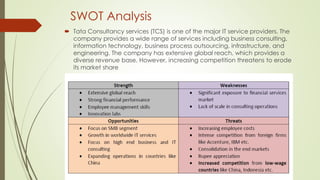

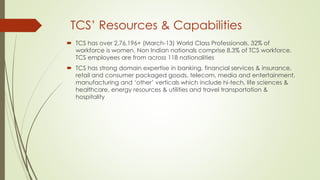

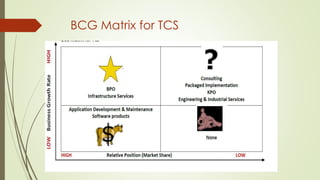

This report analyzes the IT industry in India and Tata Consultancy Services' (TCS) business strategy. It provides an overview of the growing Indian IT industry and its competitive advantages. It then performs a PESTLE analysis of the external environment, Porter's Five Forces analysis, and a SWOT analysis of the industry. For TCS, it describes the company's profile, financial performance, resources, service offerings, and growth strategies. It analyzes TCS' strategies using the BCG matrix and provides recommendations to strengthen TCS' position, such as focusing on higher value services and intellectual property.