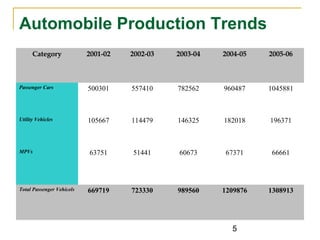

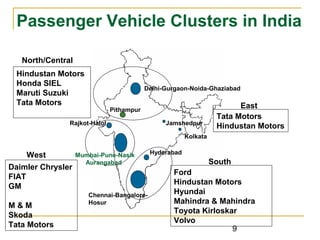

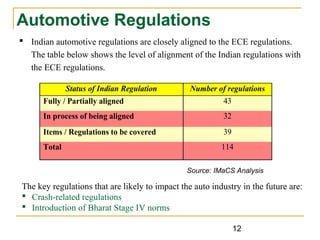

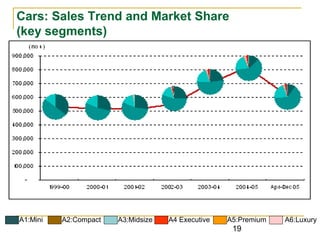

The automotive industry in India has grown significantly over the last 5 years. Vehicle sales reached around 9 million in 2005-06, with growth of 14% annually. India has emerged as the 2nd largest two-wheeler market, 4th largest commercial vehicle market, and 11th largest passenger car market. Major global and domestic players operate in the highly competitive Indian auto industry. The future of the industry looks promising with rising incomes, availability of financing, and government support through policies like lowering duties on smaller cars.