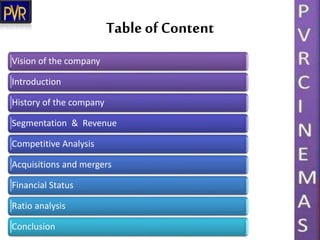

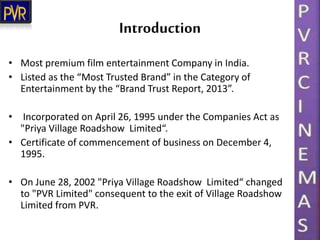

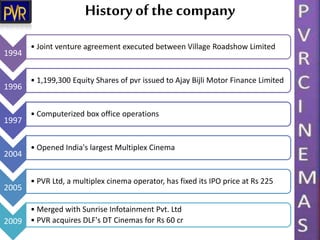

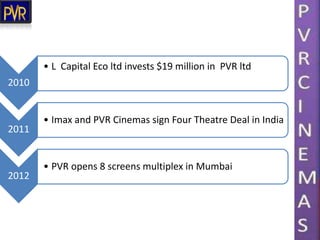

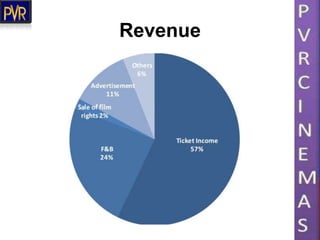

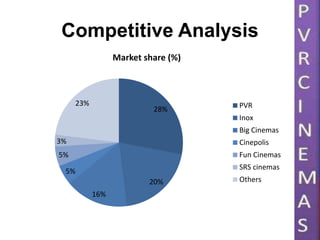

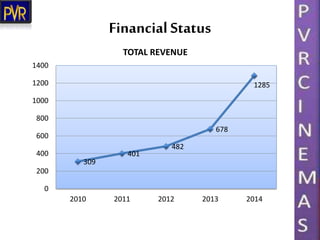

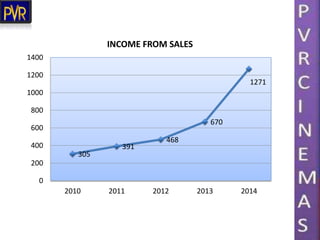

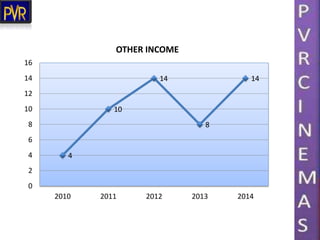

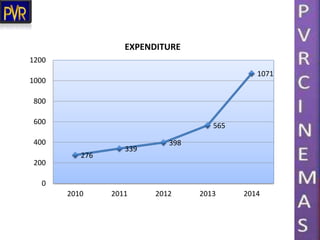

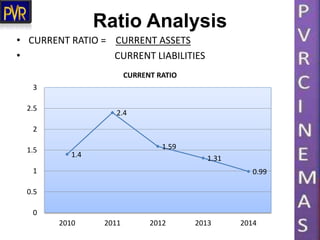

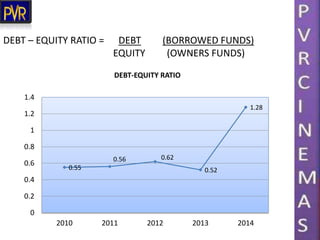

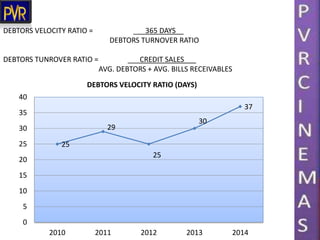

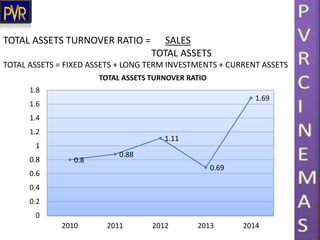

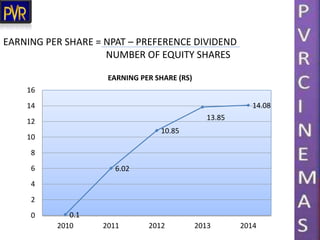

The document outlines the history, vision, and financial performance of PVR Limited, a major player in India's cinema exhibition industry. It discusses key milestones, such as mergers, acquisitions, and notable investments, while presenting financial data from 2010 to 2014. The company aims to lead in the retail entertainment domain, backed by solid market share and growth indicators.