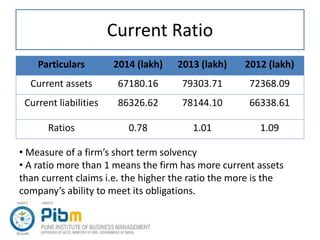

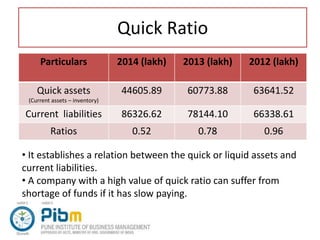

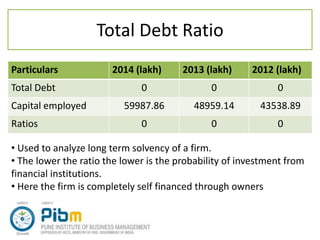

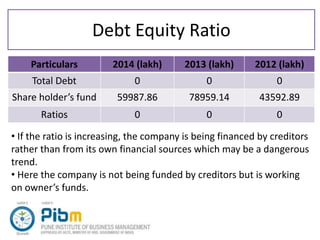

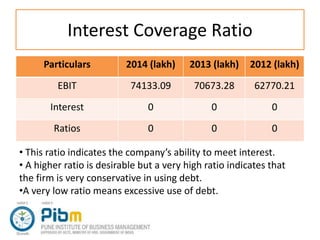

This document analyzes various solvency ratios for a company over three years from 2012-2014. It defines solvency ratios as ratios that establish relationships between current assets and current liabilities to measure a company's ability to meet its short-term obligations. The document then examines key solvency ratios for the company, including the current ratio, quick ratio, total debt ratio, debt equity ratio, and interest coverage ratio over the three year period. For each ratio, it provides the specific calculations and interprets what the ratios indicate about the company's solvency and use of debt financing.