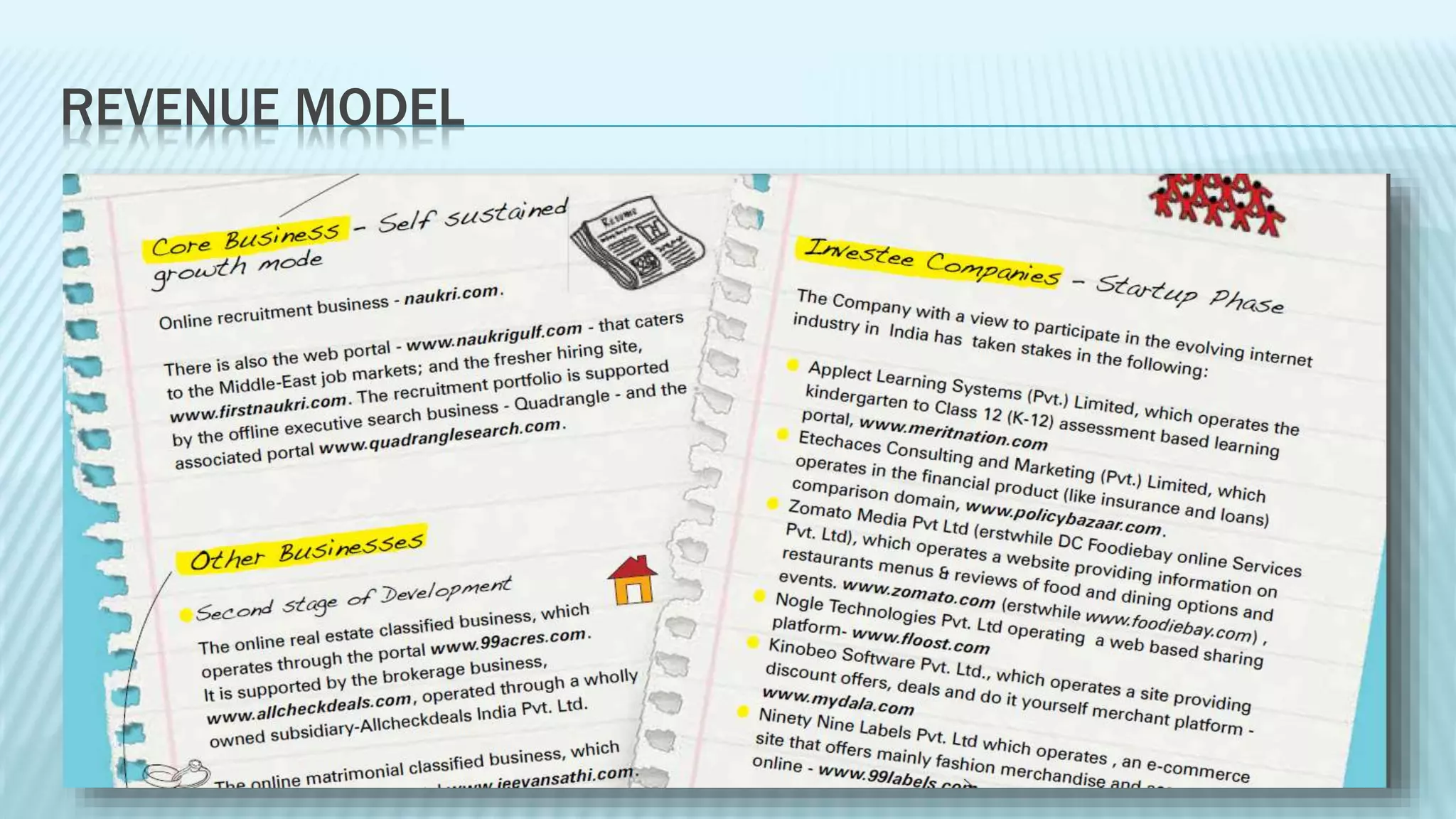

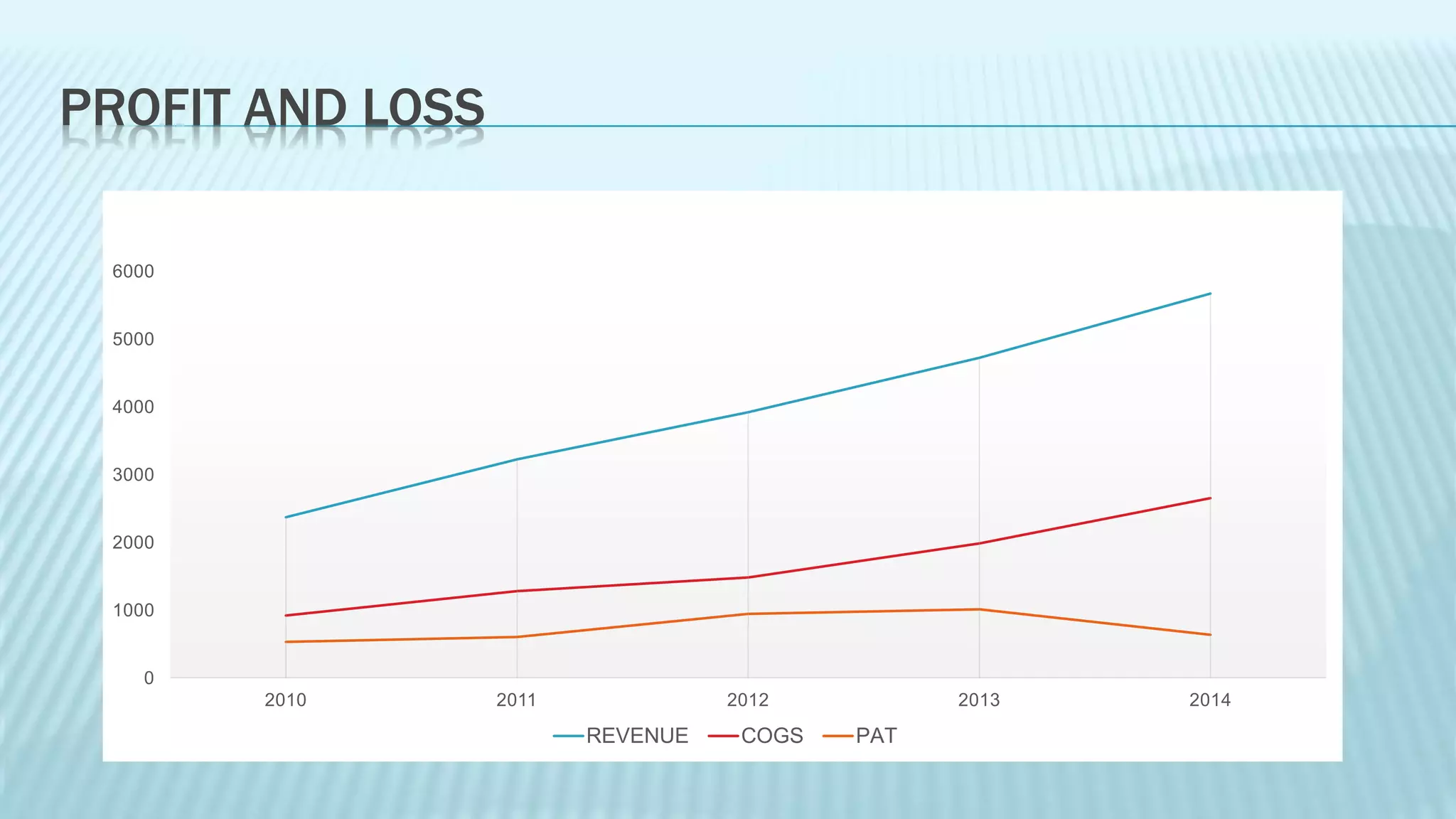

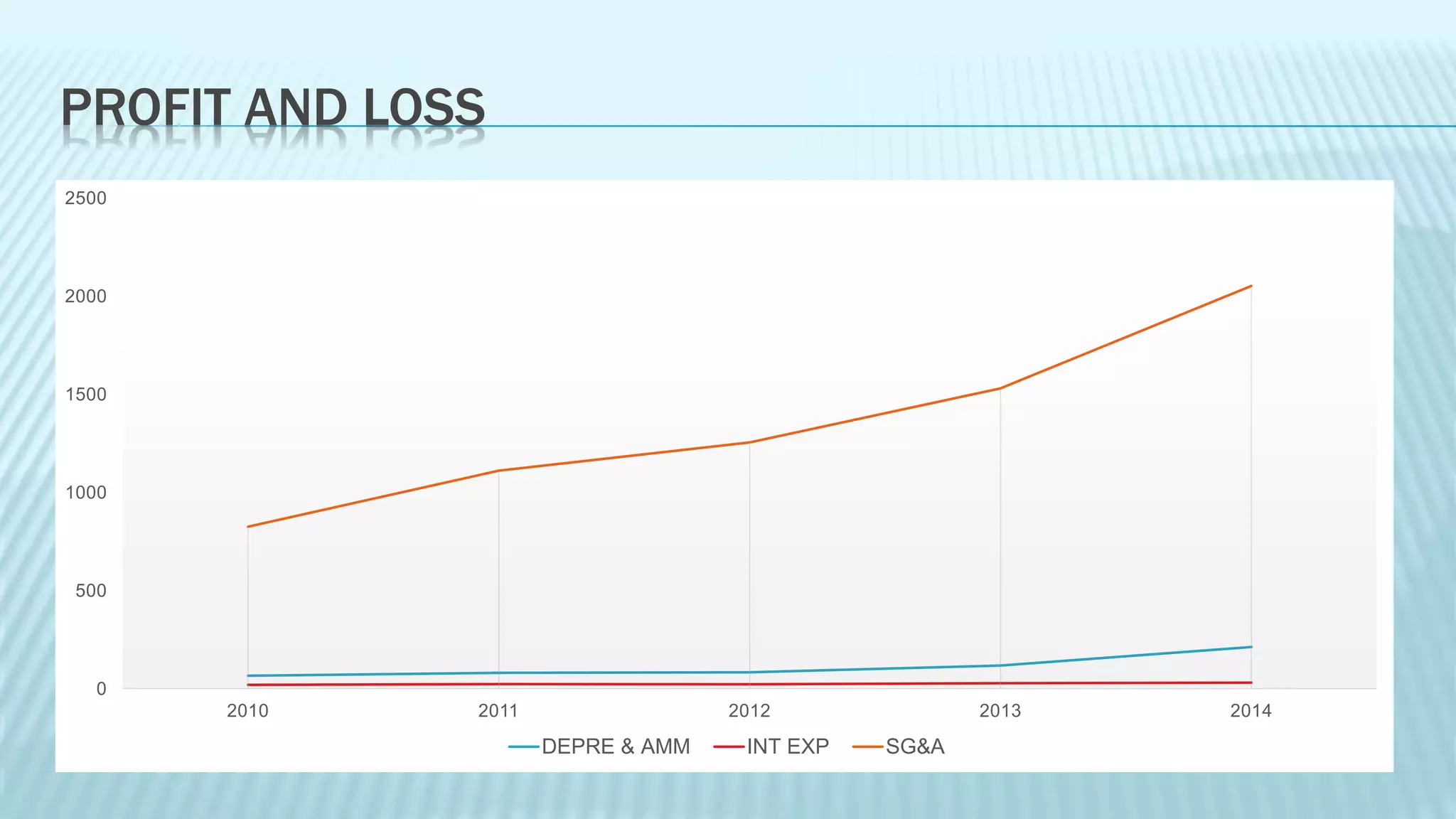

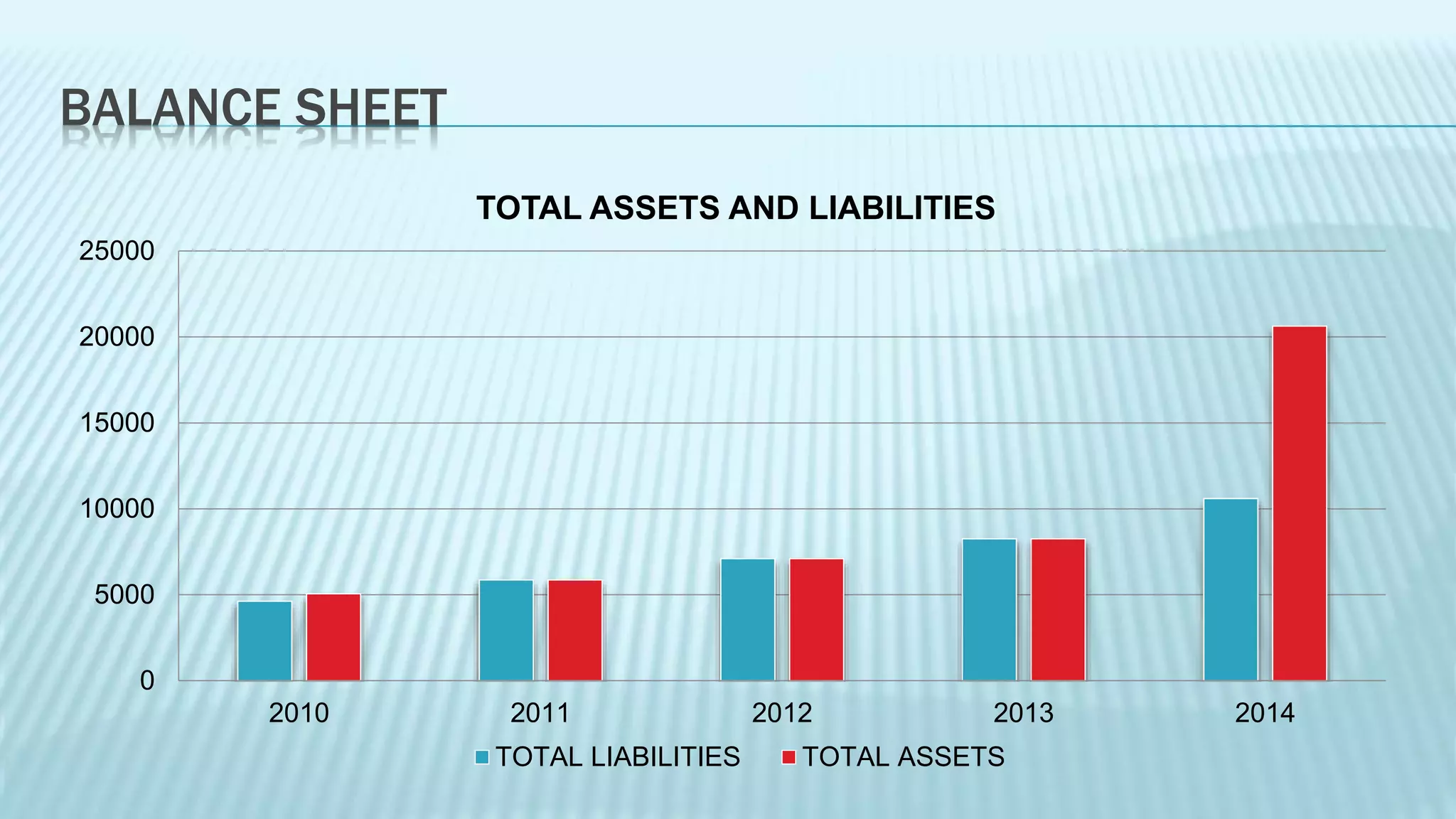

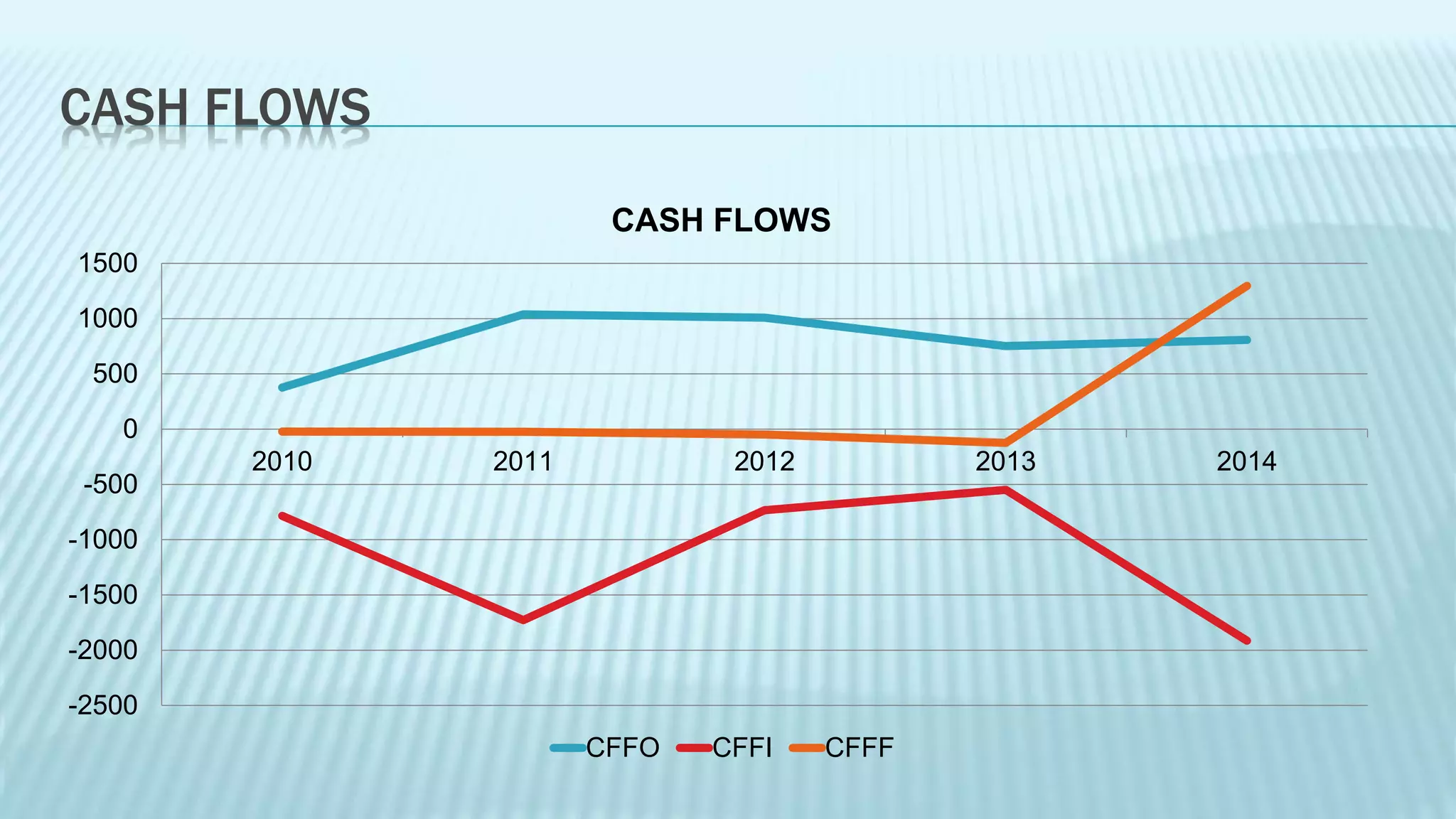

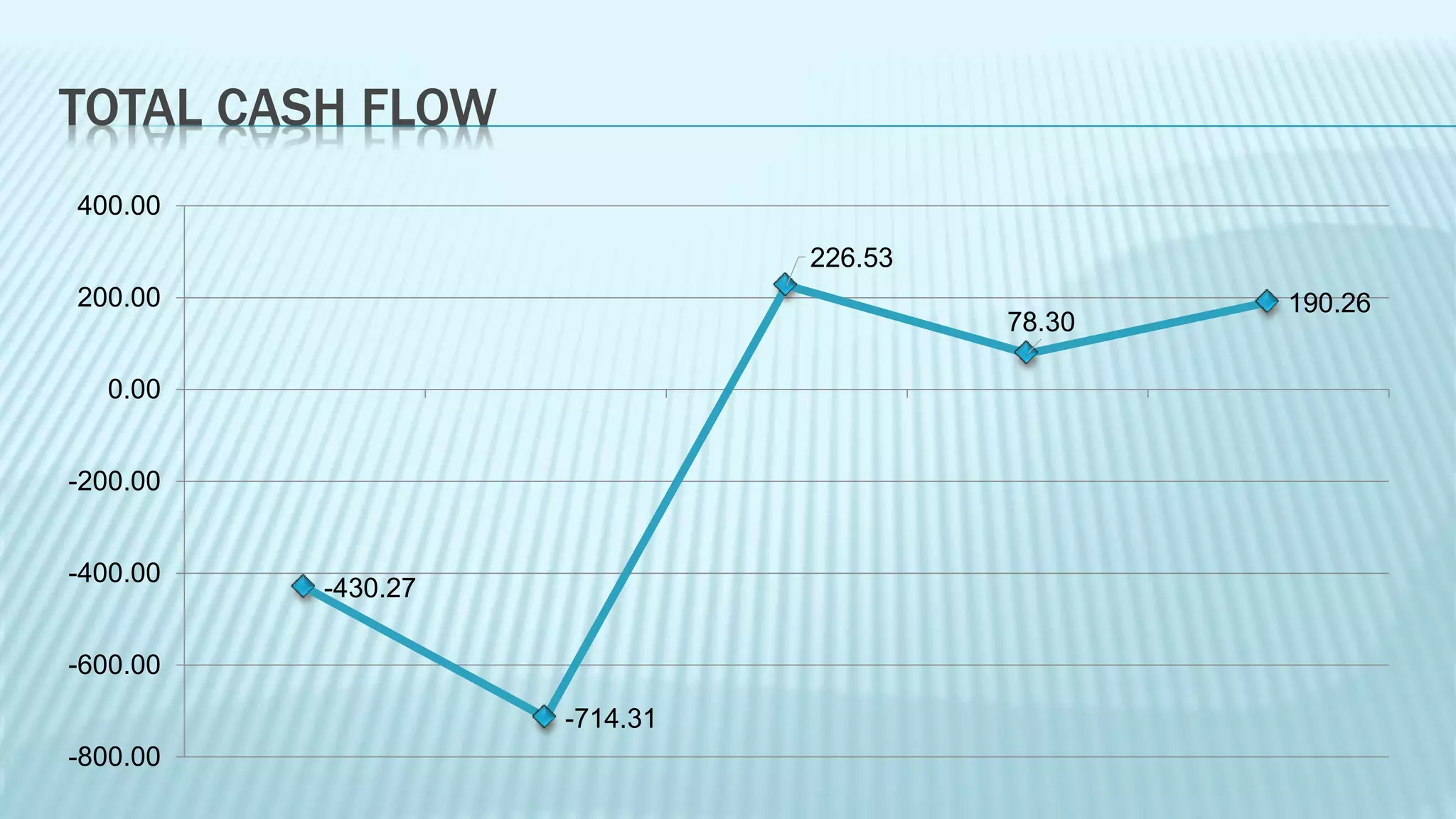

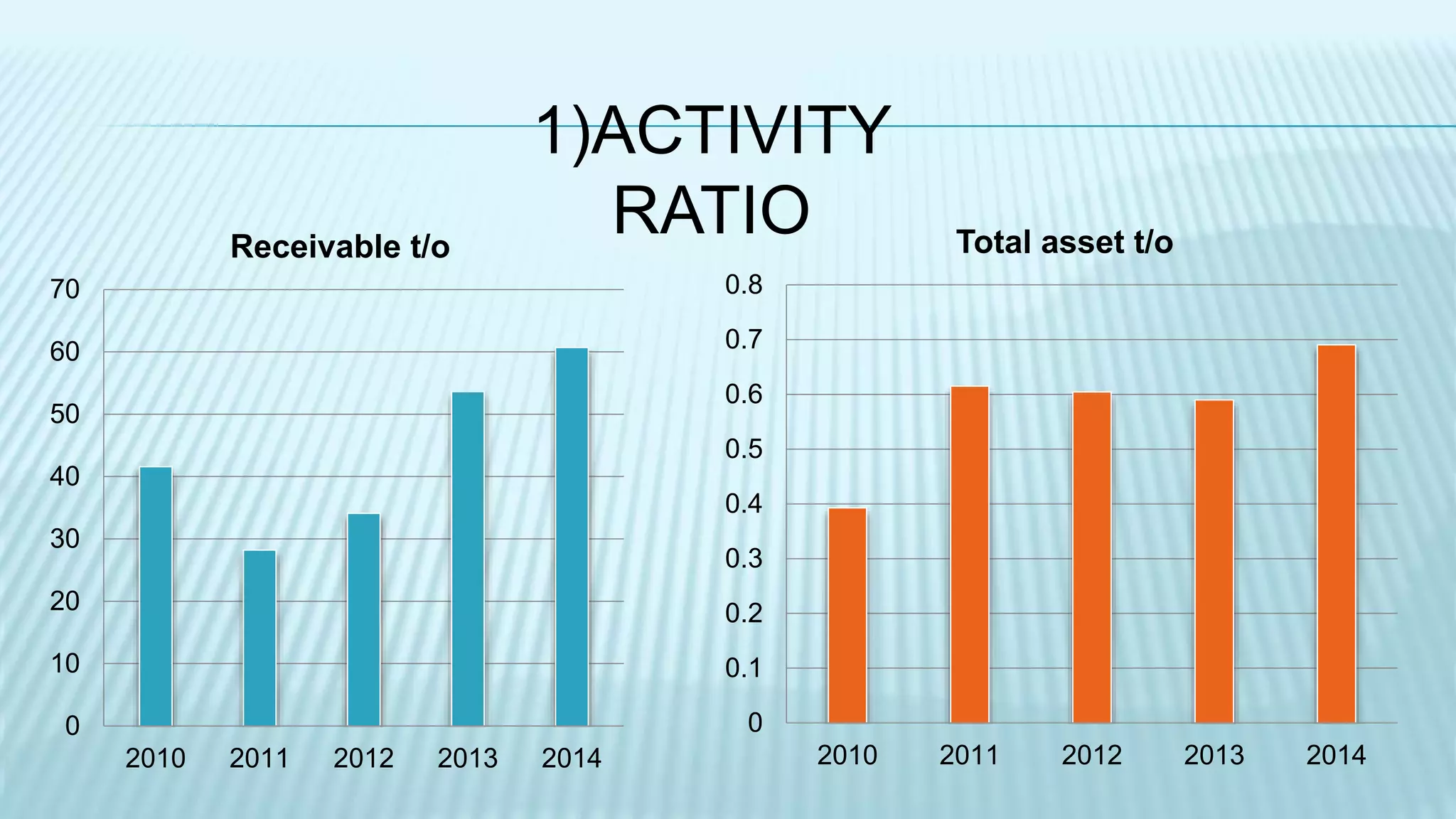

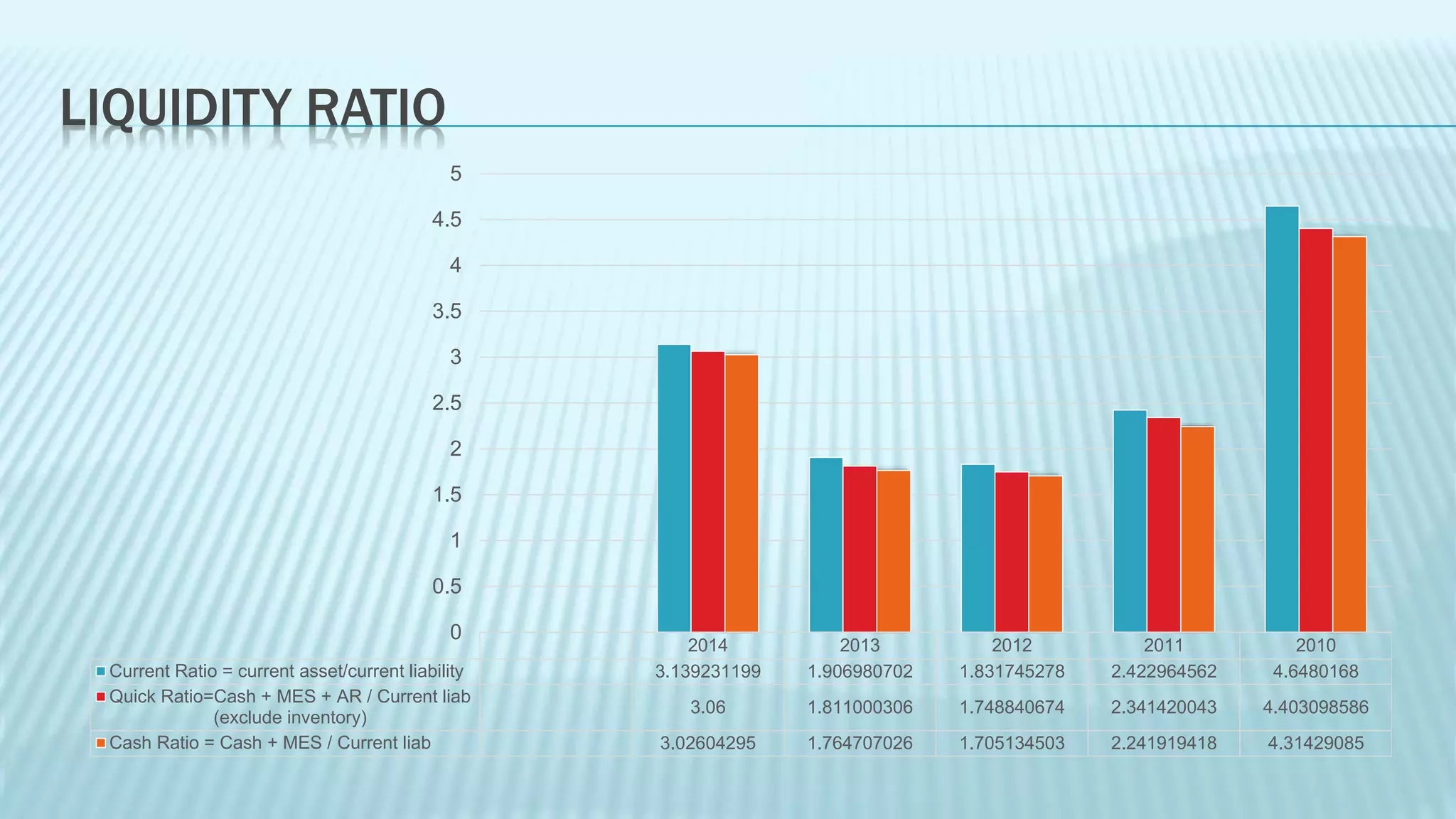

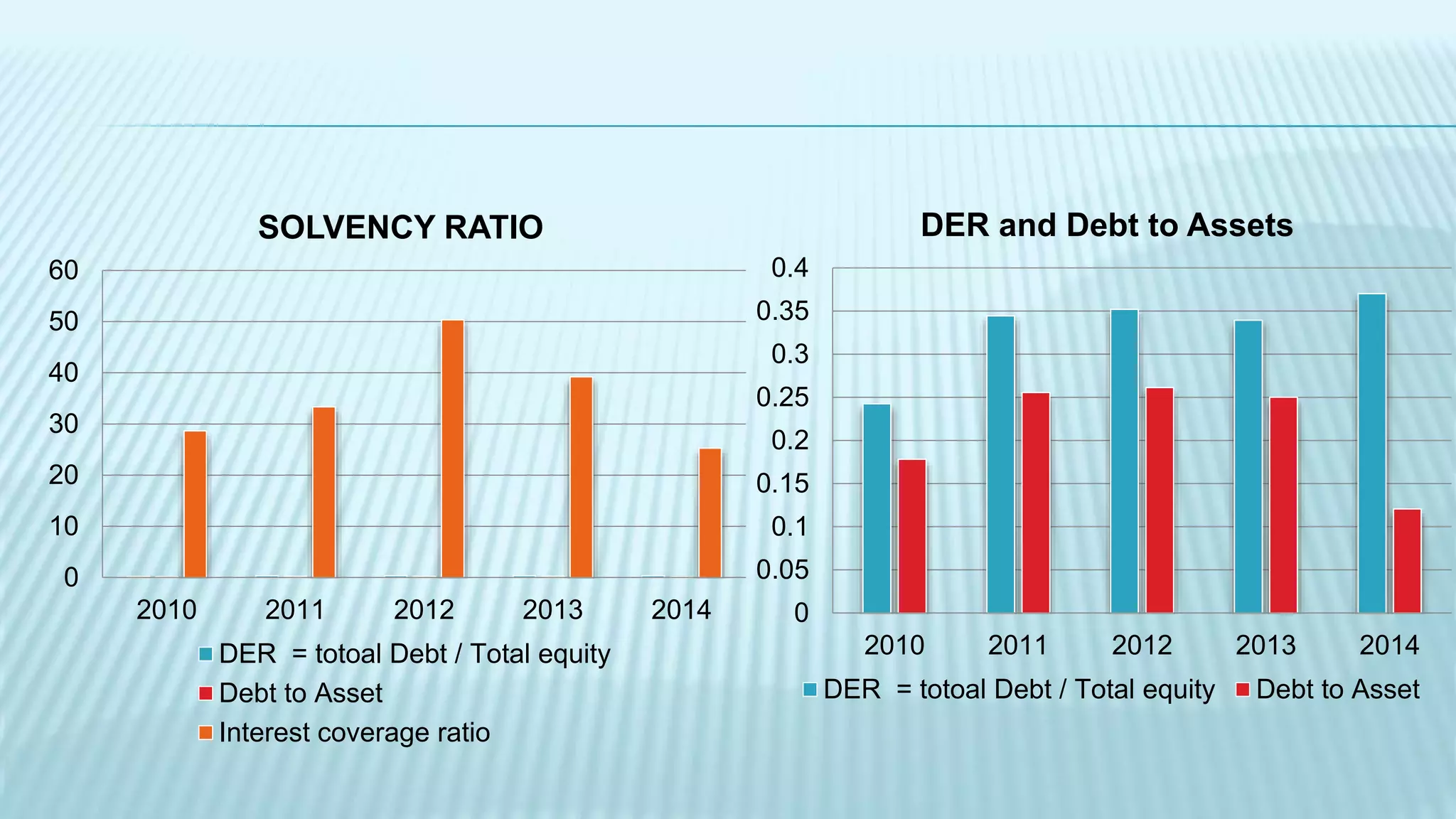

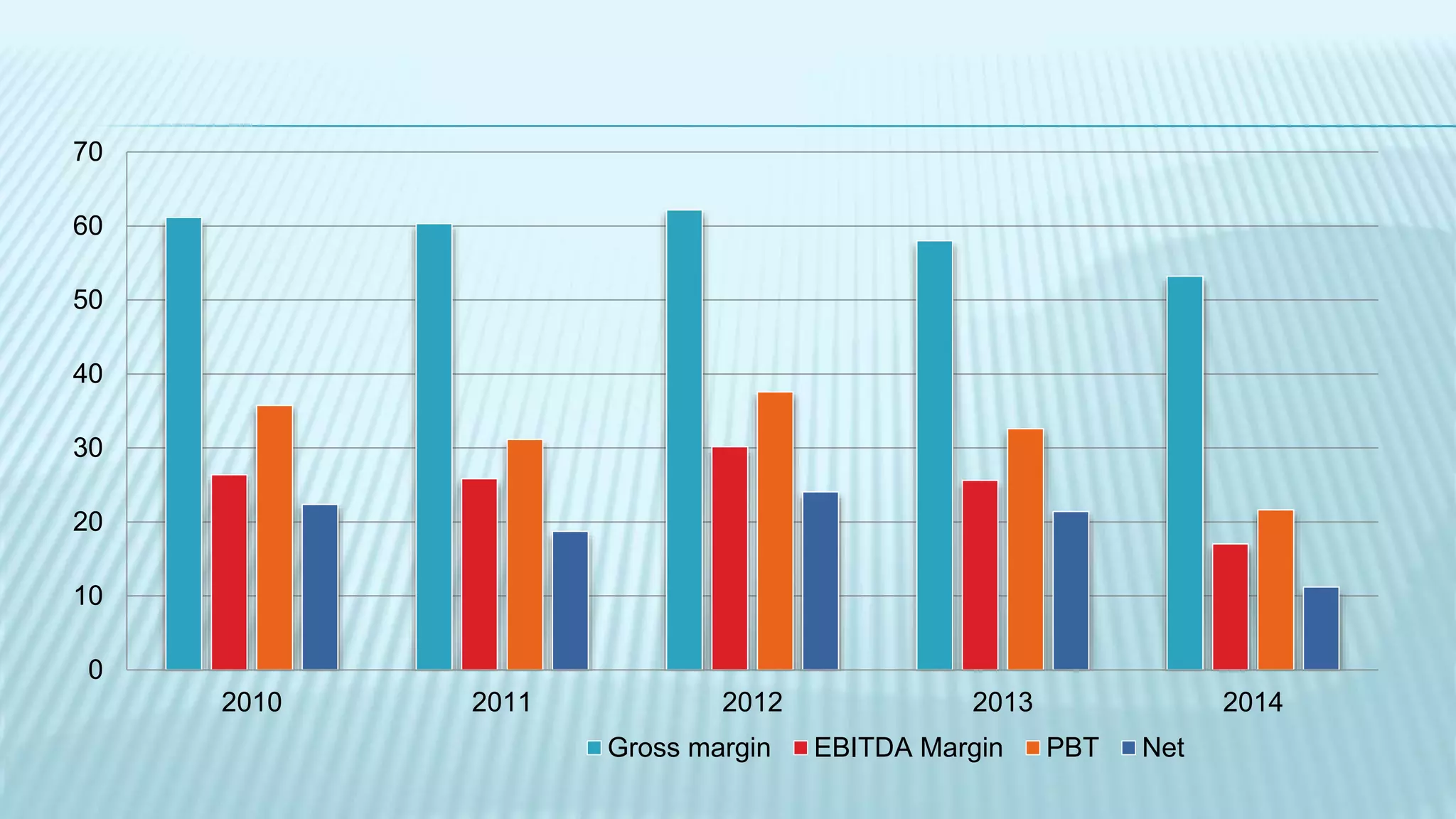

Info Edge (India) Ltd, founded in 1995 by Sanjeev Bikhchandani, is an Indian e-commerce company specializing in online classifieds with diverse businesses including recruitment, matrimony, real estate, and education. The document discusses the company's revenue models and key financial data from 2010 to 2014, highlighting trends in profit, cash flows, and various liquidity and solvency ratios. Additionally, it provides insights into the company's valuation metrics, including price-to-earnings ratios.