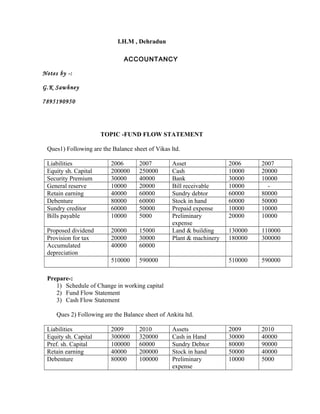

The document contains sample accounting questions related to topics like fund flow statement, cash flow statement, working capital analysis, and capital budgeting techniques like payback period and post-payback period analysis. Specifically, it provides 7 questions with numerical details requiring the preparation of schedules, statements and evaluation of projects using mentioned techniques.