview of the refrigerator market in India. It discusses key facts and figures on demand trends, market segmentation, major players and their market shares. Godrej, Whirlpool, and Videocon are some of the major players with a combined market share of over 50%. The document also analyzes factors influencing demand, marketing strategies of companies, pricing trends and critical success factors in the industry like economies of scale, product differentiation and access to distribution channels.