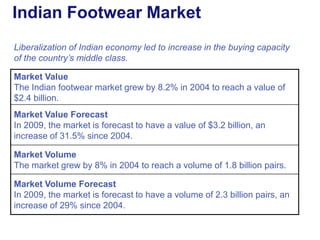

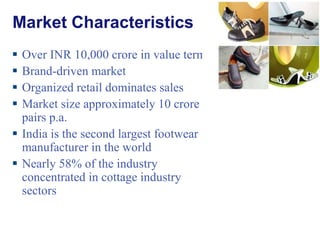

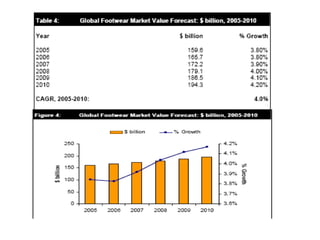

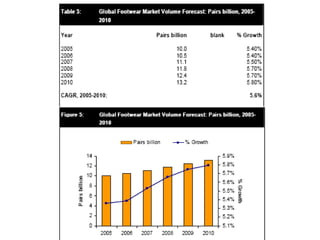

The document discusses the global and Indian footwear markets. The global footwear market grew 3.8% in 2005 to $159.6 billion and is forecast to reach $194.3 billion by 2010. In India, liberalization increased purchasing power and the footwear market grew 8% in 2004 to 1.8 billion pairs worth $2.4 billion. Major Indian brands include Bata, Liberty, Woodland, and Reebok. The market is shifting towards branded, casual styles and growth in sportswear, women's/kids segments.