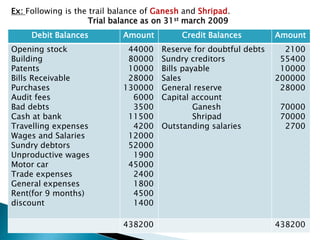

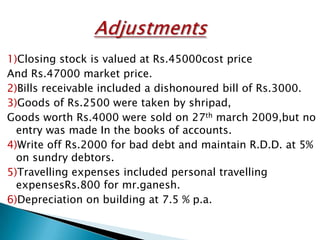

The document discusses final accounts, which are prepared at the end of the financial year and include the trading account, profit and loss account, and balance sheet.

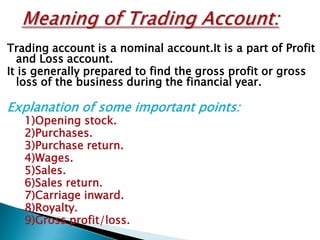

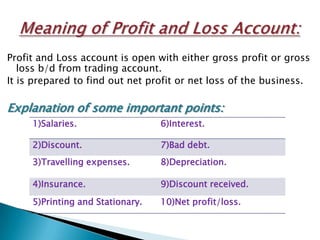

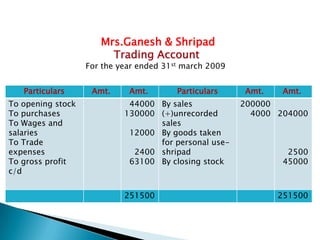

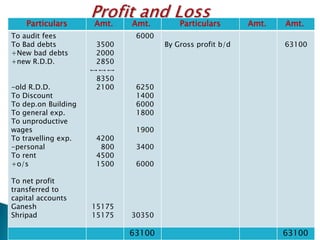

The trading account shows gross profit or loss and is prepared from items like opening stock, purchases, sales, and closing stock. The profit and loss account is prepared from the gross profit/loss and shows net profit or loss using items like expenses.

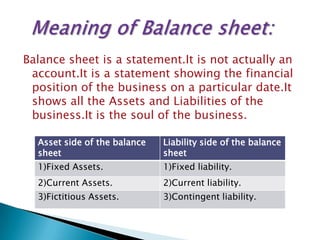

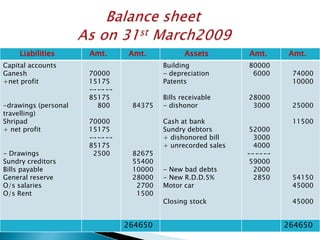

The balance sheet shows the financial position on a date through assets like fixed assets and current assets, and liabilities like capital, creditors, and outstanding salaries. It balances when total assets equal total liabilities.