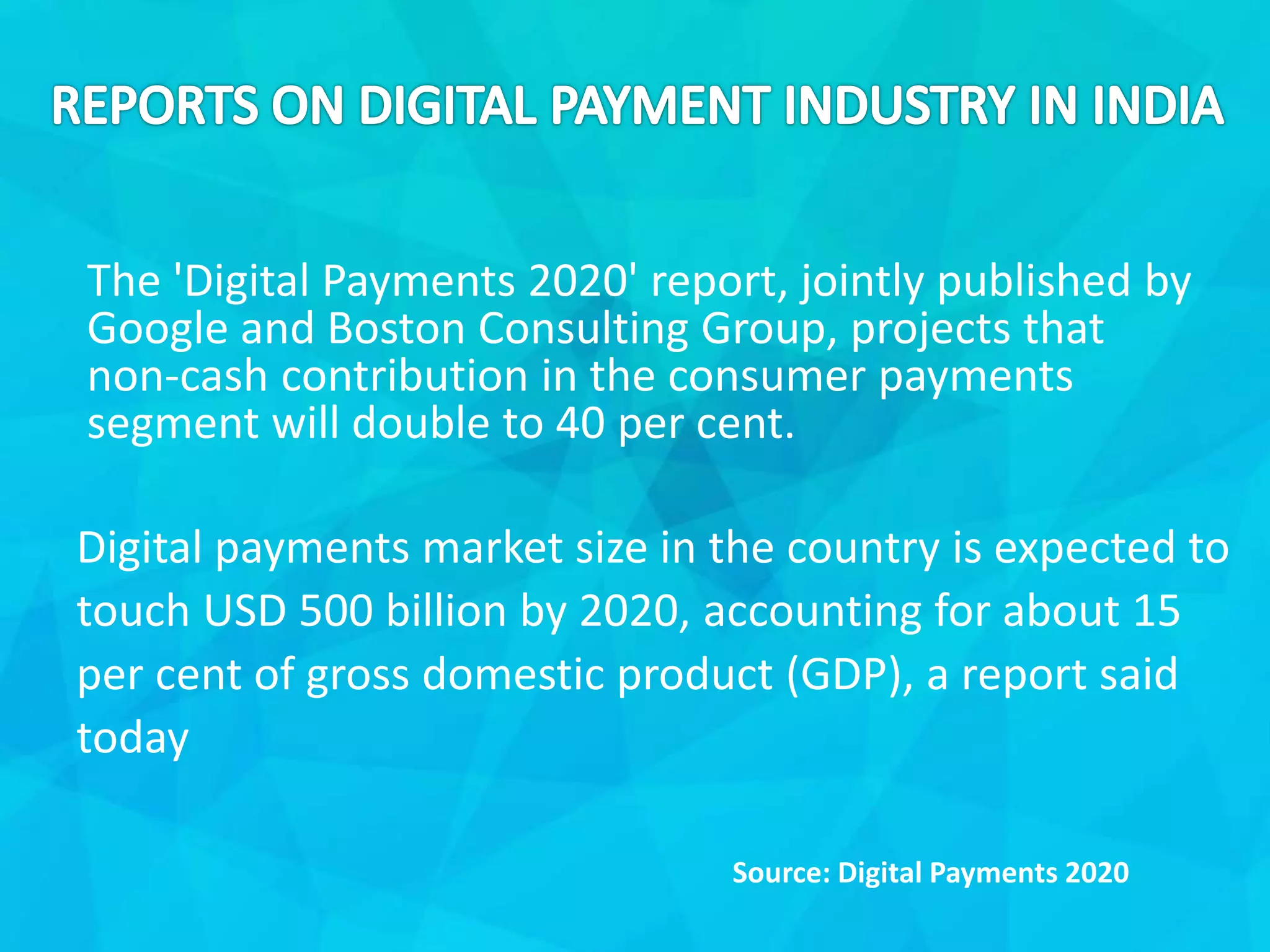

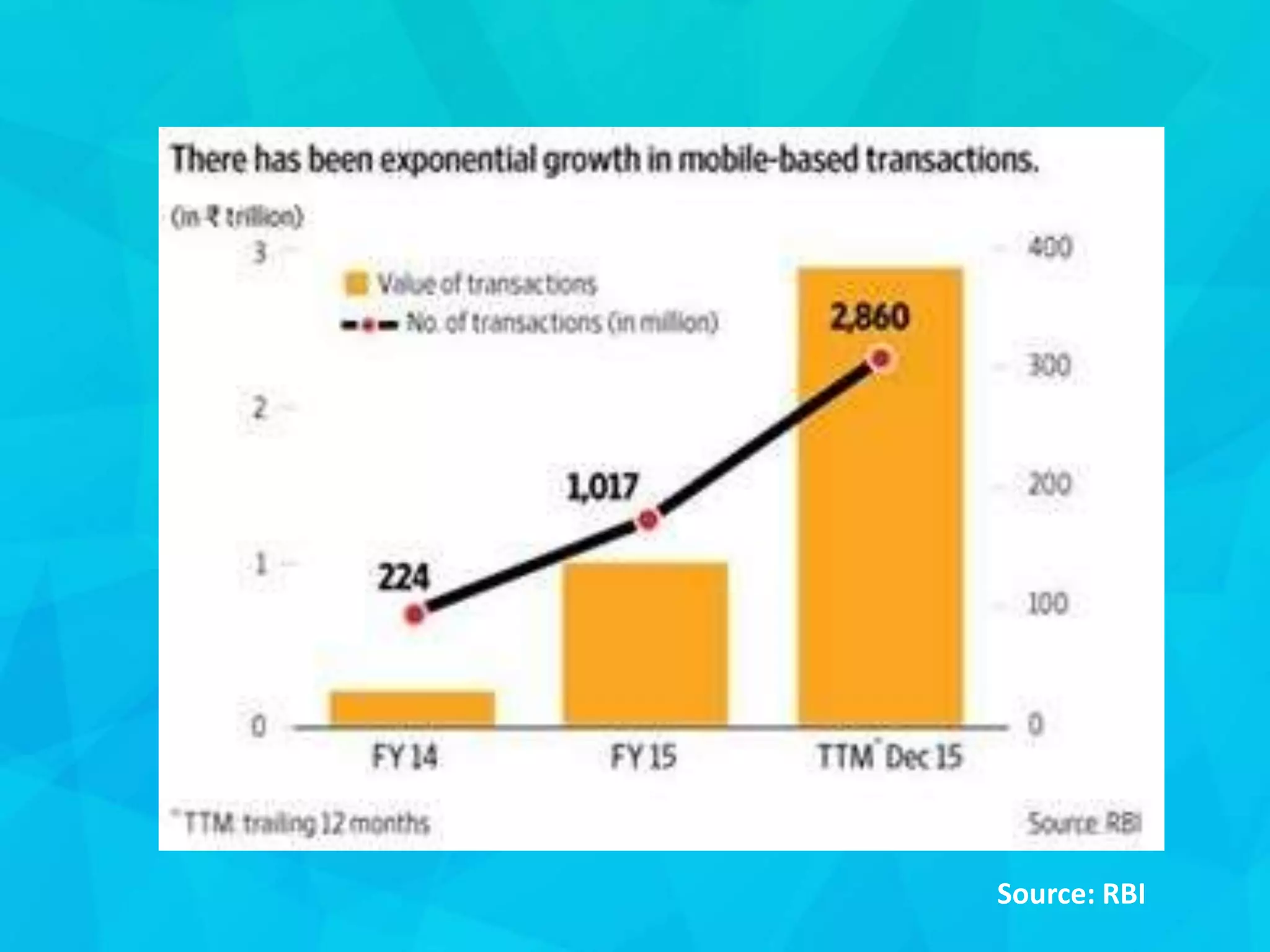

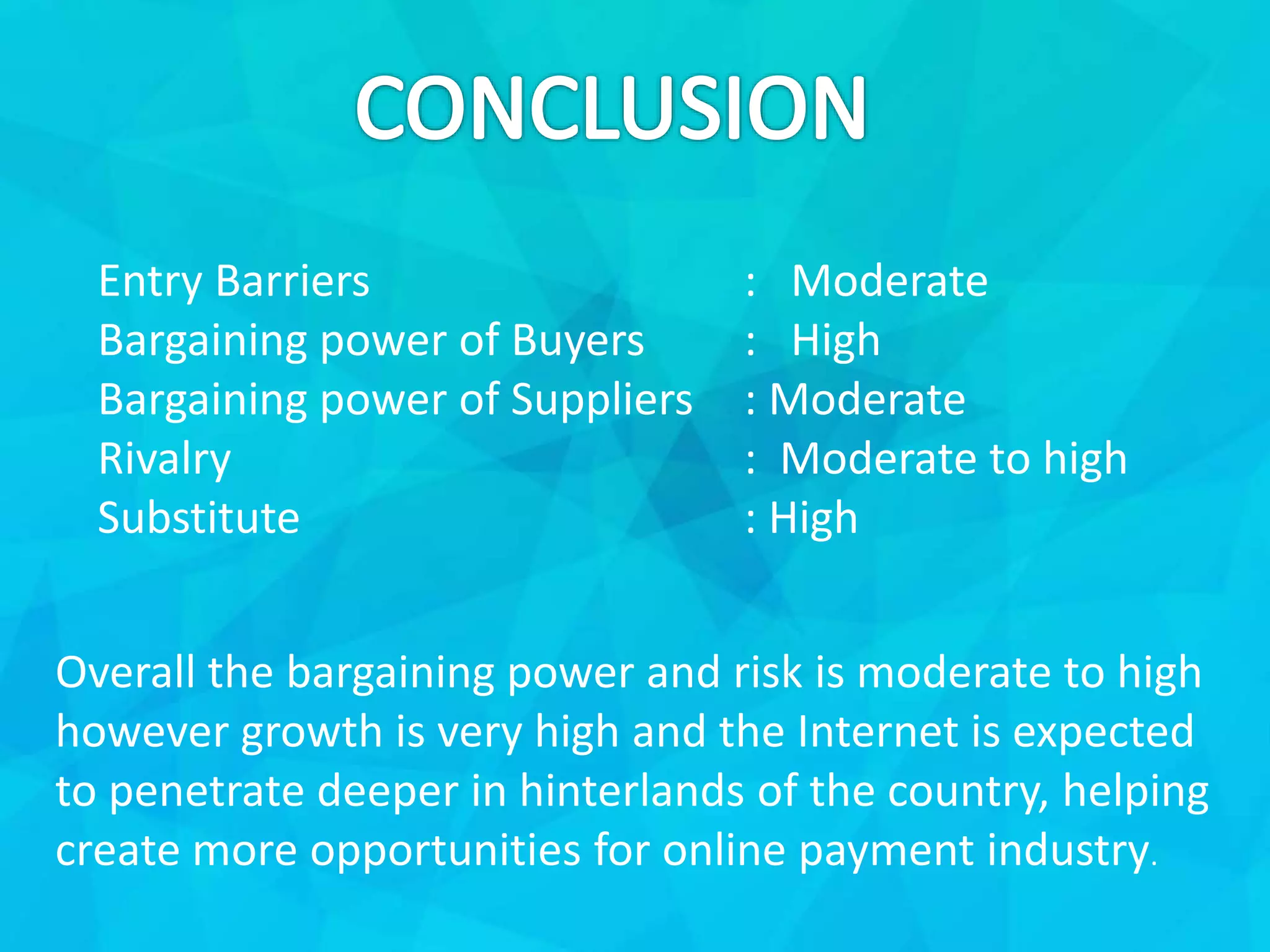

The document discusses the evolving digital payments industry in India. It notes that digital payments are expected to reach $500 billion by 2020, accounting for 15% of GDP. Customer demand is driving companies to offer instant, one-touch payment solutions. The government's JAM Trinity initiative of Jan Dhan, Aadhaar, and mobile phones holds the key to transforming financial inclusion in India. Technology is projected to make payments simpler with merchant networks growing 10x by 2020 and driving consumption. Digital identity will help accelerate customer acquisition.